[ad_1]

Hear

to this Gasoline for Thought podcast.

Affordability, stock, and incentives tendencies are shifting

the aggressive panorama.

It has been a turbulent 4 years for the US auto business, from

the COVID-19 pandemic to stock fluctuations and provide chain

disruptions.

However sadly for a few of the business’s most necessary

stakeholders, the turbulence is not over but. Automakers and their

captive financing teams are going through intensified competitors and

issue attracting prospects, on account of a number of converging tendencies.

These vary from a latest surge in car stock and

affordability considerations to fluctuating incentives and evolving

shopper behaviors.

Here is a breakdown of how these tendencies are taking part in out in 2024,

and what they imply for OEMs and captive lenders.

Rising Stock: Extra Automobiles, Extra Challenges

In August 2024, the variety of automobiles out there on the market within the

US jumped to 2.88 million—51% increased than at this stage in

2023. Nonetheless, there are some indicators that total stock development is

slowing, with year-over-year comparisons displaying a gradual lower

in the previous few months; after March stock marked a 63% enhance

yr over yr.

However with extra 2025 mannequin yr automobiles getting into the showrooms

this September and October, strain will once more speed up to promote

down remaining inventory of 2024 automobiles. There are nonetheless 2.07 million

mannequin yr 2024 automobiles in retail marketed stock. For

comparability, at this identical time final yr, there have been just one.33

million mannequin yr 2023 automobiles in marketed stock.

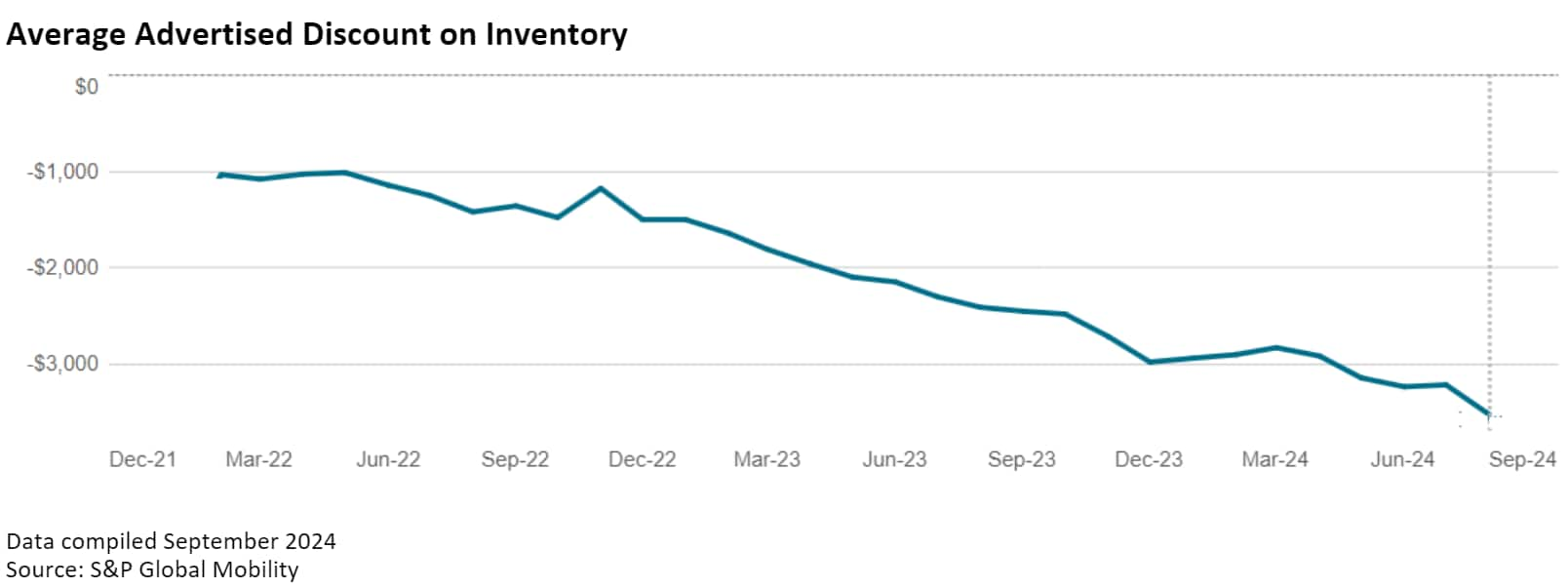

This enhance in stock, particularly with the 2025 fashions now

rolling out, means dealerships have to filter their 2024 fashions.

