[ad_1]

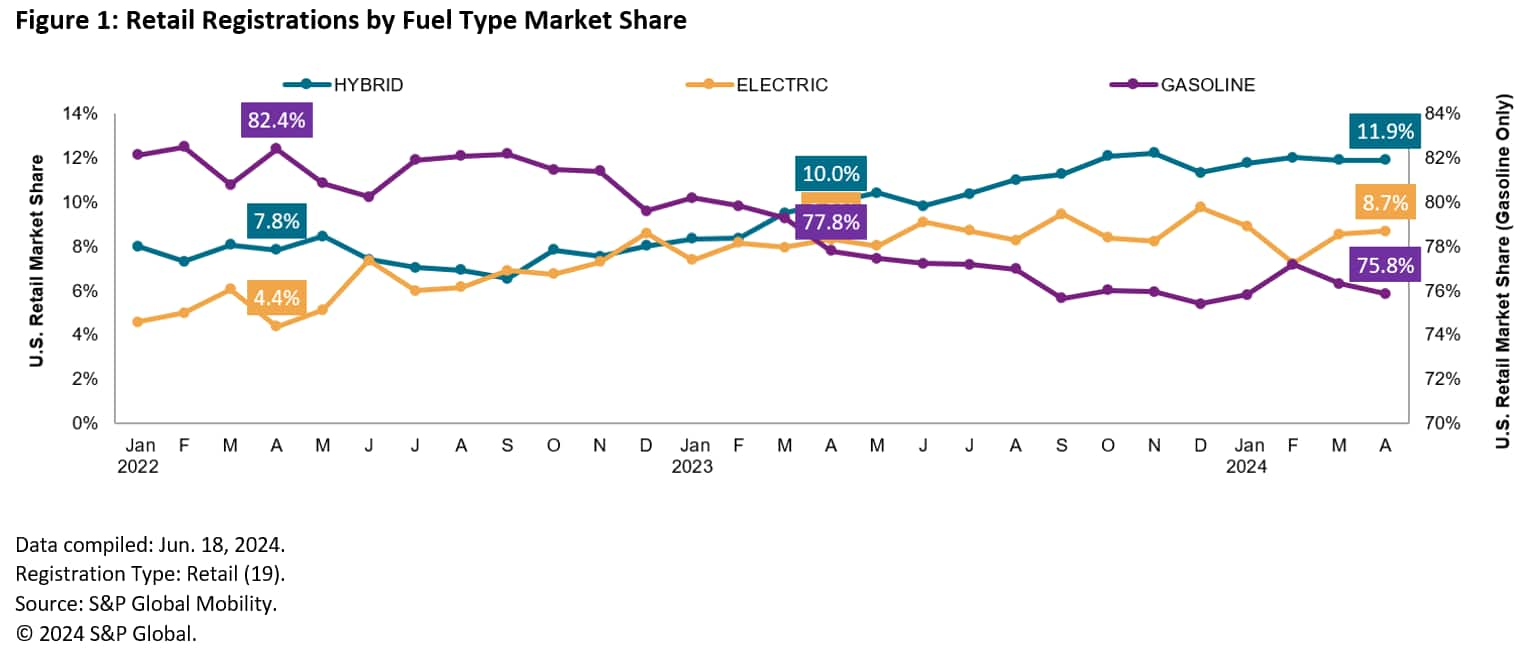

Beginning in early- to mid-2023, the expansion in US retail market

share for electrical autos has slowed. The April 2024 retail share

of 8.7% was up simply 0.4 share factors from a 12 months in the past, whereas

hybrid share rose nearly 2 factors over the identical time interval.

