[ad_1]

Aftermarket alternatives abound as candy spot continues to

develop.

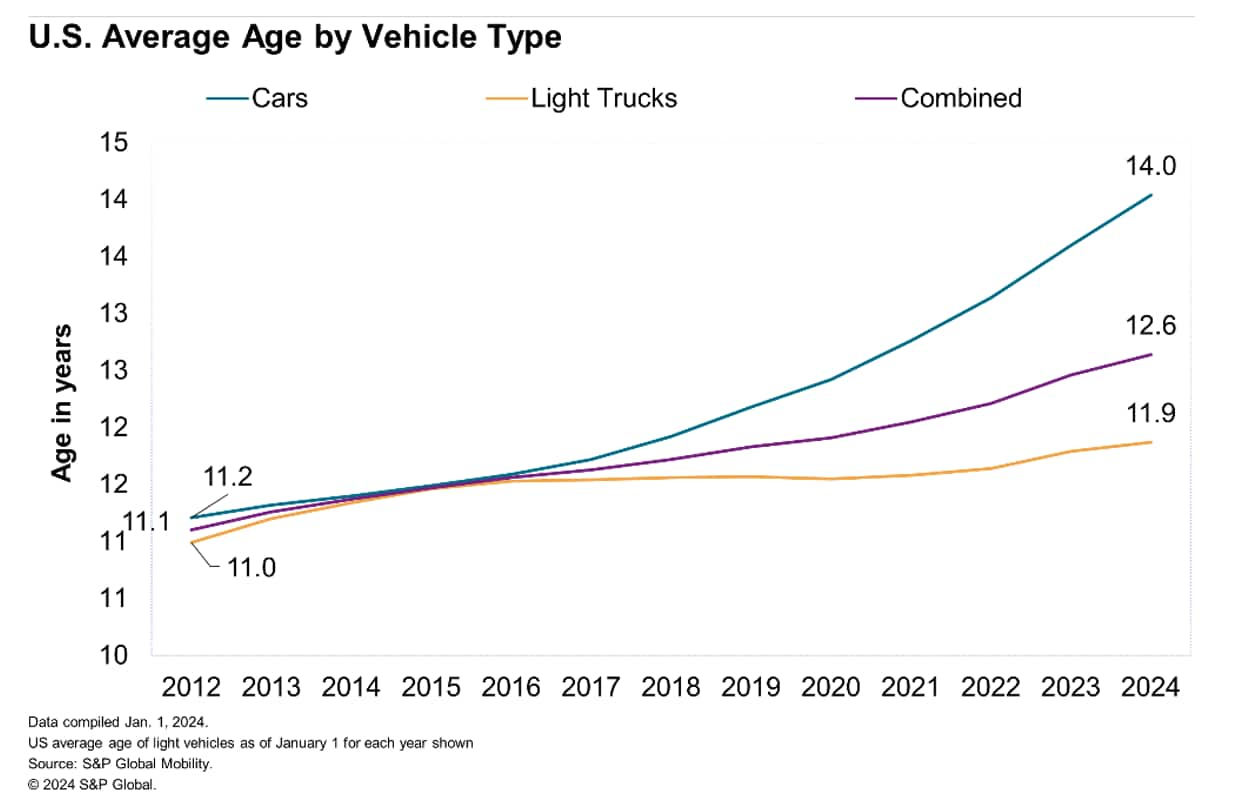

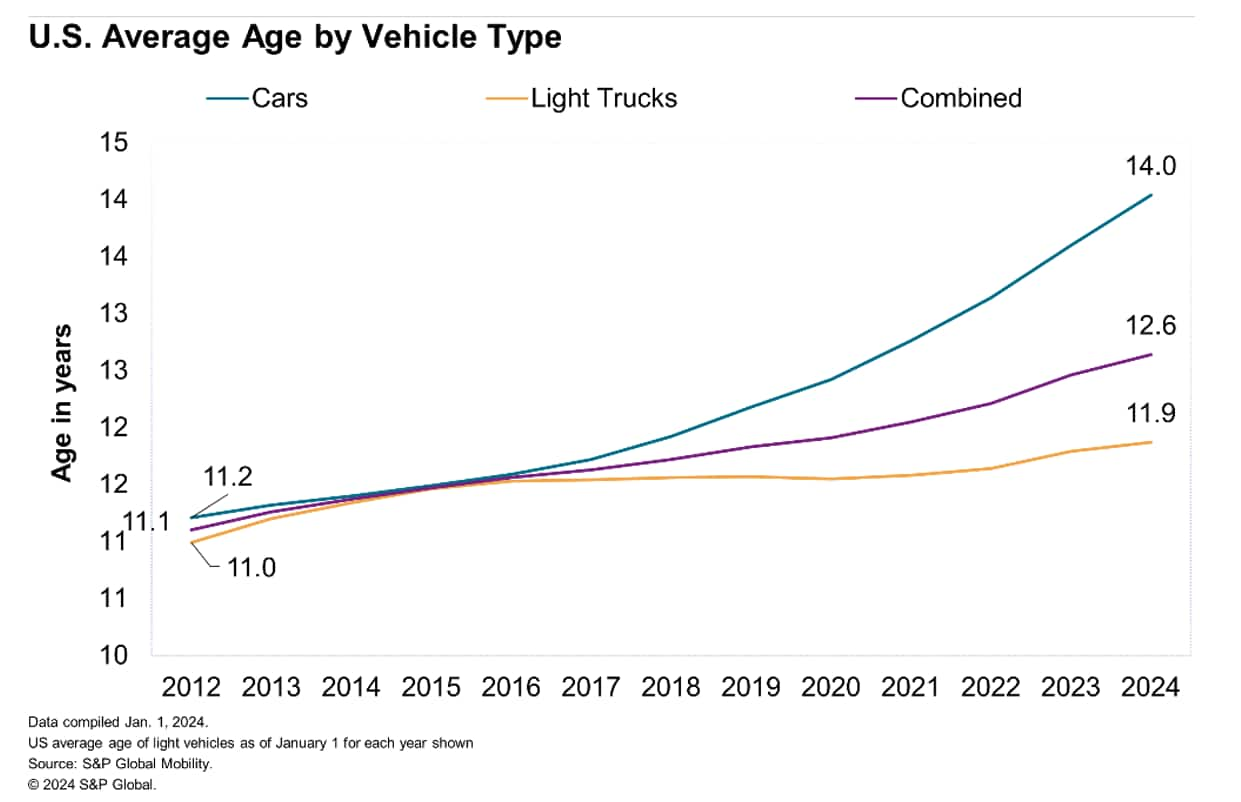

Automobiles on the street are getting even older, in accordance with

S&P World Mobility. The typical age of automobiles and light-weight vehicles

in america has risen once more to a brand new report of 12.6 years

in 2024, up by two months over 2023, in accordance with new evaluation.

Enhance in common age is exhibiting indicators of slowing as new

registrations normalize.

This continues to enhance enterprise alternatives for firms

within the aftermarket and automobile service sector within the US, as restore

alternatives are anticipated to develop alongside automobile age.

“With common age progress, extra autos are coming into the prime

vary for aftermarket service, usually from 6 to 14 years of

age,” mentioned Todd Campau, aftermarket follow lead at S&P World

Mobility. “With greater than 110 million autos in that candy spot

— reflecting almost 38 % of the fleet on the street —

we count on continued progress within the quantity of autos in that age

vary to rise to an estimated 40 % via 2028.”

Two passenger automobiles scrapped for each new passenger automobile

registration

Automobile scrappage charges — the measure of autos exiting

the lively inhabitants — proceed to carry regular. As of January

2024, the scrappage charge was 4.6%, largely unchanged from 4.5% in

January 2023.

Wanting on the mixture of the fleet, since 2020, greater than 27

million passenger automobiles exited the US automobile inhabitants, whereas simply

over 13 million new passenger automobiles have been registered. On the identical

time, over 26 million mild vehicles (together with utilities) have been

scrapped and almost 45 million have been registered.

“Shoppers have continued to show a choice for

utility autos and producers have adjusted their portfolio

accordingly, which continues to reshape the composition of the

fleet of autos in operation available in the market,” mentioned Campau.

