[ad_1]

Whether or not your views on the tempo of BEV adoption are optimistic or pessimistic, EVs are right here, and extra are on their method.

Automotive advertising and marketing goes by means of a transformative change. The business's path to electrification, whereas bumpy, is giving customers extra automobile choices and decisions than ever earlier than.

At present, US auto consumers have practically 450 automobile nameplates to think about. With the arrival of electrical autos throughout each mainstream and luxurious model, and rising demand for hybrid powertrains, there will likely be practically 650 nameplates by the tip of the last decade — all competing for showroom area, lot area, advertising and marketing price range and most significantly, the hearts and minds of shoppers.

Stock restoration pushed by EV provide, resulting in pivots

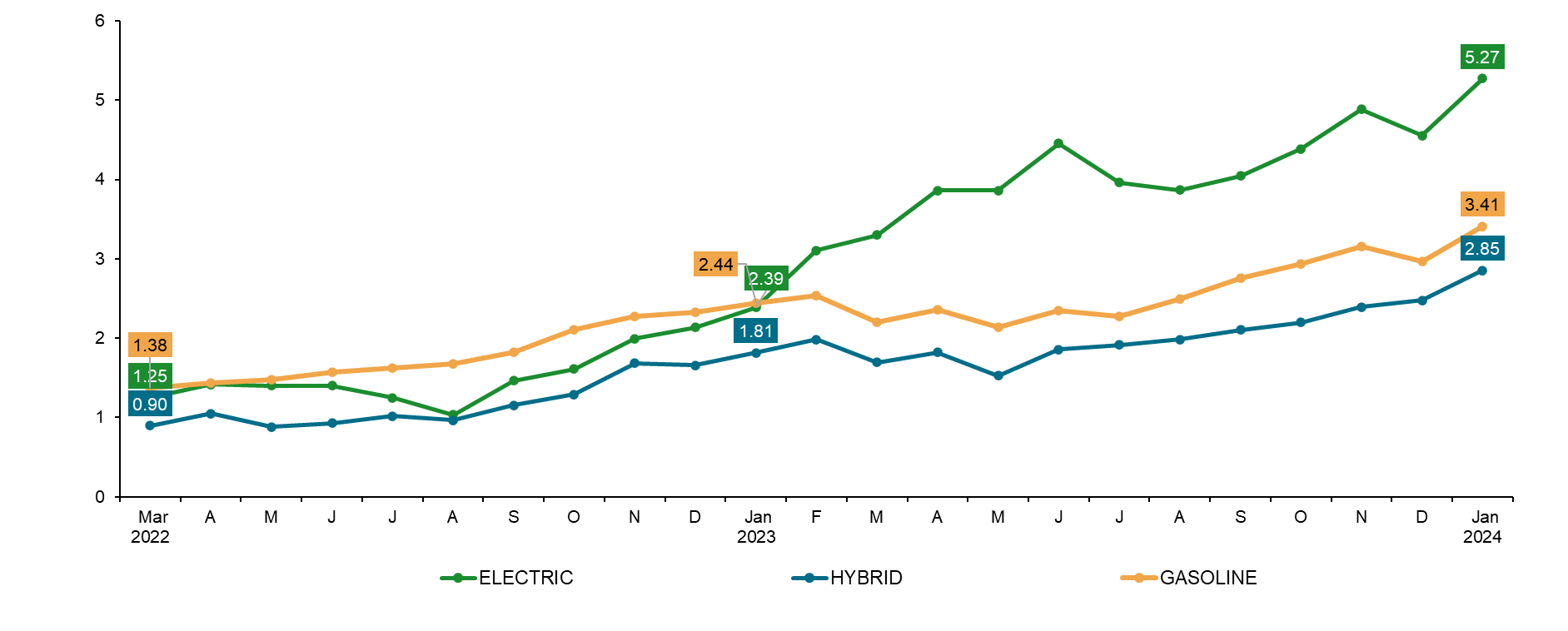

The business has largely recovered from the semiconductor provide constraints and on common, dealership stock is up 2x since January 2022. An enormous contributor to elevated inventories, electrical autos are occupying a rising quantity of lot area. Since early 2023, EV inventories have risen extra quickly than ICE or hybrid choices out there. But gross sales haven’t saved tempo and in January 2024, nationwide EV stock exceeded 5 months' provide (Determine 1).

