[ad_1]

Putting a deft stability between home electrical

car battery manufacturing and worldwide partnerships is

essential to a sturdy EV battery provide chain

On the COP26 convention, in a daring dedication to environmental

sustainability, India's Prime Minister Narenda Modi pledged to

obtain internet zero emissions by 2070. Because the world's third largest

emitter of CO2, India is banking on electrification of the

transportation sector, and the shift in direction of electrical automobiles

(EVs), to attain this aim. This transition considerably

will increase India's want for lithium-ion (Li-ion) batteries for

electrical automobiles..

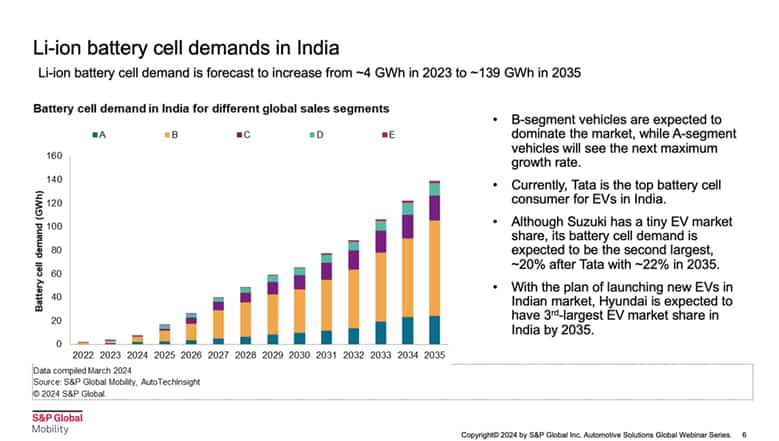

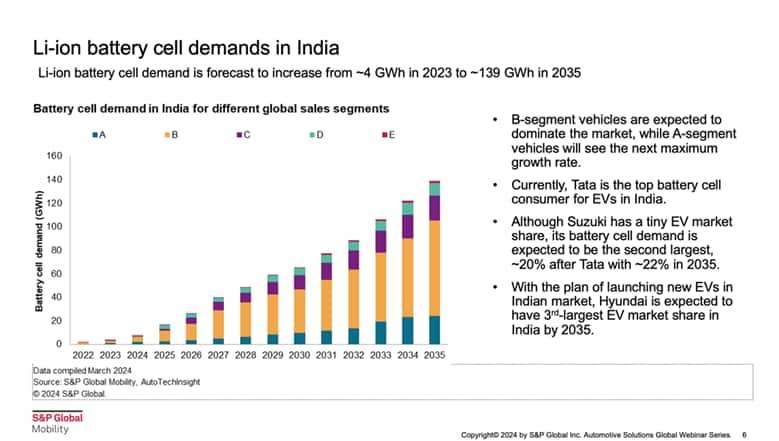

S&P World Mobility's AutoTechInsight forecasts demand for

EV lithium batteries in India to surge from 4 gigawatt hours (GWh)

in 2023 to just about 139 GWh by 2035. A significant share of this demand is

projected to return from the economically important gentle car section

– the workhorses of Indian commutes and commerce. The exponential

progress in EV adoption could have implications for the sourcing and

manufacturing of EV battery elements by authentic tools

producers (OEMs), suppliers and producers in India.

Rising EV battery cell demand in India

EV battery cell demand is pushed largely by B and A section

passenger automobiles, that are characterised by their compact construct

and affordability. Specifically, smaller B section SUVs just like the

Tata Nexon are more and more widespread with Indian drivers. These

automobiles have a better floor clearance and a wider wheelbase,

offering higher management and safety over uneven terrain like

potholed or gravelly roads.

Because of their sturdy EV portfolio, Tata Motors stays the highest

EV battery cell client in India. By comparability, Maruti Suzuki,

the nation's largest carmaker, has a comparatively small share of the

EV market. However with the automaker aiming to launch their first EV,

the eVX in 2025, Maruti Suzuki is anticipated to drive 20% of battery

cell demand in India by 2035, simply behind Tata Motor at 22%.

Whereas India continues to develop its EV manufacturing and

expertise, the EV provide chain stays fragmented. EV battery

manufacturing entails putting in particular person cells into modules and

arranging mentioned modules into packs able to delivering the ability

wanted to function a car. These three distinct phases – cell,

module, and pack – symbolize key alternatives for India to

localize electrical automobiles and EV battery manufacturing.

Driving India's Transition: Accelerating Home EV

Battery Manufacturing

As native EV battery cell manufacturing capabilities are nonetheless

nascent, India has traditionally relied on importing cells from

Better China, South Korea and Japan. It will possible change as

India goals to change into extra self-sufficient to fulfill demand.

S&P World Mobility predicts that by 2030, 13% of complete EV

battery cell demand can be sourced domestically, with the remaining

nonetheless outsourced from different nations. However this

forecast, OEMs in India are investing closely into native cell

manufacturing amenities.

That is additional spurred by the Indian authorities's proactive

stance on electrification. Insurance policies such because the Manufacturing-Linked

Incentive (PLI) scheme for superior chemistry cell (ACC) battery

storage and the Quicker Adoption of Manufacturing Electrical Autos

(FAME) scheme have inspired investments and strategic

partnerships.

