Tariffs on Chinese language-made EVs will affect automakers in Europe

and China, plus the worldwide provide chain.

The S&P International Mobility AutoIntelligence service

supplies each day evaluation of worldwide automotive information and occasions,

offering our purchasers well timed context and affect evaluation for

navigating the fast-moving trade. This Behind the Headlines

sequence affords a bi-weekly dive into the latest prime

tales.

European Union provisional tariffs on mainland Chinese language battery

electrical automobiles take impact

The European Fee put provisional tariffs on Chinese language

battery electrical automobiles (BEVs) as of July 5, 2024. An

investigation, which started in September 2023 and concluded in June

2024, by the EU's authorized arm decided that the BEV worth chain in

China advantages from unfair subsidization—inflicting a risk of

financial damage to European Union (EU) BEV producers. The

investigation additionally examined the seemingly penalties and affect of

these tariffs on BEV importers and shoppers within the EU.

The fee imposed totally different ranges of obligation on the three

fundamental Chinese language OEMs—SAIC, BYD and Geely—influenced by what

they described as the quantity of cooperation obtained from every,

amongst different elements. The total breakdown is:

- BYD is topic to 17.4% extra obligation for its Chinese language-made

automobiles bought within the EU. - The person duties for Geely and SAIC are 19.9% and 37.6%,

respectively. - Different BEV producers in China who cooperated however weren’t as

totally investigated are topic to a 20.8% weighted common

obligation. - The obligation for different non-cooperating corporations is 37.6%.

These provisional duties will apply for a most length of

4 months, throughout which interval EU member states will vote and a

remaining determination shall be made. If accredited, definitive duties would

be in place for 5 years. Tesla is the biggest China-based

exporter to the EU by quantity, and it could obtain an individually

calculated obligation fee on the definitive stage.

There was pushback from the mainland China automakers

affected, together with SAIC who has requested a listening to. SAIC insists

that its cooperation and proof was unfairly evaluated by the

Fee.

With the US imposing 102.5% tariffs on Chinese language EVs and Canada

contemplating comparable duties, these measures imposed by the EU add to

China's considerations that domestically based mostly corporations will face extra

commerce limitations in world markets and shall be pressured to shift

manufacturing some place else. Turkey has joined the international locations imposing

a tariff, whereas in Brazil the regional automakers' affiliation is

now calling for a 35% import tax.

Nonetheless, maybe counterintuitively, German automakers and the

trade

oppose the import tariffs. The German Affiliation of the

Automotive Trade (VDA) has argued that the tariffs wouldn’t

solely have an effect on Chinese language producers but in addition European corporations and

their joint ventures in China specifically. “It’s because a

massive proportion of car imports from China into the EU come

from European and American producers,” stated the VDA.

The affiliation additional warned of the potential for

countermeasures from China; one potential is studies that Chinese language

automakers have requested the nation's authorities to impose import

tariffs on EU-made automobiles with massive engine displacements. In

2023, China was the third-largest export marketplace for German-made

vehicles, by way of models, after america and the United

Kingdom. Volkswagen and BMW additionally issued statements opposing the

duties. Outdoors of Germany, Stellantis CEO Carlos Tavares expressed

comparable criticism.

The hefty duties will decelerate the tempo of some smaller-scale

mainland China-based automakers looking for to launch EV gross sales in

Europe with exported fashions. Main Chinese language carmakers similar to BYD,

nonetheless, are decided to increase into the worldwide market.

For these bigger gamers, manufacturing exterior of China could also be an

possibility that skirts tariffs. BYD is increasing, together with lately

opening a plant in Thailand, contemplating a plant in Mexico,

creating a producing base in Brazil, organising a European

manufacturing plant in Hungary, and dealing with the Turkish

authorities to arrange a website there.

Whereas the duties are supposed to shield companies long-term,

there are sometimes unintended penalties of such actions which may

take years to disclose themselves. The response of the European

automakers additionally demonstrates the complexity, because the tariff has

potential to harm their enterprise in each the EU and China. Western

automakers planning or already exporting from mainland China to

world markets, together with the EU, North America and Brazil, will

additionally must rethink sourcing plans.

Within the fast time period, shoppers within the EU could properly face greater

costs for BEVs. Tesla, MG and China's NIO have already indicated

they could elevate European costs of their Chinese language-made fashions

following the EU's determination. China can also retaliate with tariffs

towards items or providers exterior the auto trade.

