[ad_1]

Over the previous few weeks, BEV meeting and battery crops have

opened, began development, and been delayed, as globally the

trade adjusts to an inconsistent demand path.

The S&P International Mobility AutoIntelligence service

offers every day evaluation of worldwide automotive information and occasions,

offering our shoppers well timed context and affect evaluation for

navigating the fast-moving trade. Behind the Headlines presents a

bi-weekly dive into the newest high tales.

New BEV battery capability comes on-line in

Asia-Pacific

Inconsistent demand progress for battery electrical autos (BEVs)

in 2024 is more and more anticipated to proceed in 2025. As automakers

stability capital expenditure and shopper demand, plenty of

battery initiatives are being delayed and revised, whereas others are

shifting full steam forward.

On the BEV battery aspect, a plant between Hyundai Motor and LG

Vitality Resolution (LGES) has began manufacturing in Indonesia. It’s

the primary battery cell plant within the nation, with annual capability

of 10 GWh of battery cells and supported by a US$1.1 billion

funding introduced in 2021.

On the car meeting aspect, GAC Aion, a brand new power car

subsidiary of GAC Group, has inaugurated a brand new plant in Thailand.

That plant has annual capability of fifty,000 models and noticed US$65

million invested. The GAC Aion plant is the second of its sort to

be opened in Thailand this month; BYD's plant opened in early July

with capability for 150,000 new-energy autos every year.

VinFast has additionally began development on a brand new plant in

Indonesia, geared toward constructing right-hand drive variations of the VF 3,

VF 5, VF 6 and VF 7 autos for the Indonesian market; this plant

is deliberate to have 50,000-unit annual capability.

In North America, battery initiatives are delayed and

revised

In the meantime, on the opposite aspect of the world, Ford and GM have

slowed ramp-up of their BEV manufacturing capability will increase. This

slowdown is having an affect on North American manufacturing

investments, whereas VinFast is discovering that breaking into the US is

tougher than anticipated.

After GM's CEO confirmed the corporate won’t attain the goal

for 1 million models of put in BEV capability in 2026, LGES

indicated it should gradual development on a brand new battery cell plant in

Michigan. LGES stated that it’ll regulate the pace of its general

investments and is in search of methods to make sure its crops are

versatile, feedback which counsel different modifications might be made. The

GM-LGES Michigan plant is an Ultium Cells LLC three way partnership with

GM, the third between the 2 within the US.

Ford has additionally introduced one other shift in its North American

manufacturing plans. As an alternative of manufacturing the deliberate three-row BEV

utilities for the Ford and Lincoln manufacturers at its Oakville, Ontario

(Canada), plant, Ford will begin constructing the current-generation

F-Sequence Tremendous Obligation truck there in 2025. As quickly as 2026, the subsequent

technology can be produced there as properly. Ford dedicated to

electrified options for the subsequent Tremendous Obligation, although stopped brief

of committing to BEV manufacturing at Oakville.

Saying world gross sales of 21,747 autos within the second quarter

of 2024, VinFast decreased its steerage for 2024 full-year gross sales from

100,000 models to solely 80,000 models. VinFast additionally delayed its first

US BEV plant to 2028; that is the second delay for a plant which

was initially meant to see manufacturing begin in July 2024.

In the meantime, Turkey will get BYD funding and creates

potential hedge towards EU tariffs

Turkey's authorities introduced that it’ll not impose tariffs on

Chinese language automakers who make investments domestically, after imposing a 40% tariff

on mainland Chinese language passenger automotive imports. US presidential

candidate and former President Donald Trump has stated that he may

think about the same coverage if he wins the US election in November

2024.

In early July BYD reached an settlement with Turkey to take a position

US$1 billion into car manufacturing there. SAIC can also be stated to be

in discussions to start manufacturing in Turkey, whereas Chery stated in

an earlier assertion, “We’re working intensively on the

feasibility evaluation of manufacturing facility development in Turkey and

manufacturing in Turkey along with the related Ministries. We’re

striving to have the ability to produce in Turkey as quickly as attainable.” Any

facility constructed in Turkey might probably circumvent tariffs

imposed by European Union member states.

