[ad_1]

CC BY-ND

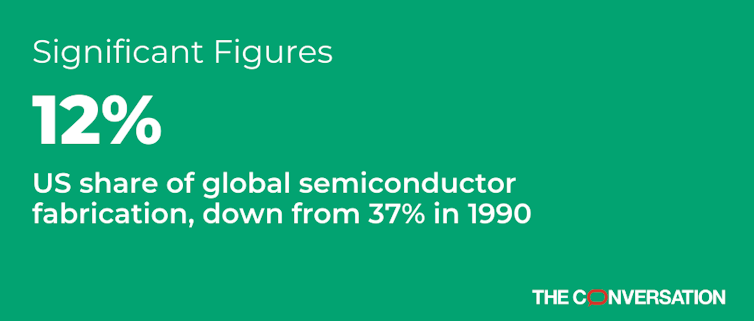

President Joe Biden’s govt order calling for a assessment of provide chains for crucial merchandise put a highlight on the decades-long decline in U.S. semiconductor manufacturing capability. Semiconductors are the logic and reminiscence chips utilized in computer systems, telephones, autos and home equipment. The U.S. share of worldwide semiconductor fabrication is solely 12%, down from 37% in 1990, in line with the Semiconductor Trade Affiliation.

It may not appear vital that 88% of the semiconductor chips utilized by U.S. industries, together with the automotive and protection industries, are fabricated exterior the U.S. Nonetheless, three points make the place they’re made crucial to the U.S. as the worldwide chief in electronics: decrease functionality, excessive world demand and restricted funding.

Decrease functionality

The growing reliance by U.S. chip corporations on worldwide companions to manufacture the chips they design displays america’ diminished functionality. U.S. semiconductor corporations have 47% of the worldwide chip gross sales market, however solely 12% are manufactured within the U.S. Assembly expectations for ever quicker and smarter electronics requires chip design innovation, which, in flip, relies on probably the most superior fabrication applied sciences obtainable.

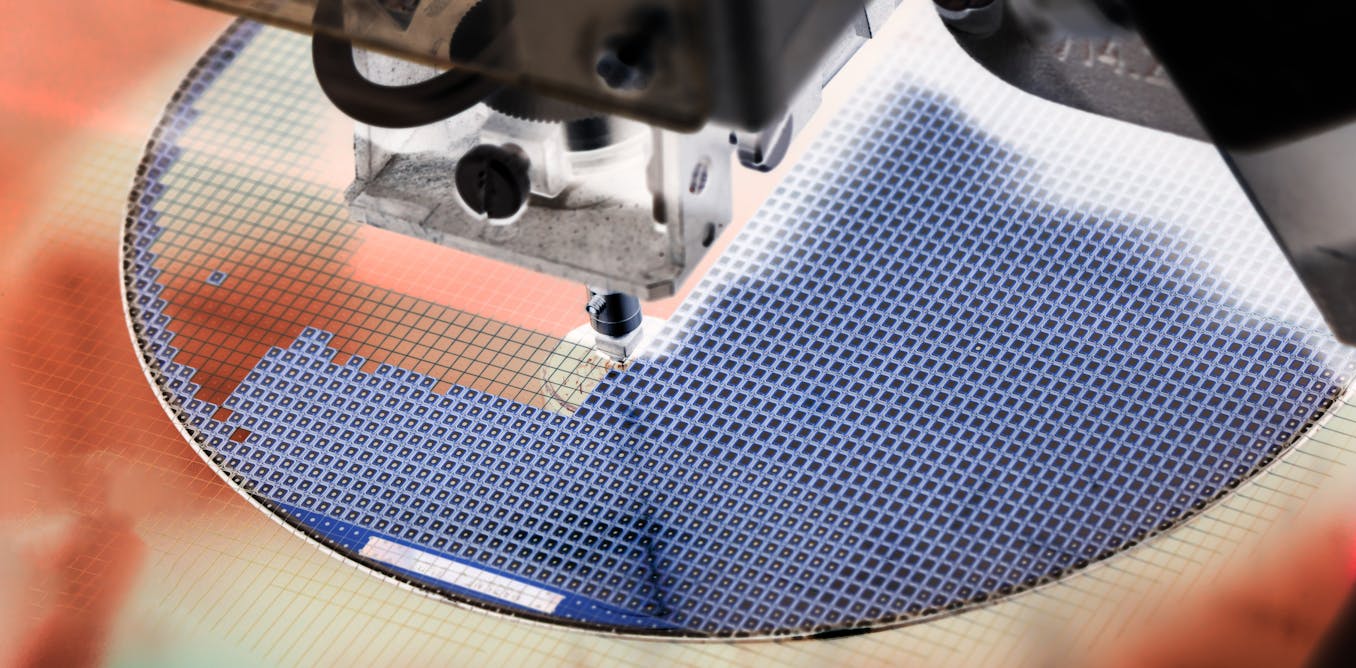

Advances in semiconductor fabrication are primarily based on the variety of transistors, the smallest of a chip’s digital elements, per sq. millimeter. Essentially the most superior semiconductor fabrication applied sciences and services, often known as fabs, are labeled as 5 nanometers, or millionths of a millimeter. The quantity refers back to the course of fairly than any specific chip function. Typically, the smaller the nanometer ranking, the extra transistors per sq. millimeter, although it’s a difficult image with many variables. The best transistor densities are about 100 million per sq. millimeter.

Taiwan and Samsung in South Korea are growing 3 nanometer fabs whereas the U.S. doesn’t but have a 7 nanometer fab. Intel has introduced that its 7 nanometer fab gained’t be prepared for manufacturing till late 2022 or early 2023. This leaves the U.S. with out the means to take advantage of superior chips.

Excessive world demand

With the pandemic, demand for cell telephones, laptops and different work-at-home units and elevated use of the web have put stress on fabs to extend the variety of chips they’re delivering for these merchandise. The worldwide automotive trade predicted that demand for vehicles would fall in the course of the pandemic, so it lowered its orders for semiconductors chips utilized in car security, management, emissions and driver info methods. The auto trade has restarted manufacturing however is now confronted with a scarcity of semiconductor chips.

Lately, eight state governors requested Biden to redouble efforts “to induce wafer and semiconductor corporations to develop manufacturing capability and/or briefly reallocate a modest portion of their present manufacturing to auto-grade wafer manufacturing.” This “modest” reallocation can’t be completed with out inflicting shortages elsewhere. And it can’t be completed rapidly. For instance, Taiwanese semiconductor big TSMC has reported a six month lead time from inserting an order to supply, and producing a chip is estimated to take as much as three months.

Liu Yucai/Visible China Group by way of Getty Photos

Restricted federal funding

The governments of Taiwan, South Korea, Singapore and China every make investments tens of billions of {dollars} annually of their semiconductor industries and it exhibits. These investments embody not simply the services themselves but in addition the R&D and power improvement vital to maneuver to the subsequent technology of fabs. Such incentives within the U.S. stay minimal.

[Over 100,000 readers rely on The Conversation’s newsletter to understand the world. Sign up today.]

TSMC plans to speculate US$25-28 billion this 12 months in fabs alone and has promised to speculate $12 billion for a fab in Arizona. To place this in perspective, the Arizona TSMC fab is predicted to start out processing 20,000 wafers a month, in contrast with the 1,000,000 wafers in current TSMC services in Taiwan and China.

Biden’s govt order about provide chains is a crucial step in figuring out the investments wanted to enhance the prospects for the U.S. semiconductor trade.

[ad_2]