To do that, they’re providing larger reductions — about $3,534 on

common in August, which is 10% greater than in July and 40% increased

than they had been providing at the moment final yr.

For lenders, this indicators a shift to a purchaser’s market, the place

aggressive financing will probably be key. Captive lenders may see extra

alternatives to supply engaging financing choices like leasing to

assist transfer these automobiles.

Affordability and Incentives: A Persevering with Curler Coaster

Journey

Even because the market shifts within the consumers’ favor, car costs

stay a hurdle for potential buyers. The typical MSRP in retail

marketed stock reached over $51,900 as of August 2024. This,

mixed with excessive rates of interest, has made affordability an enormous

concern for consumers. Even following the Fed’s September announcement

to chop rates of interest by 50 foundation factors, borrowing prices stay

significantly increased than pre-pandemic and are nonetheless a vital

headwind going through potential consumers out there.

With consumers feeling the pinch, captive lenders might want to

take into consideration how they will help make automobile purchases extra reasonably priced.

Providing versatile mortgage phrases, aggressive rates of interest, and

using leasing packages might assist ease a few of the monetary

stress for shoppers.

In the course of the COVID-19 pandemic, automakers and their lending arms

confronted unprecedented challenges. They decreased leasing choices and

incentives on account of extreme stock shortages and heightened

shopper demand, which resulted in traditionally low leasing

charges.

Because the market begins to stabilize, OEMs now discover themselves

contending with record-low returns from lease prospects on account of that

multi-year leasing decline. In response, they’re being pressured to

implement focused incentives to maintain market share and stimulate

gross sales.