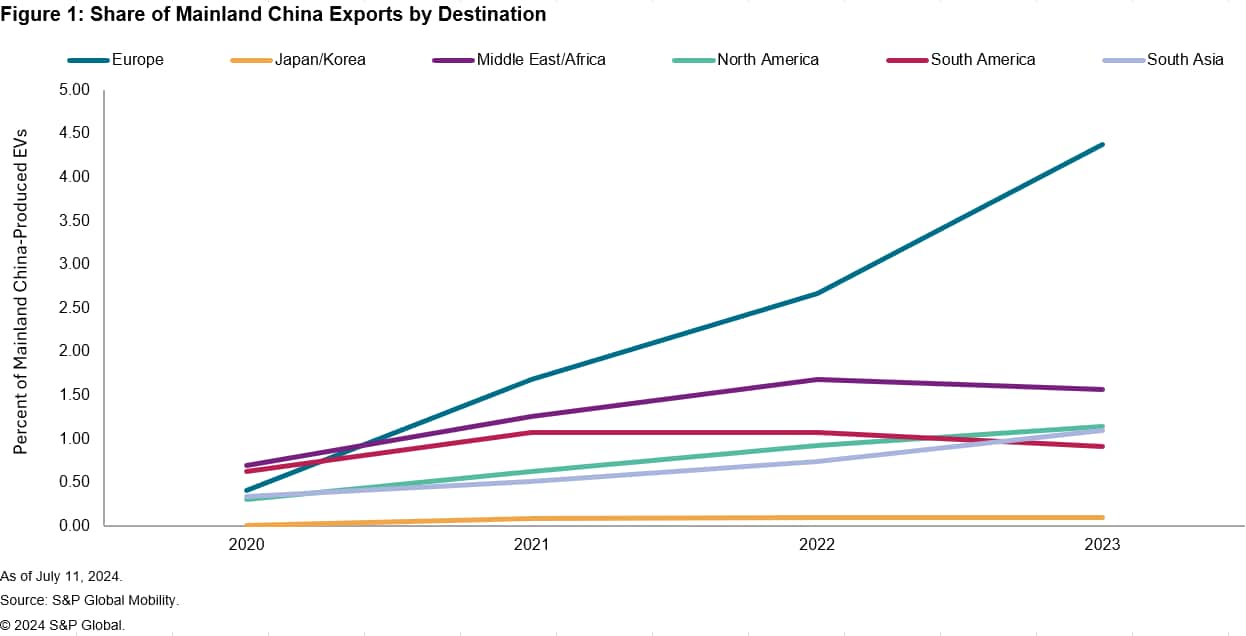

As a share of mainland China exports, Europe has grown from

seeing lower than 0.5% of exports from the nation in 2020 to 4.4%

in 2023; Europe is the biggest area for mainland China exports

as we speak, adopted by Center East/Africa, at 1.6%, in response to the

June 2024 S&P International Mobility gentle car manufacturing

forecast. In 2020, almost 93% of the automobiles produced in mainland

China remained within the nation. In 2023, 84% of the automobiles

produced within the nation have been bought there. Over that very same interval,

gentle car manufacturing in mainland China grew 23%, from 23.3

million models in 2020 to twenty-eight.8 million in 2023.

Battery manufacturing ups and downs

Growing battery manufacturing is among the many components wanted

for BEVs to achieve success, within the sense that it contributes to

lowering price. Nonetheless, BEV adoption is in a very uneven

part, more likely to final by 2026, with inconsistent and uneven

progress.

In opposition to that backdrop, Swedish battery firm Northvolt

lately introduced a strategic overview of its enterprise, on account of be

accomplished in third quarter 2024, evaluating timelines and capital

allocation. The corporate reported 19% progress in revenues in 2023, to

US $128 million, but in addition 106% improve in adjusted losses, to US

$569 million. The corporate's CEO indicated that there could also be a

refocus to plans already in course of, with initiatives not but began

being reined in for now.

Then again, Hyundai and LG Power Options inaugurated

their three way partnership battery plant in Indonesia on July 2

(manufacturing began earlier within the second quarter). The plant has

an annual capability of 10 gigawatt hours (GWh). Within the US, a joint

enterprise between PACCAR, Daimler Truck and Cummins, known as Amplify,

broke floor on a brand new plant due for manufacturing to start out in 2027

with annual manufacturing capability of 21 GWh. And Stellantis introduced

a collaboration with a French analysis group seeking to

develop next-generation battery cell expertise, although it's

unclear when that venture will end in production-ready

expertise.