By Tom Libby, Affiliate Director, Business Evaluation and Loyalty

Options and Cecilia Simon, Guide

S&P World Mobility evaluation finds some stunning tendencies

amongst car registrations for ultra-wealthy households.

Extremely-wealthy households within the US aren’t shopping for the varieties of

vehicles you would possibly anticipate.

As a substitute of pricey automobiles like Lamborghinis and Rolls

Royces, the preferred automobile acquired by these households within the

previous six months has an MSRP beneath $48,000. Additional, some of the

in style segments is a mainstream phase.

These are two of the findings rising from a evaluation of the

S&P World Mobility buy habits and demographic information of

the highest tier of US households. Our evaluation mixed revenue information

from the Census with car registration and loyalty information from

S&P World Mobility. This allowed researchers to categorize

family incomes into tiers and apply these insights at numerous

geographic ranges, together with zip codes.

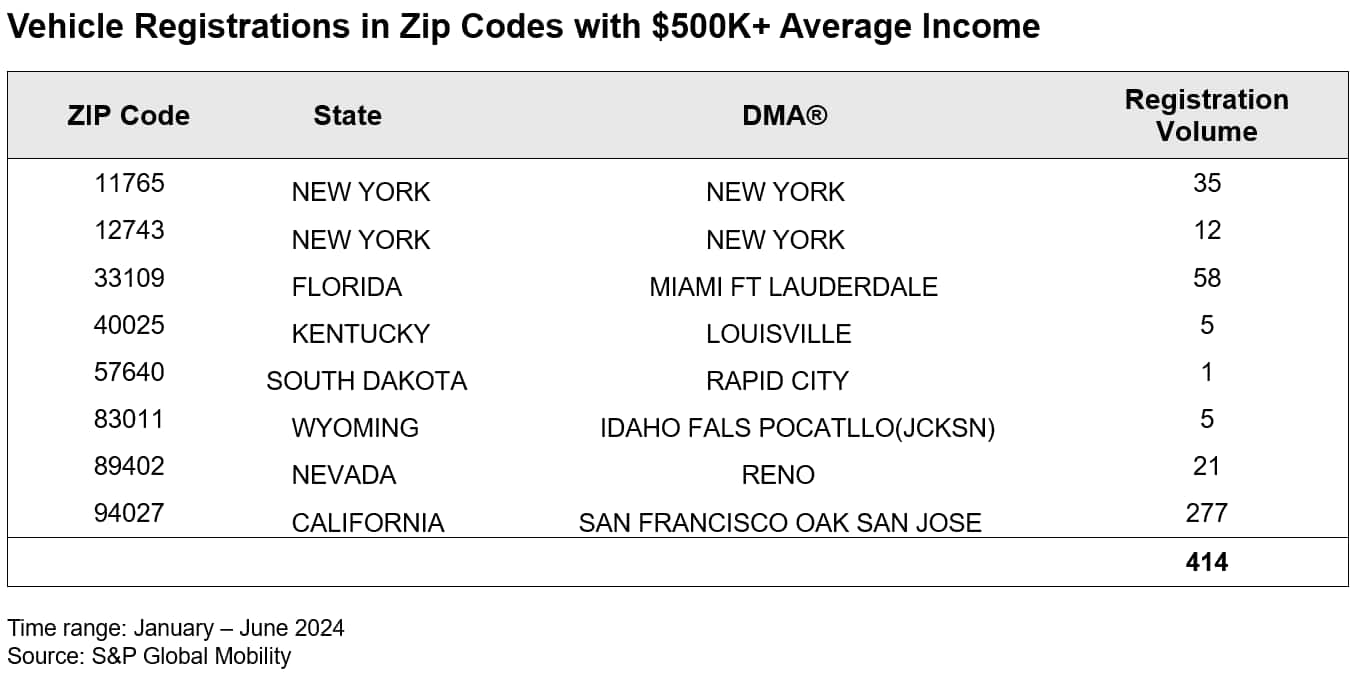

There are 9 zip codes within the US with a mean family

revenue within the prime tier, $500,000 and extra. There have been 414 retail

registrations in these zip codes (one zip code didn’t have any

registrations) within the first six months of 2024.

