After supply-chain disruptions in 2021 and 2022, North America’s

medium and heavy industrial car (MHCV) sector is poised for

restoration in 2024.

In North America, the USA accounts for about

80% of business car demand. Following the COVID-19 pandemic,

the USA’ economic system and commercial-vehicle market have

demonstrated outstanding power. By extension, Mexico advantages

from cross-border commerce with the US, bolstered by a robust native

forex and an inflow of competitively priced imports from China.

In Canada, anticipated financial development and an increase in personal

consumption and funding additionally sign a strong truck market.

S&P International Mobility’s analysis, specializing in Class 4-8

automobiles in North America, forecasts continued development in 2024 and

2025. Analysts from the Mobility crew spoke to exterior audiences

about this outlook after the second-quarter forecast replace, in Could

2024, throughout a recorded session.

Our most up-to-date forecast launch in August 2024 re-confirmed the

form of the outlook for the area, with minor adjustments. This

forecast aligns with financial indicators resembling development in housing

building and private consumption, the latter of which is

anticipated to reasonable. Nevertheless, rates of interest may see a downward

adjustment within the latter half of 2024, which may additionally stimulate a

faster-than anticipated rebound, relying on the dimensions and timing of

the adjustment.

Traits in Medium-Obligation and Heavy-Obligation

Vans

Under the highest macro-economic indicators influencing this

forecast lies truck tonnage, which refers back to the complete weight of

cargo or freight transported by vans. This isn’t only a quantity.

It’s a barometer for the trucking business’s effectivity and a

reflection of financial vitality.

Regardless of a tepid efficiency in 2023, truck tonnage is projected

to achieve momentum within the subsequent two years, as client spending

continues to develop, suggesting extra demand for vans on the roads

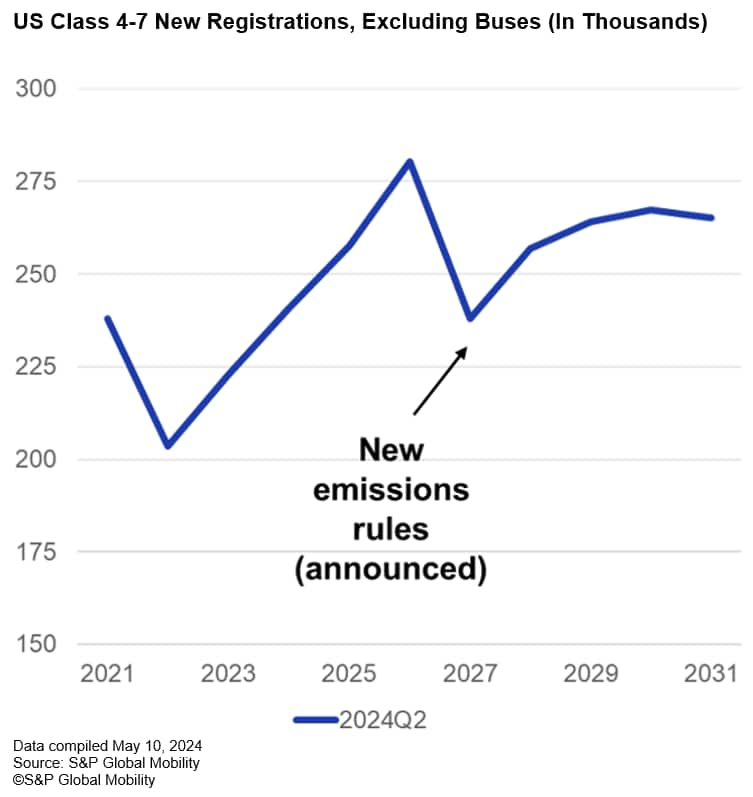

to satisfy client and enterprise wants. Notably, the medium-duty truck

market, spanning Class 4 to Class 7, is predicted to develop

constantly via 2025. This sector is inclined to regulatory

shifts, with looming emission requirements set for 2027 more likely to

drive a surge in purchases as fleets and clients look to

capitalize on pre-regulation fashions.

There are divergent developments throughout completely different weight courses in

the medium-duty truck market. Class 6 automobiles which can be well-liked in

the lease and rental areas—such because the Freightliner M2 106,

Hino L6, and Ford F-650—are additionally well-liked selections for supply

providers associated to building and housing like towing and

supply.

In 2023, Class 6 vans noticed a robust 12 months, largely pushed by the

supply of beforehand ordered automobiles linked to the surge in

housing and building exercise. Nevertheless, the basics of the

housing market are at present weak, and the gross sales quantity of Class 6

vans is predicted to dip in 2024.

