Regardless of infrastructure and manufacturing challenges that would

mood the tempo of electrical automobile (EV) adoption, India’s giant

home market, low present EV penetration charges, and growing

manufacturing capability make it a horny vacation spot for

automakers and suppliers.

If Tata Motors’ and Mahindra’s success in navigating the

pandemic and semiconductor shortages are any indication, India is

anticipated to turn out to be a serious participant in international gentle automobile

manufacturing. Moreover, with international provide chain disruptions and

the return of protectionism, India’s place as an export base for

mature markets is turning into more and more viable.

Bridging Gaps In World Provide Chain

Supply: S&P World Mobility Mild

Supply: S&P World Mobility Mild

Car Manufacturing Forecast

India’s Resilient Automotive Sector

Whereas main markets like mainland China, the USA, and

Germany grappled with manufacturing setbacks throughout disruptions brought about

by COVID-19 and semiconductor shortages, India’s automotive sector

confirmed resilience. Indian OEMs demonstrated a stronger functionality

to safe semiconductor provides regardless of having decrease buying

energy in comparison with international automobile producers and providing fewer

options of their autos.

India’s excessive GDP development fee, which is additional projected to

stay over 6% between 2026 and 2031, considerably larger than the

international common of two.7%. India’s home market is a major

draw for international automakers. Because the third largest market in gentle

automobile gross sales and the 4th largest in gentle automobile manufacturing,

India’s low automobile penetration fee of simply 38 autos per 1,000

individuals presents a large development alternative. In line with S&P World Mobility Mild

Car Manufacturing Forecasts, manufacturing capability is predicted

to rise from 6.8 million items in 2023 to 10 million by 2031,

additional solidifying India’s position within the international automotive

panorama.

Concurrently, the US and EU’s elevated tariffs on Chinese language EVs

have created a void that India is well-positioned to fill. With its

secure provide chain, gentle automobile manufacturing development in India is

anticipated to keep up a gradual tempo. S&P World Mobility

initiatives a development fee of 4 p.c for 2024, with longer-term

expectations of development stabilizing between 4% and 6% yearly

via 2031.

A major driver of this development is the anticipated improve

in exports from main producers like Maruti Suzuki and Hyundai

which can profit from the rising demand for reasonably priced autos

in rising markets.

Suzuki, for instance, goals to ramp up manufacturing to 4 million

items by 2031, with a deal with hybrids and EVs.

XEV Transformation: India

Information compiled: eighth July 2024.

Supply: S&P World Mobility.

XEVs = Gentle Hybrid electrical automobile (MHEV)+ Hybrid

electrical automobile(HEV)+Plug in Hybrid automobile (PHEV)+Vary extender

electrical automobile (REX)+Battery Electrical Car (BEV)

