[ad_1]

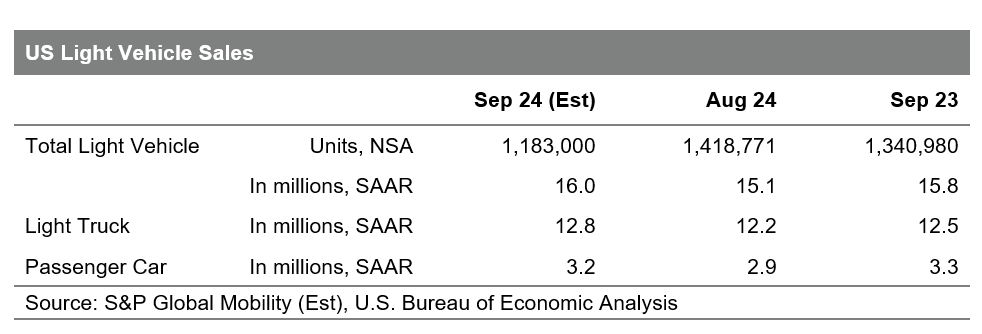

On a quantity estimate of 1.18 million models, US mild automobile

gross sales in September are anticipated to understand a calendar-induced

decline of roughly 12% year-over-year.

On the brilliant aspect, this may translate to a seasonally

adjusted annual fee (SAAR) of 16.0 million models, a notable bump

from the 15.2 million unit studying in August and sustaining a

unstable sample for this month-to-month metric since Could. The

month-to-month volatility within the SAAR studying displays the present

state of auto demand.

“New automobile gross sales stay caught in impartial,” mentioned

Chris Hopson, principal analyst at S&P International Mobility.

“The general tenor of the auto demand atmosphere stays considered one of

constant, however unmotivated quantity ranges as customers within the

market proceed to be pressured by excessive rates of interest and

slow-to-recede automobile costs, that are translating to excessive

month-to-month funds.”

Regardless of growing to 2.88 million models on the finish of August,

vendor marketed stock within the US has additionally largely leveled out

because the spring. “With 2025 mannequin 12 months autos now changing into

accessible at an elevated fee (up 65% vs. July), strain to promote

down remaining inventory of 2024 mannequin 12 months autos will start to

mount,” suggests

Matt Trommer, affiliate director of product at S&P International

Mobility.

