|

The new automotive registrations knowledge from the European

Car Producers' Affiliation (ACEA) signifies that hybrid

electrical autos (HEVs) will stay prevalent longer than the

business anticipated.

In January-October 2024, battery-electric car (BEV)

registrations within the EU dropped by 4.9% 12 months over 12 months. Their

market share additionally fell from 14% final 12 months to 13.2%. Apparently,

HEV registrations elevated 17.5% in October, with their market

share rising to 33.3% from 28.6% final October. The demand tendencies

are related in the US. Though BEV demand continues to

develop, extra development is seen within the conventional HEV phase in

2024.

The lower-than-expected development price in BEV demand has disrupted

the funding and product methods of unique tools

producers globally. Many are scaling again their EV investments

and reviving give attention to hybrid expertise.

Throughout the 2024 CEO Investor

Day in Seoul, Hyundai introduced plans to double its

hybrid lineup from 7 to 14 fashions. This growth will embrace

hybrid expertise throughout varied car classes, together with

small, massive and luxurious automobiles. Moreover, Hyundai revealed it’s

creating the next-generation TMED-II system, a parallel full

hybrid system, which is anticipated to be built-in into manufacturing

autos beginning January 2025. Hyundai can also be engaged on a brand new

vary extender electrical car (REEV) expertise.

Volvo Automobiles has

additionally revised its technique, shifting away from its preliminary objective of

solely promoting BEVs by 2030. The corporate now plans to permit

for as much as 10% of gross sales to be delicate hybrids. In the meantime, Ford is

decreasing capital expenditure meant for pure EVs from 40% to 30% of

its annual capital expenditure finances. The difficult transition

to pure EVs can also be driving Basic Motors and Volkswagen to beef

up their plug-in hybrid lineup within the close to future.

On the not too long ago concluded Paris Motor Present, many OEMs showcased

hybrid variations of their autos. The Alfa Romeo Junior Speciale

Ibrida by Stellantis featured a 136-hp 48-V Hybrid VGT structure

and 156-hp electrical motor. The hybrid system features a 48-volt

lithium-ion battery, and a 21-kW electrical motor built-in right into a

6-speed dual-clutch gearbox. The automaker additionally showcased a 280-hp

plug-in hybrid model of the mannequin 12 months 2025 Alfa Romeo Tonale.

Dacia unveiled an all-new C-segment SUV Bigster in two variations: a

mild-hybrid model that includes a 0.8-KWh battery, 48V belt stator

generator (BSG) and a brand new Hybrid 155 model that includes a 1.4-kWH

battery and 12V BSG and transmission mounted motor. Mainland

Chinese language automakers BYD and GAC additionally unveiled hybrid fashions,

alongside their EV choices, in addition to Ford.

