The evolution of EV battery expertise displays a mix

of historic developments, rising improvements, and market

calls for.

The lithium-ion battery — now synonymous with electrical

automobiles (EVs) and accessible commercially since 1981 — took a

whereas to catch on in automotive circles. The primary EV had a lead

acid battery and was developed a full 100 years earlier by Gustav

Trouvé in 1881.

Certainly, by 1900, of the 4,192 automobiles produced within the US that

yr, 1,575 (38%) had been electrical. Automobile speeds had been low at that

time and a lead acid battery was ample to present 100 miles of

vary. Nevertheless, as car speeds elevated and necessities

modified, the lead acid battery was not ample. EVs

rapidly fell by the wayside as the inner combustion engine (ICE)

dominated.

Then in 1996, Basic Motors (GM) — performing upon a California

Air Sources Board (CARB) mandate for zero-emission automobiles

(ZEVs) — launched its first era EV1. This car

once more had a lead acid battery. Like its EV counterparts earlier in

the century, the EV1 couldn’t stand toe-to-toe with ICE

rivals because the lead acid battery lacked the power density

(volumetric and gravimetric) to compete. Even the second era

EV1, this time with a extra energy-packed nickel steel hydride

battery, couldn’t compete with the ICE.

These developments came about with lithium-ion as a bystander,

although it gives as much as thrice the power density

(volumetric and gravimetric) of lead acid and roughly two

occasions the density of nickel steel hydride.

Similtaneously GM was tinkering with the EV1, in Japan

Nissan launched the Altra EV in 1998 to little fanfare. The Altra

is critical in that it was the primary EV outfitted with a

lithium-ion battery. It by no means caught on. It was not till the

lithium-ion-equipped Tesla Roadster was launched in 2008 {that a}

fireplace was lit underneath the EV market and lithium-ion turned

mainstream.

The primary lithium-ion battery chemistries

That’s not the place the story ends with lithium-ion. The phrase

“lithium-ion” is definitely catchall for numerous cathode (a battery's

constructive electrode) chemistries involving lithium. Materials for the

anode (the unfavorable electrode) is fairly set, with graphite

universally accepted as the fabric of selection, albeit with silicon

more and more added to the combination to enhance power density on the value

of a diminished cell cycle life.

Within the first functions of lithium-ion, the cathode chemistry

selection was between lithium together with oxides of nickel,

cobalt or manganese. Nickel was favored for its power density,

cobalt for its reversibility, and manganese for its security. Now, in

lithium-ion batteries of this sort, a cathode combining all three

in various ratios — NCM — is favored due to the

attribute trade-offs famous above.

Till comparatively lately, the NCM ratio was primarily 1:1:1.