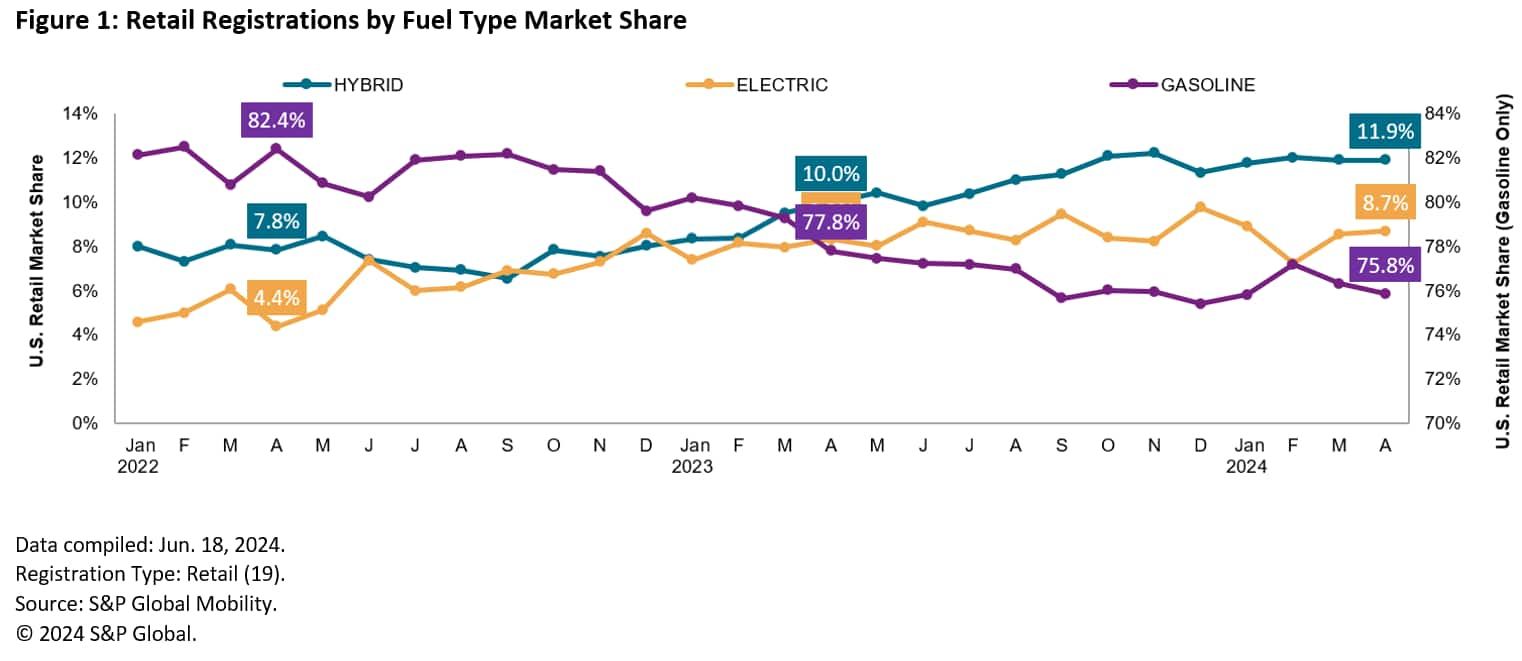

However the electrical car (EV) story shouldn’t be that easy. If

Tesla's outcomes are eliminated, then the EV market has carried out at a

larger degree than most notice. As Determine 2 suggests, despite the fact that

the EV-minus-Tesla market did have a slight dip within the

January/February time interval, it got here again in March and reached an

all-time excessive of 4.5% in April. Not solely is that this April share up 1.3

share factors from simply two months in the past, however it’s up nearly 2

full share factors from April 2023.

