This content material can be obtainable

on our LinkedIn publication.

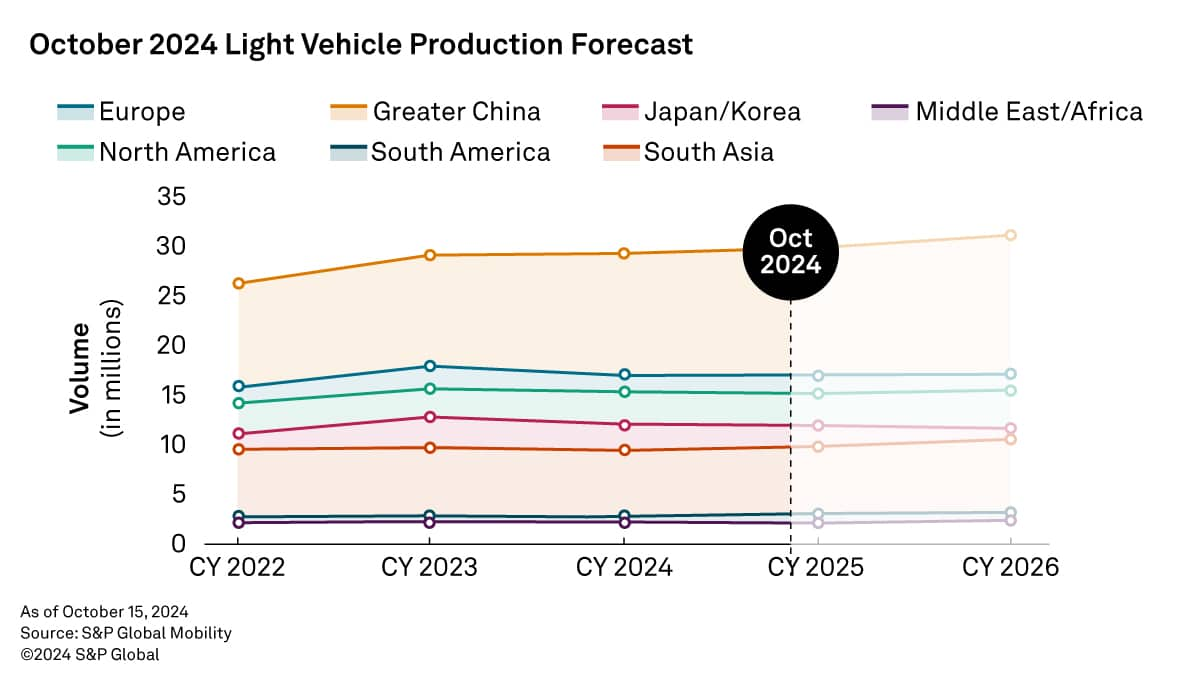

Every month, we leverage world mild car manufacturing actuals,

registration information, and gross sales information to provide the most recent,

short-term manufacturing forecast obtainable.

Here is a detailed have a look at world manufacturing information by area and our

up to date October manufacturing forecast.

As we enter the fourth quarter of 2024, slower development in

important areas and uncertainties surrounding battery electrical

car (BEV) adoption proceed to problem the manufacturing

outlook. This month’s forecast notably revises Europe downward due

to diminished demand and mandated fleet emissions necessities, whereas

Larger China sees a modest enchancment due to authorities

stimulus.

Europe: The European mild car manufacturing

outlook was diminished by 107,000 items for 2024 and 292,000 items for

2025, pushed by weakening demand in Central and Western Europe. An

EU discount mandate of 15% for fleet emissions in 2025 will

stress OEMs to handle provide to the market successfully. In

distinction, Jap Europe sees a rise of 35,000 items for 2025,

supported by Russian demand.

Larger China: In Larger China, our mild

car manufacturing outlook was elevated by 73,000 items for 2024

however decreased by 42,000 items for 2025. NEVs are the first development

driver, persevering with their robust momentum with 1.1 million retail

items bought in September. A elementary consumption restoration is just not

anticipated this yr, even because the scrapping coverage offers modest

help.

Japan/Korea: The Japan mild car manufacturing

outlook was upgraded by 22,000 items for 2025 and 128,000 items for

2026, with a key driver being a change in sourcing for the Nissan

Leaf North America, from the UK to Japan. South Korea’s manufacturing

outlook was diminished by 9,000 items for 2024 and 16,000 items for

2025, reflecting slower gross sales in Europe.

North America: The North American mild car

manufacturing outlook was decreased by 12,000 items for 2024 and

113,000 items for 2025, with the revisions for subsequent yr pushed by

quite a lot of car program delays. Stock administration efforts,

significantly for the Detroit 3, proceed to affect the near-term

manufacturing outlook for the area.

South America: South America’s mild car

manufacturing outlook was elevated by 36,000 items for 2024 and

35,000 items for 2025, pushed by stronger gross sales in Brazil and

usually improved demand expectations for Argentina.

South Asia: The South Asia mild car

manufacturing outlook was elevated by 25,000 items for 2024 however

diminished by 73,000 items for 2025. The ASEAN market exhibits stronger

current manufacturing exercise, whereas India’s manufacturing outlook has

been meaningfully revised down for 2025 and past, because of financial

challenges and excessive stock ranges.

Obtain a free mild car manufacturing forecast pattern

right here.

This text was revealed by S&P World Mobility and never by S&P World Scores, which is a individually managed division of S&P World.