Nevertheless, with the need to scale back value and enhance sustainability

(attributable to environmental considerations over cobalt mining) and power

density, the nickel ratio has been elevated to the purpose that NCM

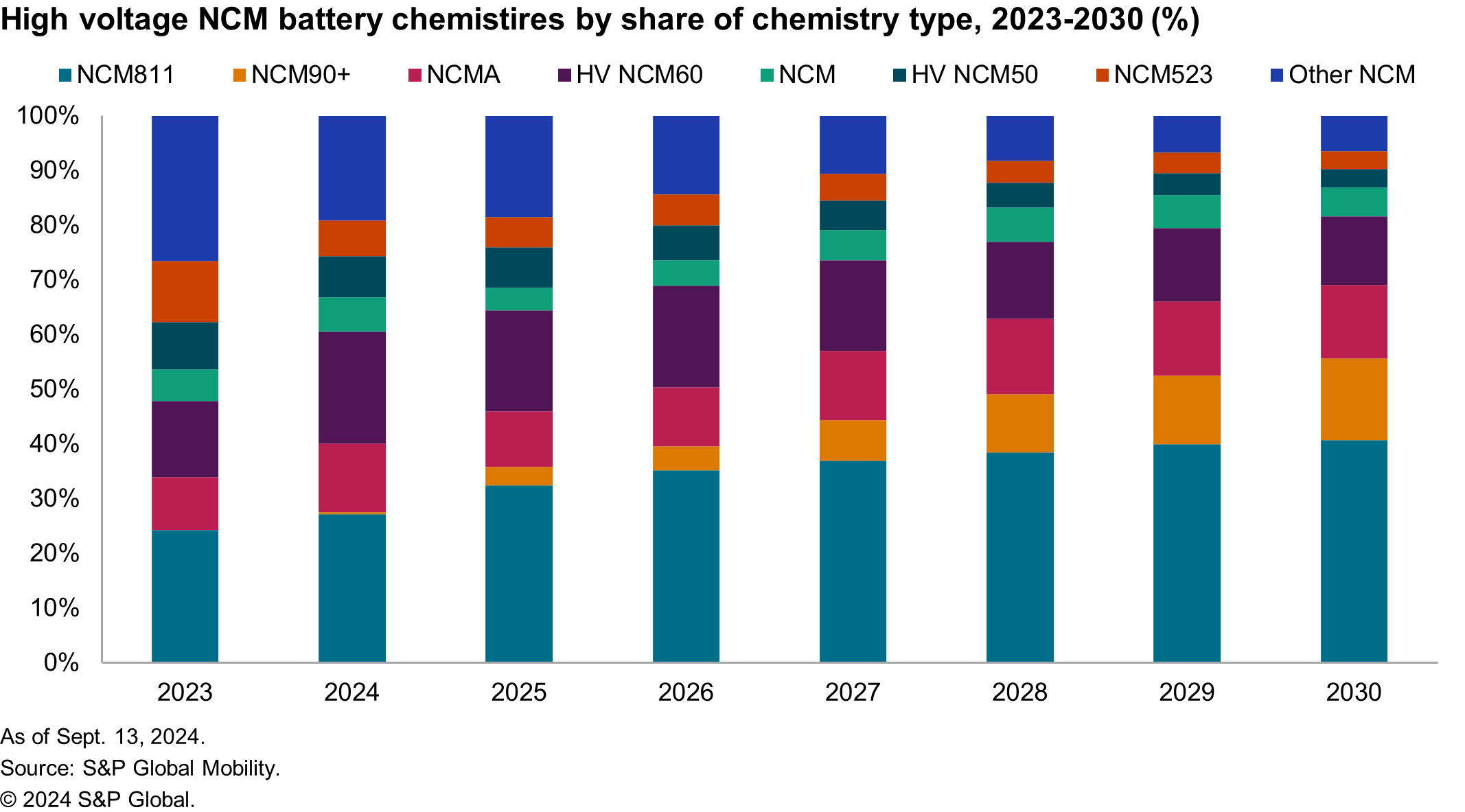

811 (8:1:1) has reached close to ubiquity within the NCM kind. The graph

beneath reveals the market make-up and forecast for the assorted NCM

combos.

The NCM811 mixture holds sway over the market and can

progressively improve its share. The so-called NCM90+, NCMA and HV

NCM60 chemistries are additionally of word. NCM90+ denotes cathodes the place

the cobalt and manganese content material is reduce additional (typical ratios can

be 9:0.5:0.5 therefore the 0 within the nomenclature) to enhance power

density. NCMA batteries take the premise of the NCM battery and add

aluminum to the combination for higher power density.

All of the above largely pertains to lithium-ion batteries of the NCM

kind (with a passing point out of NCA – nickel, cobalt, aluminum).

Including additional complexity has been the arrival of LFP (lithium iron

phosphate) lithium-ion batteries, a lot favored by Chinese language OEMs for

their decrease value, enhanced thermal stability and the widespread

availability of iron phosphate cathode supplies. These attributes,

along with the expiration of patents for LFP batteries in 2022,

have seen heightened curiosity within the chemistry outdoors of Mainland

China with European and North American-based OEMs constructing LFP

provide chains.