Determine 1: Retail Marketed Stock/Retail Registrations

Supply: S&P International Mobility Mar. 2022 – Jan. 2024

And extra stock is coming. 2024 and 2025 will see over 130 new automobile launches — and greater than half of them will likely be electrified. Consequently, producers have needed to pivot, tempering EV manufacturing quantity to higher align with demand. S&P International Mobility's forecast displays an anticipated EV manufacturing decline of 4% in 2024 and 10% in each 2025 and 2026 respectively.

Hybrid's rising position in electrification transition

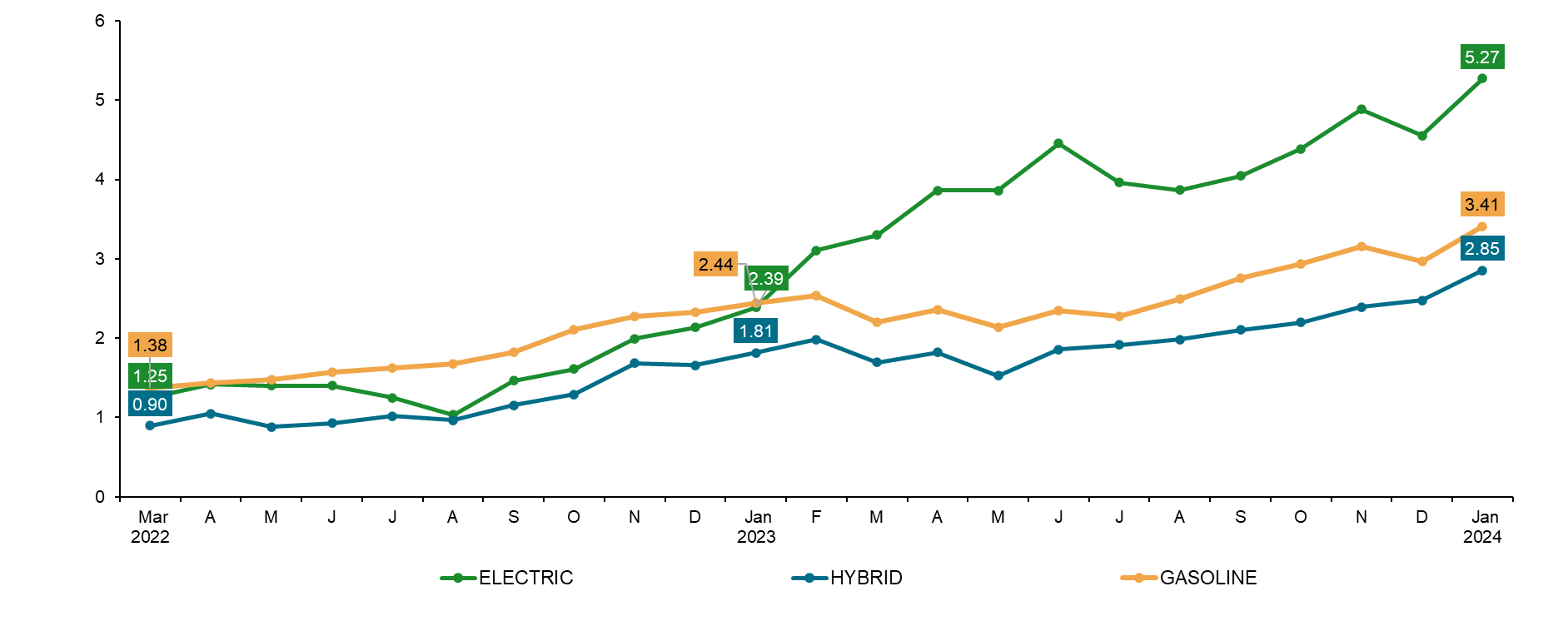

Whereas EVs stack-up, hybrid autos are having a second. In line with S&P International Mobility evaluation, hybrid share of latest automobile registrations has been over 10% for seven consecutive months whereas EV share has topped 9% simply twice in the identical time span (Determine 2).

Hybrid loyalty can also be at a six-year excessive (42%), whereas EV loyalty (66%) has plateaued during the last 5 quarters. Moreover, over 8% of EV households that return to market are migrating to a hybrid, the best share since 2018.

Determine 2: Retail market share by gasoline sort

Supply: S&P International Mobility US Market share by gasoline sort. 2018 – Jan. 2024. *Q1 2024 consists of Jan. information solely

Electrified automobile gross sales stay a largely additive buy

Electrified autos typically compete for family parking area, with seven-in-ten new EVs becoming a member of different autos within the driveway as an alternative of changing one. For hybrids, the break up is six-in-ten as addition versus alternative whereas ICE autos have a extra even break up of 49% additive vs. 51% alternative.