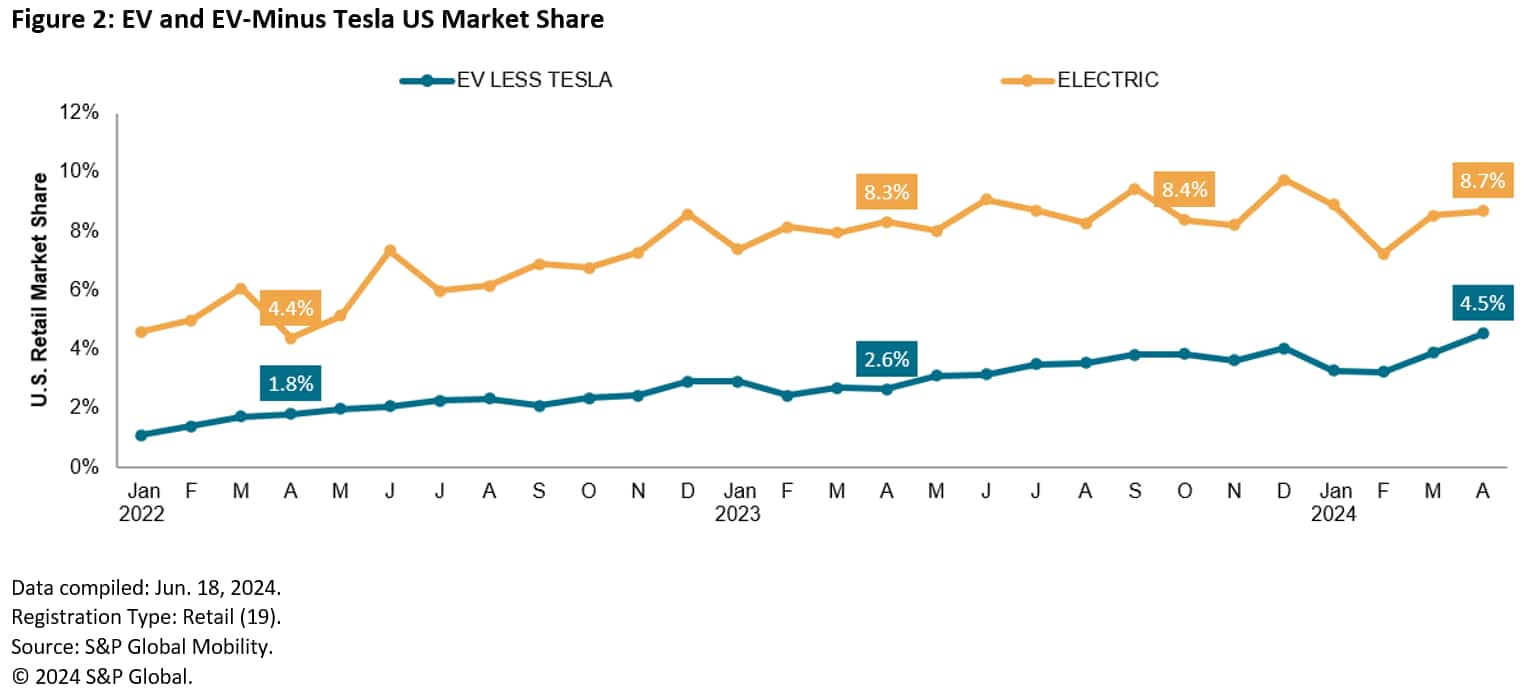

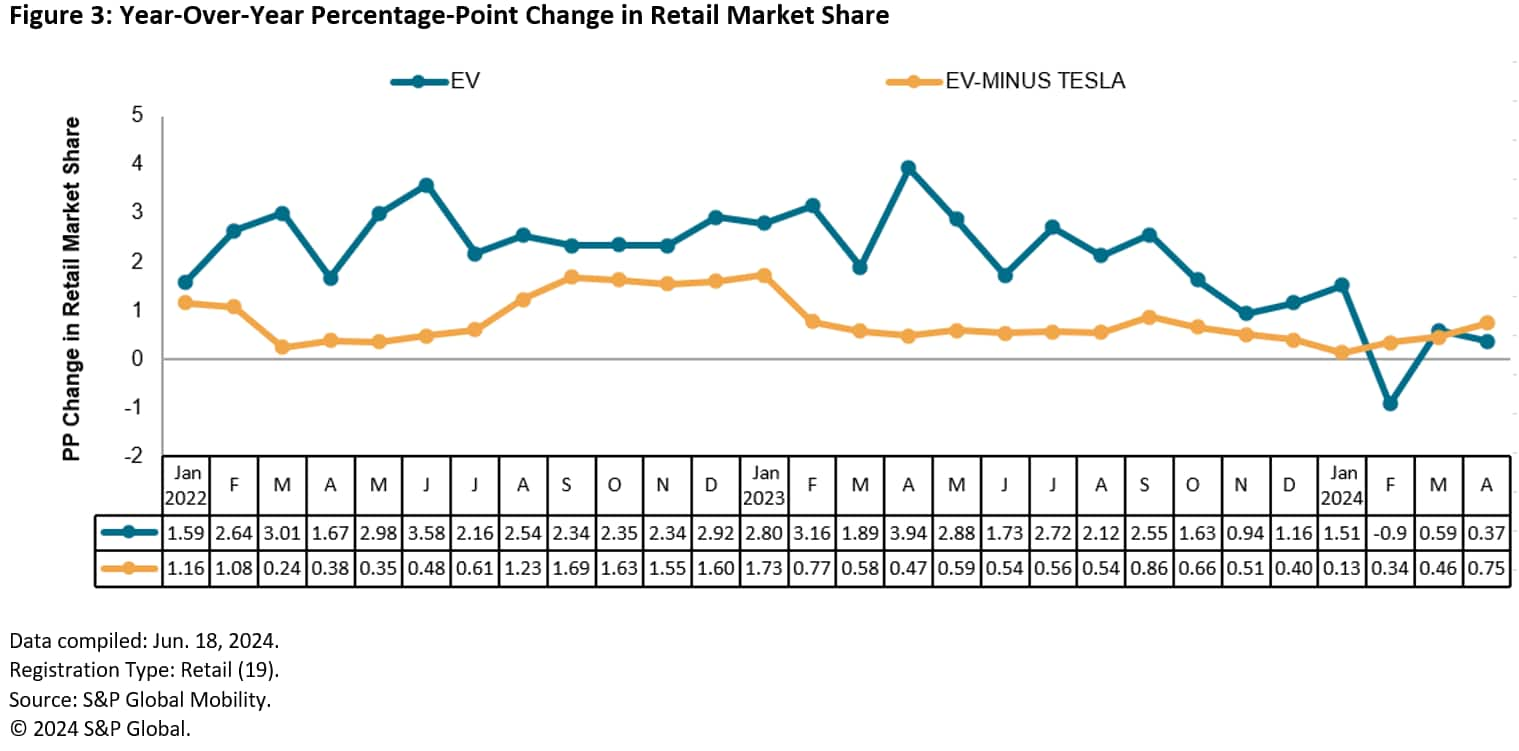

A evaluation of the year-over-year modifications in market share for each

the overall EV and EV-minus-Tesla markets reinforces the conclusion

that the second is out-performing the primary (see Determine 3). The

general EV market was down nearly a full share level in

February, and its good points in March and April had been each lower than 1

share level. But, with out Tesla, the class has loved

constant year-over-year market share enhancements relationship again to

at the least the beginning of 2022.

April outcomes on the model degree additional illustrate the unfavourable

market affect of Tesla. The general EV market climbed 12%

year-over-year in April, but when Tesla is eliminated, EV deliveries

jumped a powerful 75%. Eighteen manufacturers loved year-over-year

will increase in April, whereas solely 9 skilled declines. 4

further manufacturers had EV registrations this previous April however none a

12 months in the past.

Among the many 18 manufacturers with year-over-year good points, EV deliveries

doubled (at the least) for eight of them in April, and registration

volumes for 3 of them surpassed 6,000 models, together with Ford

(6,409), Hyundai (6,049) and Toyota (4,509).

