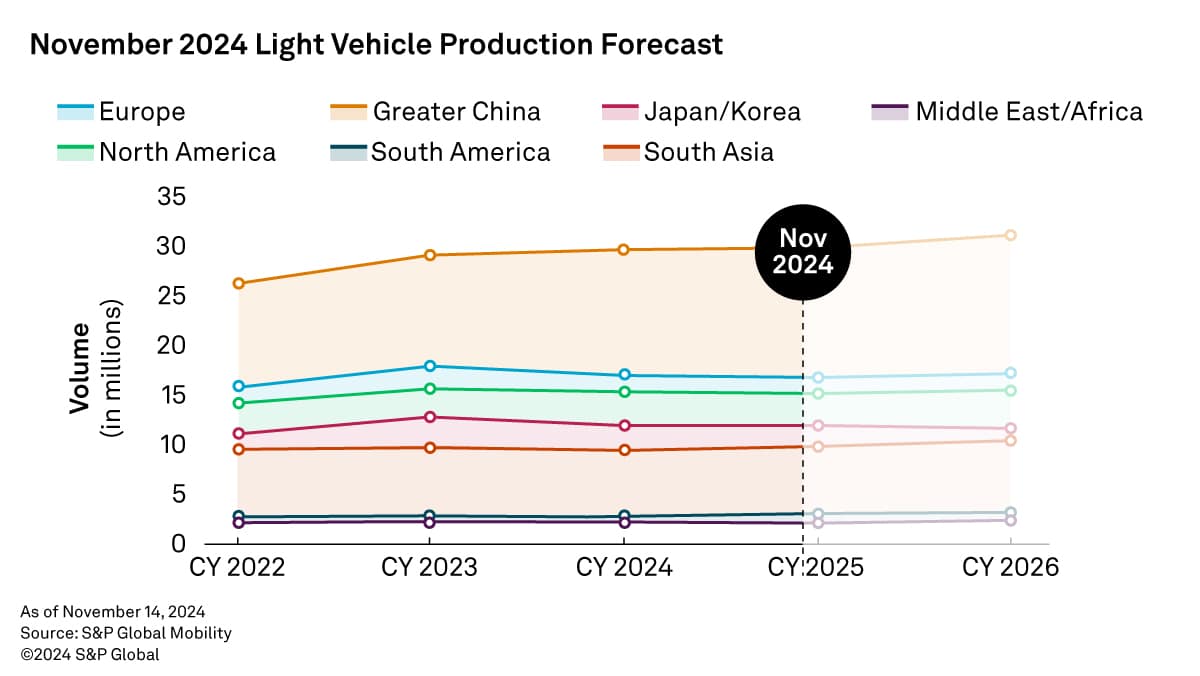

Every month, we leverage international mild car manufacturing actuals,

registration knowledge, and gross sales knowledge to supply probably the most up-to-date,

short-term manufacturing forecast out there.

Here is an in depth have a look at international manufacturing knowledge by area and our

up to date November manufacturing forecast.

Prime Takeaways for the Month

Gentle car manufacturing forecasts are blended globally, with

notable downgrades in Europe and South Asia, whereas Larger China

sees an upward revision because of improved gross sales from authorities

scrappage subsidies. The US elections have launched uncertainties

which can be anticipated to negatively have an effect on BEV volumes and the

electrification combine. Total, the 2024 manufacturing outlook is

barely stronger, however ongoing stock administration and demand

dynamics proceed to pose challenges throughout varied areas.

Noteworthy Changes

Europe: The sunshine car manufacturing outlook

for Europe has been downgraded by 92,000 models for 2024, primarily

because of lowered forecasts for Stellantis and Volvo. Considerations over

potential strikes and manufacturing disruptions, together with flooding in

Spain, have additional impacted the forecast.

Larger China: Larger China’s manufacturing

outlook has been elevated by 409,000 models for 2024, pushed by a

restoration in gross sales supported by scrappage subsidies. The market is

anticipated to develop by 2.4% year-over-year, though financial

uncertainties might mood future projections.

Japan/Korea: Japan’s manufacturing outlook for

2025 has been upgraded by 39,000 models, with Toyota anticipated to

preserve robust momentum. In distinction, South Korea’s manufacturing

forecast for 2024 has been lowered by 12,000 models because of

disappointing home gross sales and exports.

North America: North America’s manufacturing

outlook stays largely unchanged and continues to typically

replicate wanted stock correction. Ford’s manufacturing for 2025 has

been revised down by 45,000 models on the anticipated must de-stock

as we enter the brand new 12 months. Moreover, manufacturing for Stellantis

for 2024 was lowered by 48,000 models because of significant manufacturing

downtime in This fall-2024 with a view to rein in elevated inventories.

South America: The South American mild car

manufacturing outlook has been elevated by 23,000 models for 2024,

attributed to stronger-than-expected manufacturing leads to Brazil

and Argentina. Changes for 2025 and 2026 have been minor, focusing

on car timing modifications.

South Asia: South Asia’s manufacturing outlook has

been lowered by 63,000 models for 2024, pushed by manufacturing

weaknesses within the ASEAN market and excessive stock ranges in India.

Downward revisions for 2025 and 2026 replicate incremental home

and export demand challenges, notably within the ASEAN market.

Obtain a free mild car manufacturing forecast pattern

right here.

This text was printed by S&P World Mobility and never by S&P World Scores, which is a individually managed division of S&P World.