Automobiles in operation grows to 286M, whereas EV VIO exceeds

3M

The US automobile fleet surged to 286 million autos in operation

(VIO) in January, up 2 million over 2023, however the distribution of

autos by age is altering. Automobiles beneath the age of six

accounted for 98M autos in 2019, or about 35 % of VIO.

Right now they symbolize lower than 90M autos and will not be anticipated to

attain that threshold once more till 2028 when they may symbolize

about 30% of VIO, in accordance with S&P World Mobility estimates.

That is pushed by the impression of COVID and subsequent provide chain

shortages that disrupted automobile provide and registrations – and

following traditionally excessive volumes in 2015-2019.

Consequently, the first driver of VIO progress will probably be autos

within the aftermarket 'candy spot' — autos 6-14 years of age,

and even older autos, which can be anticipated to symbolize about 70%

or extra of VIO for the subsequent 5 years, which can function a

tailwind to aftermarket service alternatives.

EVs on the street additionally continued to extend, with 3.2 million EVs

in operation in January. 2023 EV registrations surpassed one

million models for the primary time and elevated about 52% in contrast

with 2022. The speed of EV progress was slower than some automakers

had anticipated, and there may be potential for the common age of EVs

to rise within the quick time period as client adoption slows. The typical

age of EVs in the usis 3.5 years and has been holding largely

regular since 2019 with new registrations representing a big share

of general EV VIO.

“We began to see headwinds in EV gross sales progress in late 2023,

and although there will probably be some challenges on the street to EV adoption

that would drive EV common age up, we nonetheless count on vital

progress in share of electrical autos in operation over the subsequent

decade,” mentioned Campau.

Entry extra detailed VIO evaluation with

AftermarketInsight.

[ad_2]