In 2024, Ola Electrical began mass manufacturing of the NMV21700

cylindrical cell battery at its Chennai-based Gigafactory for its

two-wheelers. Main business OEMs like Rajesh Exports, Amara Raja,

Reliance, and Adani additionally plan to construct lithium-ion battery cell

factories and ramp up home electrical car battery manufacturing

capacities.

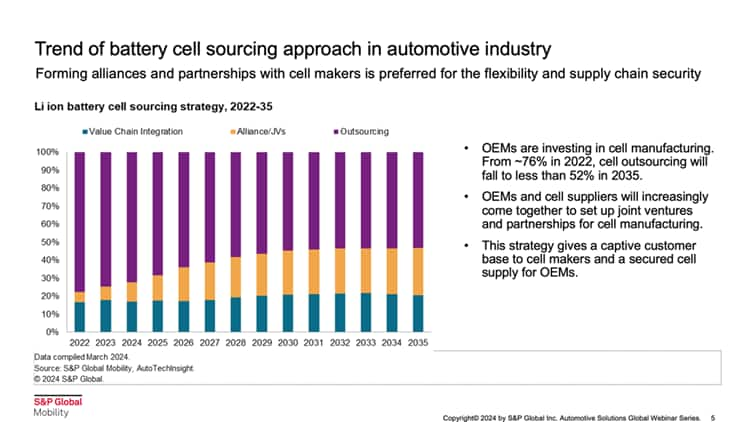

Concurrently, OEMs and EV battery cell producers in India

are forming joint ventures (JV) with worldwide cell makers,

module makers and pack suppliers. Key alliances embrace Suzuki's JV

with Toshiba and Denso in 2017 to assemble a cell manufacturing

plant in Gujarat. The power began as an meeting plant for

modules and packs and is about to start manufacturing EV battery

cells in 2024 and 2025.

General, the rise in JVs and worth chain integration displays

the broader business transfer in direction of securing provide chains and

fostering sustainability and effectivity. Outsourcing is anticipated to

lower markedly, from 76% in 2022 to lower than 52% by 2035.

Developments in India's EV Battery Chemistry and Mineral

Sourcing

Rising demand for EV battery cell manufacturing has additionally solid a

highlight on battery chemistry developments in India. Not all lithium

batteries for electrical automobiles are created the identical. The selection of

cathode materials influences efficiency, price and environmental

influence, making it an important issue for EV batteries producers

and policymakers. Presently, LFP (Lithium Iron Phosphate) and LMFP

(Lithium Manganese Iron Phosphate) chemistries dominate in decrease

car segments resulting from their thermal stability and value

effectiveness, attributes which might be essential in price-sensitive

markets like India.

By 2030, excessive nickel NCM (Nickel Cobalt Manganese) is anticipated

to seize higher market share in increased car segments owing to

its increased vitality density, making it appropriate for longer vary

journey. Mid Nickel NCM and NCMA (Nickel Cobalt Manganese Aluminum)

are additionally gaining traction, significantly within the mid-range car

segments.

Cathode and anode energetic supplies (CAM/AAM) used within the

development of lithium EV batteries are essential elements that

decide efficiency and vitality storage capabilities. Strategic

acquisitions and investments from India OEMs and producers not

solely assist to broaden EV battery manufacturing capability however also can

enhance home technological capabilities.

For example, Himadri's funding in Sydney-based start-up,

Sicona Battery Applied sciences, which focuses on high-capacity

silicon anode expertise, is poised to revolutionize battery

capacities and charging speeds. Likewise, India's first CAM

provider Altmin is ramping up its manufacturing of LFP cathode

supplies, which can be important to powering a variety of

electrical automobiles.

With the automotive business exploring cost-effective

options to lithium EV batteries, sodium-ion expertise has

emerged as a promising candidate. Albeit with a decrease vitality

density, sodium EV batteries are low price, considerable in provide, and

safer, making them appropriate for 2 and three-wheelers with smaller

electrical car battery packs. Commercialization of sodium EV

battery expertise, which remains to be maturing, will not be totally

underway until 2030, however corporations like Reliance New Vitality Photo voltaic –

which acquired UK-based sodium-ion expertise firm Faradion –

are gearing as much as lead on this nascent market.

The moral sourcing of battery minerals is changing into a paramount

concern because the business scales. Narratives round lithium, nickel,

and cobalt are more and more scrutinized beneath the lens of ESG

ideas, forcing suppliers and firms to stability price

effectivity with moral accountability. Whereas an estimated 5.9

million tons of lithium reserves in Jammu and Kashmir presents

potential to localize mineral provide, it additionally highlights

complexities of extraction and their environmental influence in these

mountainous areas. Like with EV battery cell manufacturing, it

will take strategic partnerships with Bolivia, Argentina,

Indonesia, Australia and different nations to acquire the mandatory

Lithium, Nickel and Cobalt provides.

Because the business continues to evolve, the combination of superior

applied sciences and strategic partnerships can be key to sustaining

progress and reaching the electrification objectives set forth by the

authorities. This holistic strategy will guarantee a future the place India

is each a client and an important contributor to the worldwide shift

in direction of sustainable automotive options.

This text is a part of a collection that includes

highlights from S&P World Mobility's 2024 Options Webinar

Sequence. The Indian EV Battery Outlook webinar occurred on April 2,

2024.

Register

for upcoming webinar

classes.

[ad_2]