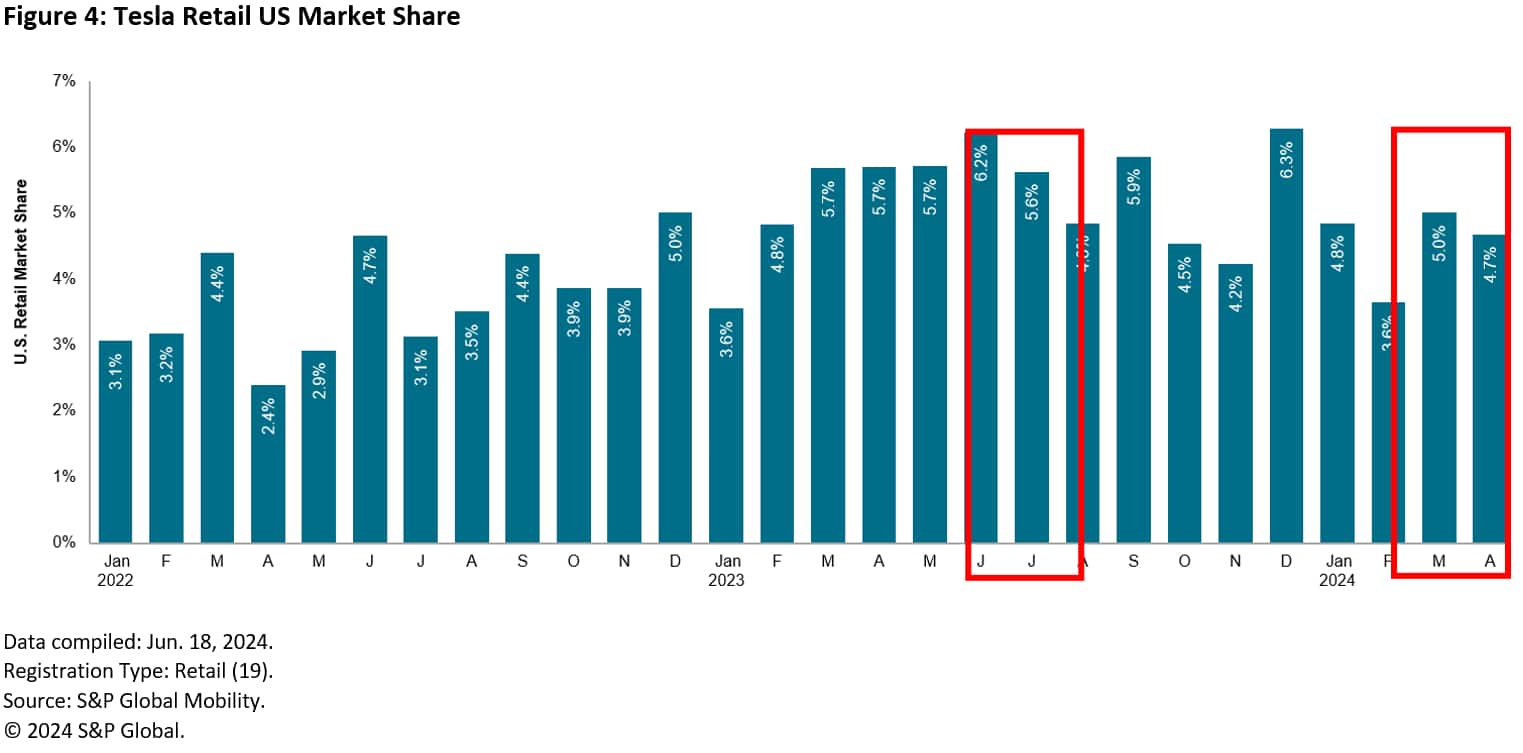

Predictably, Tesla's share of the US market declined in every of

the three most up-to-date months (versus a 12 months in the past), by no means exceeding

5% throughout this time interval whereas exceeding that threshold in two of

the three corresponding months a 12 months in the past.