In distinction, Class 5 vans are projected to thrive. Class 5

vans are more and more necessary for utilities and municipalities,

and because the inhabitants grows in North America, the demand for these

automobiles is predicted to extend. As well as, the expansion in on-line

procuring and e-commerce has led to increased demand for supply

automobiles like Class 5 vans.

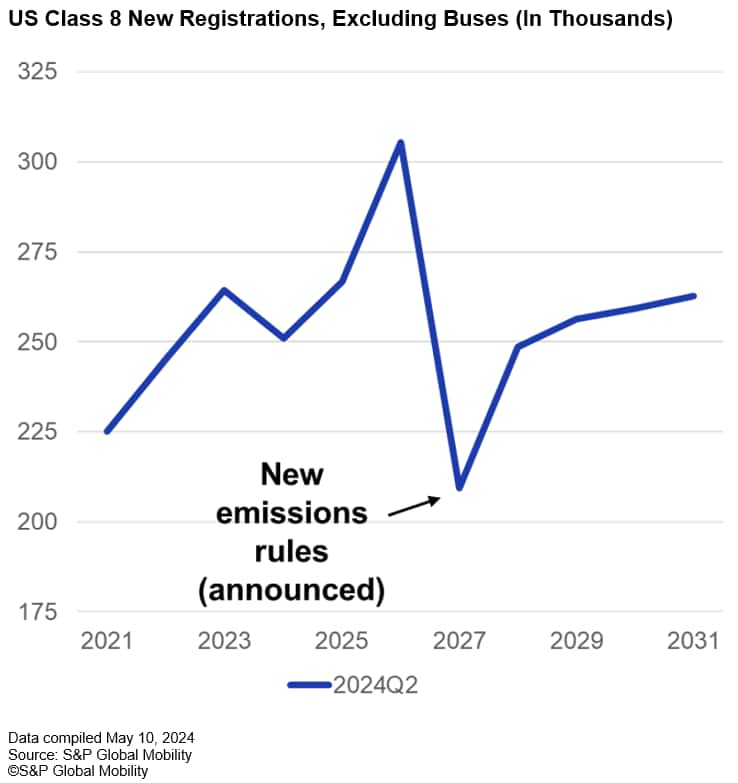

Class 8 vans are about half the MHCV manufacturing quantity in

North America. These embody the Freightliner Cascadia, at present

the highest MHCV truck within the area by manufacturing quantity; the

Worldwide LT; PACCAR’s Peterbilt 589; and the Mack Anthem for

long-haul transportation. The expansion of Class 8 vans is predicted

to face challenges in 2024, attributed primarily to ongoing provide

chain constraints and hostile circumstances in long-distance

trucking.

The Future Outlook and Shift Towards Sustainable

Powertrains

The business is anticipating a robust 2026 after fluctuations in

2024 and 2025, with much less volatility than anticipated. New fashions,

together with Volvo’s VNL and the newest technology Freightliner

Cascadia, will debut throughout this timeframe. The surge in manufacturing

will fall by 2027 with the newly proposed EPA 27 emission

rules and elevated compliance prices.

Mexico’s heavy truck market exhibits indicators of vigorous development,

pushed by stable substitute demand towards an growing older fleet and

boosted by a strong native forex and competitively priced

imports. Main OEMs like Daimler Truck, PACCAR, Traton, and Toyota

have a big presence in Mexico. The presence permits them to

regulate their manufacturing combine between equally tooled vegetation within the

United States and Mexico to raised reply to market calls for and

manufacturing wants.

Conversely, Canada’s smaller market is predicted to see a surge

in personal consumption and funding, probably propelling

sturdy demand for Class 8 vans.