Continued advances in inventories and incentives are anticipated,

however given reviews of some automakers culling output expectations

for the rest of the 12 months, affordability points are anticipated to

stay stubbornly sticky whilst the primary rate of interest lower was

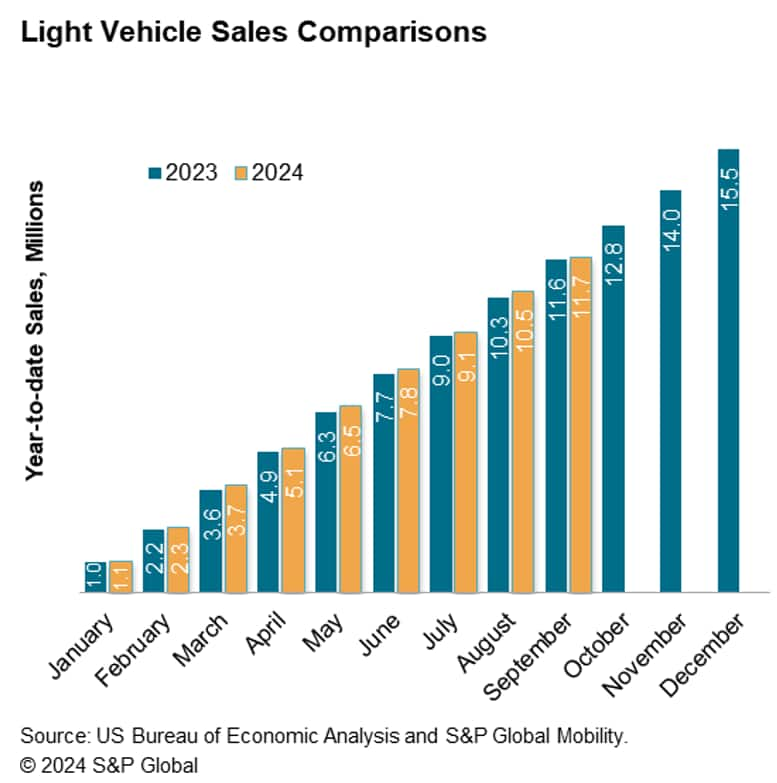

made. In our September 2024 forecast replace, we have lowered our

calendar 12 months 2024 US gross sales outlook to fifteen.9 million models, down

from a earlier projection of 16.0 million models. Equally,

our mild automobile manufacturing outlook for North America has additionally

been downgraded to a 2024 calendar 12 months projection of 15.5 million

models, reflecting automobile timing and stock correction

impacts.

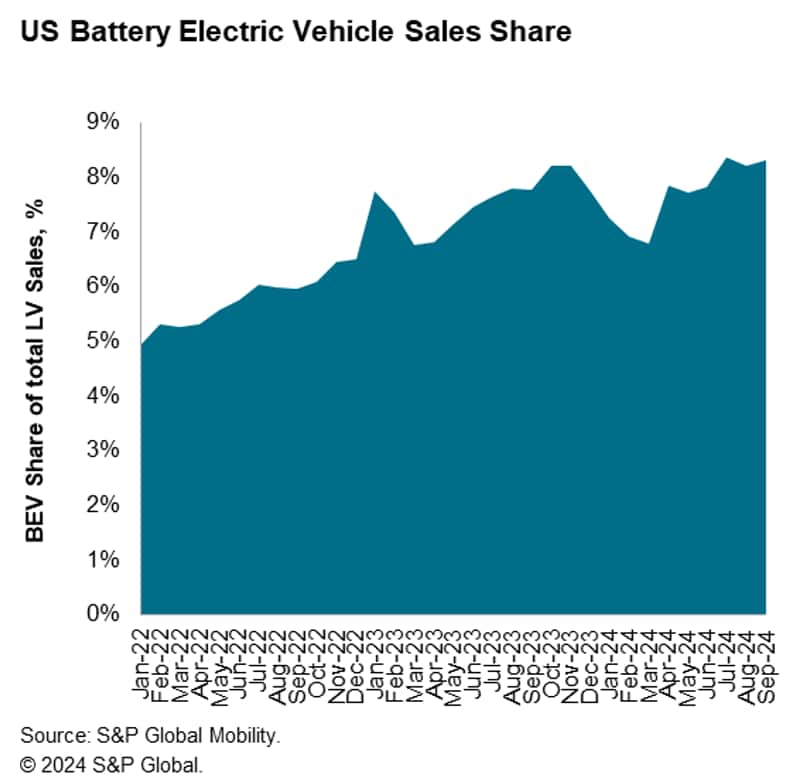

Robust growth of battery-electric automobile (BEV) gross sales

stays an assumption in the long term mild automobile gross sales

forecast. In line with S&P International Mobility’s new registration

knowledge, BEV share of gross sales has been above 8% in each June and July,

progress from ranges earlier within the 12 months. Within the speedy time period,

average month-to-month volatility is anticipated. September BEV

share is anticipated to stay above 8% as soon as once more.

Assisted by the present roll outs of autos such because the

Chevrolet Equinox EV and Honda Prologue and to be adopted by new

BEVs such because the Polestar 3, Jeep Wagoneer S and Volkswagen ID.

Buzz slated for launch within the fourth quarter, electrical automobile

gross sales are anticipated to advance over the rest of the 12 months.

Get a free preview of our Mild Automobile Gross sales

Forecast.

This text was printed by S&P International Mobility and never by S&P International Scores, which is a individually managed division of S&P International.

[ad_2]