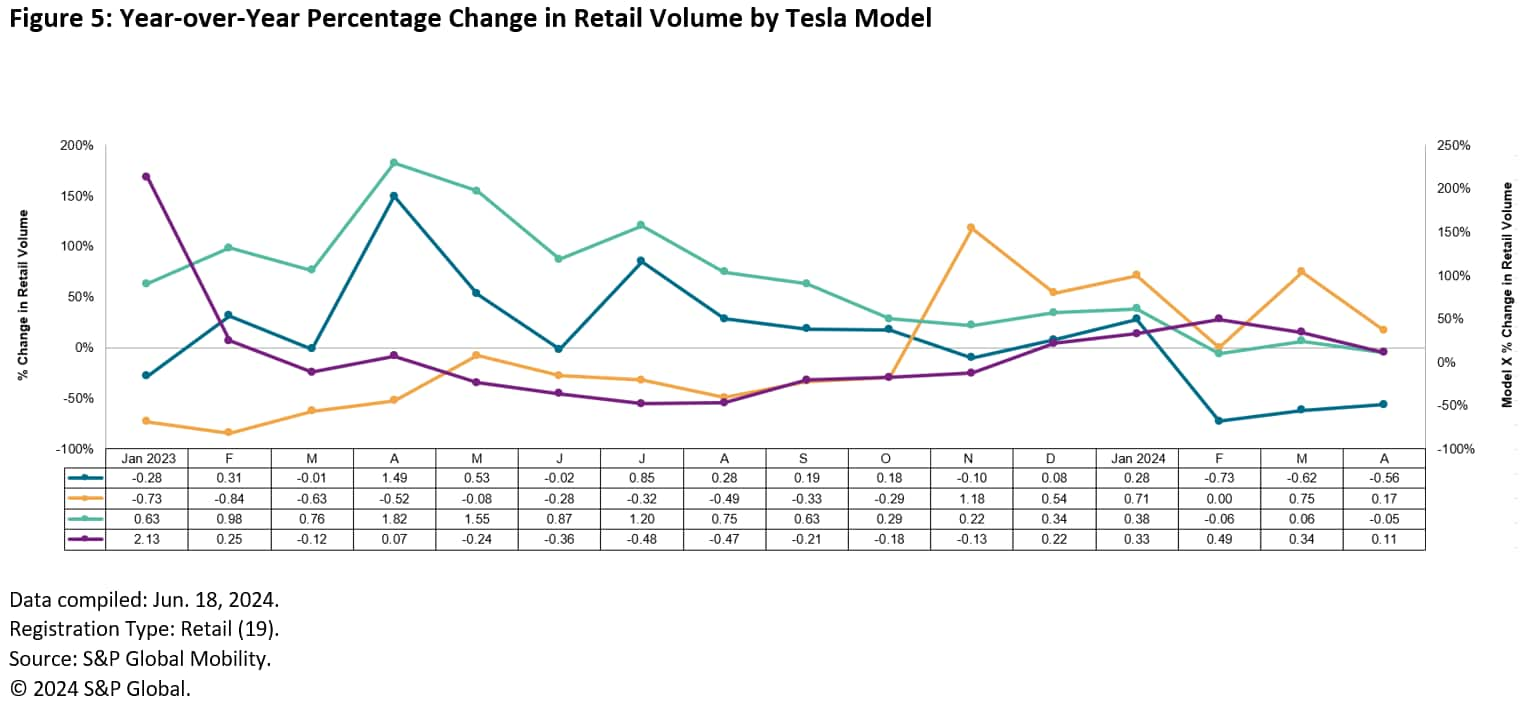

On the mannequin degree, gross sales of the Mannequin 3 plummeted by greater than

half in every of the three most up-to-date months, whereas the opposite three

Tesla fashions had year-over-year good points or stayed even. Each the

changeover to a brand new model and lowered IRA (Inflation Discount

Act) credit for the 2024 model have negatively impacted the

Mannequin 3's efficiency. With no registrations a 12 months in the past, the

Cybertruck shouldn’t be included on this evaluation.

