The rise in new automobile inventories, from lower than 1

million models in January 2022 to virtually 3 million models in August

2024, has caused different main adjustments to the {industry}. The

better availability of autos has offered shoppers with extra

buying choices, shifting leverage and bargaining energy in favor

of the patron and creating downward stress on costs. This has

led to the resurrection of leasing, which now accounts for a

quarter of all new automobile transactions, up greater than eight

share factors from 16.6% in September 2022 to 24.9% in August

2024. Notably within the luxurious house, leasing offers prospects

the chance to drive a automobile they could in any other case be unable to

afford.

Rising inventories and better lease charges are two industry-wide

traits which have understandably led to better model loyalty.

Assuming every part else stays the identical, when shoppers have extra

selections inside a model, they’re extra more likely to discover what they need

– thus enhancing model loyalty and lowering the probability of

switching to rivals. Lessees – who’ve stronger hyperlinks with

the vendor (together with having to return the automobile at lease finish)

and shorter flip charges – are additionally constantly extra loyal to the

model than house owners (once more, every part else being equal).

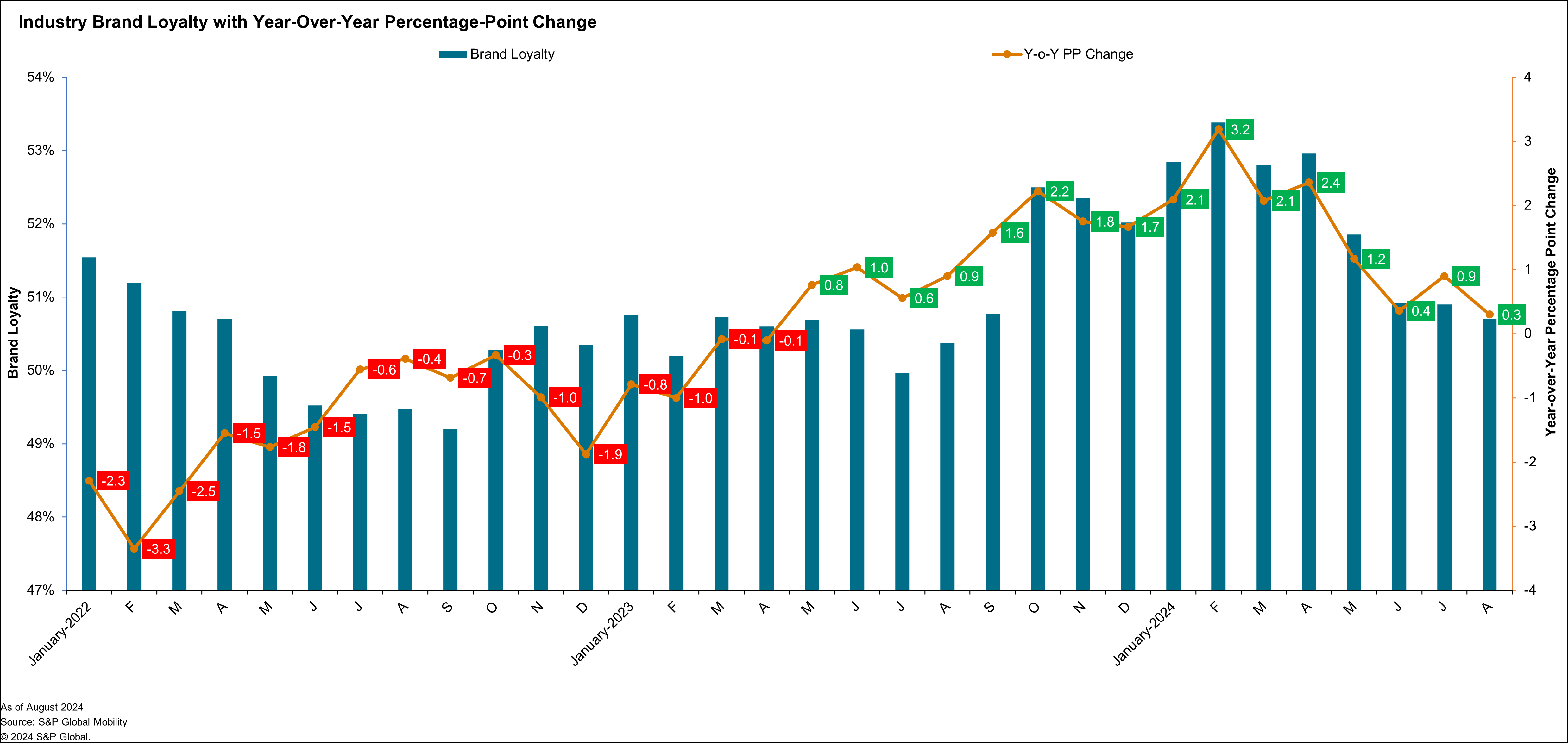

As the next chart illustrates, model loyalty has climbed in

the previous sixteen consecutive months 12 months over 12 months after declining

within the sixteen prior months. Whereas industry-wide model loyalty has

elevated, it isn’t but at pre-pandemic ranges of 54%-55%.