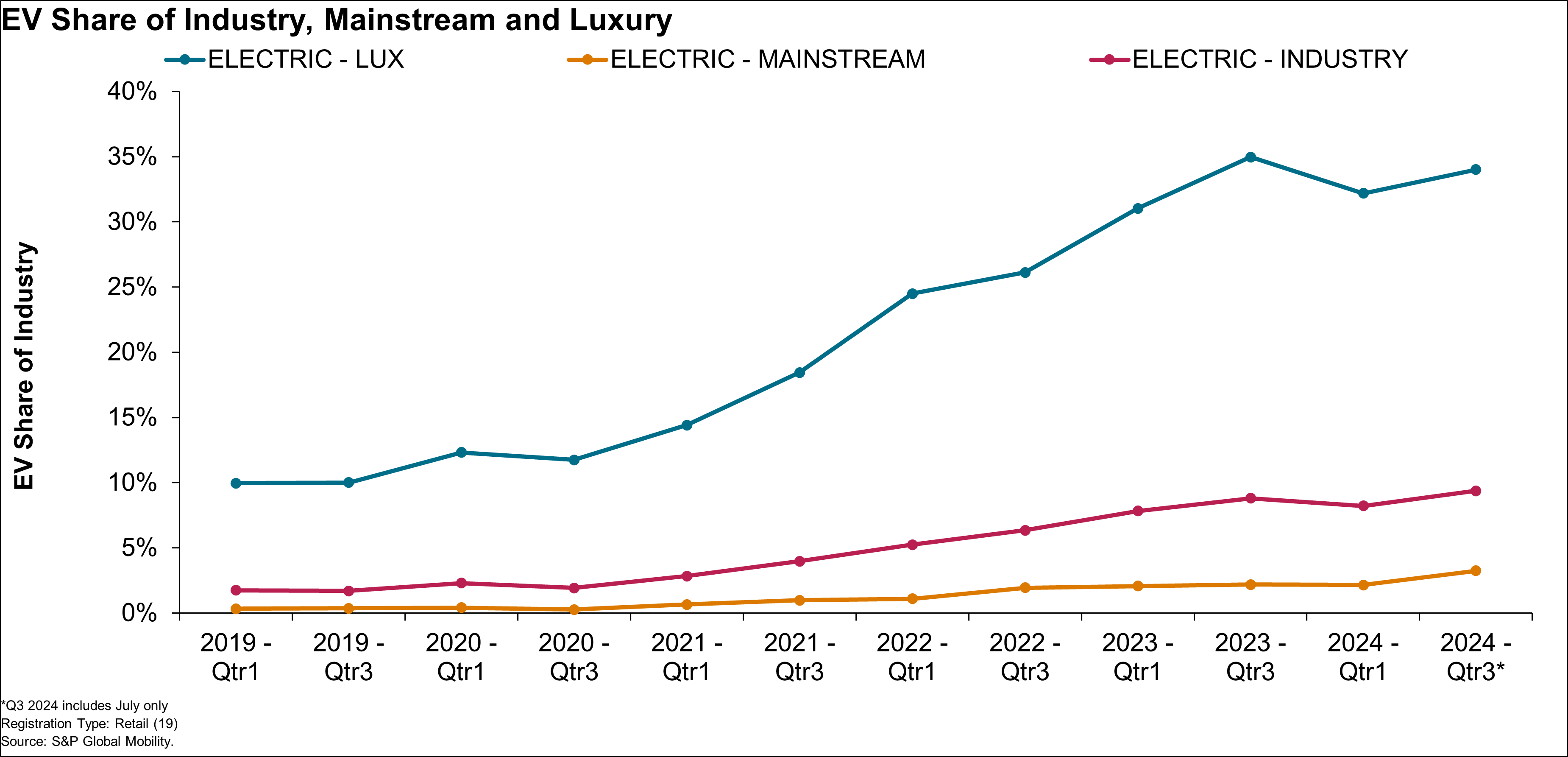

On prime of constructing up for the dearth of returning lease prospects,

automakers should additionally prioritize their electrical car (EV) gross sales.

Nevertheless, the dearth of sturdy infrastructure and shopper training

round EVs has made it pricey for producers to advertise these

automobiles successfully. In flip, OEMs have needed to allocate a better

share of their incentive spending for EVs somewhat than ICE automobiles,

creating extra promoting pressures on the ICE automobiles.

OEMs striving to stability these portfolios will face the

problem of managing incentives throughout totally different car

sorts.

Moreover, the complexity surrounding authorities rebates for

EVs — stemming from the Inflation Discount Act (IRA) and

numerous state initiatives — has created a convoluted panorama

for OEMs, lenders, sellers, and shoppers alike. The intricate

nature of those incentives complicates the buying course of,

making it troublesome for shoppers to navigate out there choices.

This complexity can result in confusion and frustration, in the end

impacting shopper decision-making and gross sales outcomes.

For captive lenders, this implies understanding the altering

incentives panorama is essential. Maintaining with the newest rebate

packages and incentives will help in tailoring financing choices

that match present market circumstances. Additionally, offering clear

info to prospects about these incentives will help simplify

their decision-making course of.