On the state degree, California, Florida and New York account for

92% of those rich households, with Nevada, Wyoming, Kentucky,

and South Dakota making up the remaining 8%. The three main

states’ excessive ultra-wealthy family mixes are pushed by sturdy

illustration within the New York Metropolis, San Francisco, and Miami/Ft.

Lauderdale DMAs.

Well-liked Car Manufacturers Amongst Excessive-Earnings

Households

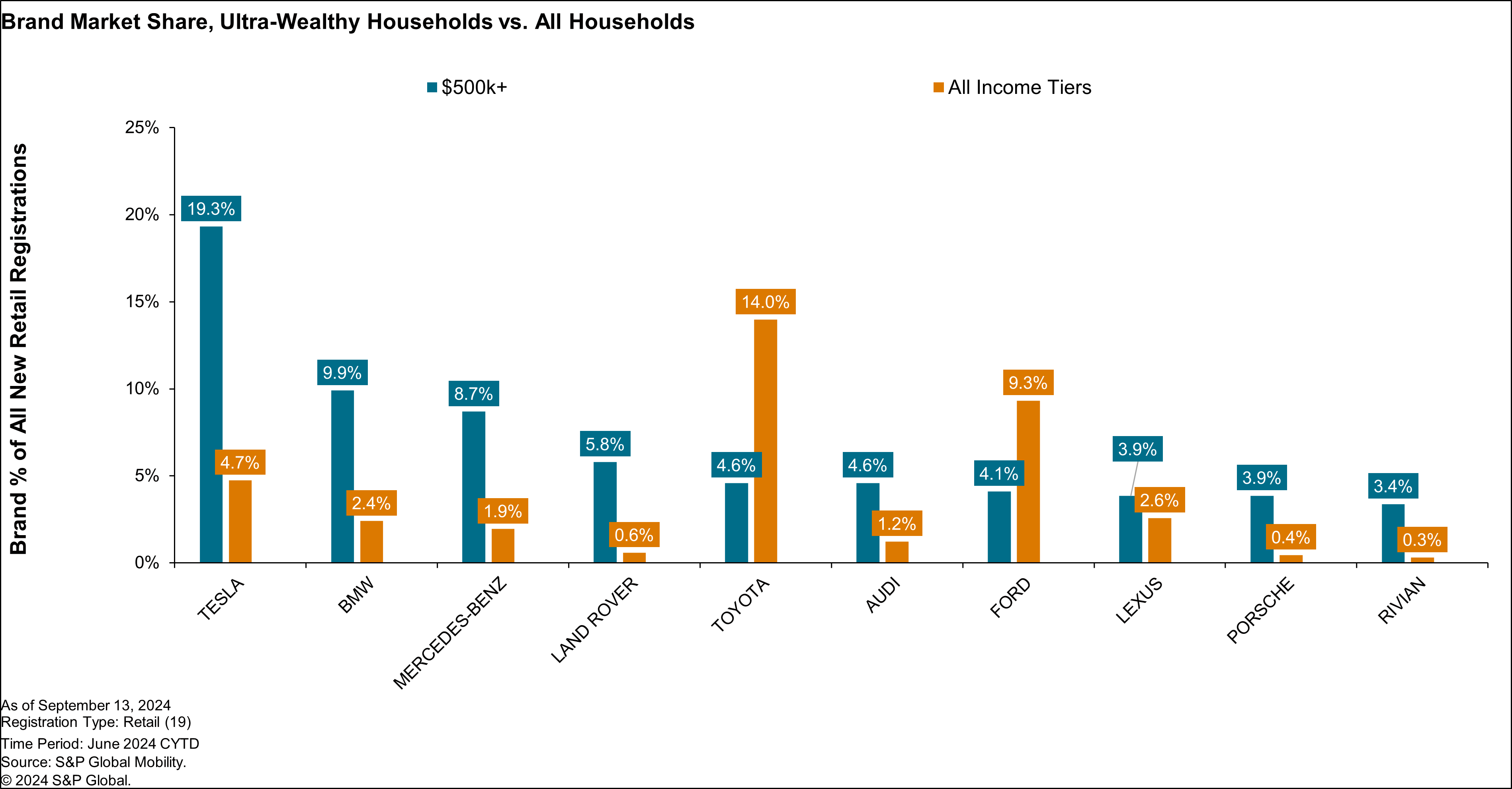

As one would anticipate, these households favor luxurious automobiles, however

not completely. Tesla registrations accounted for nearly considered one of

each 5 new registrations whereas BMWs comprised virtually considered one of

each ten. The following 4 manufacturers interesting to those households

embody Mercedes-Benz, Land Rover, Audi, and the mainstream model

Toyota. These six manufacturers by themselves captured greater than half

(53%) of all new registrations linked to those high-end households.

The unique model most often acquired by these clients is

Ferrari, which ranked #20 throughout all manufacturers.

Whereas these unique households have acquired unique, luxurious,

and mainstream automobiles, luxurious fashions dominate with 85% of all

acquisitions, with mainstream fashions comprising 11% and exotics

simply 4%. The six hottest fashions embody three Teslas and one

every from BMW, Rivian and Land Rover. The most well-liked mannequin throughout

all classes is the Tesla Mannequin Y, with a base MSRP of $47,988.

(Tied for #7 amongst all fashions is the Tesla Cybertruck.)

