[ad_1]

Hearken to this Gasoline for Thought

podcast

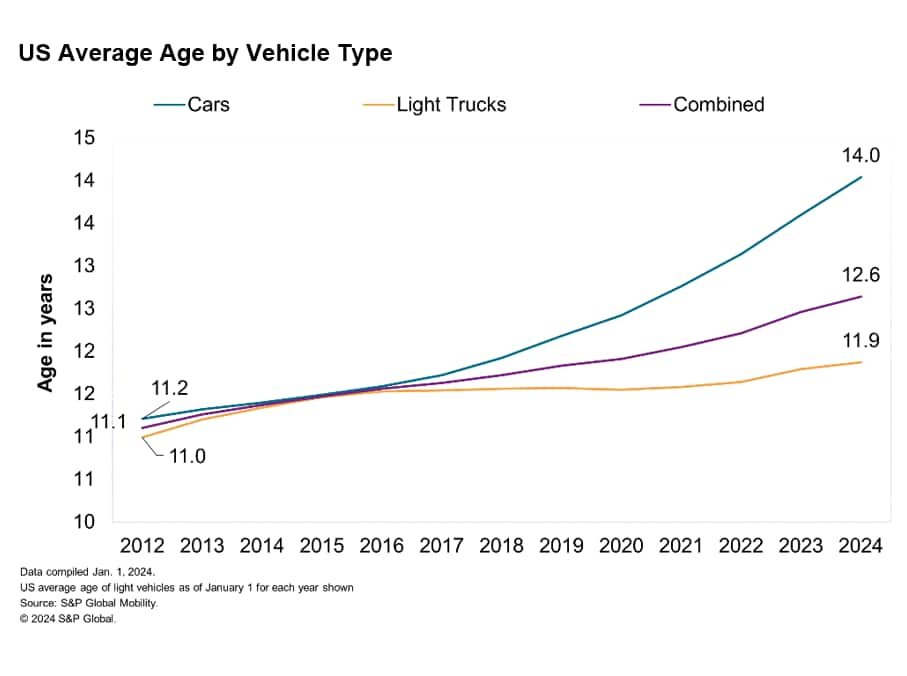

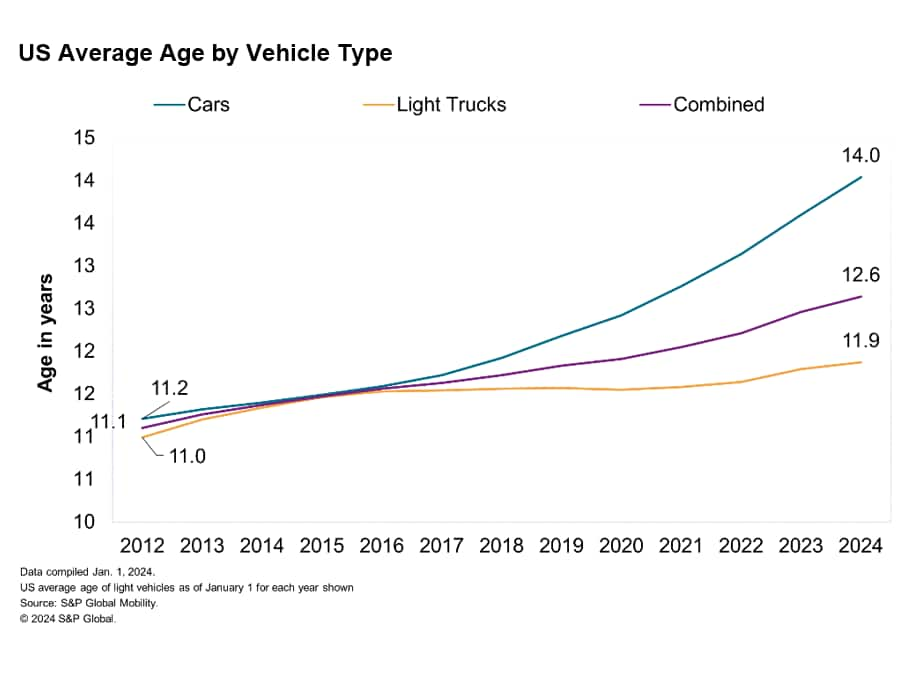

Autos on the street are getting even older, in line with new

S&P World Mobility knowledge launched final week. The common age of

vehicles and lightweight vans within the US has risen once more to a brand new document of

12.6 years in 2024, up by two months over 2023. The rise in

common age is exhibiting indicators of slowing as new registrations

normalize.

