[ad_1]

Hearken to this Gas for Thought

podcast

As EV gross sales gradual, OEMs should think about a number of elements to

align their EV manufacturing with authorities laws and shopper

demand.

Insights on this Publication & Podcast:

-

The pathway to electrification: from the here-and-now actuality to

the long-term aspiration of decarbonization within the transportation

sector. -

The US authorities regulatory aspirations and their strain on

OEMs in direction of an accelerated response to electrification. -

The buyer mindset and sentiment in direction of electrification:

pricing, know-how and the willingness of adoption. -

OEM showroom response to align regulation and pricing by way of

different automobile electrification pathways.

The primary quarter of 2024 introduced important consideration to the

tapering of electrical automobile (EV) momentum in the US,

with many clamoring “I instructed you so.” There is no such thing as a query that

aligning the present administration's aspirations of a decarbonized

transportation sector to the truth of how shoppers transition

in direction of electrified automobiles will stay very fluid. A lot of this

chapter of historical past shall be written within the coming decade and is

more likely to function surprises because the business is shifting very

rapidly to a recognized rising know-how with an unknown shopper

response. In consequence, it is very important separate immediately's

front-page information of early adopters from the mid-term ramp up and

eventual long-term stabilization of EVs within the market. It's

additionally essential that every one stakeholders are conscious that failure to

electrify isn’t an choice.

Gentle automobile gross sales within the US closed the primary quarter at an

estimated 15.4 million-unit SAAR, that includes progress of 5.4%

year-over-year. The market can also be transitioning from a

build-to-order mannequin again to a business-as-usual world of

inventories and incentives for many segments. From a propulsion

perspective, the market share for EVs is basically unchanged

year-over-year. That is starkly totally different from the 50% enlargement of

2023 and the primary time in a few years the place EV progress has tapered

to the single-digit stage.

The stagnation of EV gross sales is making many inside the business

uncomfortable (OEMs and suppliers alike) as the continuing ramp-up of

EV manufacturing capability requires a steady sturdy enlargement of

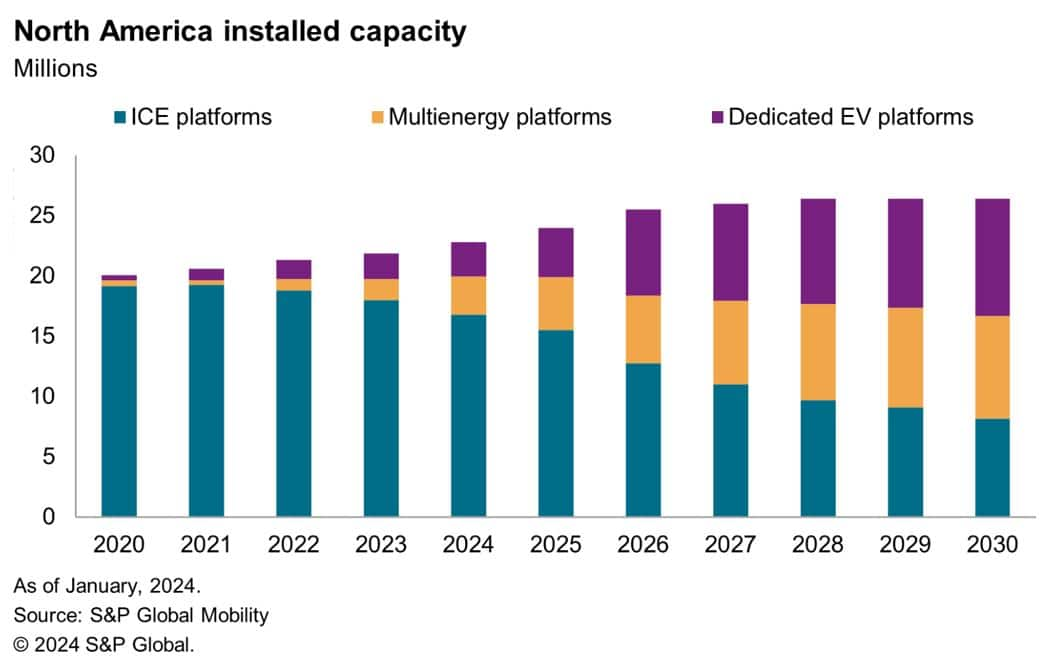

electrification. Capability in North America is roaring from 20

million items immediately to 26 million inside the subsequent few years, as all

OEMs need to proactively reply to regulatory necessities.

