Age-based shopping for is not an environment friendly method to drive

income and develop auto gross sales.

The media and automotive industries have lengthy had a mutually

useful relationship. The Fall TV season was constructed to align with

new autos coming to market annually. This season gave

automotive entrepreneurs giant swaths of the prized 25- to 54-year-old

shopper base to achieve and generate consciousness for brand new car

launches. The promoting {dollars} spent in flip funded TV content material

creation by large upfront media investments for adverts and

product integrations.

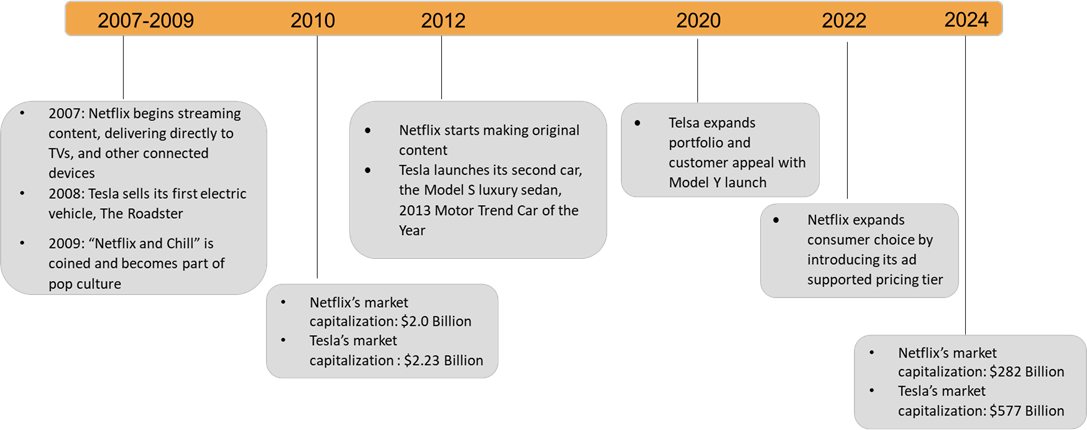

Each of those industries at the moment are present process large

transformation and upheaval in response to expertise, shopper

habits and new rivals. Have a look at this timeline from two

disruptors — Netflix and Tesla — that at the moment are market

leaders:

Fragmented media, fragmented information and extra buyer

alternative

Extra content material, extra car sorts and extra connection factors =

extra choices for what customers drive and watch. Client

alternatives and selection proceed to broaden, putting larger

strain on advertising budgets. Contemplate this:

- As we speak, customers have 450 nameplates to buy. Because the

electrification transition continues, that quantity will rise 30% to

almost 650 nameplates by the top of the last decade.- In 2016, there have been 455 scripted TV sequence. That jumped 32% to

600 in 2022, in line with Selection and Statista.

- In 2016, there have been 455 scripted TV sequence. That jumped 32% to

- Automotive trade model loyalty sits at 53% (April 2024).

It's up 4 factors from its historic low, but almost five-in-ten

new car patrons will depart their present model with their subsequent

buy. - The price of new car possession is up 30% since 2019. Solely

14% of registered autos have an MSRP beneath $30,000 right this moment. This

was 50% seven years in the past.

Demographic shopping for not an environment friendly method to drive

income and develop gross sales.