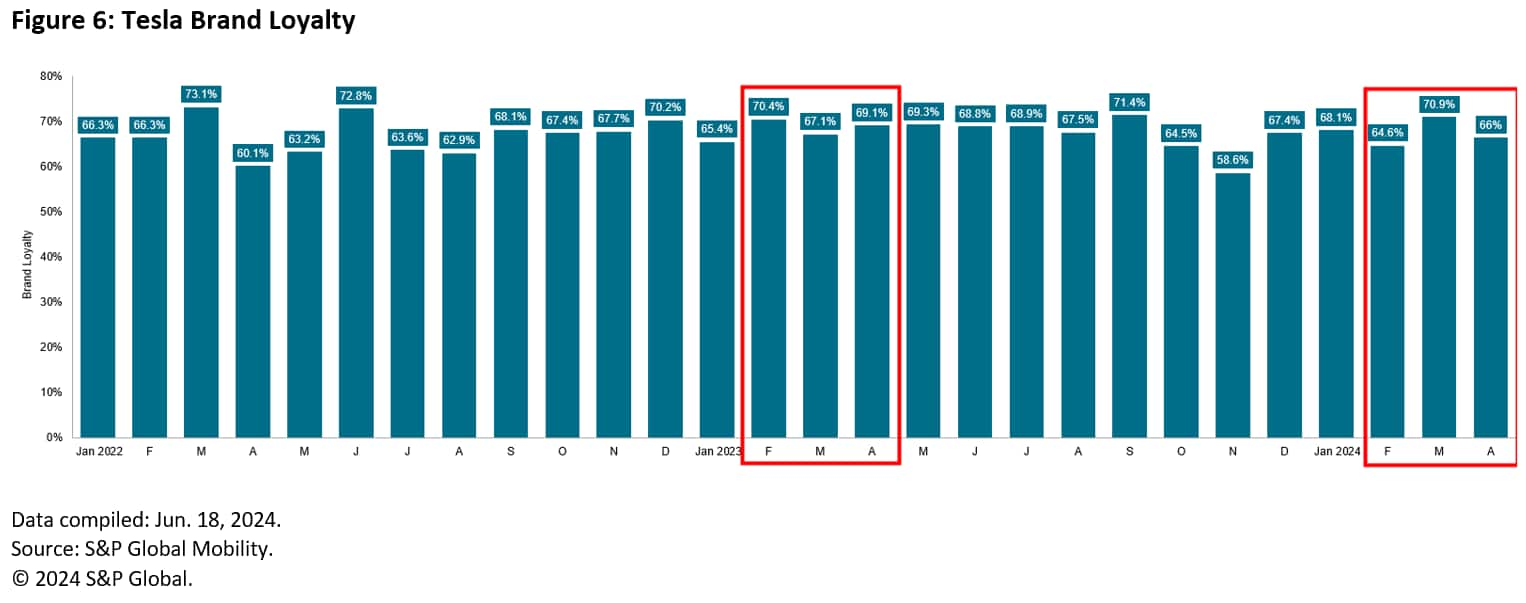

Tesla Model Loyalty Stays Regular

Given Tesla's poor exhibiting in every of the three most up-to-date

months, a decline in model loyalty would make sense. However, as proven

in Determine 6, Tesla's model loyalty has solely declined marginally

since February.

Tesla model loyalty remained comparatively regular as a result of

return-to-market (RTM) Mannequin 3 households, unable to get one other

one on account of mannequin changeover, migrated to the Mannequin Y and thereby

remained model loyal. Provided that the Y is a utility and the three a

sedan, that migration sample is smart. This previous February, extra

than 50% of RTM Mannequin 3 households opted for a Mannequin Y, the best

outcome for this sample migration relationship again to at the least the

starting of 2022.