Luxurious vs. Mainstream Section Buying

Conduct

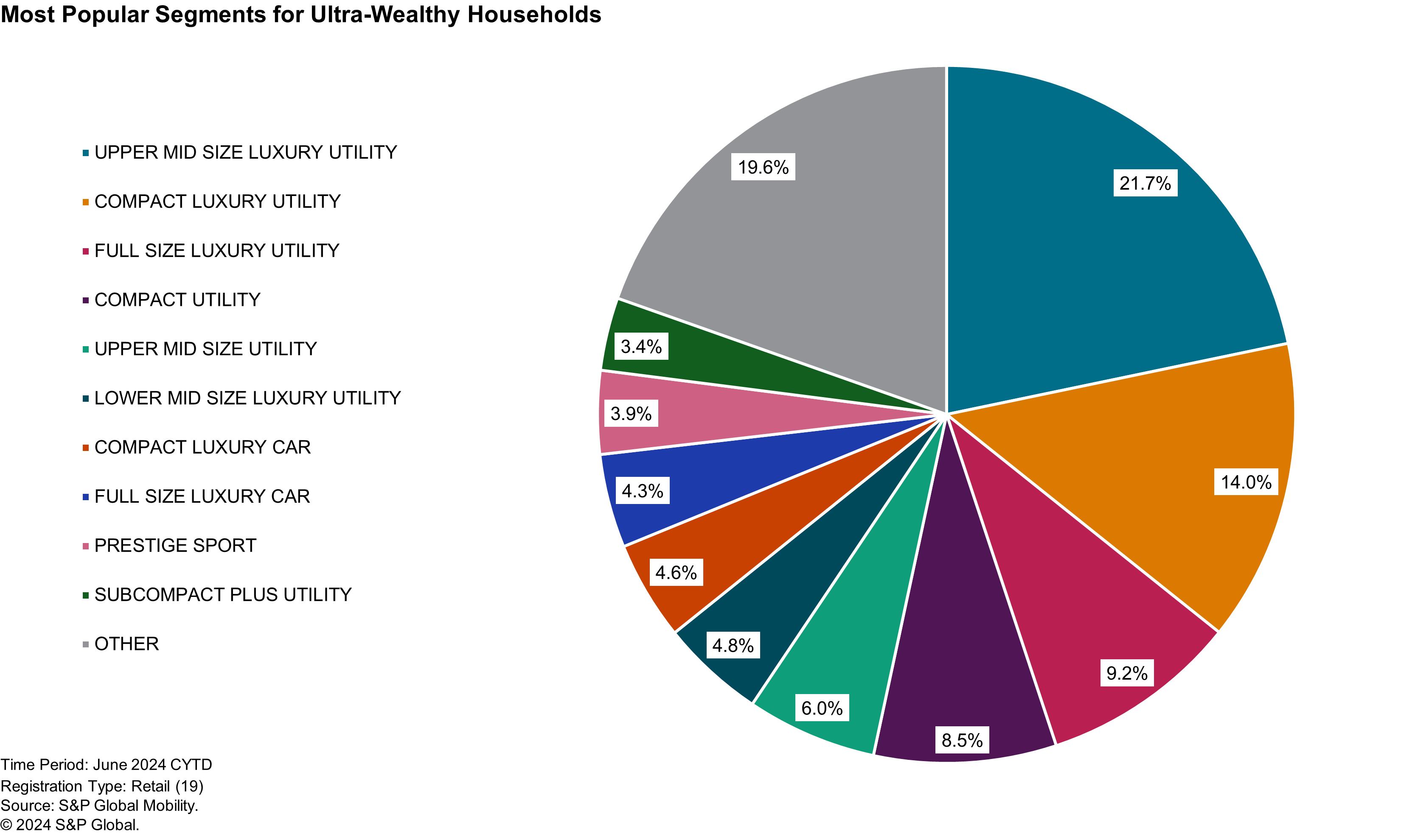

On the phase degree, new car registrations amongst this

demographic are understandably skewed closely in the direction of the luxurious

market: 71.5% of their registrations fall within the luxurious area.

Nonetheless, two of the 5 hottest segments — and three of

the highest ten — are mainstream segments, together with the Compact

Utility, Higher Mid-Measurement Utility, and Subcompact Utility Plus.

Not coincidentally, these are the three largest segments within the

{industry}, with the Compact Utility Section by itself accounting for

20% of the brand new car market. This enormous class contains compact

crossovers marketed by each mainstream model within the {industry},

together with manufacturers inside the identical umbrella company as quite a few

luxurious manufacturers.