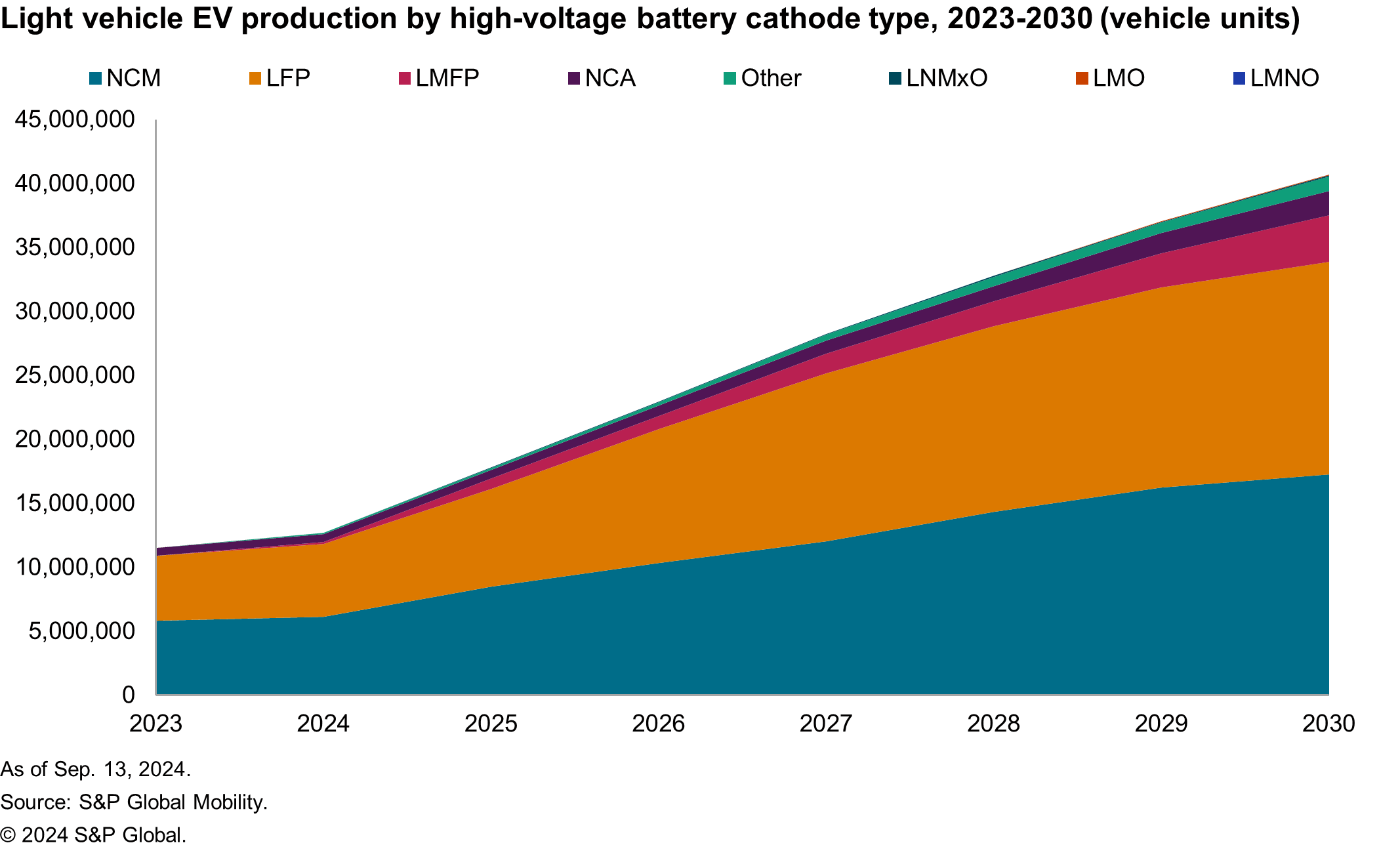

As of now, LFP and NCM — of their numerous guises —

dominate EV lithium-ion battery chemistries. In 2024, they’re

forecast to account for 94% of sunshine car EVs produced

globally.