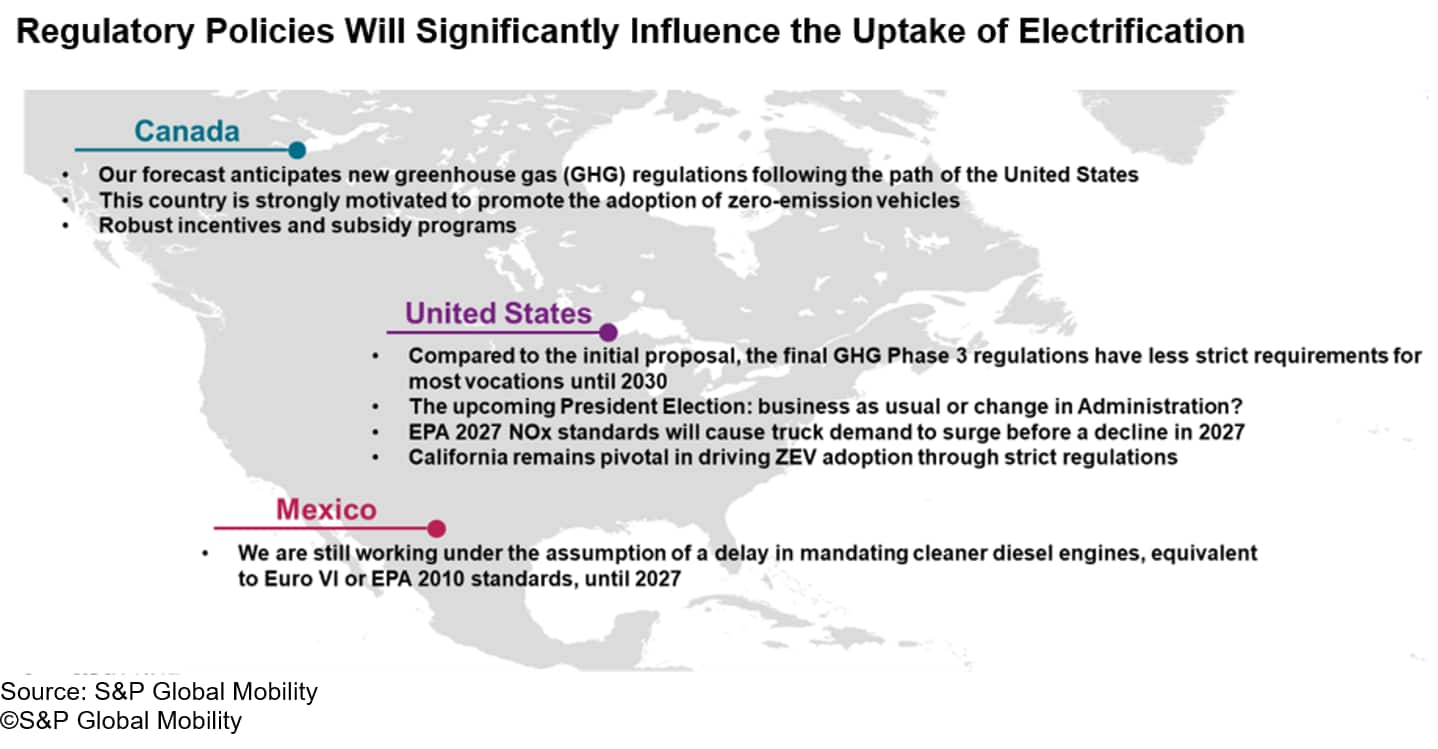

North America’s MHCV market narrative can also be characterised by

the shift towards extra sustainable and regulation-compliant

powertrain applied sciences. Canada, the USA and Mexico every

have distinctive regulatory trajectories that can considerably

affect gasoline kind forecasts and car design.

On this regard, zero-emission automobiles (ZEVs), together with battery

electrical automobiles (BEVs), are gaining traction. Nevertheless, the

market’s readiness and enthusiasm range by nation and are

influenced by regulatory frameworks and market dynamics. The United

States will attain an necessary milestone with new emissions

requirements in 2027, as described beforehand. In neighboring Mexico,

a brand new emissions commonplace can even be applied in the course of

the last decade. On the time of our forecast launch, our assumption was

this may be 2027 for Mexico; nevertheless, as of this writing,

proof is mounting that the change will come earlier, in 2025, in

line with a beforehand introduced timeline.