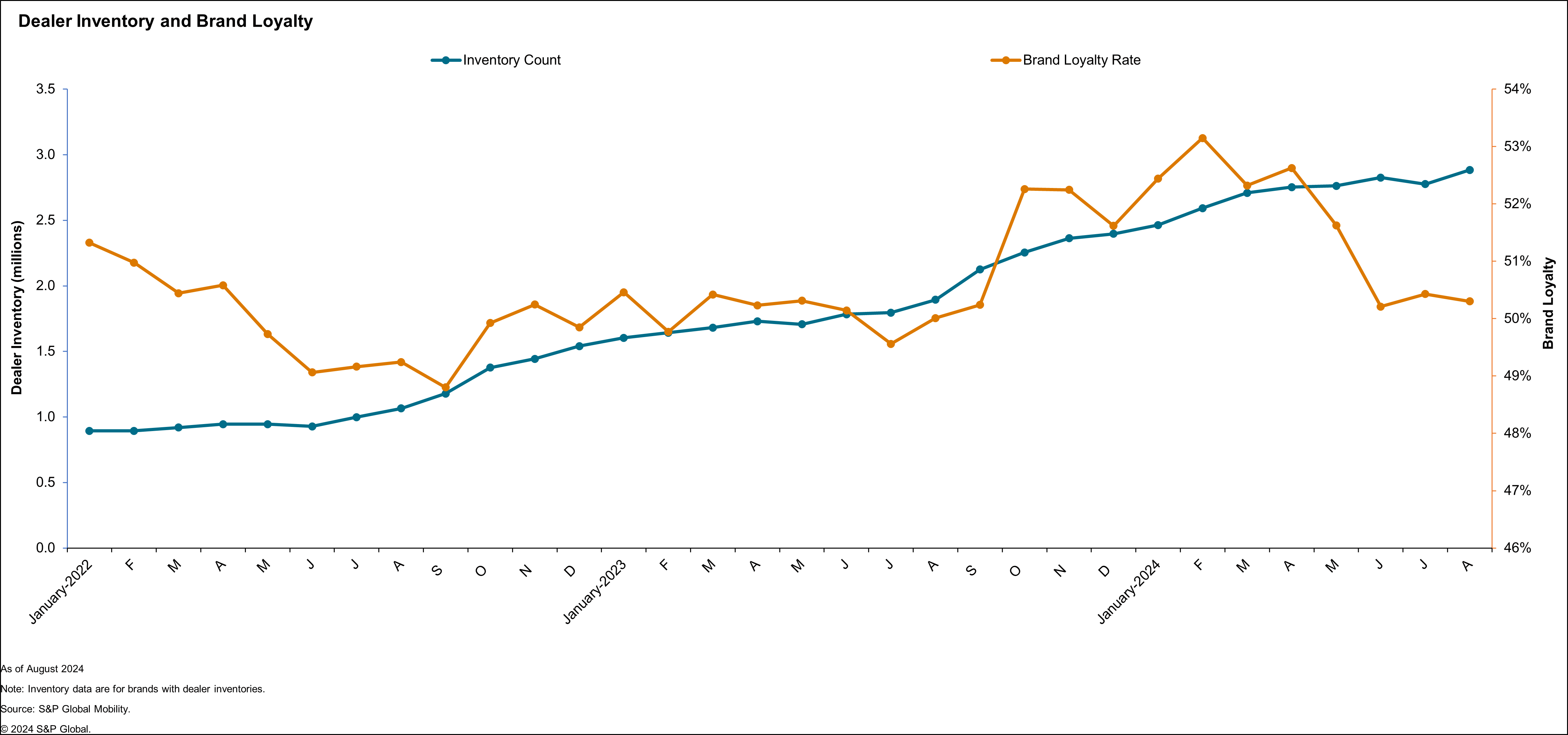

Historic precise purchaser habits helps these conclusions: The

correlation coefficient between vendor inventories and model

loyalty from January 2022 to August 2024 is .60, in keeping with

S&P International Mobility vendor stock information (see the next

chart).

