The openness of worldwide markets, amplified by the

acceleration in globalization over the previous few many years, is usurped

by the creeping return of protectionism. Nothing illustrates this

pattern higher than the continued tug of battle over electrical automobiles

(EVs) and their associated provide chains. Policymakers within the US and

European Union are rattled by the ambitions of mainland Chinese language

firms to increase exports of low-cost EV and EV components, forcing

them to announce new insurance policies and rethink import tariffs.

On this regard, the US introduced some adjustments in tariffs this

month to thwart imports from mainland China. The brand new tariffs goal

imports of EVs, lithium-ion batteries, and significant minerals such

as graphite and everlasting magnets from mainland China. In line with

the official announcement, in 2024, the tariff on EVs imported from

mainland China will improve from 25% to 100%, the tariff on

lithium-ion EV batteries will improve from 7.5% to 25%, and the

tariff on battery components will improve from 7.5% to 25%. The brand new

tariffs will take impact on Aug. 1, 2024, the US Commerce

Consultant's workplace stated on Might 22. The tariff on pure

graphite and everlasting magnets will likely be elevated from 0% to 25%,

however not till 2026.

What's the rationale behind the hikes?

The Biden administration reckons that the brand new measures had been

needed to forestall mainland Chinese language firms from flooding the

US market with cheaper EVs and batteries, which might make it

tough for American firms to compete. In line with a

assertion launched by the White Home, the present US authorities

has attracted billions of {dollars} of investments for the

growth of a dependable EV provide chain, together with batteries and

essential mineral, by means of tax credit underneath insurance policies such because the

Inflation Discount Act (IRA) and the Bipartisan Infrastructure Regulation

(BIL). The White Home implied that the newest improve in tariffs

would guarantee these investments are protected and might proceed as

deliberate.

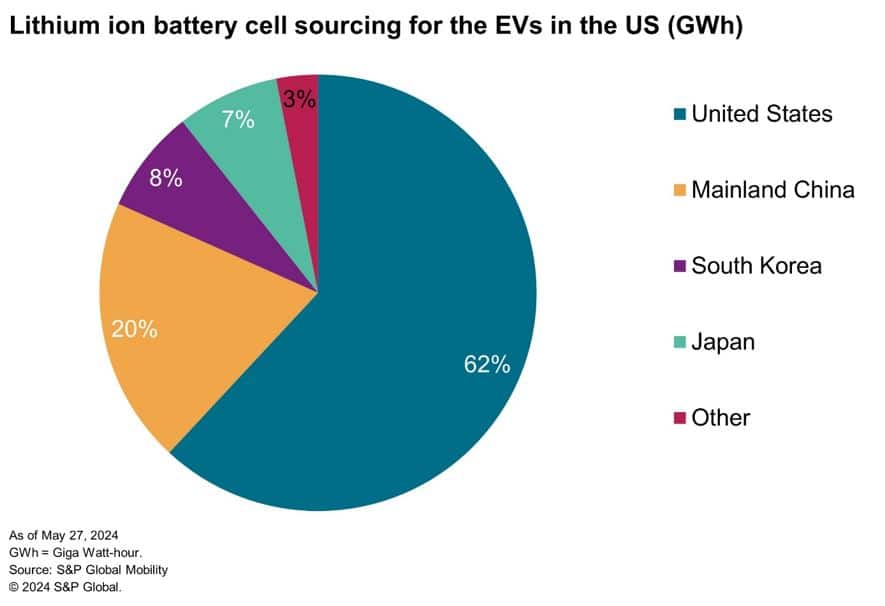

At present, the US will get most of its lithium-ion batteries from

China, however solely a small portion of those batteries are to be used in

EVs. In line with S&P International Mobility's high-voltage battery

forecast, in 2024, primarily based on GWh, about 62% of the lithium-ion

battery demand for EVs produced within the US will likely be met from vegetation

within the US. South Korea and Japan will account for roughly 8%

and seven%, respectively. Apparently, round 20% of the general

demand within the US will likely be sourced from vegetation in mainland China.

The present share of mainland China may develop considerably in

the longer term if EV firms within the US discover importing from mainland

China as a less expensive possibility than manufacturing or sourcing

batteries regionally within the US, discouraging manufacturing of the

part within the US.

Actions, reactions and

implications

The most recent change in tariff charges has come nearly 5 months

after the US administration had acknowledged mainland China as a

overseas entity of concern (FEOC) to discourage EV firms from

sourcing batteries and uncooked supplies from China-based suppliers.

Earlier in December 2023, mainland China had imposed an export

management measure on graphite, a essential uncooked materials utilized in

batteries. The transfer to comprise graphite exports was broadly seen as

a countermeasure to answer the US' export restriction for AI

chips and semiconductor manufacturing gear to mainland

China.

In line with Ali Adim, senior analyst at S&P International

Mobility, “The import tariffs intention to guard the North American

battery provide chain from cheaper Chinese language merchandise, thereby

levelling the enjoying discipline for the rising home business.

Nonetheless, these tariffs can also hinder entry to applied sciences such

as lithium iron phosphate (LFP), which presents a big price

benefit over nickel-based chemistries and is predominantly

produced in China. Moreover, the IRA disqualifies automobiles with

Chinese language batteries from tax credit, creating one other barrier to

adopting LFP expertise.

Adim added, “Some American OEMs, like GM and Ford, are exploring

home LFP manufacturing by means of licensing agreements with Chinese language

suppliers akin to CATL. Nonetheless, the price advantages of native

manufacturing are unsure as a result of lack of an upstream provide

chain in North America.”

Rome was not in-built a day

With the native content material necessities underneath the IRA and the newest

tariff hikes, the US has dealt a double blow to lithium-ion battery

imports from mainland China, nevertheless it nonetheless depends on mainland China

immediately and not directly for a spread of minerals, together with cobalt,

graphite and lithium. Mainland China continues to dominate the EV

provide chain with greater than 80% management on sure segments of the

provide chain, together with mining and processing of essential minerals.

The US authorities has made progress on onshoring EV part

manufacturing, nevertheless it takes time for environment friendly provide chains to

type and any retaliatory measure from mainland China like

reciprocal tariffs or export restrictions on essential supplies

may influence the US EV business within the quick time period.

Hugo Enrique Cruz, senior analyst at S&P International Mobility,

stated, “When evaluating the prices of uncooked supplies and operational

bills, it’s discovered that the typical value of high-energy NCM

lithium battery cells produced within the USA could possibly be 30% increased than

the cost-effective LFP batteries manufactured in China. Chinese language

producers take pleasure in economies of scale of their factories and have

a extra built-in provide chain throughout the nation. On the opposite

hand, battery producers within the US face increased prices on account of

elevated power, labor and allowing bills in comparison with their

Asian counterparts.”

Get every day insights and

intelligence by subscribing to AutoTechInsight.