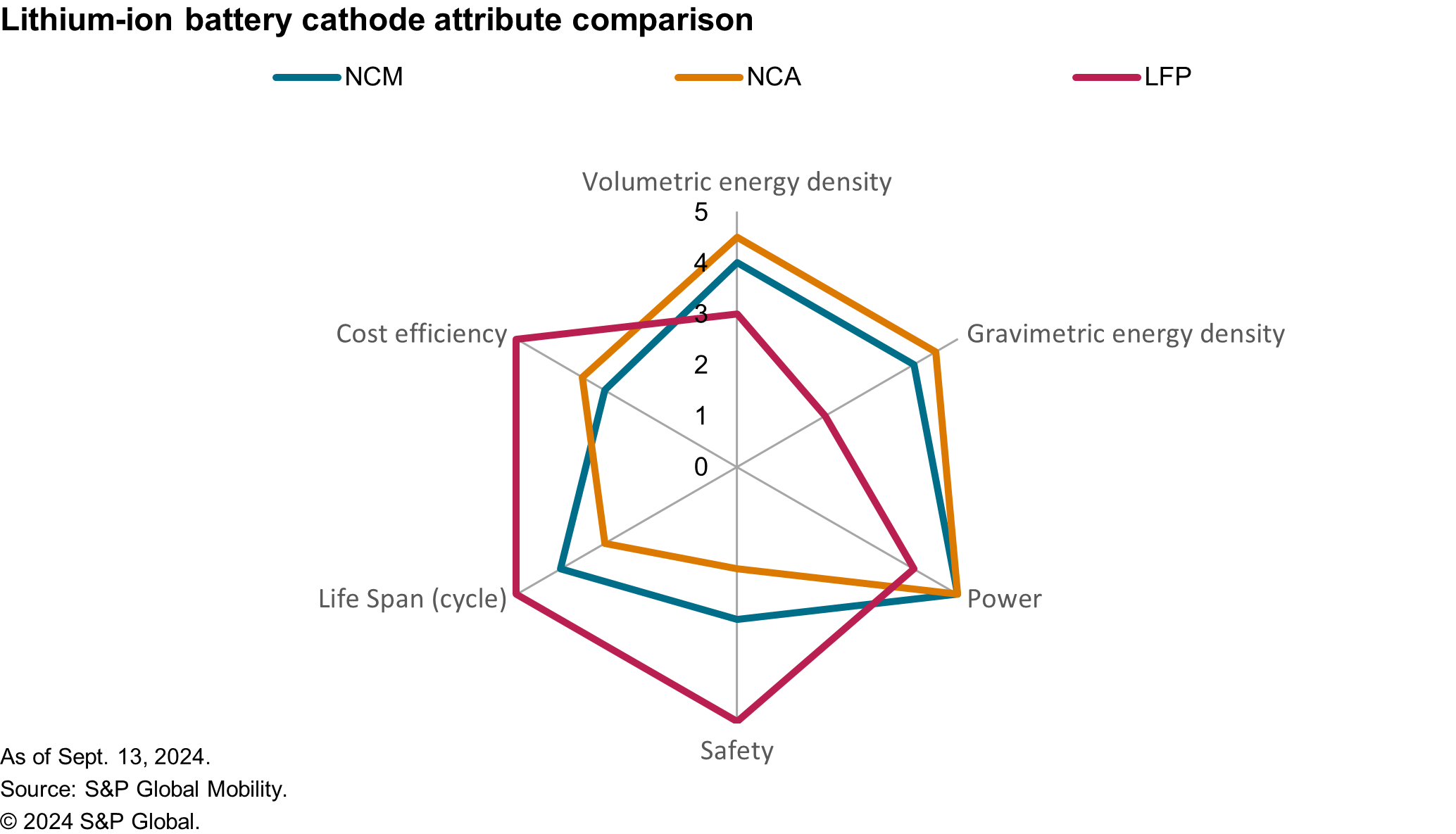

The next chart demonstrates the attribute trade-off between

all the primary competing cathode varieties for lithium-ion batteries.

Writ giant are the benefits that LFP has over competing

chemistries. Nevertheless, it falls quick in power density on each

gravimetric and volumetric measures, which means that bigger LFP

batteries are required to realize the identical vary, notably when

in contrast with NCM and NCA varieties.

This shortcoming makes LFP batteries extra appropriate for mild

automobiles in smaller segments and in these automobiles the place

efficiency is much less of an identifiable model attribute. Nevertheless,

these shortfalls shouldn’t detract from the general contribution

that LFP batteries will make in electrifying mild car fleets,

and they are going to be — and have been — a vital think about

constructing momentum in additional price-sensitive areas of the market.

What of sodium-ion and solid-state

batteries?

As gross sales development charges for EVs have lately stalled in main

markets, consideration is shifting to 2 rising battery applied sciences

— sodium-ion batteries (SIBs) and solid-state batteries (SSBs)

— that will assist revitalize the business and tackle limitations

of present applied sciences.