The standing of EVs as alternative autos will seemingly shift later this decade, signaling a considerable change in shopping for motivations because the hole between advertising and marketing spend and demand narrows.

Elevated mannequin depend impacts on gross sales and advertising and marketing

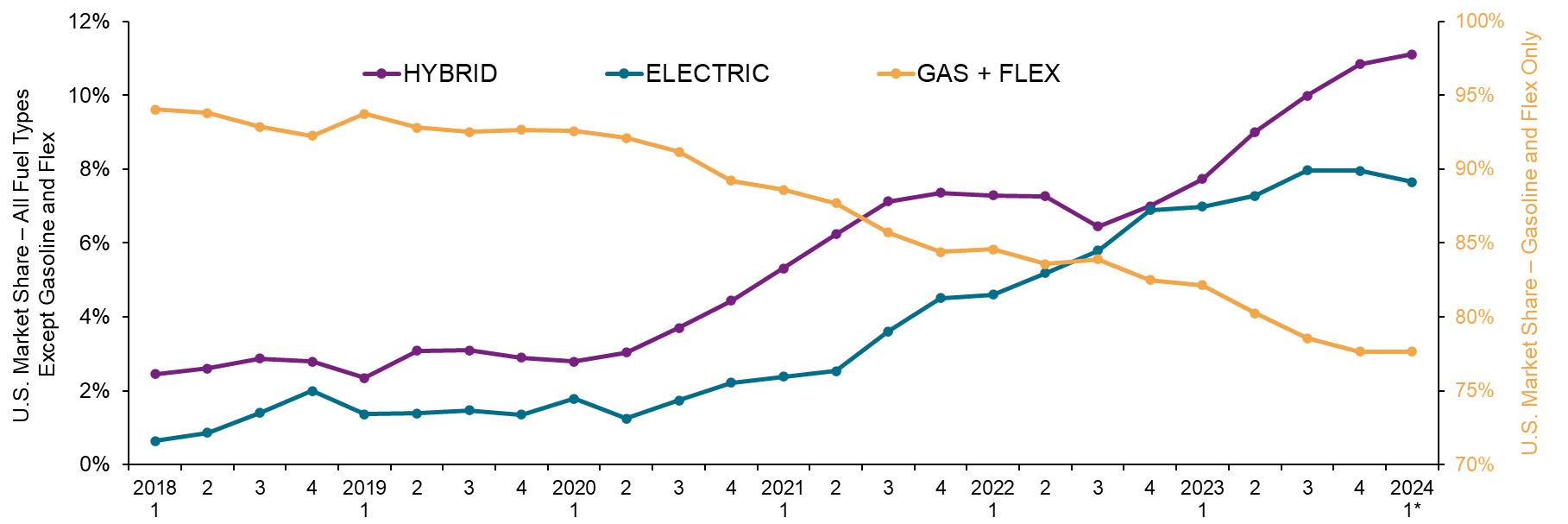

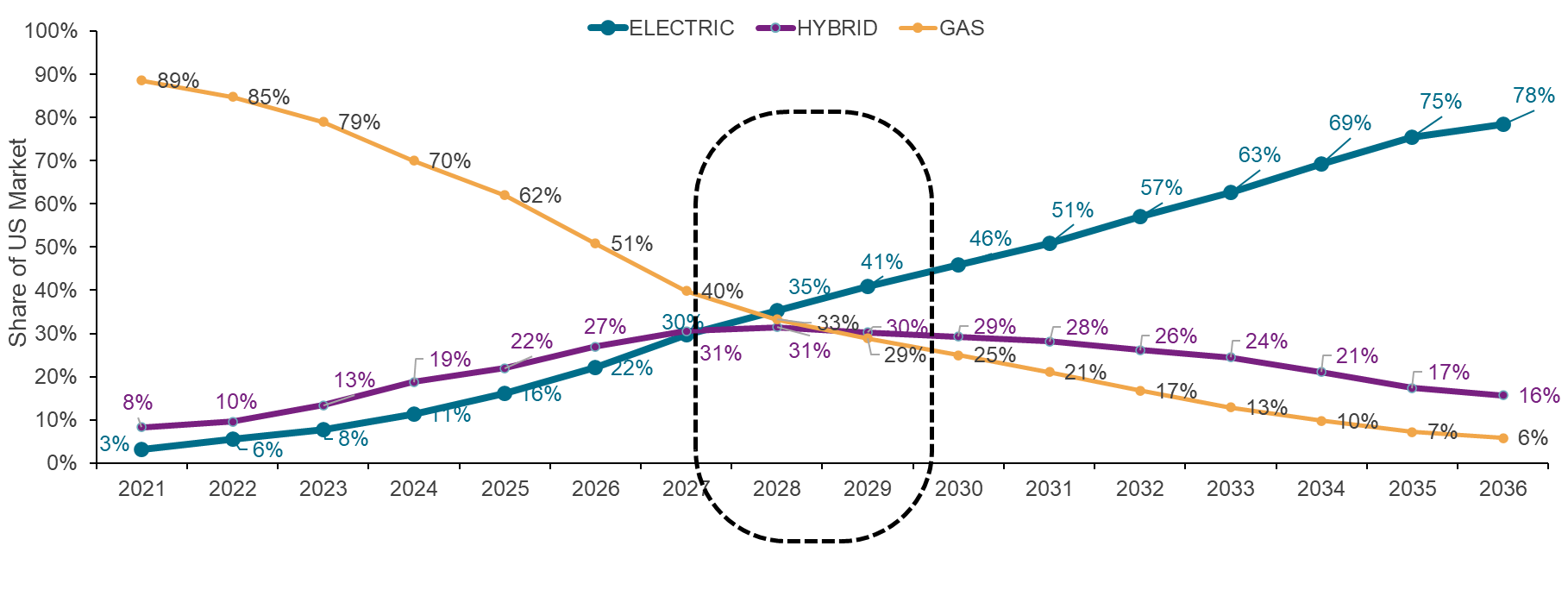

S&P International Mobility forecasts that the three propulsion system designs — hybrid, EV and ICE — will every account for 29% to 36% market share by the tip of this decade. After that, EV share is predicted to develop whereas hybrid plateaus after which joins ICE in a steady, however gradual, decline (Determine 3).

Consequently, retailers might want to develop and hone focused messaging methods for all of their EV, hybrid and ICE stock.

Determine 3: Share of latest automobile registrations by gasoline sort

Supply: S&P International Mobility US Gasoline Kind Forecast as of February 2024

The elevated mannequin depend is predicted to trigger a drop in sales-per-nameplate figures: In 2018, the common gross sales quantity per nameplate within the US market was 49,000 items. That’s anticipated to drop to 36,000 by 2030 earlier than rebounding to 39,000 in 2035, in keeping with the S&P International Mobility gentle automobile forecast (March 2024).

That is affecting manufacturing cycles, gross sales forecasting, provider relationships and advertising and marketing price range allocation.

The affect to revenue margins, platform economics, working bills, product lifecycles and go-to-market timing will lower throughout all points of the auto enterprise — from new and used automobile gross sales, to automobile acquisition, elements and repair. Retailers and their entrepreneurs must be nimble and do extra with much less.

Auto entrepreneurs should ramp-up their messaging and viewers options