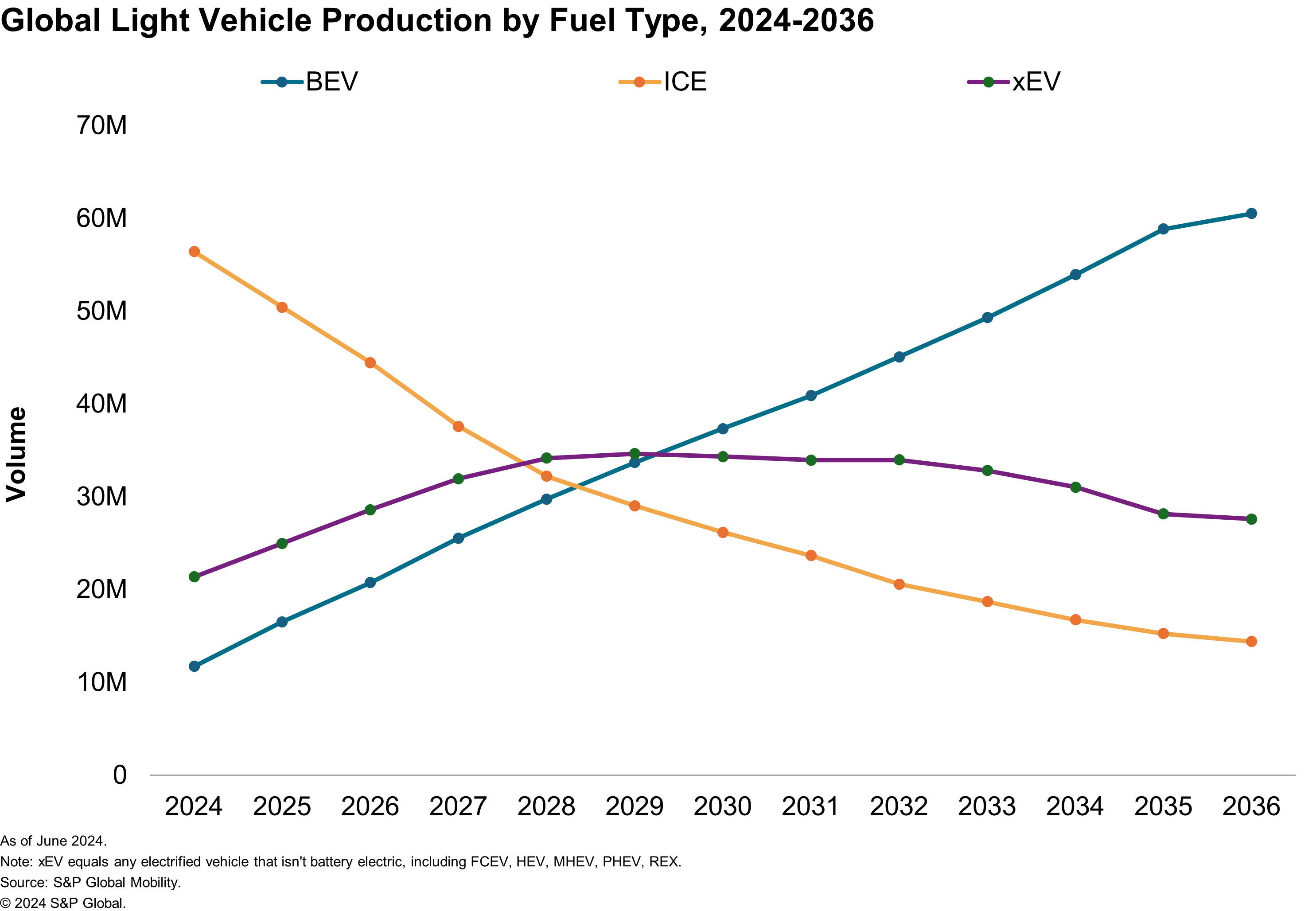

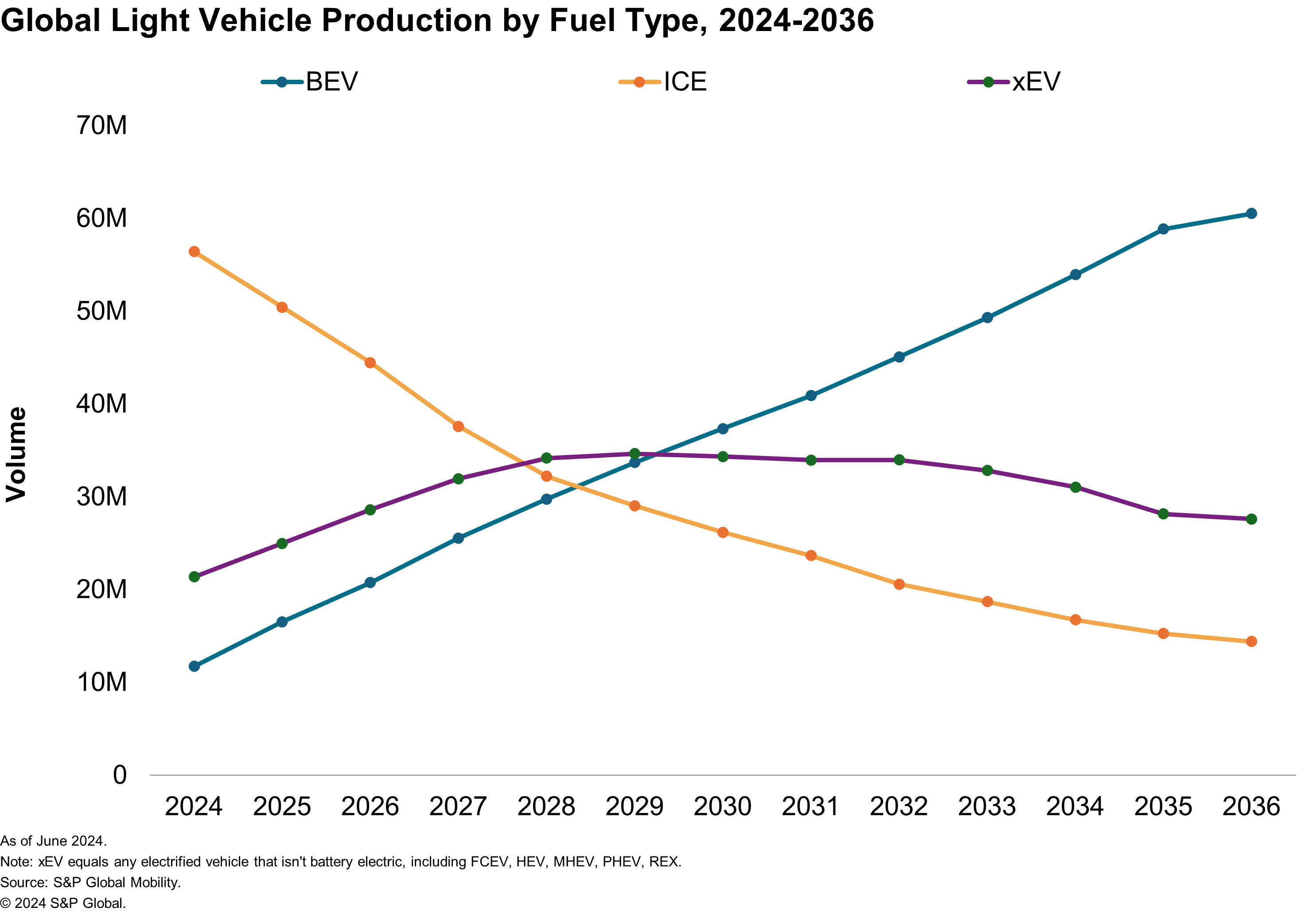

S&P International Mobility sees BEV manufacturing reaching 59%

of light-vehicle manufacturing — in 2036

The S&P International Mobility June 2024 gentle car manufacturing

forecast sees manufacturing of BEVs persevering with at a reasonably aggressive

upward slope, even with shopper hesitation in 2024. International

light-vehicle BEV manufacturing is predicted to overhaul inner

combustion engine (ICE) manufacturing in 2029.

By 2036, we see world BEV manufacturing at simply 59% of all

light-vehicle manufacturing. Nevertheless, we additionally see the potential for

Germany with 97% of its light-vehicle manufacturing having shifted to

BEVs by then.

In Mainland China, which can proceed to be the highest-volume

producer of BEVs, solely about 64% of light-vehicle manufacturing is

forecast to be BEVs by 2036. Mainland China's drive towards new

power autos (NEV) versus a laser-focus on BEVs leaves

extra room for options like plug-in hybrid (PHEV) and

range-extended electrical (REX) car options; these are forecast

to see, roughly, respective 17% and seven% of mainland China

light-vehicle manufacturing in 2036.

The US is predicted to be the third-highest BEV producer in 2036;

we forecast that 75% of light-vehicle manufacturing might be BEVs by

that 12 months. Indonesia and Thailand are long-standing

vehicle-producing nations, with alternative for each the house

market and for exports. Nonetheless, a BEV transition is predicted to take

somewhat longer there; in 2036, we forecast Thailand BEV manufacturing

at about 50% of the nation's output. In Indonesia we see BEV

output reaching 26% of manufacturing.

Although at this level, a shift to BEV-dominant car manufacturing

and gross sales is assumed to be a “when” moderately than an “if” query,

we are going to proceed to see OEMs and suppliers revising instant plans

as they stability the necessity to have capability to help the shift,

without having an excessive amount of too quickly.

Get Free Trial of AutoIntelligence.

[ad_2]