Model and Gasoline Kind Loyalty

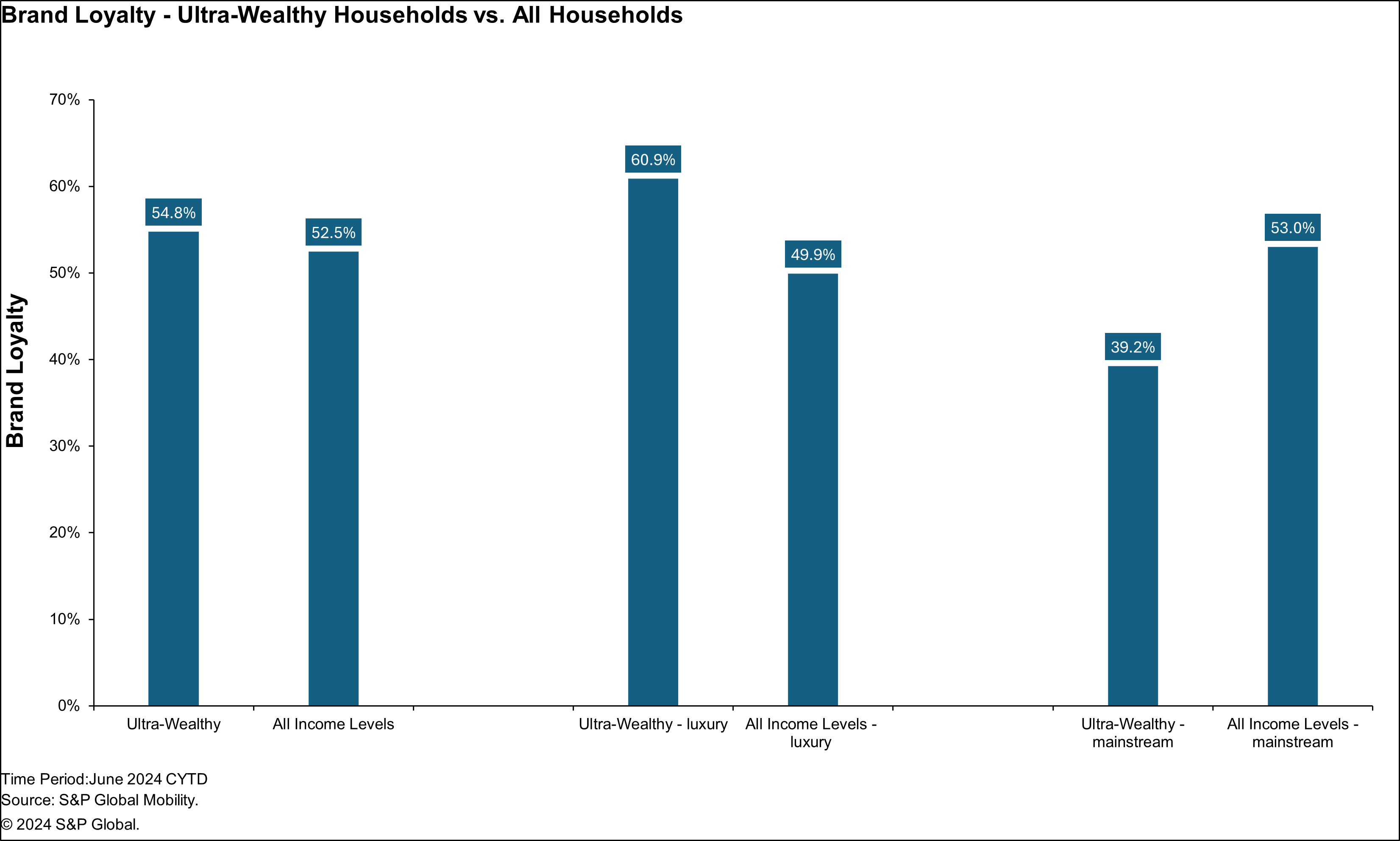

In mixture, this demographic is barely extra model loyal,

with 54.8% loyalty versus 52.5% industrywide as of June 2024.

Households with a luxurious car within the storage are considerably

extra model loyal (60.9%) than your complete {industry} (49.9%), with the

former pulled up by robust Tesla illustration (Tesla model

loyalty constantly leads the {industry} by a considerable

margin).

Conversely, model loyalty of these high-income households with a

mainstream car within the storage is simply 39.2%, far beneath the 53%

for all households with a mainstream car within the storage.