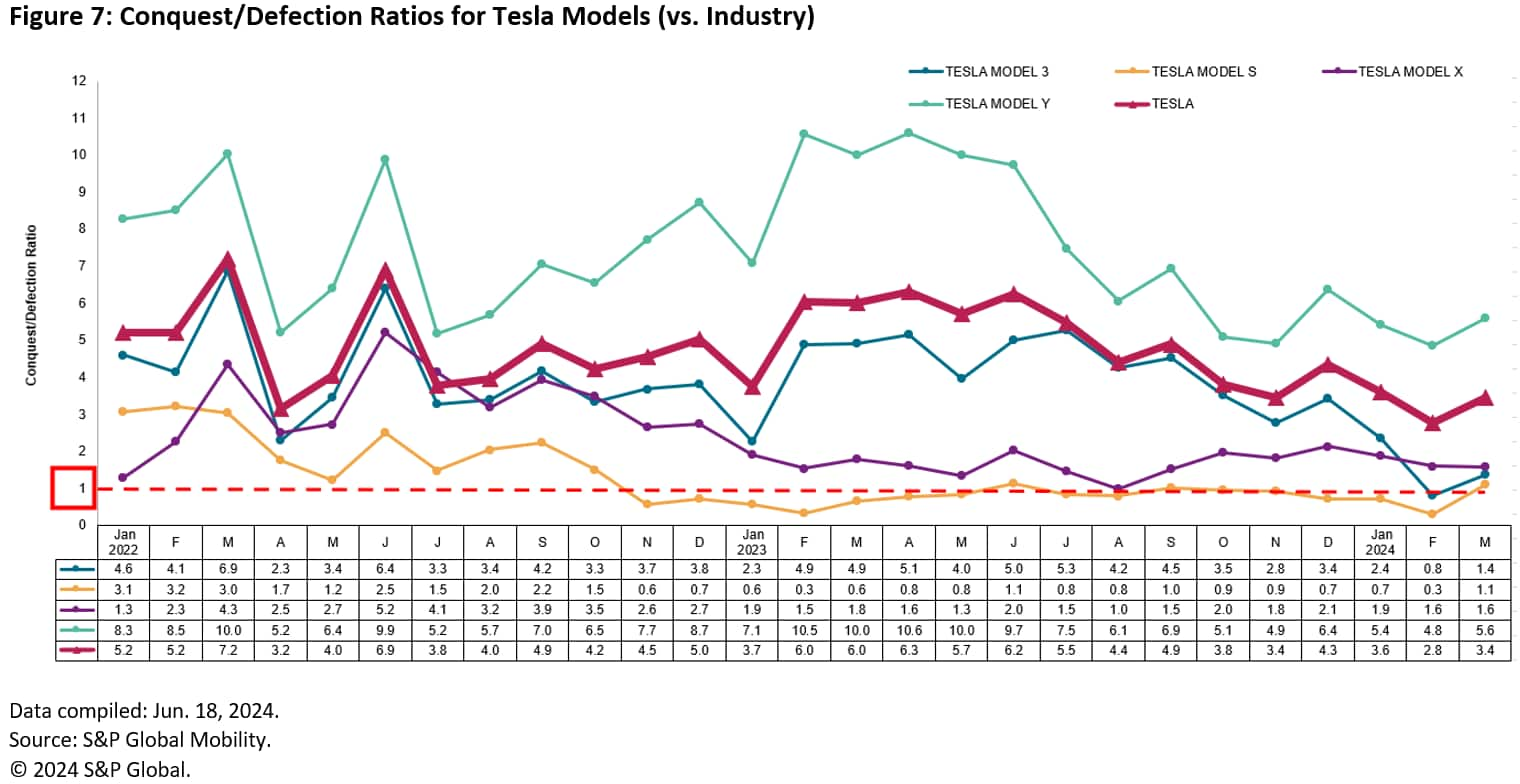

Mannequin 3's lowered availability prior to now a number of months not

solely induced homeowners emigrate to the Mannequin Y, it additionally lowered the

Mannequin 3's means to conquest aggressive model homeowners. Mannequin 3's

conquest/defection ratio with the remainder of the trade plummeted at

the beginning of this 12 months when measured versus a 12 months in the past. This 12 months's

ratios of two.4, .8 and 1.4 in January, February, and March,

respectively, all are down considerably from 2.3, 4.9 and 4.9 a

12 months in the past.

Three takeaways from this evaluation are:

- Loyalty, conquest, defection, and normal migration patterns

steadily diverge from predictable ones throughout a build-out of 1

mannequin and launch of one other. - Tesla's continued affect on your entire US EV market is

illustrated by the truth that one Tesla mannequin's atypical market

efficiency can affect not simply Tesla however your entire US electrical

car market. - By monitoring mannequin and model migration patterns on a weekly

foundation, a model can rapidly see modifications within the market and

modify advertising packages to mitigate undesirable outcomes.

Get a demo of our loyalty analytics device.

[ad_2]