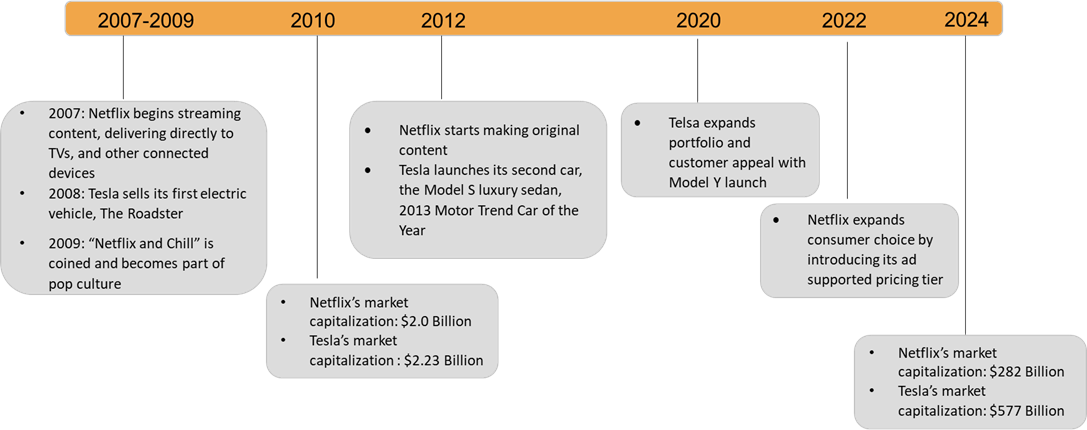

As value of possession will increase, youthful patrons are getting

priced out of latest car consideration. Share of latest car gross sales

by the coveted 18- to 34-year-old demographic has dropped to 9.2%,

its lowest share on file. In the meantime, the 65+ crowd has extra

buying energy than ever earlier than, surpassing 26% of latest car

gross sales, its highest share on file (Determine 1). How

many new automobile launches are concentrating on the 65+ demographic?

Concentrating on: Superior audiences for higher outcomes

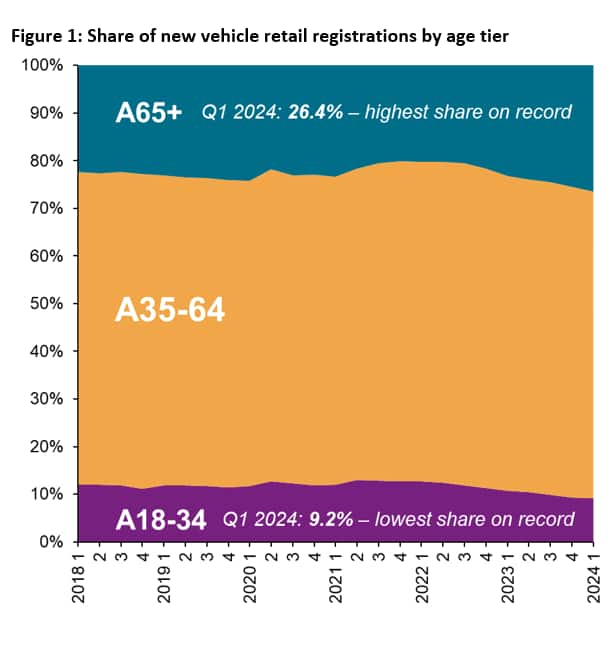

S&P International Mobility information supplies an outline on the scale of

the US automotive market right this moment. There are roughly 131 million

households within the US. (Determine 2)

- 68 million households should buy a automobile

- 52 million households should buy new automobiles

- 50 million households DON'T purchase automobiles

Having the ability to goal the 52% of US households with car-buying

potential whereas limiting the waste with the 50 million households

that don't purchase automobiles is the place automotive entrepreneurs are going to

begin maximizing their return-on-ad-spend (ROAS).