As automobile provide and the variety of out there fashions rise, so does competitors for shopper consideration. Clients count on personalization and related gives and like to deal with a lot of the consideration and transaction course of digitally. With completely different buyer sorts, automobile sorts and shopping for motivations, there’s elevated significance in focused, distinctive and dynamic messaging.

Turning market challenges into alternative begins together with your first-party information. Higher personalization requires correct, actionable information. There are three essential methods entrepreneurs can develop simpler messaging, cut back waste, and enhance advertising and marketing ROI:

- Make use of automobile verification. Does the patron nonetheless have their automobile? Cease annoying clients with irrelevant gives and cut back wasted impressions by figuring out automobile disposers.

- Enrich buyer profiles. Transcend your buyer's most up-to-date buy to develop a complete family profile — together with what different autos are owned, month-to-month cost and lease info, if they’re in-market once more, and if they’re loyal to a section, make or mannequin.

- Resolve identification gaps from inaccurate information. Identification information is usually incomplete. Information cleaning and hygiene cut back database administration prices and enhance the possibilities that your message is delivered to the supposed buyer.

At present, automotive entrepreneurs are making nice strides in leveraging know-how and information science to develop superior audiences, messaging methods and improved digital communication instruments. These are going to be important for fulfillment as a result of entrepreneurs must handle extra buyer sorts, automobile sorts and shopping for motivations. Differentiation of promoting methods would be the key to reducing by means of the elevated litter and noise of the approaching automotive market.

Obtain our Electrification Affect Overview

[ad_2]