[ad_1]

The flexibility of authentic tools producers to extract

income from a car as soon as it has left the vendor's lot is the

holy grail for the motor business. It's not at all a brand new quest,

both. The business has lengthy acknowledged the imbalance between the

income that accrues to OEMs on the level of sale and the monetary

riches harvested throughout a car's life. Jac Nasser, ex-president

and CEO of Ford, even made cradle-to-grave providers a cornerstone

of Ford's technique within the late Nineties. Extra lately, many OEMs

would slightly be seen as mobility corporations than plain previous

automakers, a nod to the spectrum of providers through which they see

development alternatives for his or her manufacturers.

The alternatives for OEMs are extra various now than ever within the

automotive's 120-year-plus historical past. The “linked” element of the

linked, autonomous, sharing and electrification (CASE)

megatrend, and, extra latterly, the software-defined car (SDV)

— or the now more and more modish AI-defined car —

emphasize this potential to extract extra {dollars} from customers, be

it for subscription or one-off cost providers. That's the speculation,

in any case. The fact, as BMW found with its infamous

heated-seat experiment, could be completely different.

To raised assess demand and customers' willingness to pay for

linked automotive options, S&P World Mobility conducts a world

survey of 8,000 car homeowners yearly. Right here

are some insights from the survey:

Linked providers manufacturers and perceptions

Most respondents had a good opinion of their present or

most up-to-date linked providers model, and 83% would possible

suggest it to a buddy. Optimistic opinions have been larger for

regional/native automaker manufacturers.

In contrast with final yr's survey, the highest three linked

providers manufacturers per nation remained nearly the identical throughout the

board. Nonetheless, the US and Brazilian markets noticed a change in

preferences. Within the US, OnStar retained its high spot, however FordPass

and Honda Join have been new entrants to second and third. In Brazil,

Volkswagen We Join, Toyota's T-Join and Honda Join have been

all newcomers within the high three.

There was a slight decline within the chance of recommending

linked providers manufacturers: a warning to automakers. On this yr's

survey, 43% of respondents have been “very possible” to suggest their

chosen model's providers, in contrast with 47% within the prior yr. The

nations the place respondents have been most certainly to suggest linked

providers have been Brazil, with 94%, and mainland China and India, with

91%.