This continues to enhance enterprise alternatives for firms

within the aftermarket and automobile service sector within the US, as restore

alternatives are anticipated to develop alongside automobile age.

Why is the common age of autos

rising?

New automobile costs stay prohibitively excessive for a lot of shoppers

within the US, with common transaction value reported at US $47,218 in

March 2024, in line with S&P World Mobility. Moreover,

inflation is proving extra persistent than anticipated and there may be

trepidation across the shift to electrical autos. A mixture of

these elements has resulted in shoppers conserving their autos on

the street longer, driving common age upward.

Development of the restore enterprise candy spot

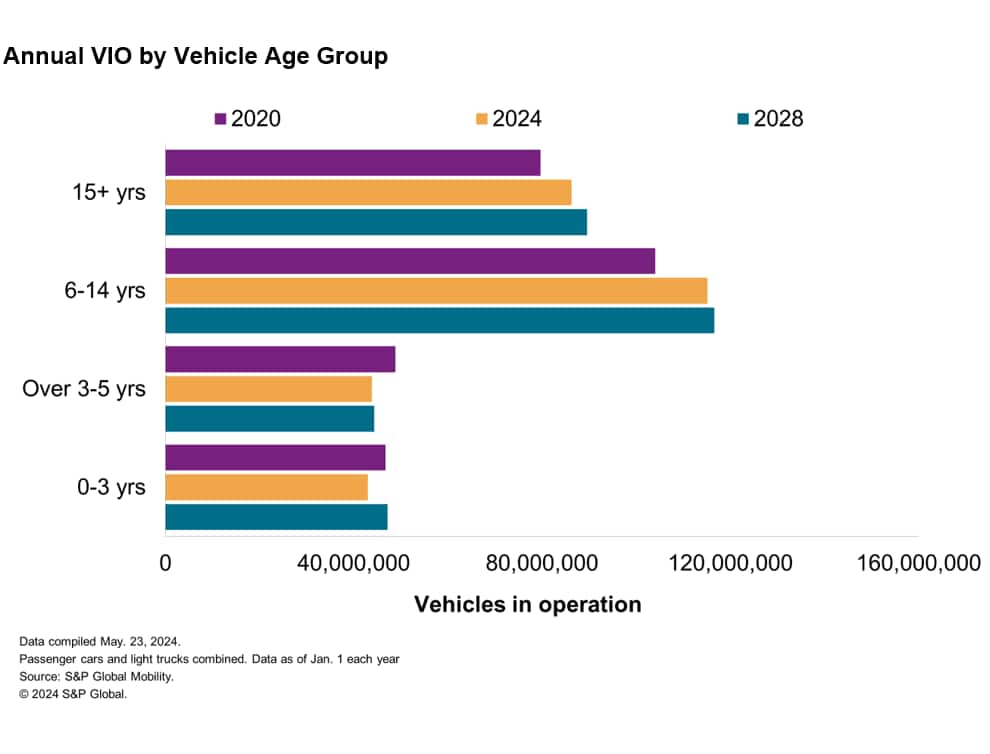

As autos are retained longer, the growing older fleet is predicted to

present extra autos to the aftermarket for repairs and

upkeep. The 6-to-14-year-old cohort is predicted to be 12%

greater in 2028 in comparison with 2020, in line with S&P World

Mobility estimates. These autos could also be on their second or third

proprietor and are more likely to already be a main aftermarket buyer.

Autos older than 15 years are seen rising at the same tempo

over the identical timeframe.

“With common age progress, extra autos are coming into the prime

vary for aftermarket service, sometimes from 6-to-14 years of

age,” mentioned Todd Campau, aftermarket observe lead at S&P World

Mobility. “With greater than 110 million autos in that candy spot

— reflecting almost 38% of the fleet on the street — we

anticipate continued progress within the quantity of autos in that age vary

to rise to an estimated 40% by way of 2028.”