Roughly 20 vegetation are anticipated to start out or restart operations this

decade (since 2020) geared in direction of ZEV meeting and dozens extra are

retooling their manufacturing from ICE to ZEV platforms.

This capability enlargement is pointing towards an business

migration—with greater than 65% of North America-manufactured

automobiles anticipated to be electrical by 2030. Nonetheless, the temper is

cautionary for a lot of OEMs with a producing base in North America

as they attempt to match authorities ambitions of a 50% Zero-Emission

Car (ZEV) market by 2030 (roughly a six-fold enlargement in a

six-year interval) alongside weaker shopper demand. This alignment

is barely aggravated because it comes on the tails of a newly minted labor

settlement that can increase wages by over 25% by means of 2027 for many

vegetation within the US and Canada and is more likely to erode

profitability.

Additionally it is necessary to say that the Biden administration

understood that matching a 50% ZEV regulatory goal would want

help. Merely put, this was going to be a carrot-and-stick

method, with the carrot being the Inflation Discount Act (IRA).

The IRA has a number of parts supporting the trail to

decarbonization within the U.S.; probably the most essential to the automotive

business are the buyer and producer credit for buy and

manufacturing of ZEV automobiles. Placing these two collectively may

signify a median stimulus of $12,090 for ZEVs that meet all

necessities, assuming a full $7,500 shopper credit score and a $4,590

producer credit score ($45 per kW on the common US battery dimension of

102 kW for 2022).

This method triggered unparalleled funding for the

enlargement of ZEV capability. OEMs assumed in the event that they constructed them (EVs)

they (shoppers) would come. It was solely pure to imagine that the

sturdy shopper demand for EVs seen in California and lots of different

West Coast markets was going to develop throughout the nation if IRA

funds helped to shut the hole in worth between ZEVs and legacy

Inner Combustion Engine (ICE) automobiles. OEMs have labored very

exhausting to match the success Tesla is having in these markets,

particularly after the EV juggernaut's Mannequin Y was the third

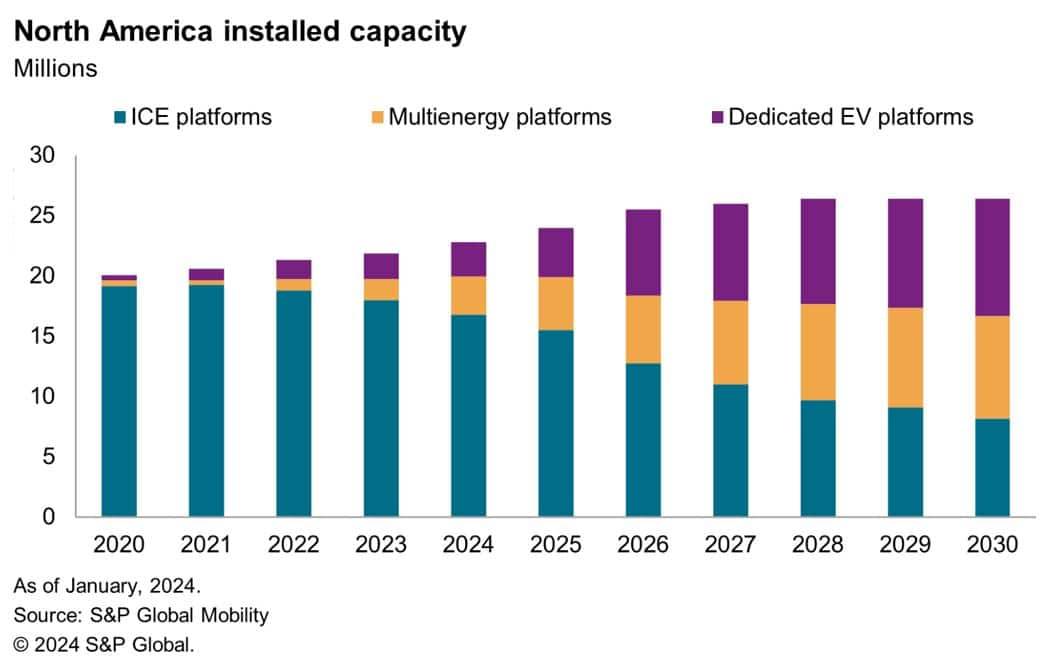

top-selling mild automobile final 12 months. The response from OEMs is a

pipeline of over 30 totally different new EV fashions due in 2024 and extra

than 200 fashions due by 2028, in accordance with present forecasts.