Satisfaction and willingness to pay

S&P World Mobility's survey indicated declining

satisfaction ranges throughout all linked providers classes

in contrast with the earlier yr. The very best satisfaction was

reported for navigation, personalization and infotainment, whereas

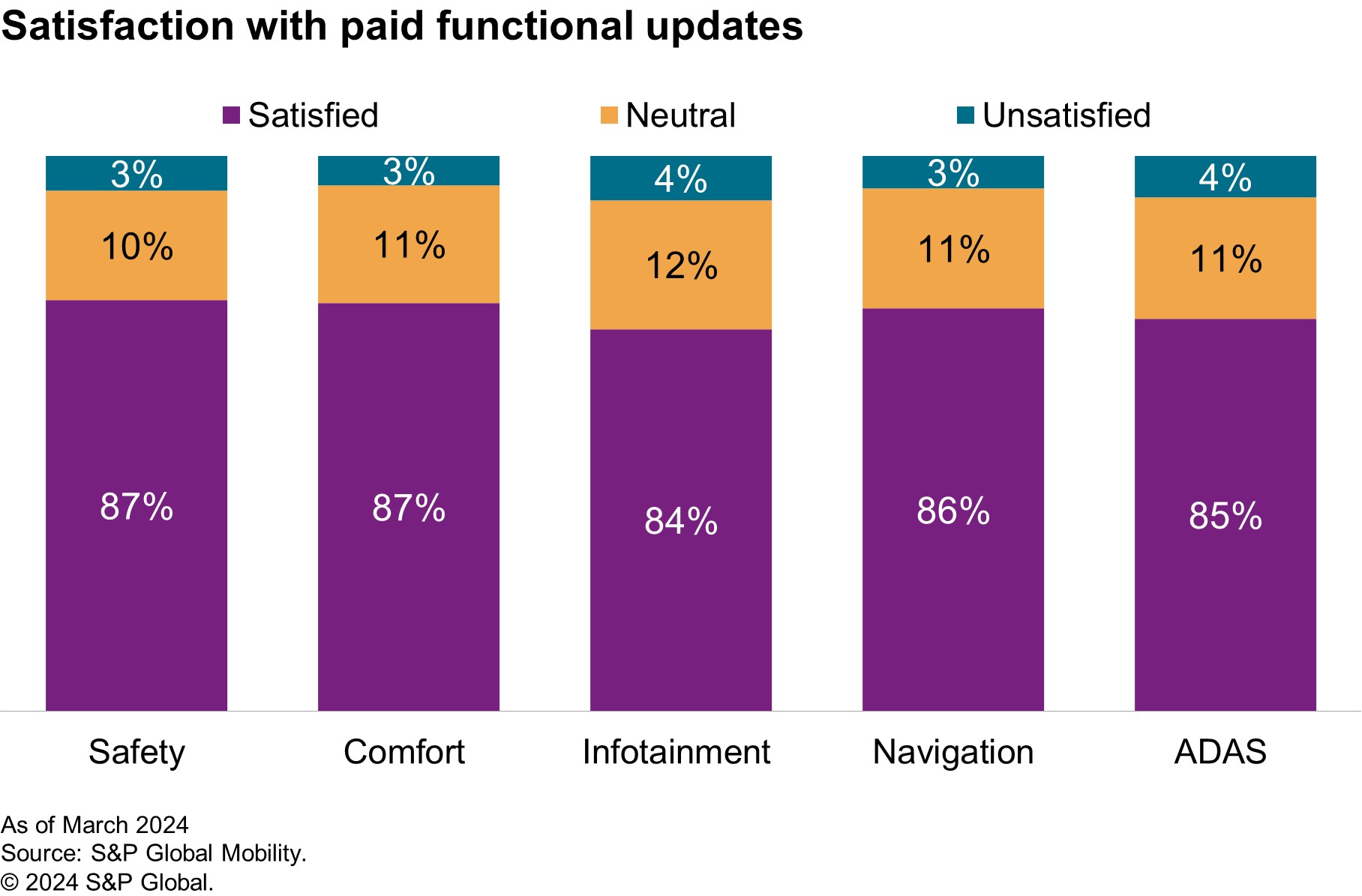

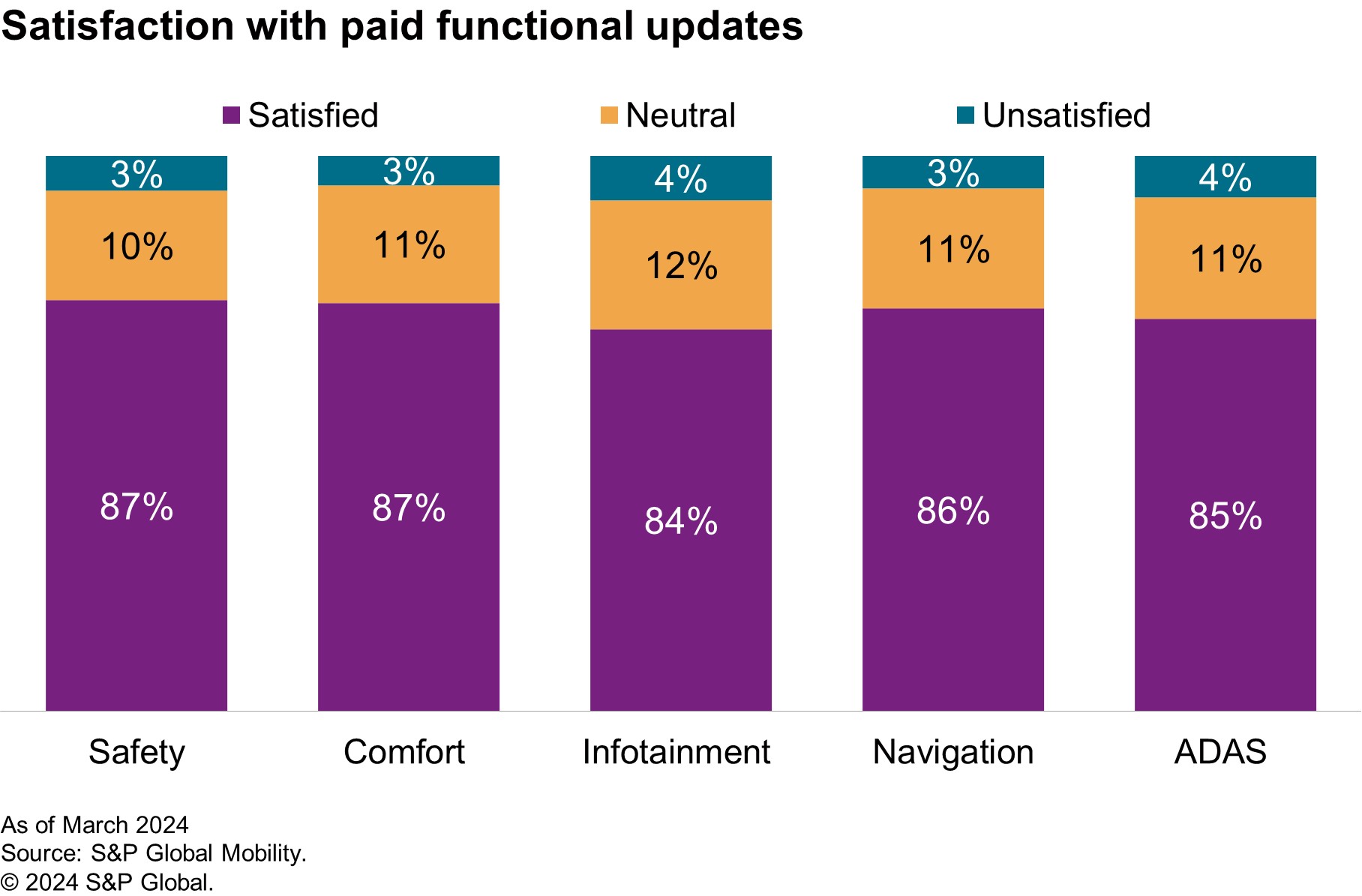

the bottom was for security and safety. Paid practical updates

confirmed excessive satisfaction in security, consolation, infotainment,

navigation and superior driver-assistance methods (ADAS).

Willingness to pay was highest for security and electrical car

providers and lowest for navigation and infotainment.

Customers expressed a robust want for navigation and security

and safety providers of their subsequent car, whereas productiveness

providers have been the least desired. The desirability of EV providers

and personalization are on the rise. For paid practical updates,

enhanced navigation, smartphone integration and fundamental ADAS

performance have been extremely fascinating. About 39% of respondents

most well-liked an annual subscription for these updates.

Information privateness considerations

As within the earlier survey, information privateness stays a major

concern, with 73% of respondents keen to share car information in

alternate at no cost linked providers. The principle reported considerations

revolved round safety, information misuse/belief and understanding the

worth of information sharing.

Lastly, although belief in sharing info has elevated

total, respondents nonetheless really feel extra snug sharing it with

automakers than with know-how corporations.

The survey demonstrates that the seek for incremental income

might be removed from the stroll within the park that some main proponents

of the SDV paradigm recommend. As ever, shopper loyalty and belief

are hard-won. The business is on the very first steps of that

journey with paid updates and subscriptions. Any false step now

may show very expensive for automakers as they work to diversify

their sources of income. The holy grail of paid updates and

subscription providers could possibly be one other empty vessel from which the

business drinks.

The survey included practically 8,000 grownup respondents from

eight territories, reflecting a various vary of regional

specifics. The web survey was carried out in native languages, and

quotas have been based mostly on demographics reminiscent of gender, age, family

earnings and area. Key standards for participation included proudly owning a

car from the mannequin yr 2019 or newer, making certain the pattern

focused have been potential finish customers of the applied sciences below

consideration.

Get day by day insights and intelligence by subscribing to

AutoTechInsight.

Subscribe to the BriefCASE e-mail e-newsletter.

Writer: Vivek Beriwal, Senior Analysis Analyst II,

S&P World Mobility

[ad_2]