As with all the things that Tesla says and does, its funding in

Mexico for a brand new automobile plant has attracted a lot consideration. The

newest hubbub across the Santa Catarina, Nuevo Leon, plant

surrounds studies that Tesla is seeking to invite its mainland

Chinese language suppliers at its operations in Shanghai to affix it in

investing in Mexico. That it’s seeking to carry a few of its

mainland Chinese language suppliers to Mexico isn’t a surprise. Authentic

tools producers (OEMs) do that on a regular basis with their

most popular suppliers. Nevertheless, Mexico, as an automotive funding

vacation spot, is doing very nicely, thanks, with or with out

Tesla.

We’ll flip to why Mexico's doing so nicely in good time. First,

we are going to tackle the elephant within the room. S&P World Mobility

has analyzed current funding bulletins by mainland Chinese language

suppliers the place Mexico is the vacation spot. Utilizing our bespoke

Part Forecast Analytics (CFA) suite of provide chain knowledge,

we now have then traced again these suppliers which might be engaged with

Tesla at its Shanghai services.

The evaluation reveals that out of the 90 investments by mainland

China-affiliated automotive firms in Mexico from 2019 till the

current, 21 of them, or 23.3% of the businesses, are recognized Tesla

suppliers. In fact, even when an organization is a recognized Tesla provider,

it doesn’t essentially comply with that these suppliers' services

will expressly provide Tesla. That is illustrated by the truth that

the place the funding location is thought, solely 9 of the 21 are

establishing in Nuevo Leon.

Whereas there’s some substance in Tesla eager to 'raise and

shift' a few of its Shanghai provide chain to Santa Catarina, it’s

not a wholesale replication. That’s as a result of a lot of its Shanghai

suppliers are the on a regular basis suppliers you’ll see anyplace else in

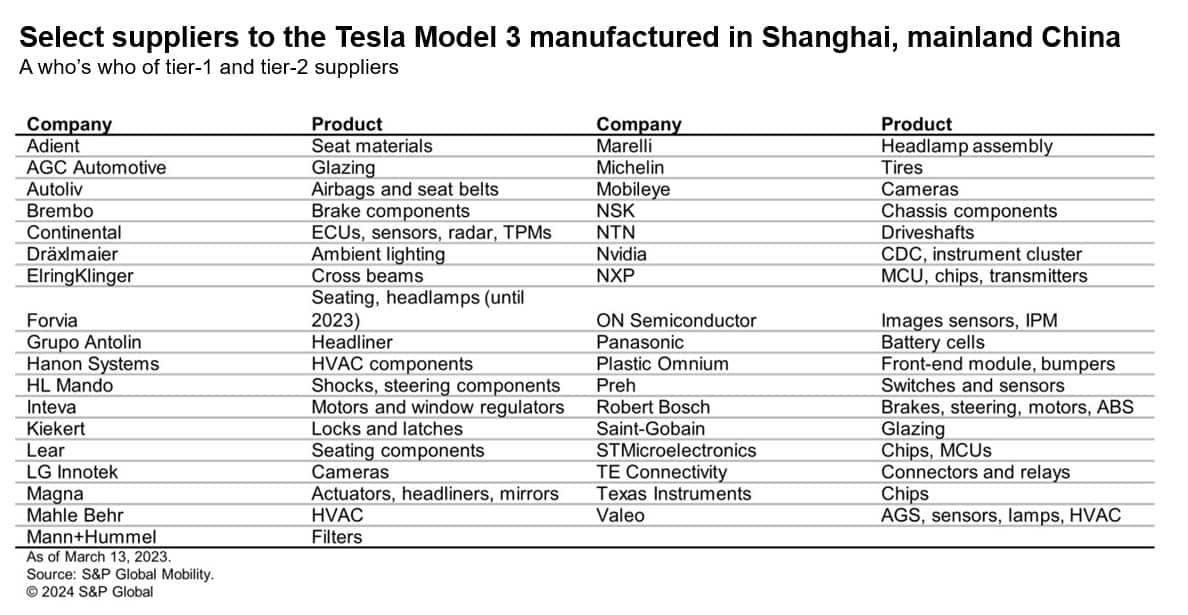

the world with a number of exceptions. For instance, a cut-down listing of

suppliers for Tesla's Mannequin 3 manufactured in Shanghai is a who's

who of Western tier-1 and tier-2 suppliers.

So why the drip-feed of knowledge to the media about Tesla's

plans for Mexico? The Santa Catarina plant is central to the following

stage of its progress at a time when Tesla is going through headwinds within the

market. Santa Catarina is central to these plans, whether or not or not

they contain the prior entry-level automotive or because the pivot to deal with

robotaxis. Both route signifies that prices should be managed (cf.

Tesla's unboxed manufacturing

system), and Tesla has to maintain its suppliers on the precise facet

of its value projections. What higher method to maintain provider prices

down than utilizing countervailing energy?

The noise surrounding Tesla's new plant, in addition to the prospect

of mainland China-domiciled suppliers finding there, does Mexico

and its wider automotive sector a disservice. Directorio

Automotriz, a Mexican public relations company that acts as a

go-between for the assorted stakeholders concerned in establishing store

in Mexico, tracks automotive investments within the nation. Its knowledge

for the previous two and a half years does exhibit the inroads made

by mainland China-domiciled suppliers, however it additionally reveals a broader

base of curiosity in Mexico. Over the interval, Mexico attracted $31.9

billion in automotive FDI from 32 international locations.

The 2 greatest elements behind any FDI relate to the native

market, in each measurement and progress. Mexico is well-placed as a result of

variety of markets that firms there have entry to. The most important

pull stays tariff-free entry to its neighbors, the US and

Canada, by means of the United States-Mexico-Canada Settlement (USMCA).

This has proved enticing to OEMs (and a path to market that will

be closed to future investments in response to a Reuters report on

April 18) when it comes to constructing automobile manufacturing capability

within the nation, and the place OEMs tread their suppliers comply with.

Between 2015 and 2025 (which excludes Tesla's plant), 1.9 million

models of sunshine automobile manufacturing capability can have been added

in response to S&P World Mobility knowledge, making Mexico the third

greatest contributor to world capability progress.

Whereas Tesla has had a big function in shaping the automotive

business since its inception, it isn’t all the time the final word

arbiter. That’s one thing price remembering when each Tesla transfer

or pronouncement by Elon Musk is topic to amplification usually

past its significance. Tesla's choice to arrange store in Santa

Catarina is the cherry on prime of a cake that already advantages from

most of the proper components.