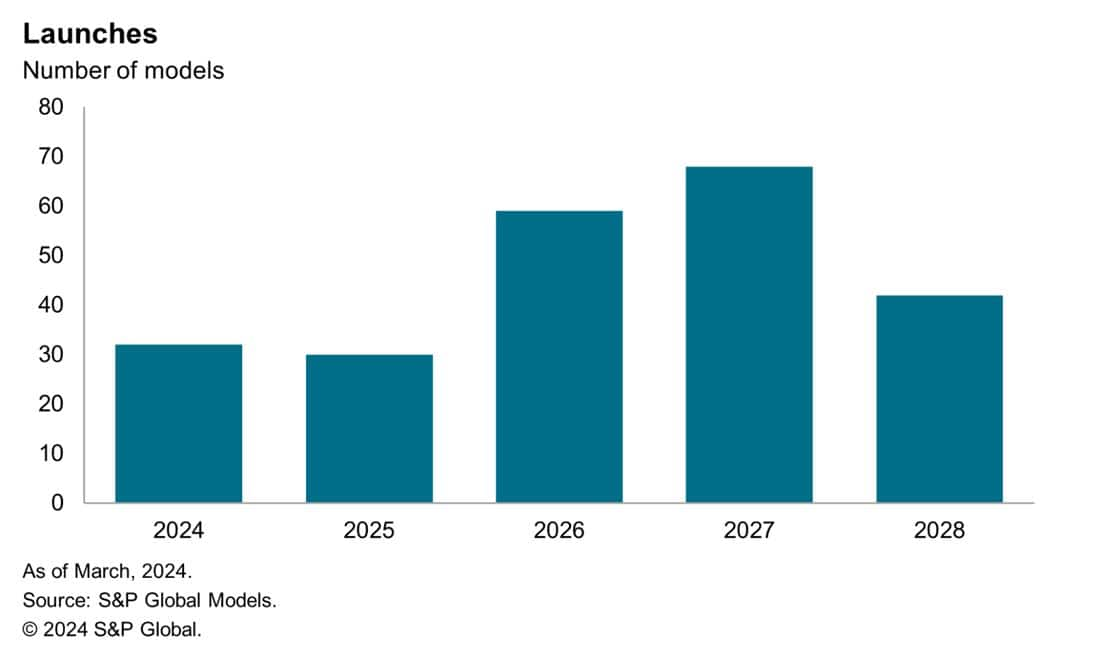

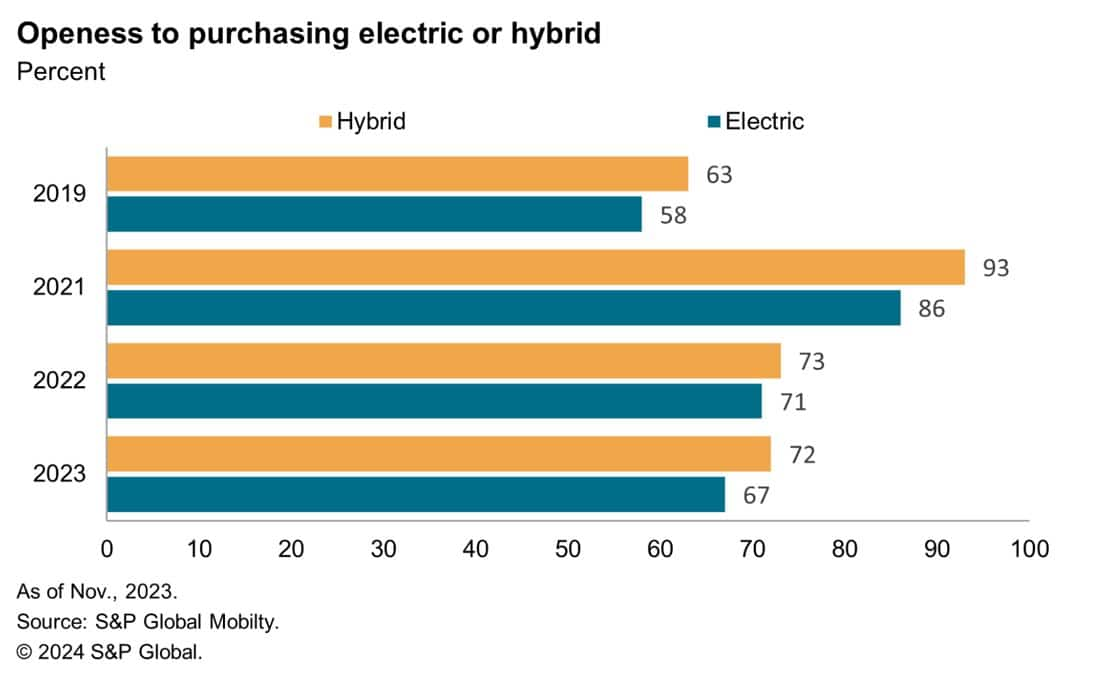

To grasp shopper habits and mindset, S&P World

Mobility runs proprietary surveys regularly, certainly one of which

measures EV shopper sentiment. This analysis basically

acknowledges the willingness of shoppers to purchase EVs. Our 2023 survey

confirmed a 67-percent willingness to think about shopping for an EV automobile,

although a 19-percentage-point decline relative to the identical survey in

2021 when EV pleasure was cresting in the midst of the

stock/semiconductor disaster. Our 2023 survey signifies the

major issues shoppers had in thoughts had been pricing, vary and

charging.

This identical survey exhibits that customers want a gentler

transition in direction of electrification—extra of an evolution than

revolution. Right here, hybrids are clearly prime of thoughts to shoppers

the place the necessity to change isn’t as drastic—basically

remaining on the identical fueling system they’re conversant in. It has

solely been in current months that we’ve got seen some OEMs assimilate

this actuality and rethink their pathway to electrification.

The electrification roadmap shall be primarily depending on the

triangulation of those three components: pricing of EVs, assembly

regulatory necessities from the federal government, and OEMs' creativity

and suppleness to regulate their showroom portfolios to greatest match

these two. Some OEMs are realigning methods to create a bridge

within the form of Hybrid Electrical Autos (HEV) and Plug-in Hybrid

Electrical Autos (PHEV) to deal with shopper issues of pricing,

vary, and charging for EVs. This comes after conventional OEMs are

now publicly stating that worth parity for EVs gained't be as straightforward as

initially envisioned and have gone again to the drafting board to

search for alternate roadmaps to appease shopper hesitation whereas

remaining good company residents.

Traditionally the regulation of the land has revolved round

