[ad_1]

The S&P International Mobility AutoIntelligence service

gives each day evaluation of worldwide automotive information and occasions. We

ship well timed context and impactful evaluation for navigating the

fast-moving trade. Behind the Headlines provides a bi-weekly dive

into latest prime tales.

In 2024, gross sales of battery electrical automobiles (BEV) settled to

single-digit development. Although BEV demand continues to develop, the

mismatch between naturally progressing demand and automaker

forecasts set the world on edge.

Given the billions invested and being deployed within the

transition, concern is warranted. Quantity has largely elevated,

although Tesla has seen softening demand for a number of of its merchandise.

Tesla’s outsized share of BEV gross sales has a big affect

exterior of mainland China. On the identical time BEV demand has entered

an inconsistent and uneven development section in most markets, mainland

China automakers are making inroads with inexpensive BEVs. The

capability of some mainland Chinese language automakers to supply lower-cost

BEVs and stay worthwhile has additionally set most different automakers on

edge, as BEV profitability stays elusive throughout the trade.

A shiny second in US light-vehicle registrations noticed an 18%

year-over-year improve in battery electrical automobiles (BEV)

registered in July 2024, the best of the 12 months up to now and above

the 6.0% the general market improved. The achieve was supported by

rising incentives in addition to having extra fashions accessible at

greater stock ranges. In July 2024, BEV share climbed to extra

than 8%. Yr thus far, BEV registrations are at 7.6%, versus 7.2%

on the identical level in 2023. BEV registrations grew 8.6% within the

January to July 2024 interval; the overall market has improved 2.5% in

the identical interval.

Nevertheless, this tempo will not be what many automakers counted on when

making funding choices within the 2020-2023 interval and the primary

half of 2024 was dominated by tales masking a perceived slowdown

in BEV demand. It’s extra correct to say that BEV demand didn’t

meet excessive projections than to say demand was slowing.

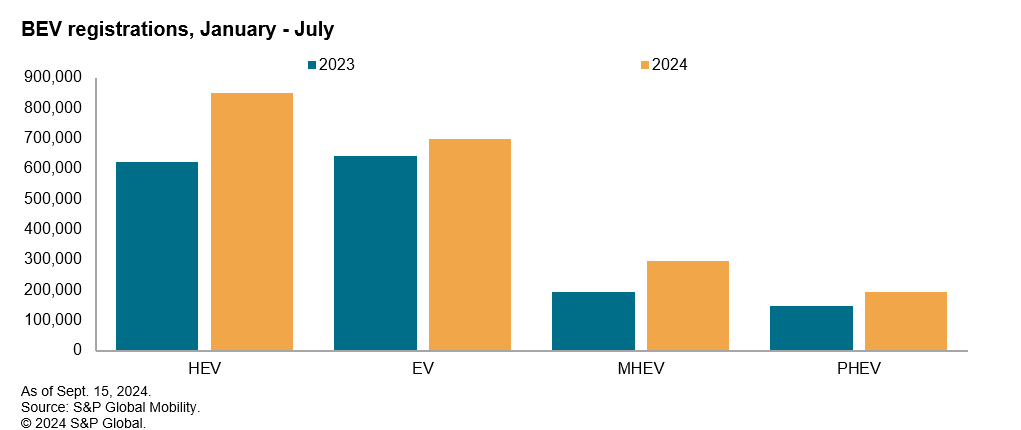

Nevertheless, within the first seven months of 2024 US light-vehicle

registrations noticed extra development in conventional hybrid-electric

automobiles (HEV). Plug-in hybrid electrical automobiles (PHEVs) have

improved as properly, although that resolution nonetheless sees slower adoption

than both BEV or HEV. In July 2024, HEV registrations had been at

10.4% of the overall market and quantity grew to only below 146,000

models for the month, in contrast with about 121,000 BEVs being

registered. Within the January to July interval, HEVs accounted for 9.2%

of all registrations.