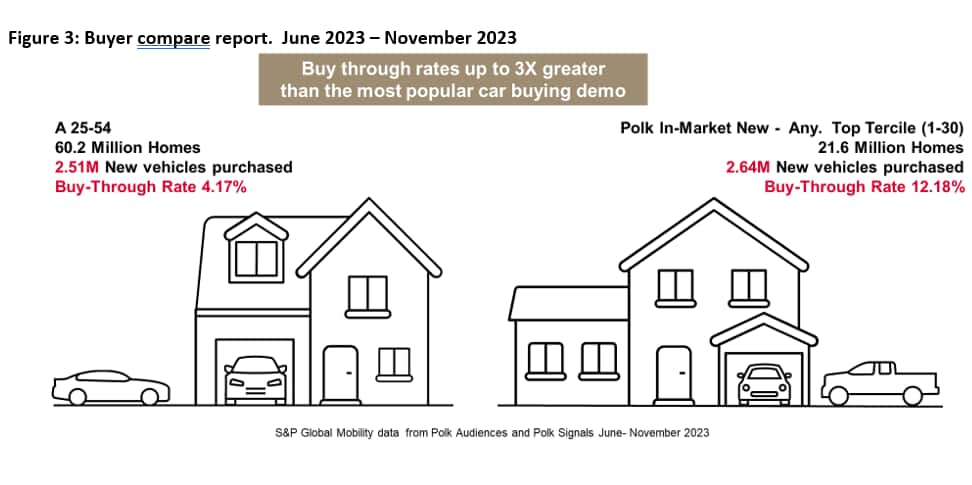

We are able to take this a step additional and have a look at buy-through charges

and gross sales efficiency from the most well-liked automotive shopping for

demographic of adults ages 25 to 54 and evaluate that to a sophisticated

viewers of in-market households (0-12 months) for a brand new car

(Determine 3).

The 60 million households with adults aged 25 to 54 purchased 2.51

million new autos over a 6-month interval, a purchase order charge of

4.17%. Comparably, the in-market for brand new car section represents

21.6 million houses that bought 2.64 million autos for a

buy-through charge of 12.18%. That's 3x larger effectivity and the

identical affect to gross sales.

The takeaway: Maximizing gross sales and buy-through charges by

figuring out and concentrating on the households which might be prepared and in a position to

purchase is the realized worth of

Polk's superior audiences.

Measuring end result over output

Enterprise outcomes are essential for assessing the success of your

advertising funding. Savvy entrepreneurs are prioritizing marketing campaign

measurement options that ship real-times gross sales raise and

buy-through charges over choices that depend on click on stream habits

proxy metrics, like web site visits and content material views.

Polk Alerts information permits entrepreneurs to see complete gross sales affect

— for themselves and the competitors — getting actionable

insights that result in smarter methods and higher choices.

Utilizing real-time gross sales information for optimization permits entrepreneurs to

analyze information mid-flight and shift towards best-performing media,

lowering waste and enhancing KPIs like cost-per-vehicle sale and

goal purchase by charges.

Extra alternative and alter are coming

S&P International Mobility initiatives greater than 130 new car

launches within the subsequent two years — and greater than half might be for

EVs. As automotive and media industries navigate the bumpy paths to

electrical car and various TV forex adoption, entrepreneurs

might be taking these measures to mitigate waste and maximize

efficiency:

- Improve improvement and use of superior audiences that focus

on in-market customers and reduce the reliance on demo-based

shopping for. - Purchase extra addressable media. The upper perceived value might be

greater than justified by increased ROI and ROAS. - Prioritize enterprise outcomes like gross sales raise and buy-through

charges as core metrics for in-flight optimization and marketing campaign

ROI.

From launching new autos to concentrating on particular prospects with

a custom-made service provide, automotive advertising has all the time

employed a big arsenal of ways to have interaction prospects and drive

dealership visitors. The accessible instruments are getting higher now,

leveraging expertise and information science to develop superior

audiences, messaging methods, improved digital communications

and extra sturdy measurement options.

These are going to be important for fulfillment as a result of automotive

entrepreneurs should handle extra buyer sorts, car sorts,

connection factors, and shopping for motivations — all whereas making

certain they don't move by any extra prospects exterior that 25- to

54-year age vary.

Study extra about Polk Audiences.

Join the Polk Automotive Options publication.

Authored by David Kaufman, Gross sales and Buyer Care Govt

Director, and Jason Jordhamo, Product Administration Director, S&P

International Mobility.