miles-per-gallon and assembly the regulatory requirement has been no

small feat over the past 20 years because it required a median 5%

enchancment in effectivity year-over-year. In response to decreasing

carbon emissions within the US, the Biden administration has added new

dimensions to that equation by proposing a revised setting of e-MPG

(equal MPG ranking for EVs and PHEVs) and the requirement to

additionally scale back emissions of different pollution. From a numeric

standpoint, if an EV used to get a 350 e-MPG ranking the revision to

the e-MPG calculation signifies that identical automobile will solely be getting

roughly 125 e-MPG ranking in coming years.

To most, that is already a really tall order to satisfy, however once more,

occasions are very fluid. The roadmap of electrification turns into even

tougher as it might need to accommodate for a protracted record of

what-ifs: US presidential elections, price of uncooked supplies, a

revision of USMCA, or different elements. This lodging and

flexibility demand that OEMs reply rapidly and, within the course of,

shift their whole worth chain at related velocity, beginning with

suppliers, uncooked materials suppliers, and logistics operators as

properly.

The writing of this thrilling chapter of the automotive historical past

e book as OEMs are requested to align pricing, regulation, and portfolios

is not going to be black and white, however a real prism of colours. Lack of

motion is actually not an choice; the OEM ships have left the

ports searching for a brand new carbon-free world and are navigating

uncharted shopper waters and the perils that come together with such

an altruistic endeavor.

Relaxation assured, we at S&P World Mobility sit up for

serving to the business greatest chart these waters to anticipate the

tough seas and storms forward.

——————————————————————-

Dive deeper into these mobility insights:

Discover Extra Electrical

Car Developments

2024 US Presidential

Election and the Auto Business – Learn the article

[ad_2]