[ad_1]

Hear

to the Gas for Thought podcast.

With a slowdown in enthusiasm for battery electrical autos,

the battery trade is wrestling with a mixture of oversupply,

underutilization of capability and decrease return on investments.

For the reason that second half of final 12 months, the electrical car phase

is going through robust headwinds, a lot to the shock of many, as EVs

have been witnessing a powerful demand in the previous couple of years in

a number of markets all over the world. The bold zero-emission (ZEV)

gross sales targets by each governments and automakers painted a rosy

image in regards to the EV trade and the way shortly it’s anticipated to

evolve.

Because the novelty of EVs fades, the final a number of months have

introduced forth the conclusion that there are nonetheless elementary

points that persist and should be addressed for EVs to be a broadly

accepted answer. A few of these points are the dearth of charging

infrastructure, lengthy charging occasions and the excessive preliminary value of EV

acquisition. Most of those challenges are usually not short-term and can

require years, if not a long time to be totally solved.

What all of the noise round EVs has led to is a large funding

from many stakeholders within the EV ecosystem, proper from materials

sourcing to organising vital manufacturing capability for

batteries. The faster-than-realized uptake of EVs was anticipated to

propel the demand for batteries which necessitated a capability

growth to have the ability to in a position to meet the demand.

Nevertheless, with the slowdown, the trade is now a

case of oversupply, underutilization of the capability and decrease

return on investments.

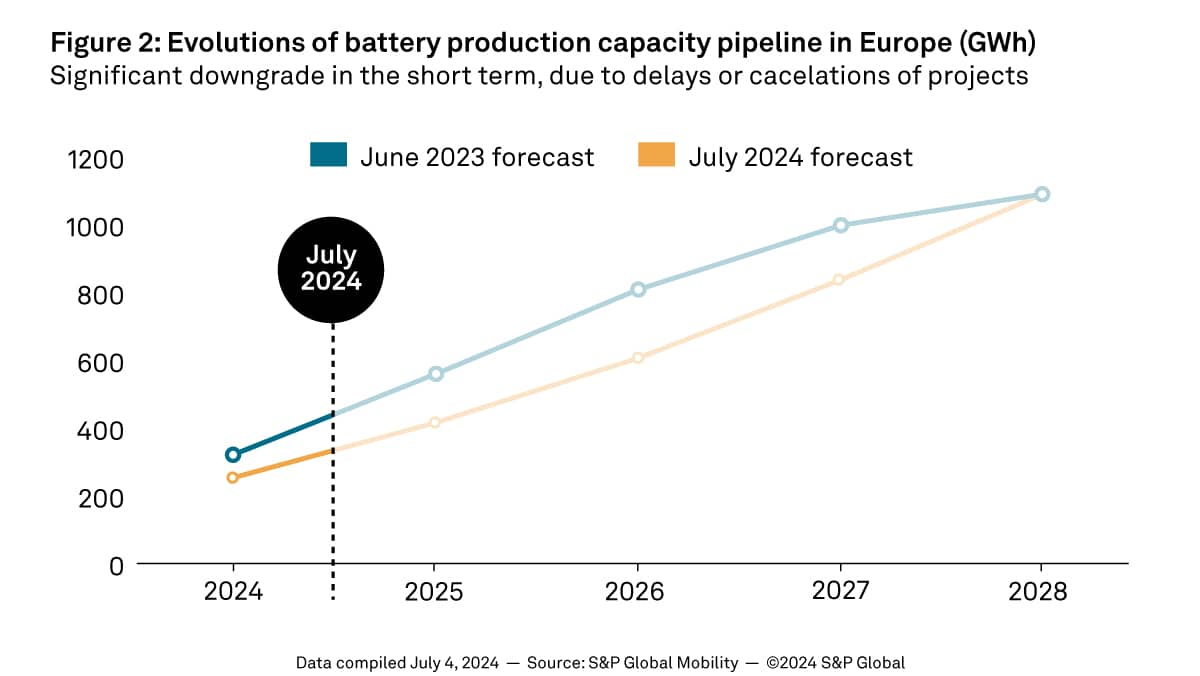

Curbing investments

From what has transpired within the trade in the previous couple of months,

the OEMs and battery gamers have watered down their ambitions.

This has led to a number of studies and official bulletins of

pulling again or postponement of investments in battery initiatives in

markets which have been seen as the largest development facilities for EVs.

Most not too long ago, it was reported that Automotive Cells Firm

(ACC), a three way partnership by Stellantis, Whole and Mercedes-Benz, has

determined to use brakes on two of its upcoming EV battery crops in

Europe. The 2 crops are positioned in Kaiserslautern, Germany, and

in Termoli, Italy. Each crops have been anticipated to have a manufacturing

capability of 40 GWh every in 2030.

ACC additionally has a plant in Douvrin, France which is already in

manufacturing and is predicted to begin battery cell provide later this

12 months. Collectively, ACC had introduced an funding of $7.6 billion in

the three crops. Within the mild of the slowdown, the three companions

are anticipated to evaluate their funding plans by the top of the

12 months or early subsequent 12 months.

