[ad_1]

Canadian new-vehicle consumers have been extra readily adopting

battery electrical autos (BEV) and plug-in hybrid electrical

autos (PHEV) than US consumers.

Although it has been effectively reported that consumers in Europe and China

have adopted BEVs extra rapidly than US consumers, the identical is true

when wanting on the US versus Canada. In Canada, the presence of

provincial incentives in Quebec and British Columbia appear to be

contributing to general Canadian electrification adoption, but additionally

to the illustration of BEVs in these two provinces. Within the US,

with its 50 states and extra advanced market, state-level incentives

appear to have much less impression on the geographic distribution of BEV

registrations.

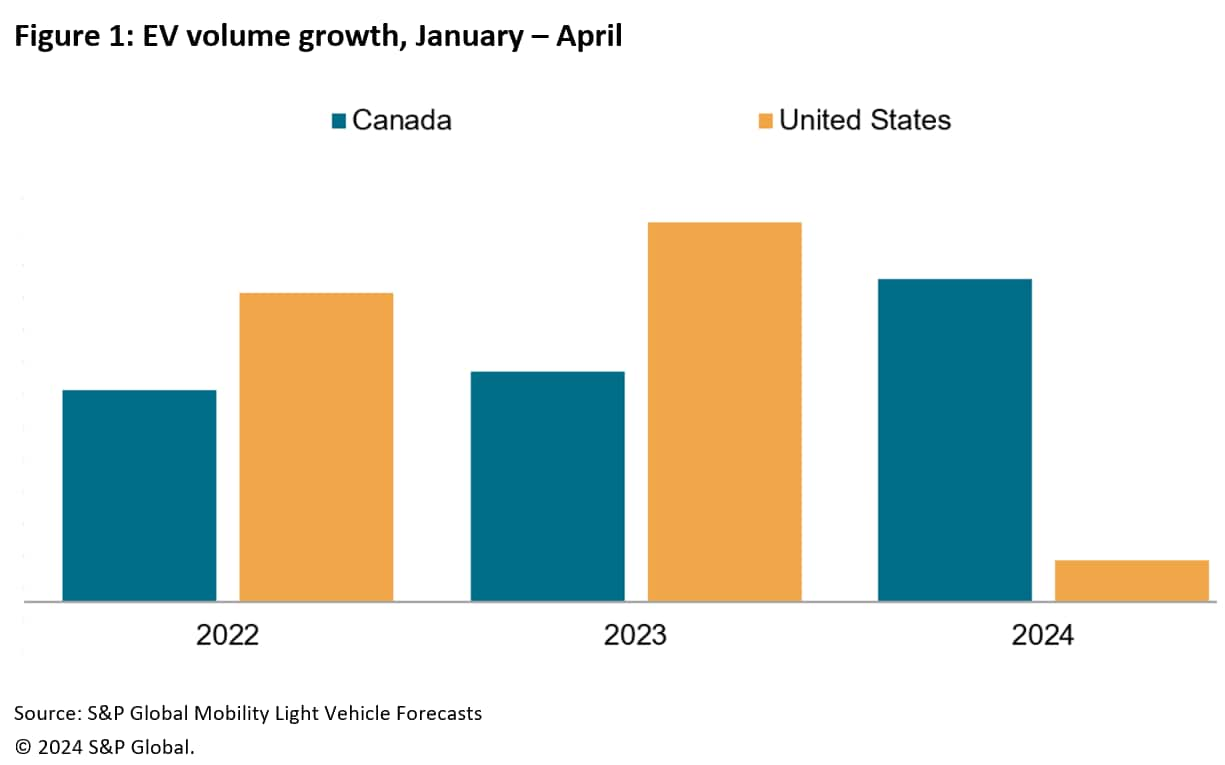

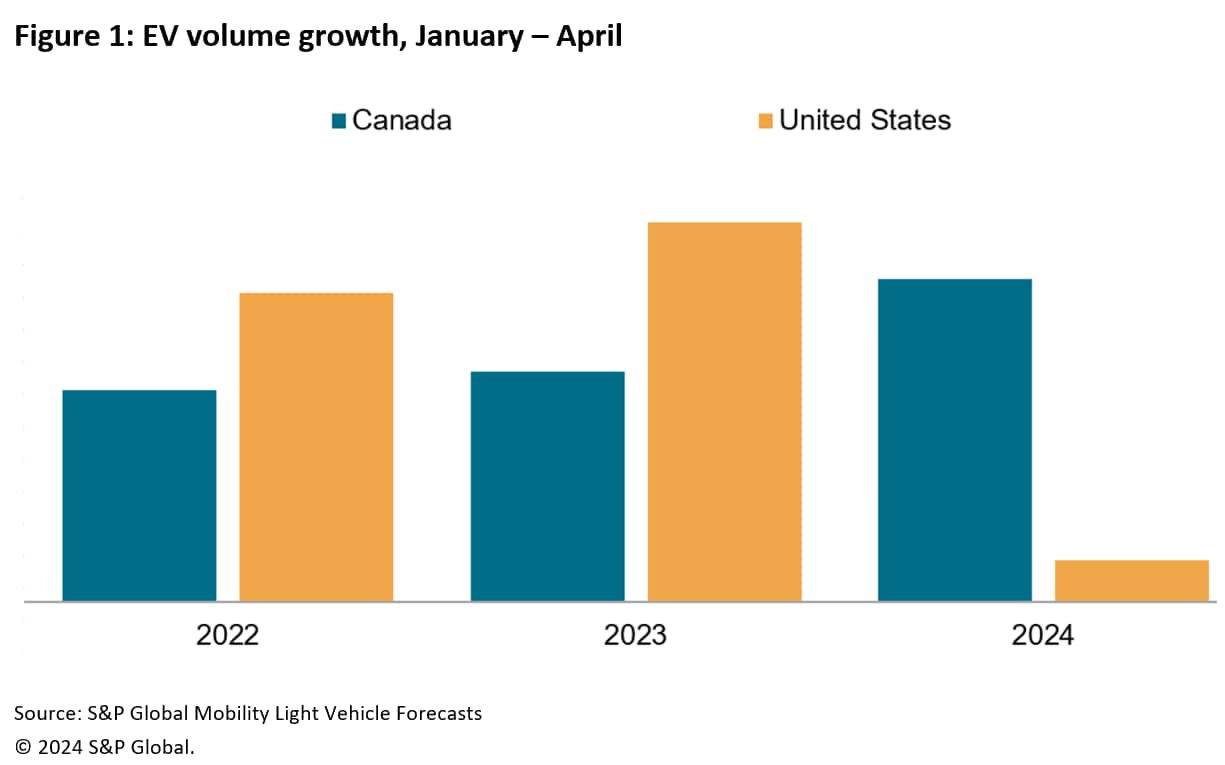

We now have taken a dive into the registration information in Canada and

the US from January via April 2024, evaluating it towards the

similar intervals of 2021 via 2023, to discover variations between

the 2 markets. In each nations, each BEV and PHEV share

continues to develop and the amount of registrations grows.

Nonetheless, within the US development is occurring extra slowly than in

current years. In Canada, BEV registrations improved 57% from 2023

to 2024, bringing share up as effectively. In Canada, PHEV registrations

elevated 75% over the primary 4 months of 2024. Within the US, BEV

market share and quantity development have each slowed. The US noticed about

25,000 extra BEVs registered in January to April 2024 than the identical

interval of 2023; quantity elevated about 137,000 models within the January

to April 2023 interval in contrast with 2022.

Canadian provincial incentives might cut back BEV value

by CA$12,000

Canada's general automobile market is notably smaller than the US

market, however broader software of the Canadian nationwide zero

emissions automobile (ZEV) rebates—in addition to Canada's determination to

work towards a ban on ICE autos by 2035—are serving to assist

sooner adoption. Canadian provinces Quebec and British Colombia

each provide incentives on prime of the nationwide authorities program and

these provinces see above-industry BEV penetration charges.