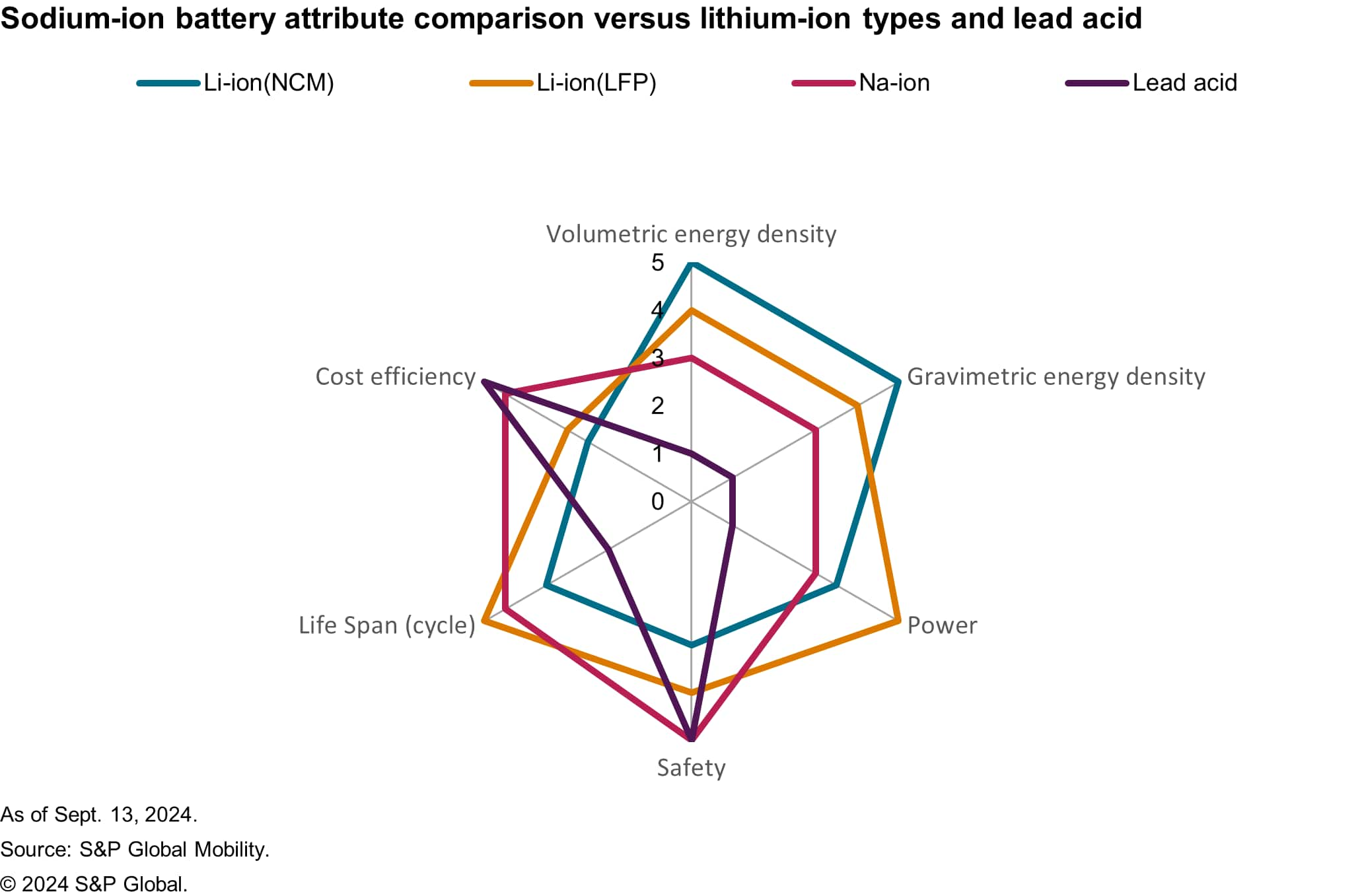

As a result of abundance of sodium in contrast with lithium, SIBs

current a probably cheaper different to lithium-ion batteries,

together with lithium iron phosphate (LFP) varieties. They keep away from the

advanced provide chains required for lithium-ion mass manufacturing.