In truth, Mercedes-Benz has additionally introduced a delay in its

electrification plans, pushing again its aim of fifty% electrified

car gross sales by 5 years. In 2021, Mercedes-Benz had mentioned that

it should have 50% electrified car gross sales (BEVs and hybrids) by

2025, which is now anticipated to be reached in 2030.

Earlier in Could, mainland Chinese language cell maker Svolt additionally introduced

that it’s dropping plans to arrange a plant in Germany. In 2022,

Svolt had mentioned that it’s going to arrange a 16 GWh cell plant in

Lauchhammer, Brandenburg to cater to European demand. The plant was

scheduled to begin manufacturing in 2025. The tariff of mainland

Chinese language gamers in Europe additionally performed a task in Svolt taking this

choice.

Volkswagen too has mentioned that it’s going to maintain again from taking a

choice on its fourth battery plant in Europe. The automaker was

aiming to arrange a brand new battery plant in Jap Europe and was

Czech Republic, Hungary, Poland or Slovakia as potential

places.

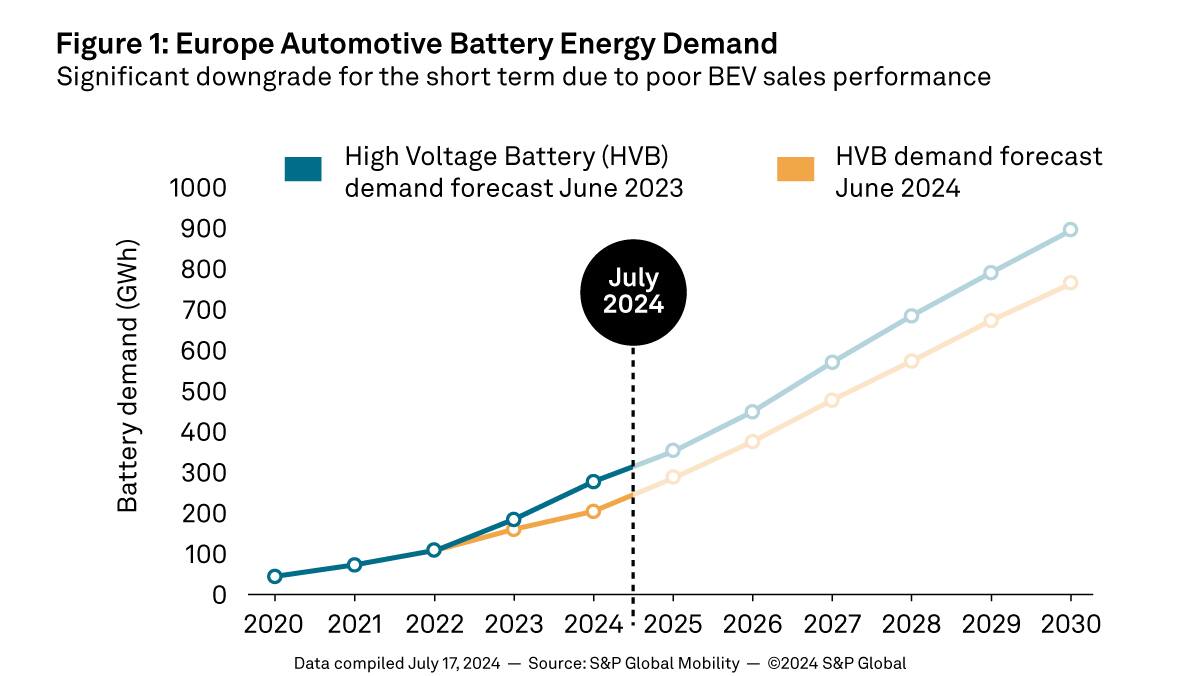

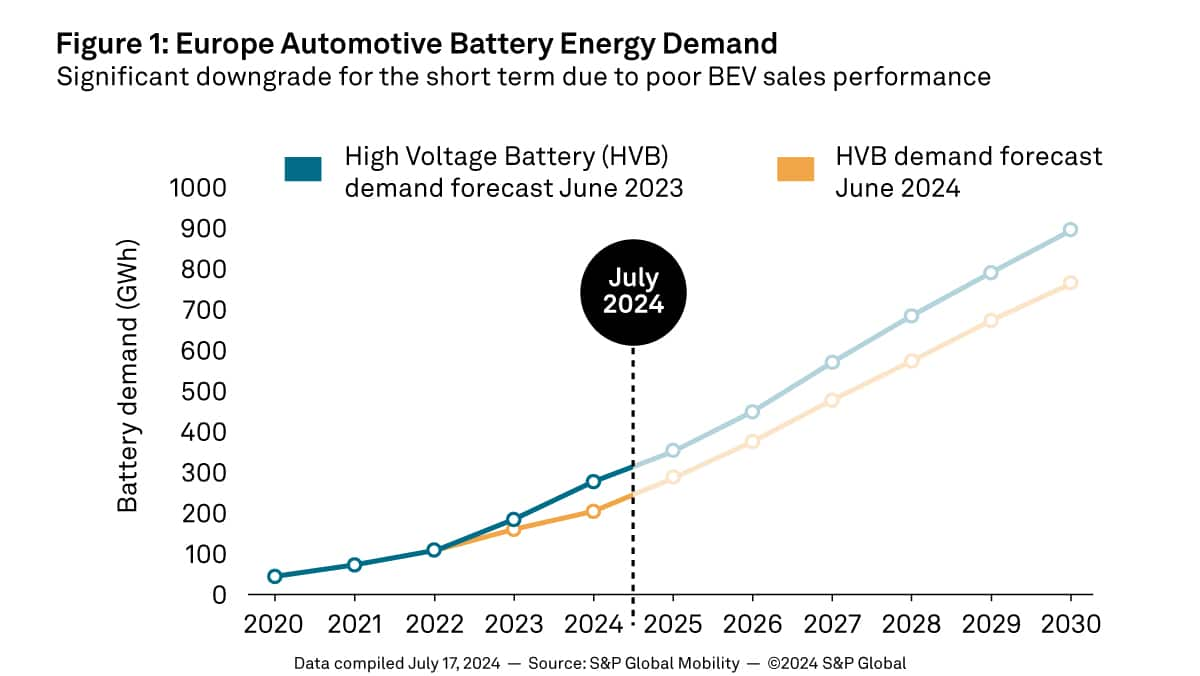

“Many of the European cell manufacturing initiatives are at the moment

going through challenges as a result of current slowdown in battery-electric

car (BEV) gross sales. The investments made in new initiatives, or the

growth of present services have been based mostly on the expectation of

continued astronomical development charges in recent times. Nevertheless, the

poor efficiency of BEV gross sales in 2024 has resulted in a surplus of

unused capacities for cell makers. The numerous value hole

between European batteries, which primarily depend on NCM expertise,

and LFP cells from China additional complicates the state of affairs for

European cell makers, particularly as automotive producers attempt to

introduce reasonably priced electrical autos,” mentioned

Ali Adim, Supervisor, Technical Analysis, S&P World

Mobility.

Europe is just not the one area the place an funding slowdown is

being witnessed. A number of studies recommend that OEMs and battery

gamers are additionally delaying their investments in North America.

American automaker Ford additionally introduced its battery investments

plans again to evaluate board. Final November, Ford introduced scaling

again of its Michigan plant within the US.

“Whereas we stay bullish on our long-term technique for electrical