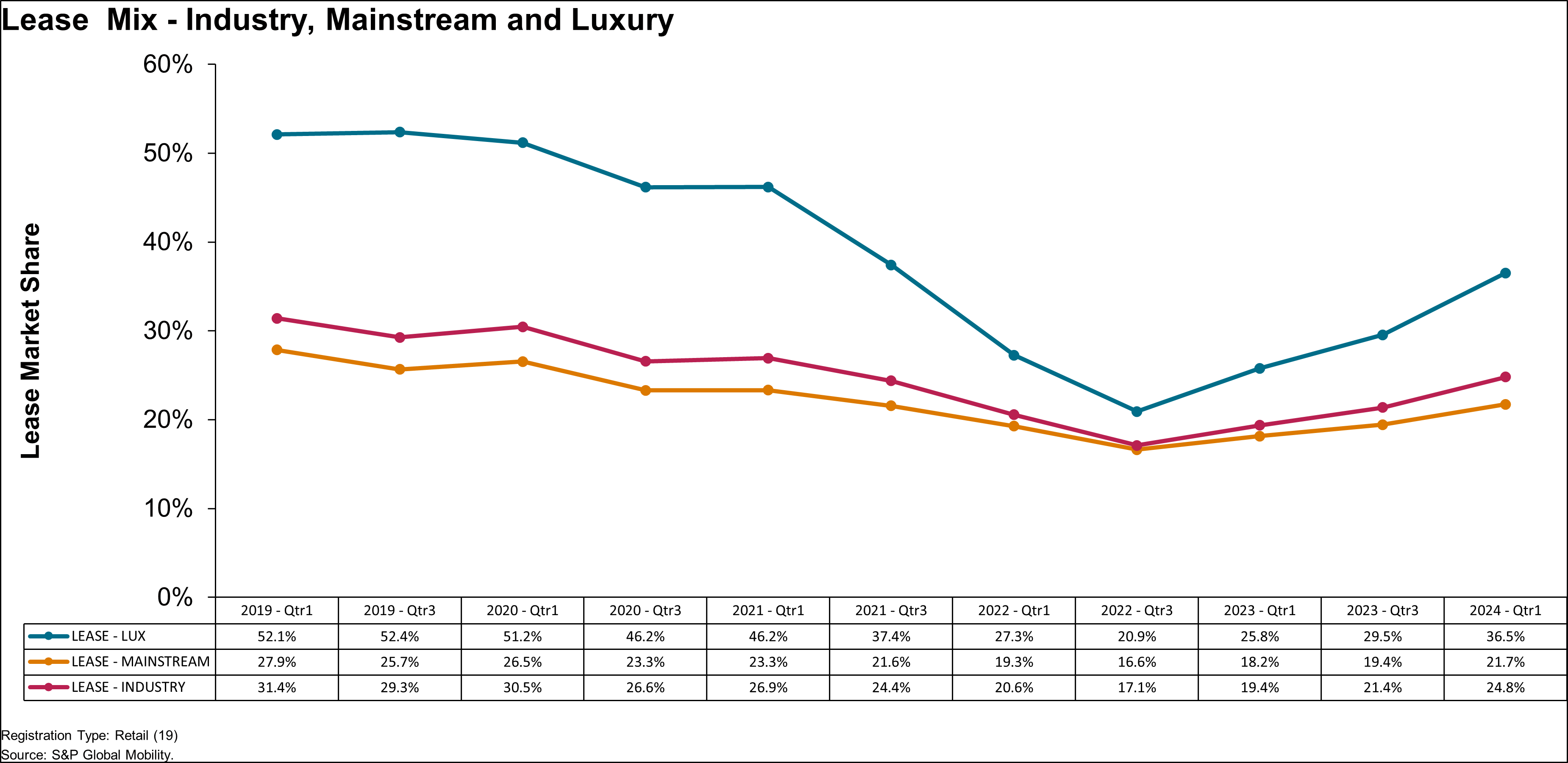

Leasing: Making a Comeback

In some excellent news for OEMs, leasing is making a

sturdy comeback, with its share of recent car registrations rising

from its low level of 17.1% in mid-2022 to 25.3% in Q2 2024.

This rise is partly on account of increased seller inventories. Again in

2022, manufacturers and sellers had substantial leverage given the dearth of

automobiles to select from, however since then market clout has moved again

to the patron, requiring increased incentives and discounting by

sellers. which in flip has led to better leasing.

The rise in leasing may also be attributed partially to the

Inflation Discount Act, which gives a $7,500 tax credit score for EV

leases.

Amongst car sorts, lease share of luxurious automobiles has risen

far more (nearly 19 share factors) than mainstream (up 5

share factors) or the business total (up 8.2 share

factors) since 2022.

This dramatic rise in leasing of luxurious automobiles started on the

identical time the Inflation Discount Act (IRA) got here into impact. Given

electrical automobiles’ disproportionate share of the luxurious market,

this has propelled each lease share of luxurious and lease share of

business to leap.

For lenders, this implies there are extra alternatives to supply

leasing choices. Captive lenders have the chance to develop their

enterprise with a concerted effort to give attention to leasing.

A Aggressive Panorama

The automotive market is in flux with rising stock,

affordability points, and sophisticated incentives buildings. For

captive lenders, adapting methods to fulfill these tendencies as effectively

because the evolving wants of consumers ought to be paramount. Providing

versatile financing options, understanding the provision of

aggressive incentives, and offering clear info will help

captive lenders stand out in a troublesome promoting market.

For added studying and help:

Get essentially the most complete, correct and

well timed car registration and loyalty information with automotive mortgage

origination exercise.

Study Extra About

AutoCreditInsight

Entry our instrument that permits OEMs and lenders to match any

car cost in opposition to rivals in actual time.

Meet us in individual on the Auto Finance

Summit.

This text was revealed by S&P World Mobility and never by S&P World Rankings, which is a individually managed division of S&P World.

[ad_2]