[ad_1]

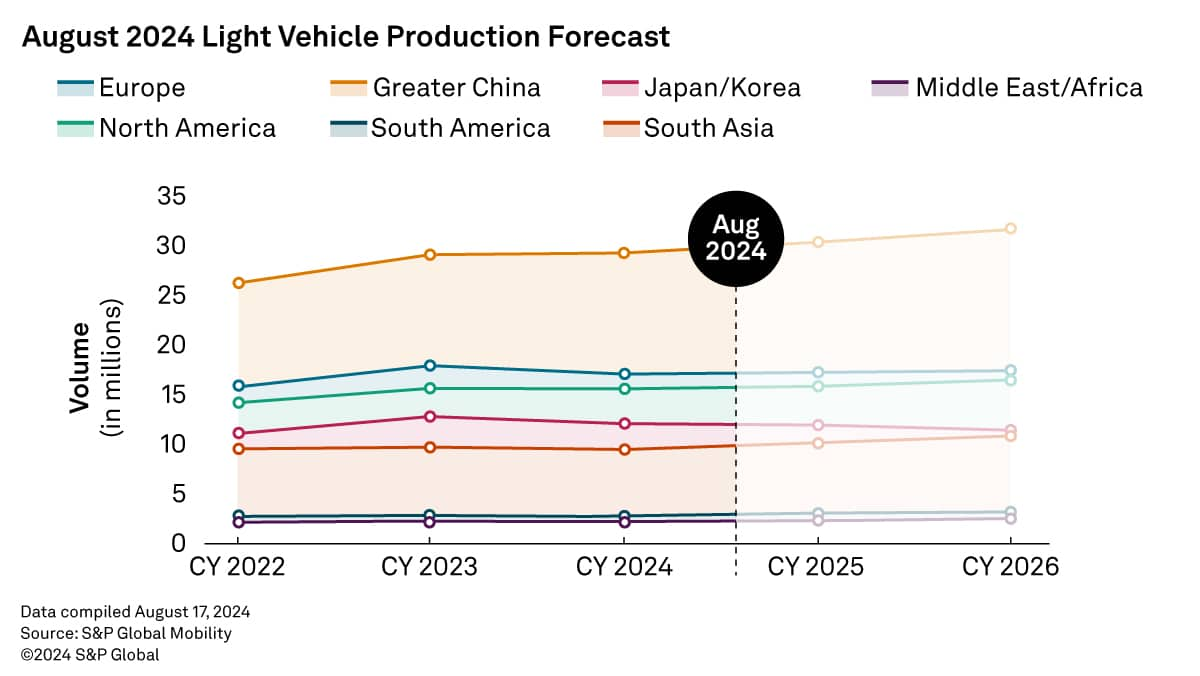

Every month, we leverage international mild car manufacturing actuals,

registration knowledge, and gross sales knowledge to provide the most modern,

short-term manufacturing forecast obtainable.

Here is a detailed take a look at international manufacturing knowledge by area and our

up to date August manufacturing forecast.

Prime Takeaways

The worldwide auto trade continues to wrestle with slowing gross sales

progress in a number of key markets and slightly excessive inventories, amongst

different elements. The manufacturing outlook displays these ongoing

challenges, and our August forecast replace consists of a mixture of each

upgrades and downgrades within the near-term. Regional changes

mirror the affect of expanded coverage help in China offset by a

concentrate on stock administration and company-specific changes in

North America.

Noteworthy Changes

Europe: The outlook for Europe mild car

manufacturing was elevated by 60,000 items and by 31,000 items for

2024 and 2025, respectively. The outlook for Western and Central

Europe, together with Turkey, was revised down by 14,000 items. This

was as a result of considerably stagnated car demand and provide chain

points. The broader European market continues to be influenced by

elevated car pricing, lingering excessive inflation and the continued

shift in electrification.

Better China: The outlook for Better China

mild car manufacturing was elevated by 227,000 items and diminished

by 354,000 for 2024 and 2025, respectively. Within the excessive

near-term, manufacturing is supported by a bolstered scrappage

incentive program, which additionally ends in one thing of a pay-back

impact after 2024. The forecast continues to mirror some unfavourable

affect to manufacturing from European tariff actions; nonetheless, we

anticipate export exercise to stay fairly sturdy as markets await

Chinese language localization efforts to extra totally ramp-up.

Japan/Korea: Full-year 2024 Japan manufacturing

was downgraded modestly by 11,000 items relative to final month’s

forecast. The downward revision is primarily related to

Daihatsu as the corporate is predicted to face manufacturing impacts

later this yr associated to compliance with new laws. South

Korea manufacturing was upgraded to 4.11 million items in 2025 and

3.91 million items in 2026 as a result of elevated demand for the Renault

Arkana.

North America: The outlook for North America

mild car manufacturing was diminished by 173,000 items and by

102,000 items for 2024 and 2025, respectively. These reductions are

primarily as a result of inventory-related reductions and manufacturing points

at Toyota. Manufacturing at Toyota’s Princetown West plant stays

idled as a result of a latest airbag recall, leading to a lack of

further items.

South America: The outlook for South America

mild car manufacturing was diminished by 2,000 items and by 1,000

items for 2024 and 2025, respectively. Within the excessive near-term,

the outlook for the area stays largely in-line with

expectations as stronger manufacturing actuals for Brazil offset

lingering weak spot in Argentina.

South Asia: The outlook for South Asia mild

car manufacturing was diminished by 11,000 items and by 56,000 items

for 2024 and 2025, respectively. South Asia’s mild car

manufacturing forecast for 2024 was largely unchanged with the August

replace, with solely a minor downward adjustment for the ASEAN market

as a result of stricter auto mortgage approvals amidst a difficult market

setting. The weak spot in ASEAN continues to be primarily

centered on Thailand and Indonesia.

Obtain a free mild car

manufacturing forecast pattern

This text was revealed by S&P International Mobility and never by S&P International Rankings, which is a individually managed division of S&P International.

[ad_2]