Initially, SIBs had been seen as appropriate just for power storage

programs or low-performance two-wheelers. Though these segments

will probably be the place SIBs will probably be primarily used, current developments

counsel there’s a area of interest inside mild automobiles that SIBs can cater

to.

SIBs are more likely to compete with LFP batteries, as their power

density is roughly 160 Wh/kg, in comparison with round 200 Wh/kg

for LFP. This decrease power density, alongside a shorter life cycle,

limits SIBs primarily to low-cost, entry-level automobiles.

Nonetheless, a number of components may drive higher adoption of

SIBs within the light-vehicle sector. Technologically, SIBs are safer,

being much less liable to thermal runaway, which may result in fires.

Sodium's decrease reactivity reduces dendrite formation, a standard

failure mode in lithium-ion cells. Furthermore, SIBs can function

effectively over a wider temperature vary, offering higher

efficiency in cooler circumstances.

The first benefits of SIBs lie of their materials prices.

Based on S&P International Mobility analysis, the fabric value

for SIBs is about 28% decrease than LFP batteries. Moreover, SIB

manufacturing processes are almost equivalent to these of

lithium-ion cells, which means that suppliers can transition with

minimal funding.

Regardless of their promise, SIB expertise remains to be in its infancy

inside the mild car market. Whereas restricted manufacturing started in

Mainland China this yr, forecasts counsel SIBs will obtain solely

low single-digit market penetration by 2030.

