|

Within the aftermath of the US election, President-elect Donald

Trump's return to the Oval Workplace has sparked hypothesis about his

intentions throughout his second time period, notably relating to the

automotive sector. Because the world observes, the intersections of

politics, trade, and commerce have turn out to be focal factors, with the

administration's stance on the Inflation Discount Act (IRA) and

its affect on electrical automobile provide chains on the forefront.

Moreover, the alliance between Elon Musk and the Trump marketing campaign

introduces a brand new dynamic. Amid these developments, Trump's “America

First” doctrine looms massive, poised to reshape commerce relationships

and unsettle international investments.

We will be extra sure about Trump's “America First” method.

In his first administration, this meant imposing tariffs or

threatening them as a negotiation lever. The goal of those

tariffs trusted the path of journey and the scale of the US

commerce deficit with varied companions. For reference, the three

greatest contributors to the US' US$1.14 trillion

deficit are — so as — mainland China, the

EU and Mexico.

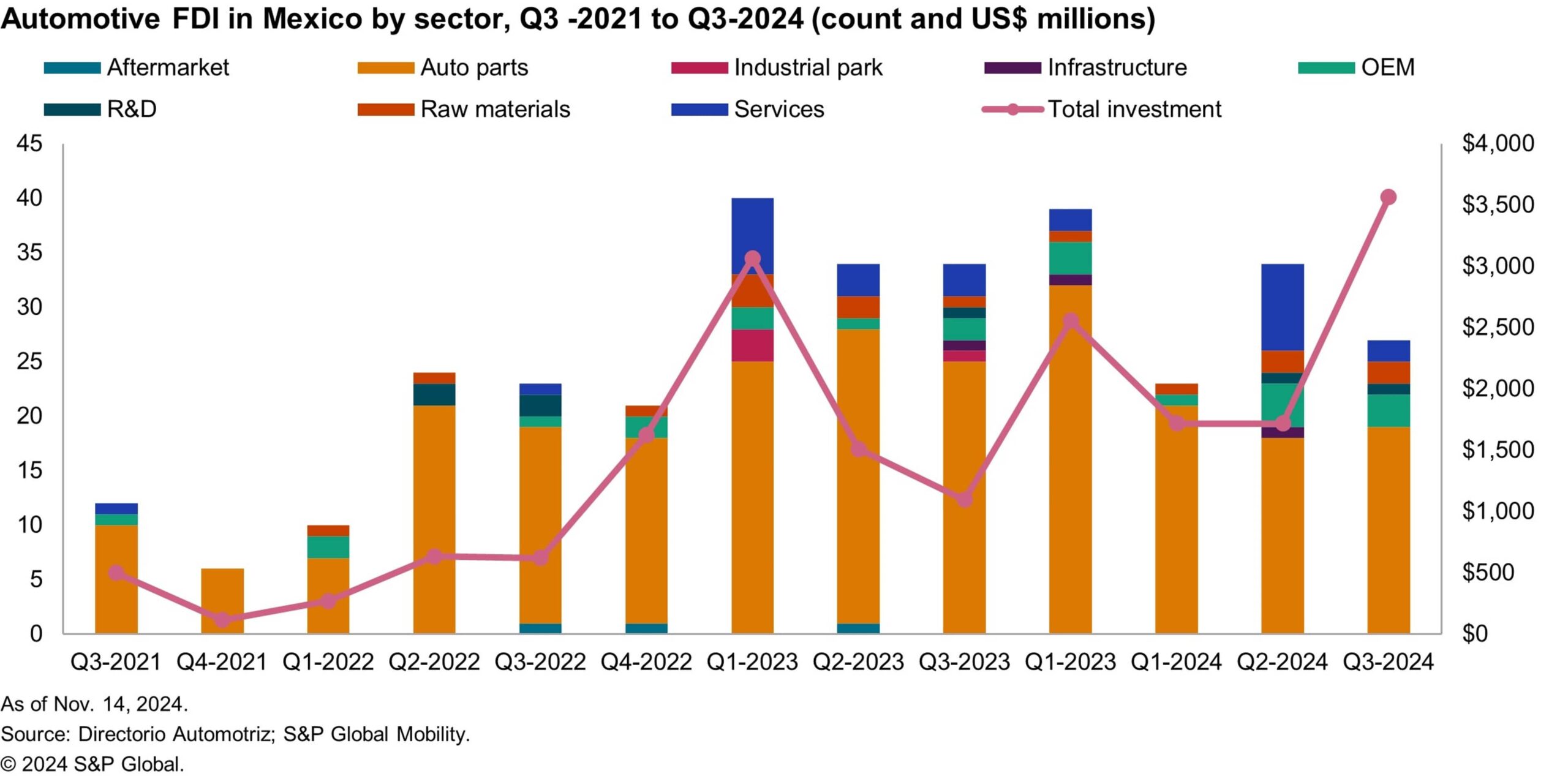

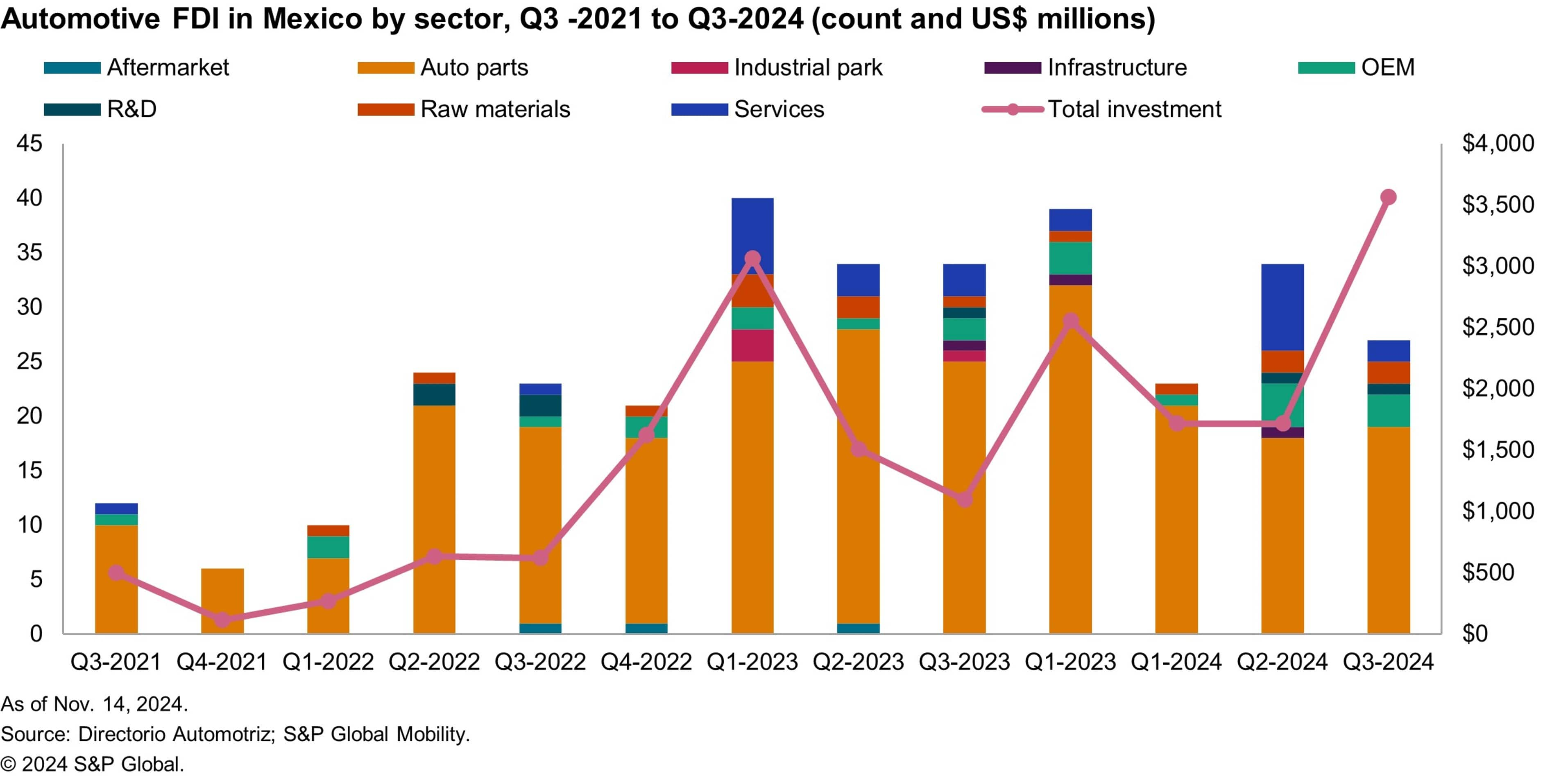

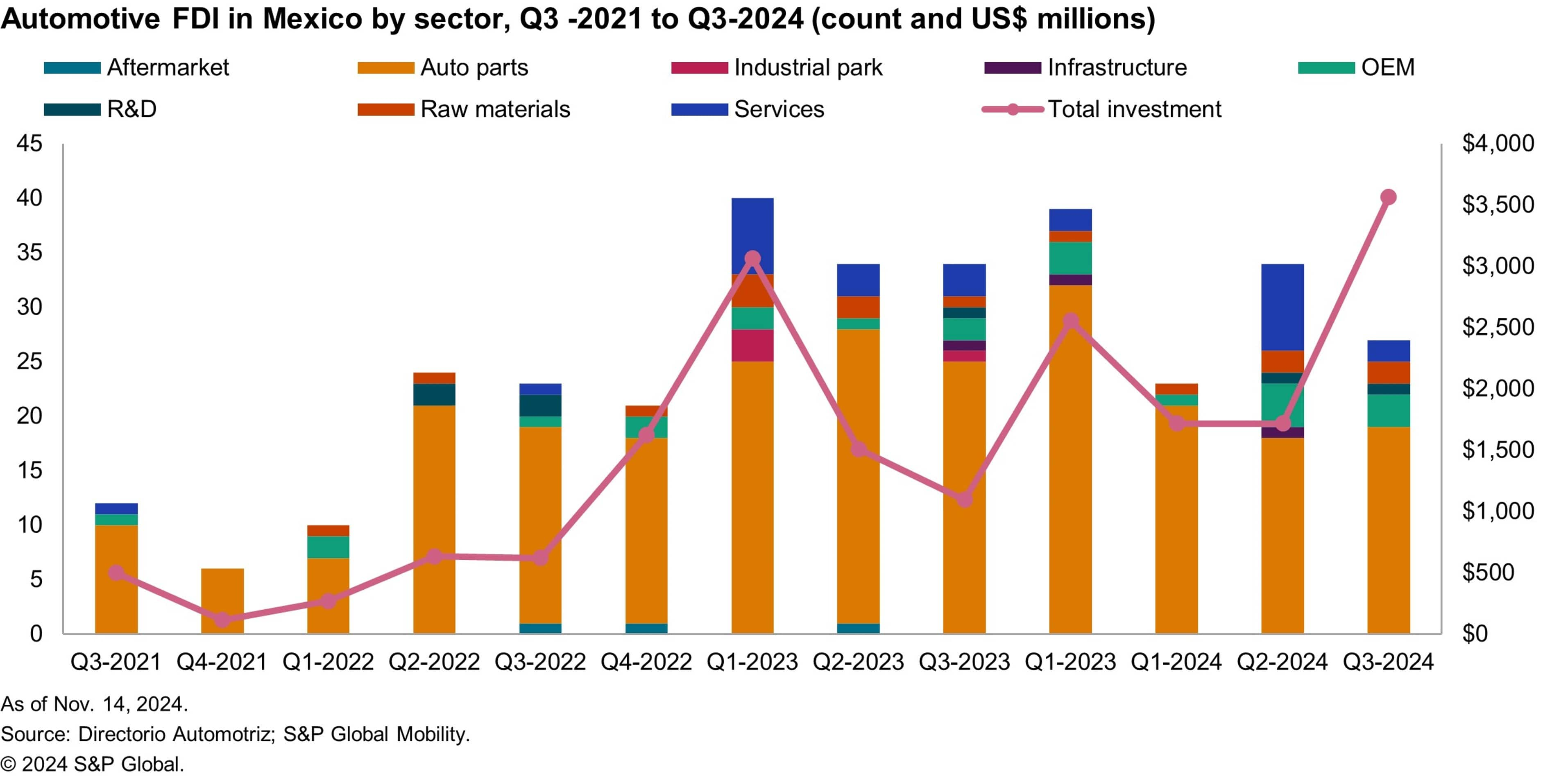

As documented beforehand,

Mexico has achieved nice success in attracting international direct

funding (FDI) into its automotive sector, in response to information from

Directorio Automotriz. Within the first three quarters of 2024, auto

funding has continued to circulation into Mexico, albeit at a slower

charge (a lower of 13.6%) in comparison with 2023. Throughout this era,

the worth of auto FDI from mainland China has elevated by over 86%

to US$3.5 billion.