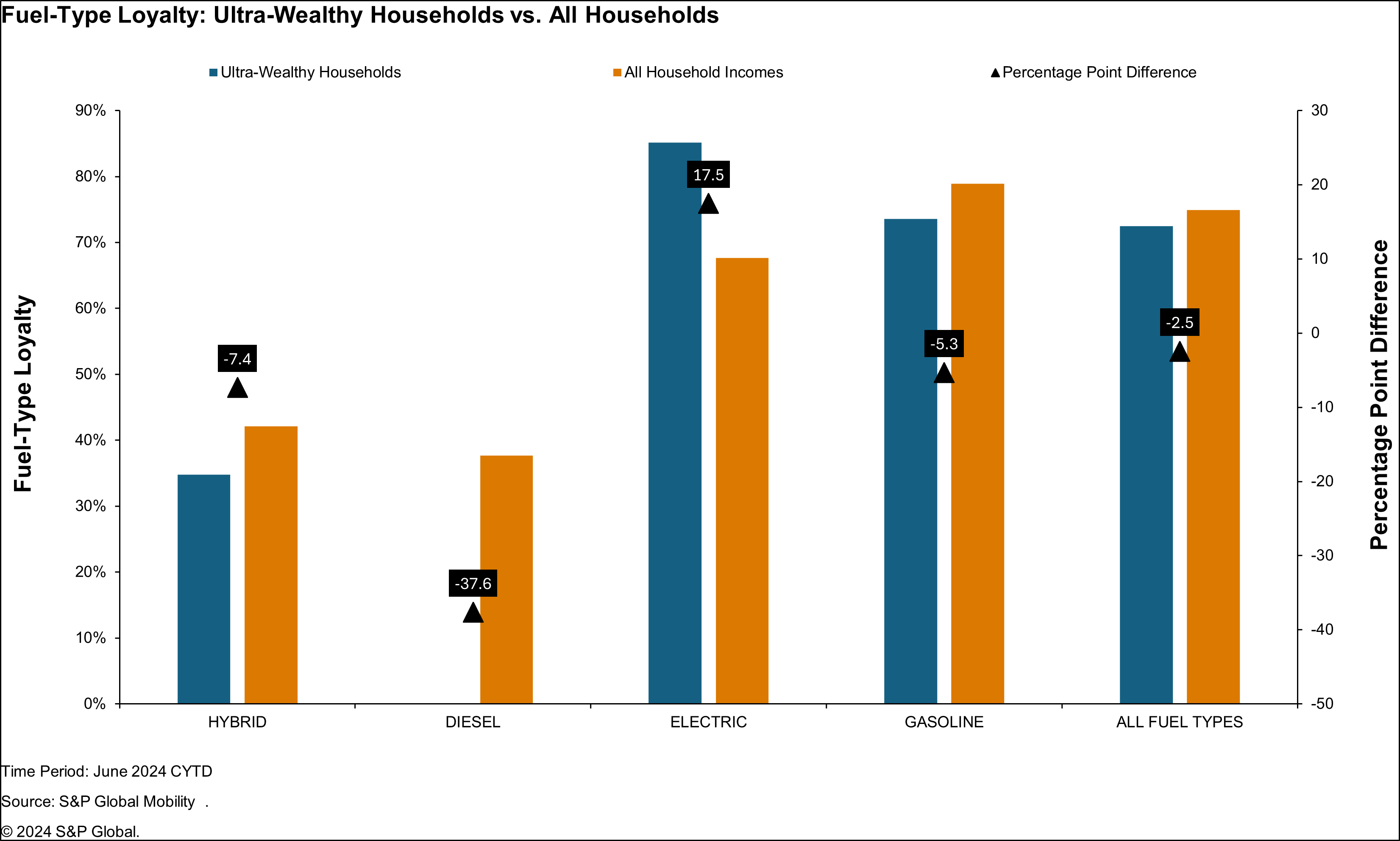

gasoline kind loyalty, these high-end households are much less

seemingly to stick with a hybrid car than the remainder of {industry}

(34.8% vs. 42.1%), however more likely to remain loyal to their

electrical car (85.1% vs. 67.7%). This exceptionally excessive EV gasoline

kind loyalty is probably due partially to those households’ robust

monetary positions which get rid of the problem of EV worth

premiums.