Canada's nationwide Incentive for Zero-Emission Automobiles (iZEV)

sees some EVs eligible for as much as CA$5,000 rebate at level of sale

for a purchase order or a lease of greater than 12 months (although the quantity

is prorated and primarily based on the lease time period). As with the US, the record

of autos that are eligible adjustments. Canada's nationwide program

has electrical vary necessities (which impacts PHEV eligibility) as

effectively as automobile value restrictions.

Quebec's program is extra clear and has fewer restrictions;

as a substitute of calling it a rebate, it’s referred to as a monetary help

program. In 2024, as much as CA$7,000 will be utilized to buy or

lease of a BEV or CA$5,000 for a PHEV. It has no revenue

restrictions however does have pricing restrictions and is being phased

out.

Among the many causes Quebec has been aggressive on the BEV entrance is

that the province will get a considerable quantity of its electrical energy from

hydropower and may assist BEVs with renewable vitality. In Quebec,

help drops in 2025 and 2026, and in 2027 is phased out

utterly. In British Columbia rebates rely upon the customer's

revenue in addition to automobile value and kind, with as much as CA$4,000 for

BEV or extended-range EV and as much as CA$2,000 for PHEVs. The province

of Ontario, nevertheless, has resisted providing any incentive; residents

there can solely entry the nationwide plan.