In the meantime, the aftersales enterprise, which generally is dependent upon

the 0-to-3-year-old autos, is seeing a decline in addressable

automotive parc. From accounting for near 17% of the on-road fleet in

2020, the autos within the youthful age class declined to just about

15% of the fleet as of January 2024. However a slight

revival within the close to time period, volumes on this cohort will proceed to

stay decrease than the pre-pandemic ranges (47 million in 2028 vs

almost 50 million in 2019).

The aftersales section witnessed a slight decline within the quantity

of restore orders final yr. New-vehicle dealerships within the US wrote

264.3 million restore orders in 2023, down barely from 265.8

million restore orders written in 2022, in line with the 2023 Nationwide Vehicle Sellers Affiliation (NADA)

Information full-year report. In the meantime, complete service elements and gross sales

income for brand spanking new automobile dealerships touched $142.62 billion in

2023, up 3.73% year-on-year, the report added. Whilst income has

climbed persistently since 2020, the tempo of progress appears to have

moderated with final yr's progress being the slowest in three

years.

Two passenger vehicles scrapped for each new passenger automotive

registration

Car scrappage charges — the measure of autos exiting

the energetic inhabitants — proceed to carry regular. As of January

2024, the scrappage fee was 4.6%, largely unchanged from 4.5% in

January 2023.

Trying on the mixture of the fleet, since 2020, greater than 27

million passenger vehicles have exited the US automobile inhabitants, whereas

simply over 13 million new passenger vehicles have been registered. At

the identical time, over 26 million gentle vans (together with utilities)

have been scrapped and almost 45 million registered.

“Shoppers have continued to show a desire for

utility autos and producers have adjusted their portfolio

accordingly, which continues to reshape the composition of the

fleet of autos in operation available in the market,” mentioned Campau.

A take a look at the scrappage pattern for different gasoline autos

signifies that hybrids are quickly rising within the fleet with such

autos gaining recognition amongst shoppers. In keeping with S&P

World Mobility knowledge, as of January 2024, solely 18% of recent hybrids

are changing the previous ones leaving the fleet, whereas 50% of the brand new

diesels are changing the previous diesels being scrapped. One of many

elements driving progress in hybrids is that they’re a pure

stepping stone within the course of EVs in addition to the truth that

they’re a complicated propulsion expertise that gives some

electrical driving functionality.

The truth that the US is promoting extra hybrids than it’s

scrapping can be indicative of the US shopper pattern of taking a

half-step in selecting a hybrid as an alternative of shifting on to an

electrical automobile (EV) when migrating from their inner combustion

engine autos. Between January 2021 to January 2024, hybrid

automobile registration within the US jumped 181% to 1.4 million,

in line with S&P World Mobility knowledge.

VIO grows to 286M, whereas EV VIO exceeds

3M

The US automobile fleet surged to 286 million autos in operation

(VIO) in January, up 2 million over 2023, however the distribution of

autos by age is altering. Autos below the age of six

accounted for 98 million autos in 2019, or about 35% of VIO.

Right now they characterize lower than 90 million autos and usually are not

anticipated to succeed in that threshold once more till 2028 when they’ll

characterize about 30% of VIO, in line with S&P World Mobility

estimates. That is pushed by the influence of COVID and subsequent

provide chain shortages that disrupted automobile provide and

registrations — and following traditionally excessive volumes from

2015 to 2019.

Consequently, the first driver of VIO progress will probably be autos

within the aftermarket 'candy spot' — autos 6-to-14 years of

age, and even older autos, which might be anticipated to characterize about

70% or extra of VIO for the subsequent 5 years. These autos will

function a tailwind to aftermarket service alternatives.

EVs on the street additionally continued to extend, with 3.2 million EVs

in operation in January. 2023 EV registrations surpassed one

million models for the primary time and elevated about 52% in contrast

with 2022. The speed of EV progress was slower than some automakers

had anticipated, and there may be potential for the common age of EVs

to rise within the quick time period as shopper adoption slows. The common

age of EVs within the US is 3.5 years and has been holding largely

regular since 2019 with new registrations representing a big share

of total EV VIO.

“We began to see headwinds in EV gross sales progress in late 2023,

and although there will probably be some challenges on the street to EV adoption

that might drive EV common age up, we nonetheless anticipate important

progress in share of electrical autos in operation over the subsequent

decade,” mentioned Campau.

Entry extra detailed VIO

data with AftermarketInsight.

[ad_2]