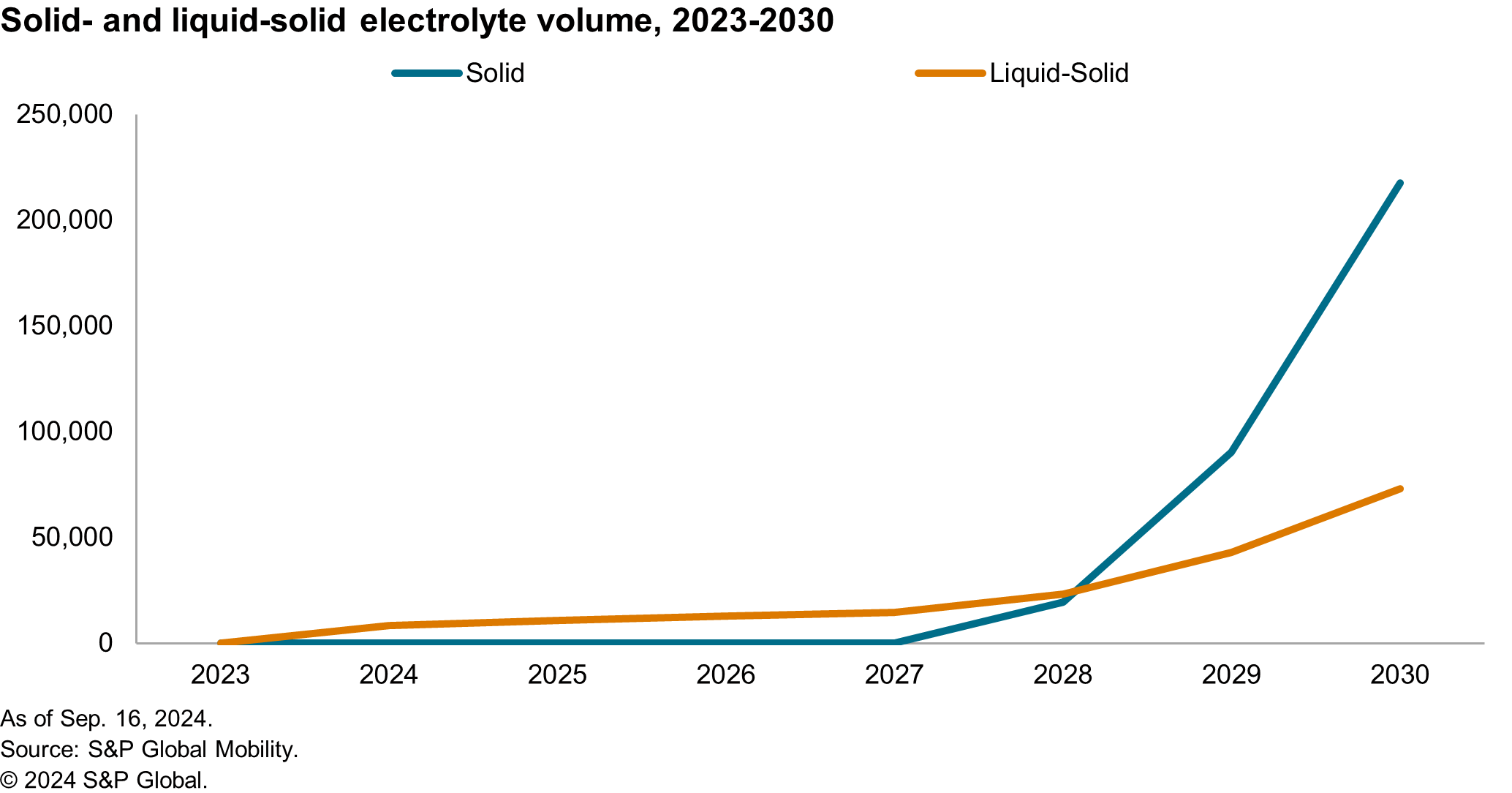

The second expertise price contemplating is solid-state batteries

(SSBs), which basically alter lithium-ion battery design by

changing liquid electrolytes with strong ones. This transition is

advanced, with interim options involving semi-solid and

almost-solid electrolytes additionally thought of for improvement.

SSBs provide three vital advantages. First, they improve

security; current liquid and gel electrolytes are extremely flammable,

particularly when used with high-nickel cathodes, that are much less

thermally steady.

Second, when paired with lithium steel anodes, SSBs can obtain

power densities 50%-80% larger than conventional high-nickel

lithium-ion cells, permitting for higher car vary. For instance,

Nio lately launched its ES8 with a 150-kWh semi-SSB, boasting an

power density of 360 Wh/kg and a spread of 930 km on the Chinese language

check cycle — about 20% greater than the very best present lithium-ion

battery.

Nevertheless, SSBs aren’t fully risk-free; they’ll nonetheless endure

thermal runaway underneath excessive circumstances or injury, and the melting

level of lithium (180°C) poses challenges.

Regardless of these benefits, a number of hurdles exist for SSB

adoption. The usage of lithium steel anodes, which may result in uneven

plating and dendrite formation, poses dangers to battery integrity.

Moreover, strong electrolytes are much less conductive, probably

limiting energy output, particularly in colder circumstances. In some

circumstances, exterior heating is critical, notably with polymer

electrolytes.

Furthermore, current gigafactories designed for lithium-ion

battery manufacturing would require vital re-investment to

accommodate SSB manufacturing, complicating the transition. S&P

International Mobility estimates that by 2025, SSB prices will probably be round

$500 per kWh — over 5 occasions the price of lithium-ion

batteries. Which means SSB packs will initially be extra

costly even with larger power density.

Whereas some analysis signifies potential value benefits for

SSBs, they may stay pricier than lithium-ion batteries within the

short- to medium-term. S&P International Mobility forecasts that

preliminary SSB functions will probably be in premium battery-electric and

hybrid automobiles, the place the higher vary promised by SSBs is a

vital promoting level. Higher China and Europe will lead SSB

manufacturing, accounting for over 73% of the forecasted 2.3 million

SSB automobiles by 2034, with main automotive manufacturers like

Mercedes-Benz and BMW dominating the output.