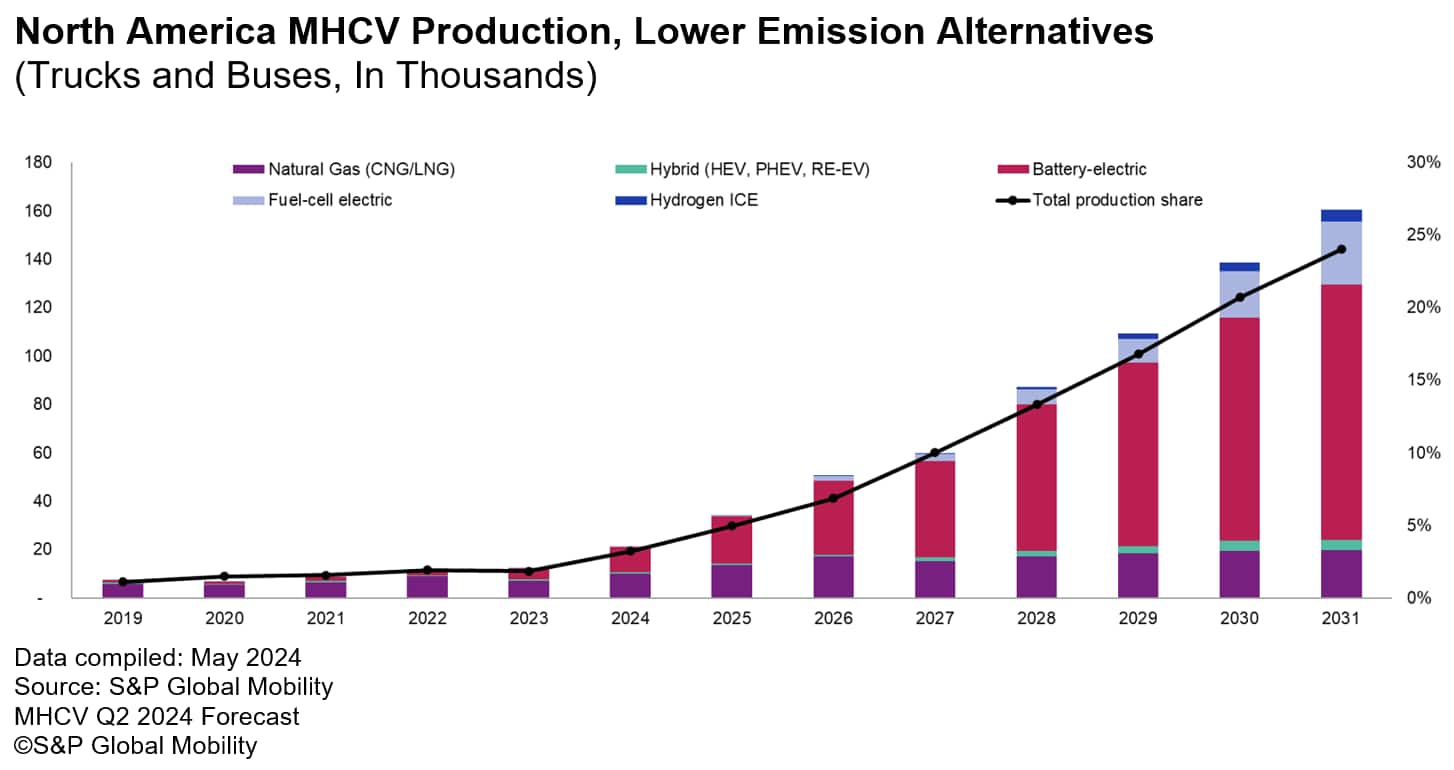

Whereas ICE and diesel will proceed to play a important function

all through this decade, the manufacturing forecast for North America

via 2031 signifies a big enhance within the manufacturing

share of decrease emissions and environmentally pleasant alternate options

like battery electrical vans. This development is formed by plenty of

components, together with technical development in addition to California’s

Superior Clear Vans rule, which requires OEMs to promote extra

zero-emission vans. Likewise, Canada’s incentive and subsidy

program for zero-emission automobiles will drive vital demand

for ZEVs within the midterm.

Furthermore, the approaching shifts in powertrain applied sciences

underscore a broader business development towards sustainability.

Stringent guidelines and OEM commitments to zero emissions will form

the transition to battery electrical and different different gasoline

automobiles. Nevertheless, excessive complete possession prices, infrastructural

deficiencies, and unpredictability in battery provides may gradual

the adoption charge and result in completely different timings throughout completely different

elements of the area.

Financial, regulatory, and technological forces converge to form

the way forward for North America’s MHCV market in the course of the

decade. With the looming EPA27 emissions requirements forward within the

United States and additional regulatory milestones past that, OEMs

should steadiness between quick alternatives and long-term

investments to make sure effectivity and sustainability heading into

2027 and past.

This text is a part of a sequence that includes highlights from

S&P International Mobility’s 2024 Options Webinar Collection. The North

America Medium and Heavy Industrial Automobile Outlook webinar

occurred on Could 16, 2024.

This text was printed by S&P International Mobility and never by S&P International Rankings, which is a individually managed division of S&P International.