Optimistic outlook for electrical motor

market

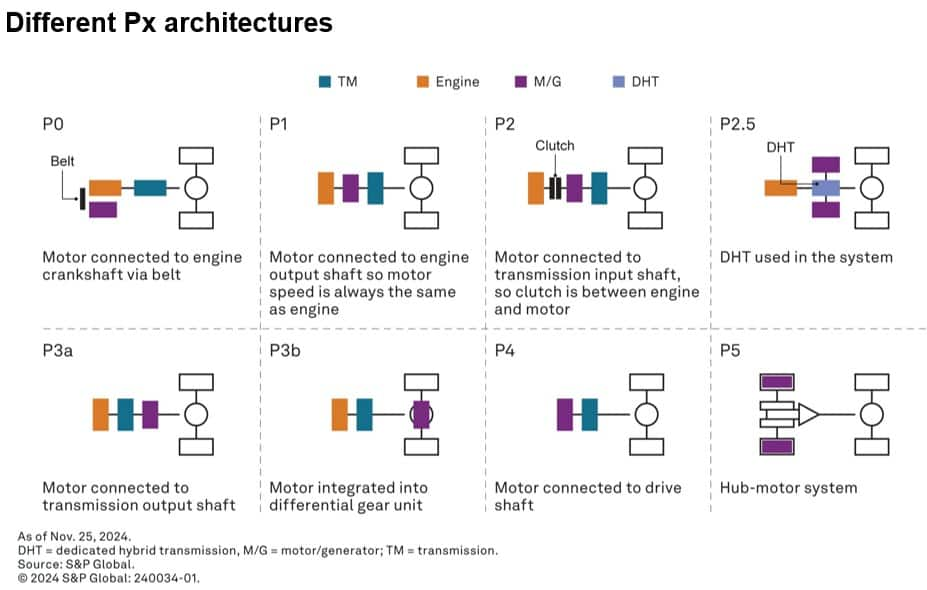

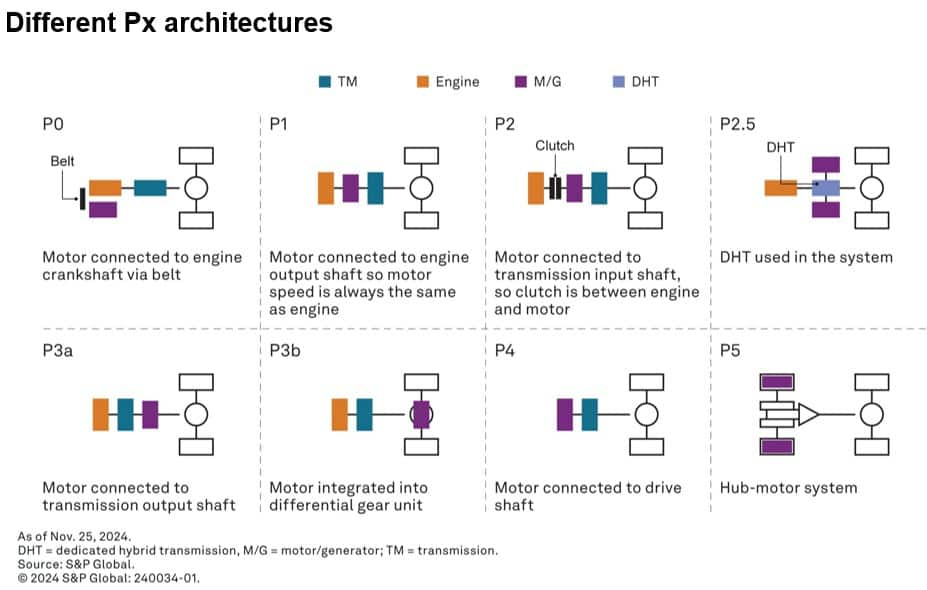

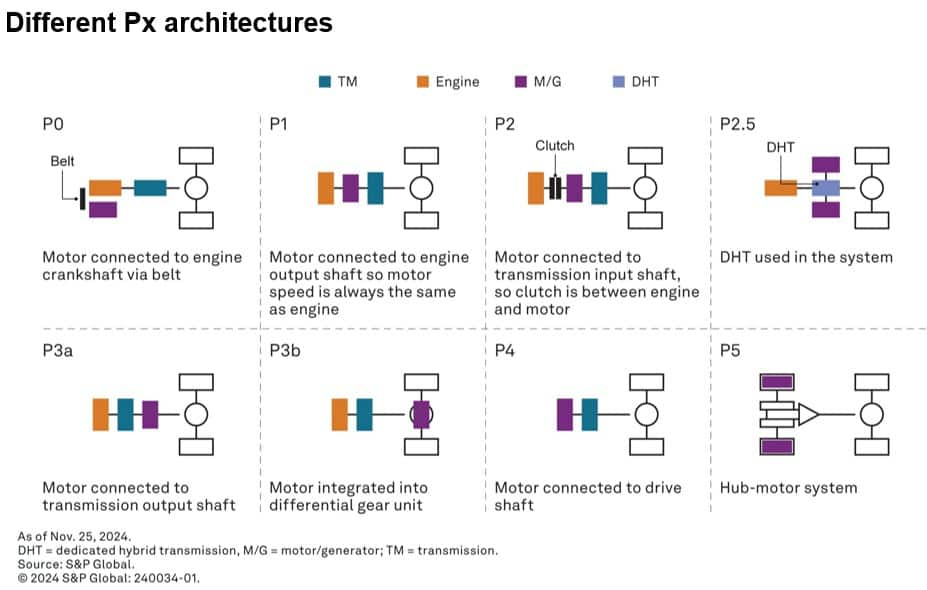

The resurgence of hybrid expertise bodes properly for non-P4 motors

business. Based on S&P International Mobility, demand for non-P4

motors (utilized in hybrid autos) is projected to extend at a

compound annual development price (CAGR) of round 11% between 2023 and

2030. All through the forecast interval Better China is anticipated to

lead the non-P4 motor market. The demand for these motors is

anticipated to proceed rising in North America and Europe till

2028. Japan and Korea may even see the rise in demand for

non-P4 motors till 2032. This enhance in demand for non-P4 motors

may be attributed to automakers equivalent to Toyota and Hyundai, which

are betting massive on hybrid autos.

Whereas the hybrid propulsion techniques are anticipated to file

development within the close to to medium time period, pure BEVs will outsell hybrids

in the long run as they’re a greater reply to the world's power

transition and sustainability objectives. Michael Southcott, supervisor,

technical analysis, S&P International Mobility, says, “With shopper

sentiment round electrical car pricing, vary and charging

capabilities remaining stagnant, and policymakers globally

reassessing bold targets, it's comprehensible that OEMs are

shifting their focus to hybrid options. Whereas this doesn't change

the last word objective of attaining 100% zero-emission autos, hybrids

supply a viable quick to midterm technique for decreasing car

emissions, giving the business time to plan for widespread

battery-electric car adoption.”

Authored By: Priyanka Mohapatra, Senior Analysis

Analyst, Provide Chain & Expertise, S&P International

Mobility

By subscribing to AutoTechInsight, you possibly can rapidly

acquire intel on market developments and expertise tendencies, dive into

granular forecasts, and seamlessly drive analytics to help

difficult decision-making.

Be taught extra and

subscribe

|