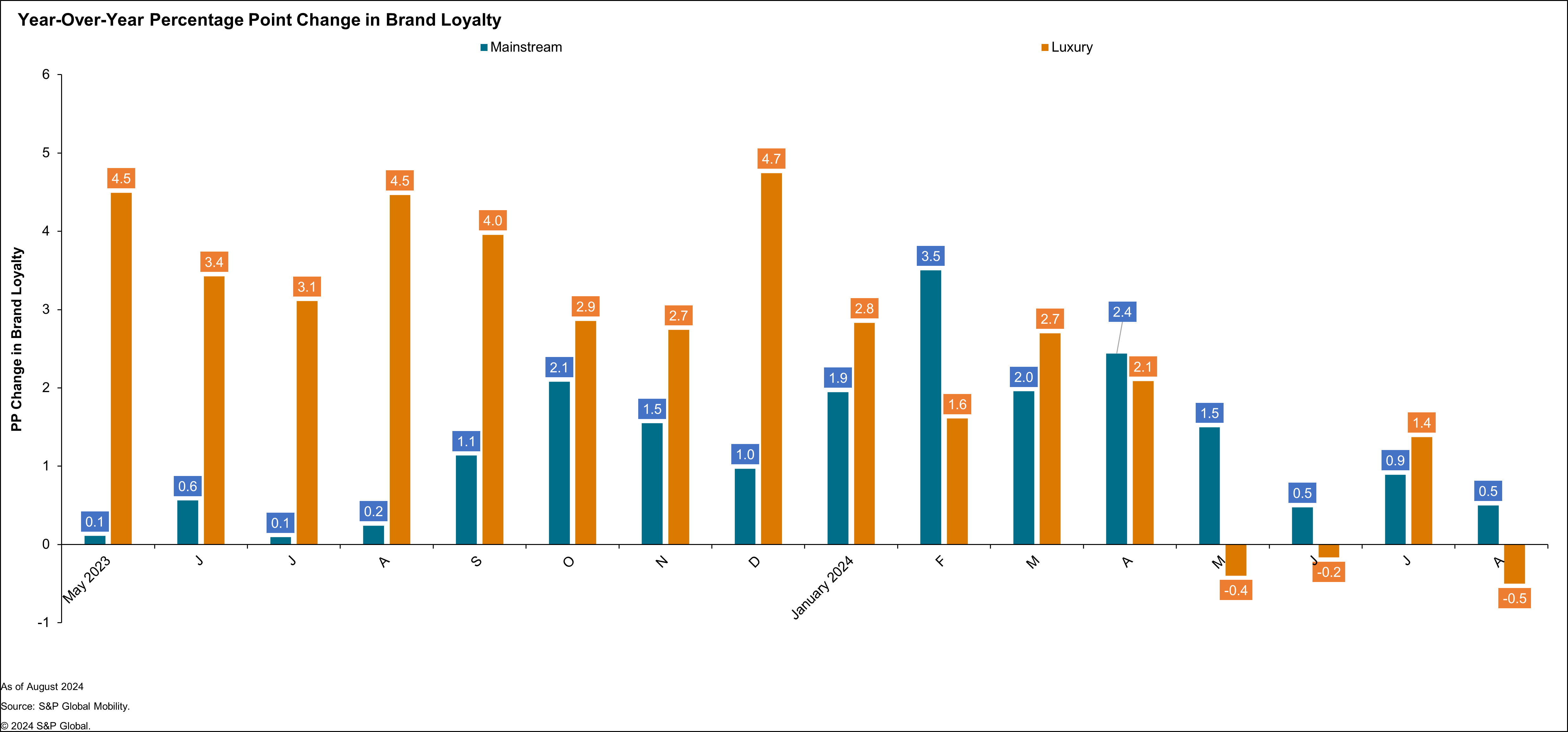

The mainstream and luxurious sectors available in the market have each

skilled rising model loyalty over the previous sixteen months, with

the mainstream manufacturers rising each month and the luxurious manufacturers

up in twelve months however down in three of the 4 most up-to-date

months.

Additionally, as proven within the following chart, through the early a part of

this fifteen-month time span, the luxurious manufacturers exhibited better

year-over-year adjustments than the mainstream manufacturers. That is possible

partly as a result of the luxurious manufacturers had dropped additional than the

mainstream manufacturers through the inventory-shortage months and

subsequently had extra floor to make up.

A number of manufacturers have had distinctive model loyalty performances,

together with Honda (with six fashions having fun with ten or extra consecutive

months of loyalty enchancment), Volkswagen (additionally with six fashions

rising for ten or extra months) and Lincoln (with one mannequin

claiming model loyalty enchancment for ten consecutive months).

Different manufacturers listed under have additionally excelled, though they’ve

not had the unbroken sequences of enhancements.

In conclusion, a number of S&P International Mobility metrics,

together with vendor inventories, leasing penetration and model loyalty

point out that the {industry} is nicely on monitor to return to its

pre-pandemic panorama. Nevertheless, the August 2024 model loyalty

outcomes (50.3%) and leasing fee (24.9%) are nonetheless under the 2019

ranges (54%, and 29.5%, respectively), suggesting the {industry} has

not but totally recovered.

Demo our loyalty analytics software

This text was printed by S&P International Mobility and never by S&P International Scores, which is a individually managed division of S&P International.