Ethnic Composition of Extremely-Rich

Households

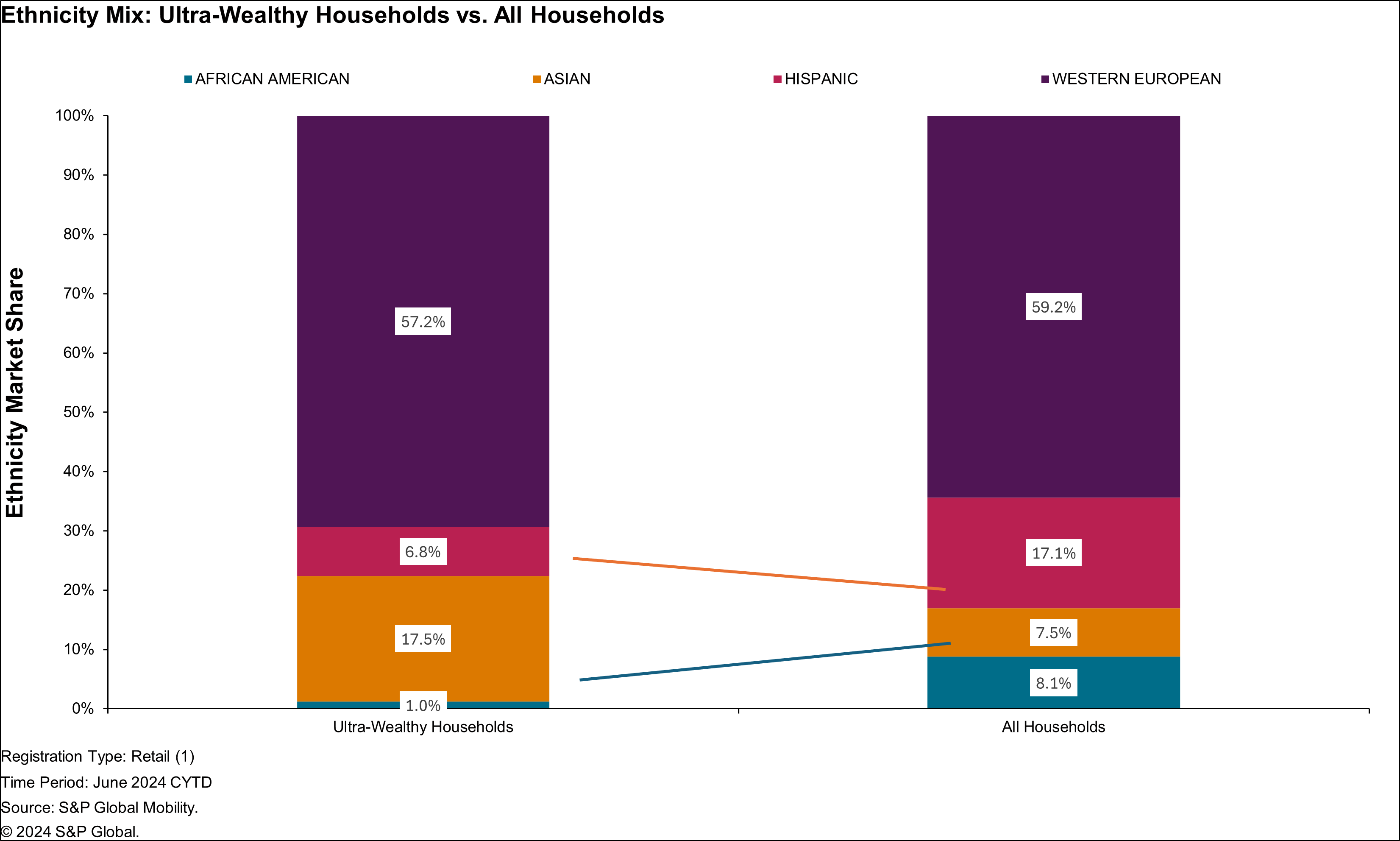

Lastly, the ethnic composition of this high-end cohort contains

Asian households at 17.5%, greater than twice the nationwide common,

whereas each African American (1%) and Hispanic (6.8%) households

path nationwide averages by substantial margins. The excessive Asian

share may be attributed no less than partially to the excessive Tesla combine,

given Tesla’s terribly excessive Asian combine within the first six

months of this yr (28%).

Conclusion

In abstract, a number of of the findings from this evaluation are

intuitive, however not all. That these high-income households are inclined to

be clustered in California, New York and Florida is sensible. And,

clearly the New York, San Francisco and Miami DMA tendencies drive

the state outcomes, although Los Angeles would even be a pure match.

Additional, these ultra-wealthy households could not need to be bothered

with the brand new car acquisition course of, main them to easily

“get one other one” of no matter is within the storage, driving up luxurious

model loyalty. Lastly, one of many foremost obstacles to EV adoption –

premiums versus same-size ICE automobiles – merely doesn’t exist for

these households, resulting in their exceptionally excessive EV

loyalty.

Then again, some findings that don’t essentially match

with one’s perceptions of this cohort embody the low mixture of unique

automobiles and the comparatively robust displaying for Toyota. And if one

have been requested to guess which mannequin industry-wide is the preferred

with this unique cohort, the Mannequin Y might not be on the prime of

the record. Additional, despite the fact that its automobiles are in all places, the

Compact Utility Section doesn’t instantly come to thoughts in

discussions in regards to the ultra-wealthy.

Lurking within the background of this whole evaluation is Tesla. Three

of the 4 hottest fashions for these ultra-wealthy households

are Teslas; the #1 DMA is San Francisco, Tesla’s former base;

Tesla’s share of this cohort is a strong 19.3% versus 4.7%

nationally; these high-end houses are exceptionally model loyal

(85.1%) when a luxurious car is within the storage, pushed no less than in

half by Tesla’s industry-leading model loyalty that varies between

65% and 75%; and, lastly, 17.1% of the ultra-wealthy households

are Asian, a discovering undoubtedly pushed by Tesla’s robust attraction to

Asians (28% of Tesla consumers within the first six months of 2024 have been

Asian).

Demo Our Loyalty Analytics Software

This text was revealed by S&P World Mobility and never by S&P World Scores, which is a individually managed division of S&P World.