The transition to BEV as a dominant propulsion system is probably going

to proceed to be inconsistent. Availability when it comes to stock

and car segments nonetheless lags behind conventional inside

combustion engine automobiles, pricing continues to be greater than comparable

ICE merchandise, infrastructure does develop slowly, and there are

nonetheless miles to go when it comes to shopper schooling, consciousness and

engagement. These points take time to resolve.

Within the meantime, many automakers are revising timing for BEV

funding. BEV profitability stays elusive and there stays the

must assist prospects not able to make the BEV change, whereas

nonetheless addressing rules. In 2024, it has turn into apparent that

the transition to BEV dominance might be inconsistent and fewer

predictable. HEV and PHEV will stay essential for an extended interval

than some automakers had been concentrating on.

Automakers are adjusting their plans to make sure the correct product

combine on the proper time in addition to managing capital funding

rigorously. BEV manufacturing targets have been reduce within the speedy

time period, merchandise canceled or delayed, longer-term BEV targets

adjusted, and capital funding re-timed. Automakers haven’t

deserted the longer-term objective of zero emissions automobiles as half

of the trail to an even bigger objective for web zero carbon emissions.

Ford and GM have each retimed BEV capability growth, delaying

when packages will come on line and the way shortly capability is being

elevated. Ford most not too long ago cancelled two BEV three-row utility

automobiles within the Ford Explorer and Lincoln Aviator area and can

use hybrid electrical propulsion techniques as a substitute. GM lowered

manufacturing targets for 2024 and 2025 and delayed the retooling of a

BEV full-size truck plant. GM has not introduced as many adjustments to

particular product plans however is predicted to have canceled or delayed

a number of tasks internally as properly. GM’s Cadillac division has

stepped again from its plans to shift to an all-BEV lineup by 2030,

and now says it can supply the “luxurious of selection” in terms of

powertrains. GM has delayed opening of its deliberate fourth US

battery plant to 2027, aligning with the delays in BEV manufacturing

plans, and its associate LG Vitality Options is slowing growth

of one in every of its US battery plant tasks.

Mercedes-Benz and Volvo Automobiles have additionally slowed a few of their

expectations for electrification. Volvo Automobiles dropped its forecast

from anticipating 100% electrified powertrains (BEV or PHEV) in 2030

to between 90% and 100%. Volvo Automobiles does count on to see 50% of its

gross sales in 2025 be electrified automobiles, nonetheless. Mercedes-Benz is

rising funding in ICE tasks to make sure its engines stay

aggressive because the change to BEV has not come as shortly because it

anticipated, and Mercedes-AMG has stated it can keep V8 engines

longer than deliberate.

However, Hyundai introduced a serious technique replace to

make investments billions extra into electrification in addition to concentrating on

annual gross sales of 5.5 million by 2030; by 2030, Hyundai expects 36%

of its world gross sales to be BEVs, although additionally planning an prolonged

vary BEV by late 2026 and never letting up on its targets for hydrogen

powertrains. After Hyundai introduced plans to spend US$90 billion

over the following 10 years to assist its initiatives, GM and Hyundai

introduced a memorandum of understanding to debate potential

partnerships for platforms, electrified automobiles and BEVs. It’s

far too quickly to know what’s going to end result from these talks. But, if the

two firms work collectively to cut back prices over the following decade,

this might have a considerable affect available on the market by making extra

reasonably priced electrified merchandise accessible quicker whereas the

automakers doubtlessly see profitability quicker.

Although a transition to zero emissions transportation stays a

central goal, customers are weighing in. In 2024, shopper

buy conduct is inflicting automakers to rethink funding

timing. The dynamics of this 12 months reinforce the advanced nature of

the change to rising BEV adoption, that buyers do maintain

important energy alongside the best way, and the significance of a nimble

company technique.

Get a free trial of

AutoIntelligence

This text was revealed by S&P International Mobility and never by S&P International Scores, which is a individually managed division of S&P International.

[ad_2]