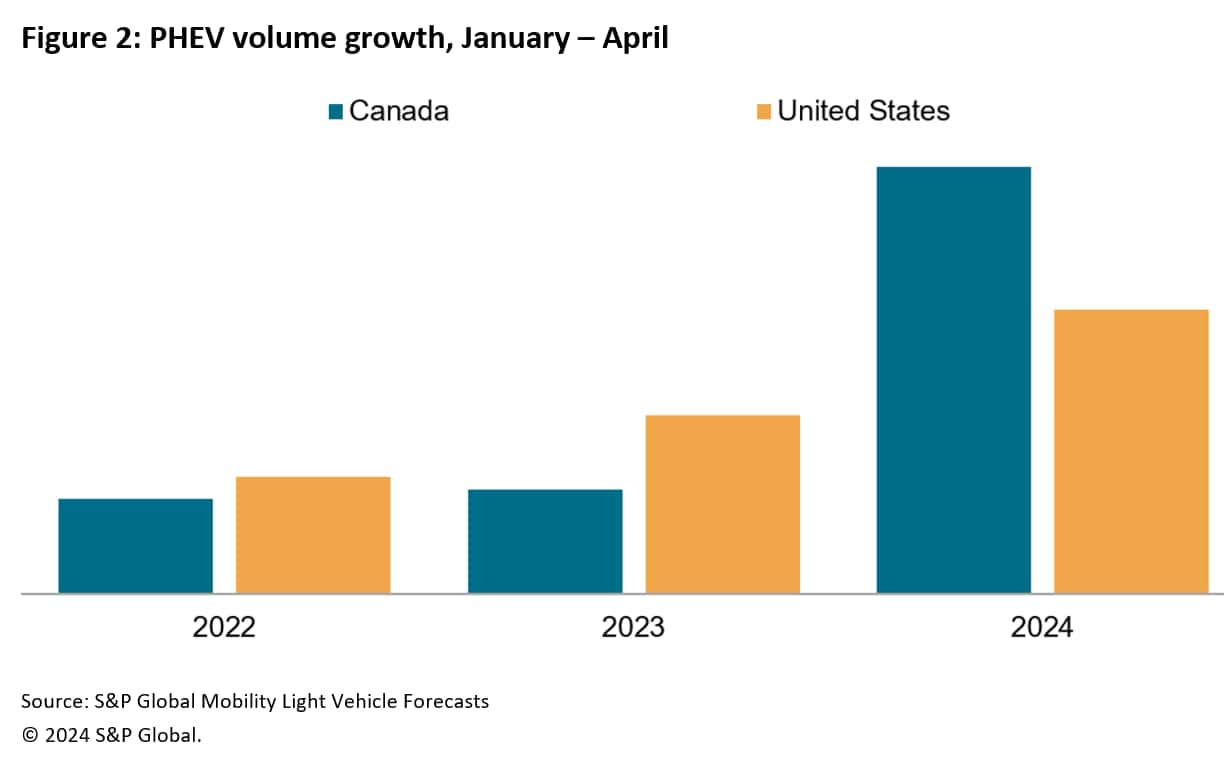

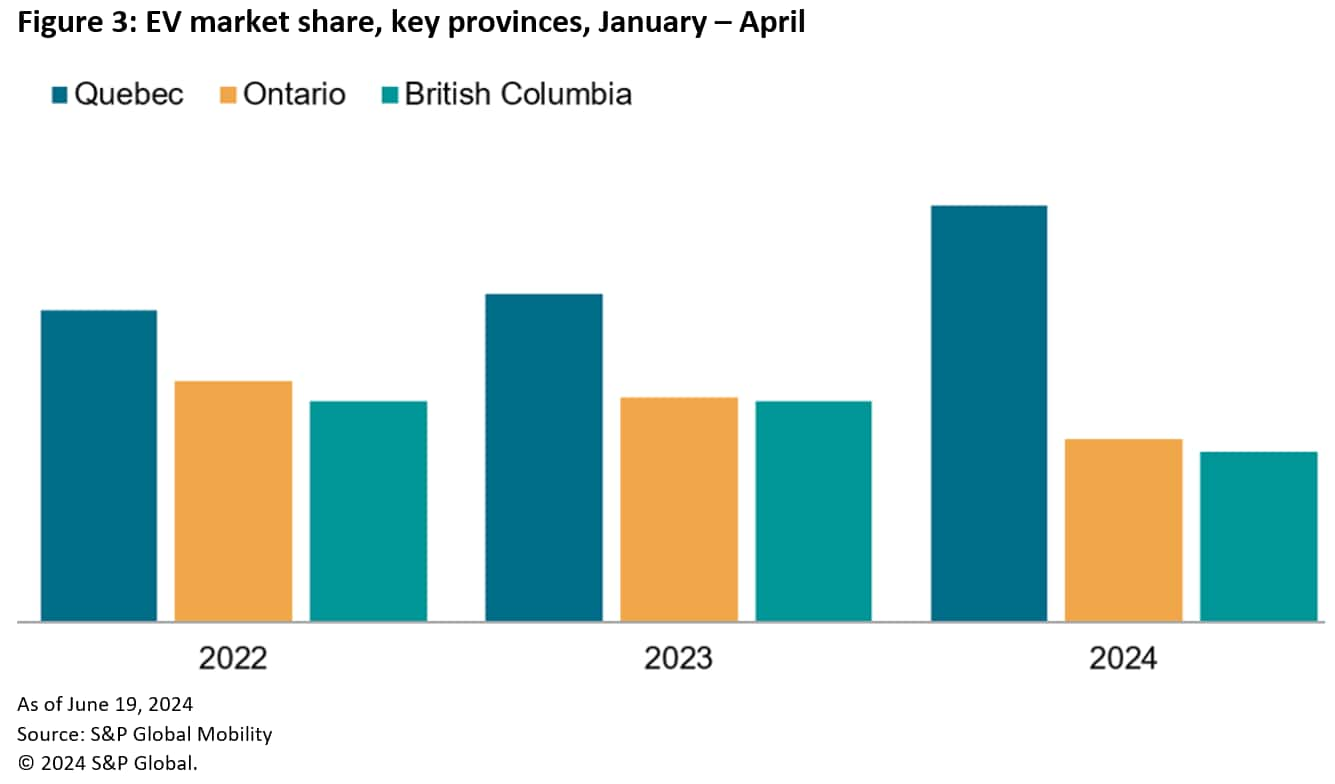

Canada's nationwide program and a nationwide coverage extra

constantly supportive of BEVs contribute to BEV and PHEV

adoption. Nonetheless, the provincial-level incentives appear to drive

regional adoption, with Quebec constantly accounting for many EV

registrations in Canada. By way of April 2024, Quebec registrations

accounted for 50.6% of Canadian BEV registrations; British Columbia

counted for 20.6% and Ontario captured 22.5%.

Quebec and British Columbia account for extra BEV registrations

than their pure registration distribution throughout the nation. In

general automobile registrations, Ontario accounts for about 39% of

automobile registrations, adopted by Quebec at about 24%, Alberta at

12%, and British Columbia, which is narrowly behind Alberta at

11.6%. If BEV adoption in Canada mirrored general automobile

registrations, Ontario would additionally lead BEV registrations and be

considerably forward of Quebec and British Columbia.

As a substitute, Quebec has held a number one place, adopted by Ontario

and British Columbia. There may be additionally proof of some change right here as

effectively, with Quebec's share of Canadian EV registrations taking a

vital bounce the primary 4 months of 2024.

Nonetheless, when registrations inside every province, in

Ontario BEVs make up barely 5% of registrations within the province

from January via April 2024, in contrast with the nationwide BEV

share at 8.5%. In British Columbia, BEVs accounted for almost 15%

of auto registrations. In Quebec, BEVs accounted for 18% of

automobile registrations. BEVs are overrepresented in Quebec, which

has the best BEV rebate logistically. In Alberta, there are

additionally no extra incentives, and BEV share there was 2.1%.

Presently, shopping for a BEV in British Columbia or Quebec has

potential for CA$9,000 in whole incentives. The adoption of BEVs is

in Quebec is definitely the strongest in Canada. And in these two

provinces, BEV share is much above the nationwide common. In

high-volume provinces the place there isn’t a added incentive, BEV share

is decrease than the nationwide common. The provincial BEV incentive