Given the place the longer term administration's gaze is more likely to relaxation,

the elevated mainland Chinese language funding will increase issues.

Thus, it’s not stunning that on the marketing campaign path, Trump raised

the prospect of rewriting the United States-Mexico-Canada Settlement

(USMCA) commerce settlement. Moreover, whereas campaigning in North

Carolina, Trump posited a 25% to 75% tariff on all Mexican items

— not simply mild automobiles — if the nation didn’t help

the US in curbing unlawful immigration. This risk is implicit in

requiring a rewrite of the USMCA.

A six-year renegotiation provision is included within the unique

USMCA, which means that renegotiations are scheduled to start in July

2026. Nevertheless, there will probably be rather more horse-trading and public

pronouncements earlier than then.

And therein lies the issue. Tariff or no tariff, massive capital

expenditure initiatives—akin to automotive investments—require

certainty within the enterprise atmosphere and readability of coverage earlier than

any {dollars} are dedicated. Thus, a lot of the give attention to the USMCA

renegotiation will probably be on Mexico as a result of commerce deficit. It’s going to

be revealing to see whether or not Mexican automotive FDI is

sustained.

To this point in 2024, the quantity of investments has slowed in contrast

to 2023, despite the fact that the worth of FDI peaked within the third quarter

of 2024, with over US$3.5 billion invested.

Cumulatively, mainland China is the biggest supply of FDI for

Mexico's automotive sector. Apparently, the nation contributing

most to its cumulative funding within the third quarter of 2024 was

the US, which can point out that firms need to safe

investments earlier than USMCA guidelines are modified—one thing the

Democrats additionally vowed to overview through the marketing campaign.

Mexico has thrived as an FDI location resulting from its entry to

sizeable markets via varied commerce agreements. Nevertheless, the

greatest draw for firms stays tariff-free entry to

neighboring markets through the USMCA. These advantages have been additionally provided

beneath the earlier NAFTA settlement, and little has materially

modified for the reason that USMCA turned operable in 2020. Each agreements

have attracted unique tools producers (OEMs) to construct

automobile manufacturing capability in Mexico; and the place OEMs tread

their suppliers will comply with. Between 2015 and 2025, Mexico is ready

to be the third-largest contributor to world mild automobile

capability development. In line with S&P International Mobility information, simply

over 2 million items of capability will probably be added, giving Mexico a

31.2% share of whole world capability development. The place the USMCA does

differ from NAFTA is that it goals to encourage will increase in Mexican

labor charges and improved employment requirements. Colleagues at

S&P International Mobility count on the 2026 renewal talks to give attention to

narrowing the Mexican wage charge differential in comparison with the US and

Canada.

This evaluation pre-supposes that the Trump administration will

wait till July 2026 to overview the USMCA. Nevertheless, Trump is

unconventional in his method to authorities. Experiences counsel the

administration might impose 100% tariffs on automotive imports from Mexico,

violating the USMCA settlement. Nevertheless, the USMCA does permit for

tariffs to be imposed on a member in sure circumstances. Such

circumstances embody: Nationwide safety issues together with protection

and nationwide infrastructure, non-compliance with labor and

environmental requirements, or if commerce cures are required whereby

surging imports hurt native industries and anti-dumping and

countervailing tariffs are required. If the Trump administration

have been to tug any of the accessible levers, or threaten to, the

febrile and unsure atmosphere would intensify and dampen

automotive funding commitments in Mexico.

By subscribing to AutoTechInsight, you possibly can shortly

acquire intel on market developments and expertise traits, dive into

granular forecasts, and seamlessly drive analytics to assist

difficult decision-making.

Be taught extra and

subscribe

|