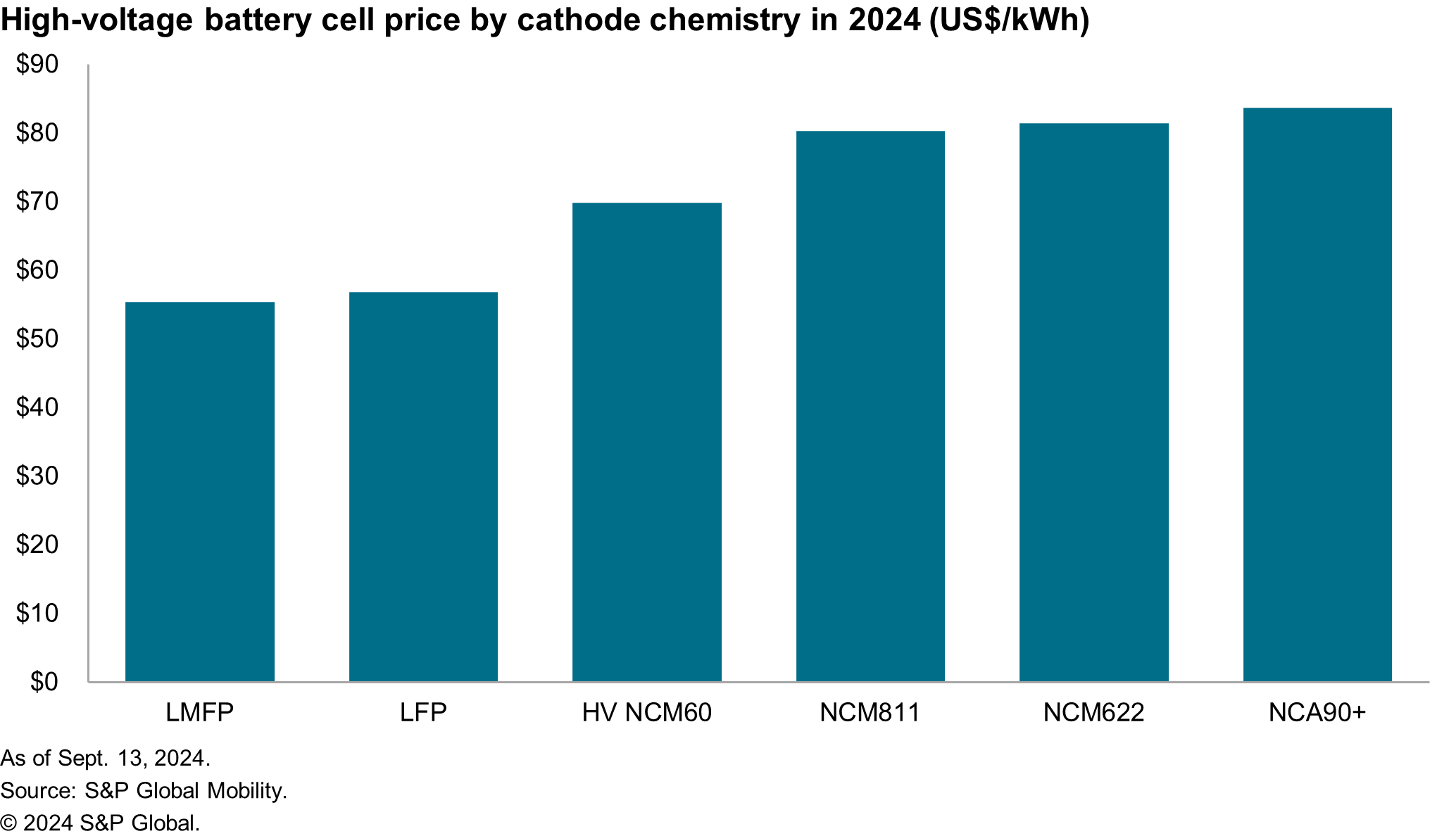

Lastly, as has been seen on this evaluate of battery chemistries,

value is a significant parameter within the decision-making tradeoffs OEMs and

suppliers need to make of their pursuit of the precise battery

chemistry for his or her use case. Price can also be one of many essential drivers

of EV adoption. It was typically held that EV gross sales would solely take off

as soon as EV batteries achieved value parity with the ICE. This degree was

deemed to be on the US$100 per kWh worth level for the battery

pack. A number of chemistries at the moment are at that degree in keeping with the

value mannequin developed by S&P International Mobility.

Conclusion

The evolution of EV battery expertise displays a mix of

historic developments, rising improvements, and market calls for.

In the end, the continued evolution of battery expertise will probably be

pivotal in driving the adoption of electrical automobiles, making them

extra accessible and interesting to customers whereas contributing to a

extra sustainable automotive panorama. The continued pursuit of

cost-effective, high-performance batteries is not going to solely affect

the trajectory of the EV market but in addition play a vital position in

addressing international power and environmental challenges.

Get excessive voltage battery forecast information

Watch the Webinar: Accelerating Sustainable Mobility by

Battery Provide Chain Administration