applications are contributing to Quebec and British Columbia capturing

extra BEV share than bigger new-vehicle markets in addition to being

effectively forward of nationwide BEV penetration.

State-level incentives have blended impression in

US

Within the US, BEV registrations are nonetheless extremely concentrated in

the state of California. Like Quebec, California over indexes in

BEV registrations past what will be defined just by its

state-level incentives. Within the US, the states which supply

incentives even have extra assorted applications, which presumably creates

extra variability in impression of state-level applications within the US.

California has additionally led with extra strict automobile emission guidelines

for many years, it has sometimes been a pattern setting, early adopter

state inside and out of doors the auto {industry} in addition to usually being a

digital know-how chief and embraced Telsa in a short time. Within the

January via April interval, California accounted for 34% of US

BEV registrations; the state's dominance of the BEV market is

assisted by state-level incentives. It was adopted by Florida,

nevertheless, with 8% and no state-level incentives. Texas is third,

with 7% of US BEV registrations and a extra modest US$2,500

incentive.

There are a complete of 15 states within the US providing some stage of

incentive on prime of federal incentives, however BEV distribution within the

US does nonetheless usually see the very best quantity states in general

registrations additionally being the highest BEV states. Inside California

registrations, BEVs account for 21.4% of the entire autos

registered, additionally far above the national-level BEV market share of

about 7%. BEVs accounted for six.6% of whole Florida automobile

registrations, near the nationwide determine, whereas in Texas, BEVs

are at 5.2% of auto registrations to date in 2024.

The motivation in Texas, a extra modest quantity than California

gives, has not pulled the BEV share in Texas above the nationwide

common. No different US state accounts for greater than 4.5% of BEV

registrations, whatever the measurement of any incentive.

Get a free trial of AutoIntelligence Each day.

[ad_2]