Transition to Clear Applied sciences

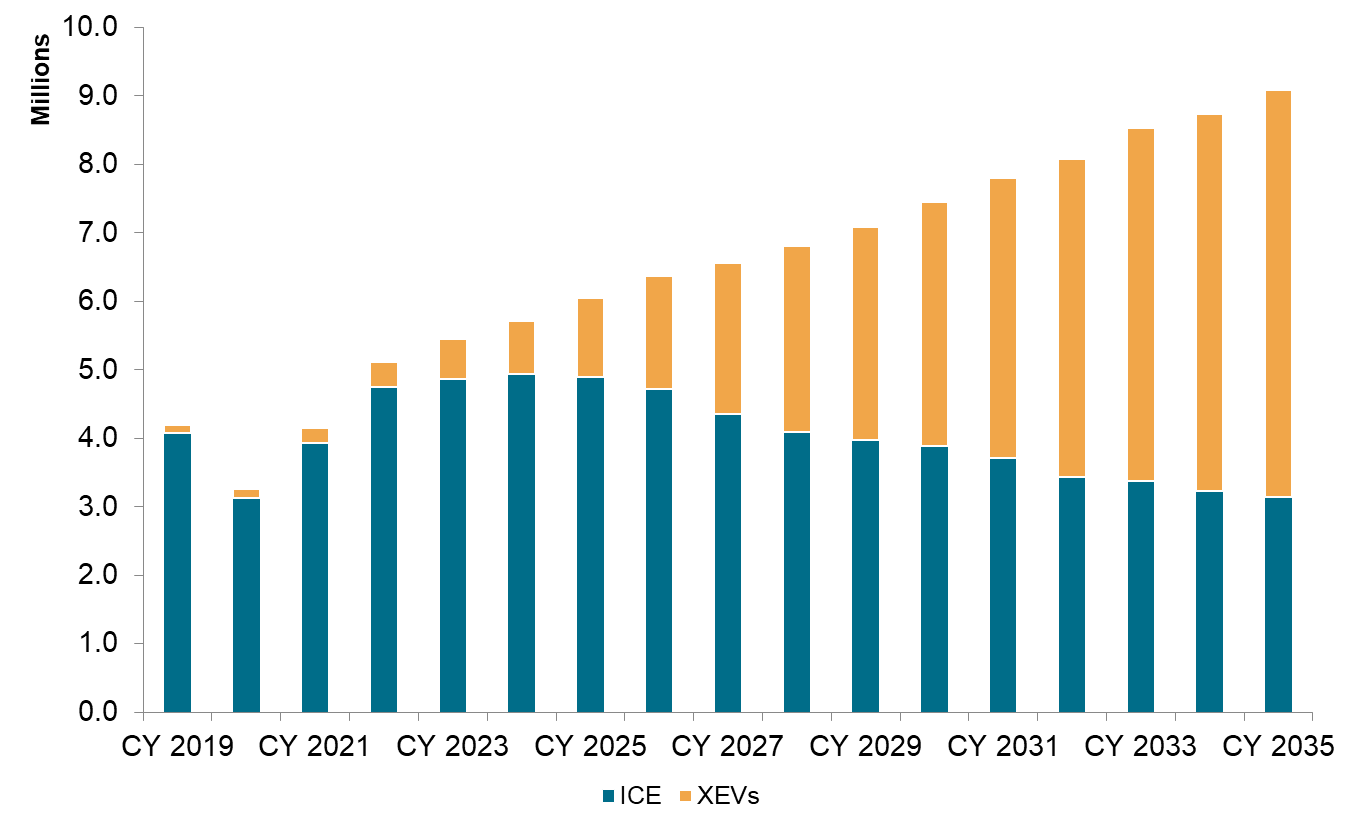

India’s automotive panorama can also be shifting in direction of EVs. The

share of inner combustion engine (ICE) autos produced in

India is projected to lower dramatically, from 97% in 2019 to

round 35% by 2035. The implementation of stricter emission

requirements just like the Bharat Stage 6 (BS6) and upcoming BS 7 norms

have pushed producers to innovate and transition in direction of

cleaner applied sciences.

The market can also be witnessing a corresponding rise within the

adoption of low emission autos like XEVs. Demand for hybrid

electrical autos (HEVs) and battery electrical autos (BEVs) is

anticipated to develop considerably, with a notable improve in hybrid,

vary extender autos and plug-in hybrid autos within the quick

time period.

Nevertheless, the present state of infrastructure, significantly the

availability of charging stations and the general EV ecosystem in

India might mood the tempo of EV adoption. Customers and

automakers are nonetheless considerably cautious within the present EV panorama.

There’s a famous delay in adopting new fashions and platforms because of

uncertainty surrounding regulatory circumstances, just like the

aforementioned BS7 emission norms.

Excessive prices related to early-stage EV manufacturing have

additionally led to rising automobile costs, elevating issues about

affordability amongst first-time patrons. The rise in reductions

for ICE autos amid client trepidation and excessive stock

ranges might additional gradual the speed of adoption within the speedy

future.

Even with these mid-term pressures, the pattern is unmistakable.

Car producers in India are more and more adopting

multi-energy platforms that may help each inner combustion

engine (ICE) autos and EVs. Over the following few years, these

platforms are anticipated to extend available in the market, setting the stage

for the eventual rise of devoted EV platforms. Total, the

long-term outlook for EVs in India is optimistic. As infrastructure

improves and client issues are addressed, EV adoption is probably going

to speed up, in line with S&P World Mobility forecasts.

Because the automotive business is within the midst of a technological

revolution, there may be additionally a heightened emphasis on provide chain

administration. Improvements like ADAS (Superior Driver Help

Programs), software-defined autos, and AI (Synthetic

Intelligence) have gotten customary options, which require OEMs to

combine these parts into their provide chain.

This text is a part of a sequence that includes highlights from

S&P World Mobility’s 2024 Options Webinar Collection. The

webinar, India’s Mild Car Manufacturing Outlook and Tata Motors’

Provide Chain Resiliance, occurred on July 16, 2024.

This text was revealed by S&P World Mobility and never by S&P World Rankings, which is a individually managed division of S&P World.