autos, we’re re-timing and resizing some investments. As acknowledged

beforehand, we’ve got been evaluating BlueOval Battery Park Michigan

in Marshall. We’re happy to substantiate we’re shifting forward with the

Marshall challenge, in line with the Ford+ plan for development and

worth creation. Nevertheless, we’re proper sizing as we stability

funding, development, and profitability. The ability will now create

greater than 1,700 good-paying American jobs to supply a deliberate

capability of roughly 20 GWh,” Ford mentioned in an announcement in

November 2023.

BlueOval Battery Park Michigan is a $3.5 billion funding by

Ford Motor Firm which is able to produce lithium iron phosphate (LFP)

batteries that can energy quite a lot of Ford's next-generation EV

passenger autos and pickups. Beforehand, the plant was set to

manufacture 35GWh of batteries and make use of 2,500 individuals.

There even have been studies that Panasonic, one of many greatest

cell producers in the USA, may delay investing

in extra capability of battery crops in North America.

Panasonic was reportedly planning to arrange a 3rd plant within the

US. Nevertheless, the delay in funding might have put the plans for the

third plant in a limbo. “There's a necessity to manage the pace of

funding relying on the pace at which EVs unfold,” Yuki

Kusumi, Panasonic group's chief government, was quoted as

saying.

There have additionally been studies that recommend Northvolt might delay

organising its plant in Montreal, Canada, which was anticipated to

develop into operational by 2026.

Northvolt not too long ago hit one other roadblock when BMW, considered one of its

greatest prospects, reportedly cancelled its €2 billion order for EV

lithium-ion battery cells. The provision of the cells, which have been to

be produced in Europe on the Northvolt gigafactory at Skellefteå in

northern Sweden, was scheduled to begin in 2024. Though

manufacturing delays have been cited as one of many causes for

cancellation, BMW may be reviewing its cell demand, given the

slowdown in EV gross sales.

The cooling down of demand has additionally led to a big drop in

the costs of essential battery uncooked supplies resembling nickel cobalt

and lithium. In line with S&P World, Costs for lithium,

nickel and cobalt sharply decreased in 2023 and are anticipated to

decline additional in 2024.

Excessive voltage battery forecast

knowledge.

By Srikant Jayanthan, Senior Analysis Analyst II, S&P World

Mobility

[ad_2]