[ad_1]

By Mike Wall, Government Director, Automotive Evaluation, S&P

World Mobility

Every month, we leverage international mild automobile manufacturing actuals,

registration knowledge, and gross sales knowledge to provide the most recent,

short-term manufacturing forecast accessible.

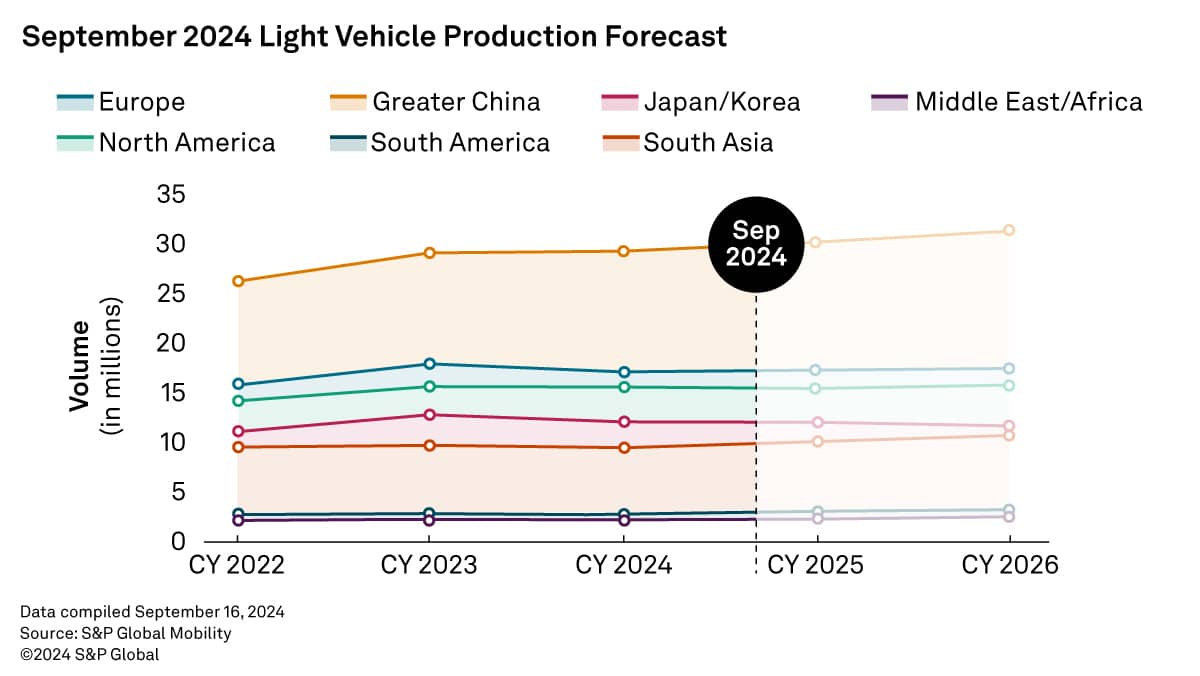

This is an in depth have a look at international manufacturing knowledge by area and our

up to date September manufacturing forecast.

High Takeaways for the Month:

This month’s forecast represents ongoing challenges with

managing manufacturing and stock amidst unstable demand and

uncertainties surrounding electrical automobile (EV) adoption.

Forecasting downgrades resulting from weaker demand fundamentals, timing

actions, and macroeconomic pressures. Whereas some areas like South

America present indicators of enchancment, total, international mild automobile

manufacturing has been revised down for the near-to-intermediate

time period.

Noteworthy Changes

Europe’s mild automobile manufacturing outlook for

2024 was barely downgraded by 14,000 items, largely resulting from weaker

actualized manufacturing in Western and Central Europe. Although

stronger output from premium German producers helped offset

a number of the discount. The area’s forecast stays secure for

2025, with a modest upward revision for 2026 resulting from a barely

improved demand outlook, notably in Russia.

Higher China noticed a discount of 19,000 items

for 2024 and a extra vital downgrade of 205,000 items for

2025, reflecting subdued home demand regardless of authorities

incentives. Aggressive value competitors and shopper hesitation,

coupled with a weaker macroeconomic atmosphere, have additional

dampened the manufacturing outlook. The long-term forecast for 2026

stays beneath strain on expectations for a weaker market restoration

amid macroeconomic headwinds.

Japan and Korea confronted combined changes, with

Japan’s manufacturing outlook for 2025 diminished by 29,000 items resulting from

potential regulatory compliance points for Daihatsu. Nonetheless, 2026

noticed a slight improve resulting from elevated momentum for ICE and hybrid

fashions like Toyota’s ES and Corolla Cross. Korea’s manufacturing for

2024 and 2025 was diminished resulting from wage-related strikes and weaker

demand, notably within the U.S. and Europe, however the long-term

forecast stays secure.

North America’s manufacturing outlook was

considerably downgraded by 120,000 items for 2024 and 429,000

items for 2025, pushed by a lower in U.S. mild automobile gross sales and

program cancellations. Car timing actions and stock

corrections additional impacted the forecast, with the steepest cuts

anticipated for 2026. Total, North American manufacturing is

anticipated to say no year-over-year for 2 consecutive years, with

BEV-related program revisions contributing to the reductions.

South America’s forecast improved, with

upgrades of 30,000 items for 2024 and 79,000 items for 2025, pushed

by stronger manufacturing and demand in Brazil and Argentina. Key

fashions just like the Fiat Strada pickup and Hyundai HB20 are anticipated to

increase manufacturing. Nonetheless, warning stays resulting from seasonal results

and stock administration challenges.

South Asia’s manufacturing forecast for 2024 was

diminished by 50,000 items, reflecting ongoing weak spot in ASEAN

markets, notably in Thailand and Indonesia, resulting from stricter

mortgage approvals and financial headwinds. India additionally noticed a downgrade

for 2025 and past, affected by the weaker rupee, elevated

rates of interest, and a shift towards retail gross sales reporting,

suggesting firms will search to cut back extra stock and

streamline stock administration from sellers to the manufacturing

line.

Obtain a free mild automobile manufacturing forecast pattern

right here

This text was revealed by S&P World Mobility and never by S&P World Rankings, which is a individually managed division of S&P World.

[ad_2]