During the last 18 months, there was a big shift

towards leasing for electrical automobiles in the USA —

pushed each by market dynamics and federal laws.

Wanting first at {industry} dynamics, automobile inventories have

grown because the pandemic and microchip scarcity have receded. These

adjustments have additionally shifted the market from a vendor’s market to a

purchaser’s market. As consumers have gained extra leverage, downward

strain on pricing has intensified.

One main device used to decrease costs, notably for luxurious

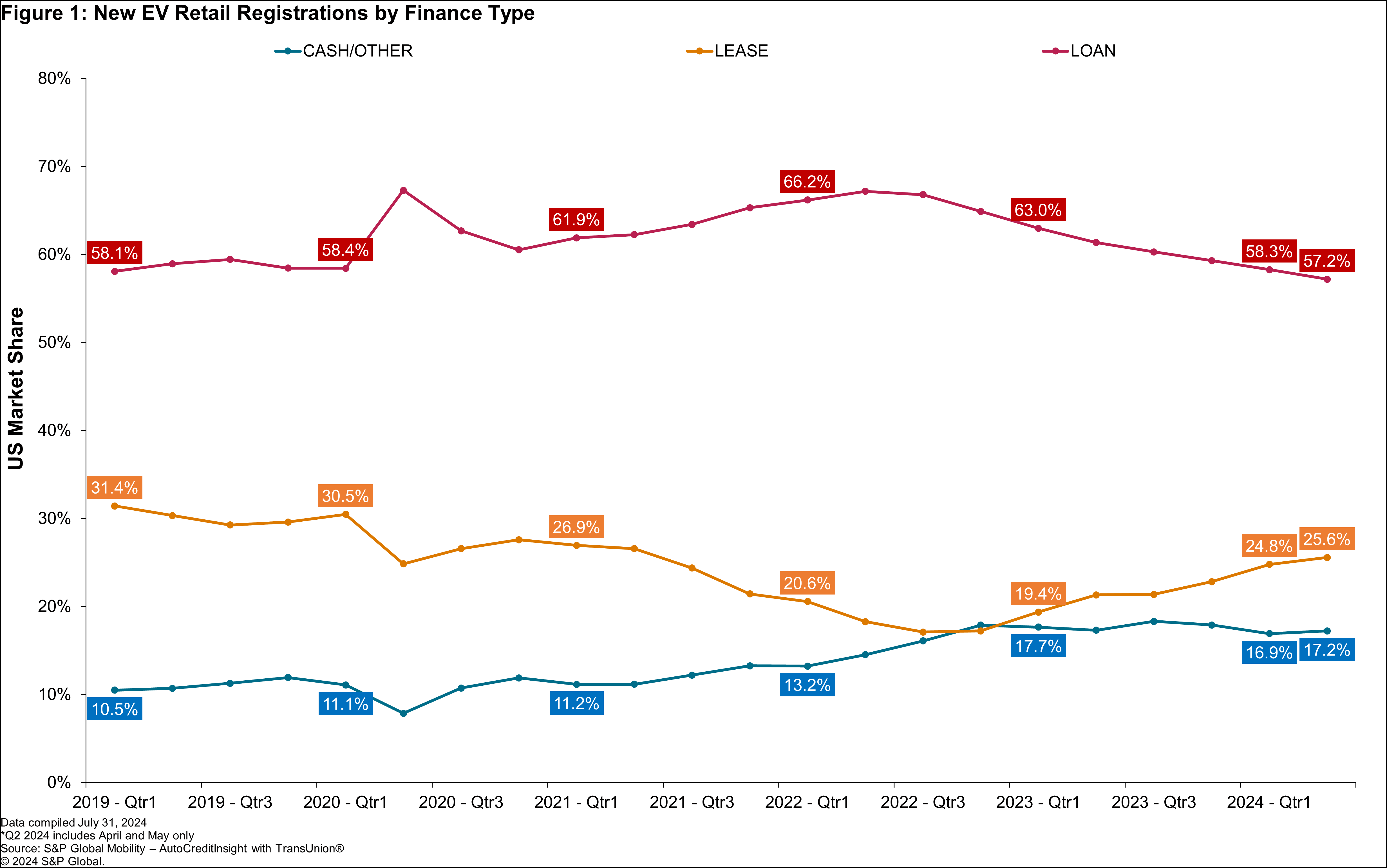

automobiles, is leasing. We’ve seen a rising share of leased

new automobiles because the second half of 2022, as proven in Determine 1.

From its low level of 17.1% in Q3 2022, lease combine has climbed extra

than 8 share factors to 25.6% this previous April and Could. Notice

that almost all of leasing good points have come on the expense of loans, whereas

money combine has remained comparatively steady because the finish of 2022.

However federal laws, and particularly the Inflation

Discount Act (IRA) signed into legislation by President Biden in August of

2022, has additionally contributed to this shift. Particularly, the IRA

permits most EV leases to qualify for a $7,500 tax credit score, in

distinction to loans, which have quite a few {qualifications}. These

extra funds offered by the IRA have additionally enabled sellers to

provide engaging EV lease month-to-month funds, relative to mortgage

funds.

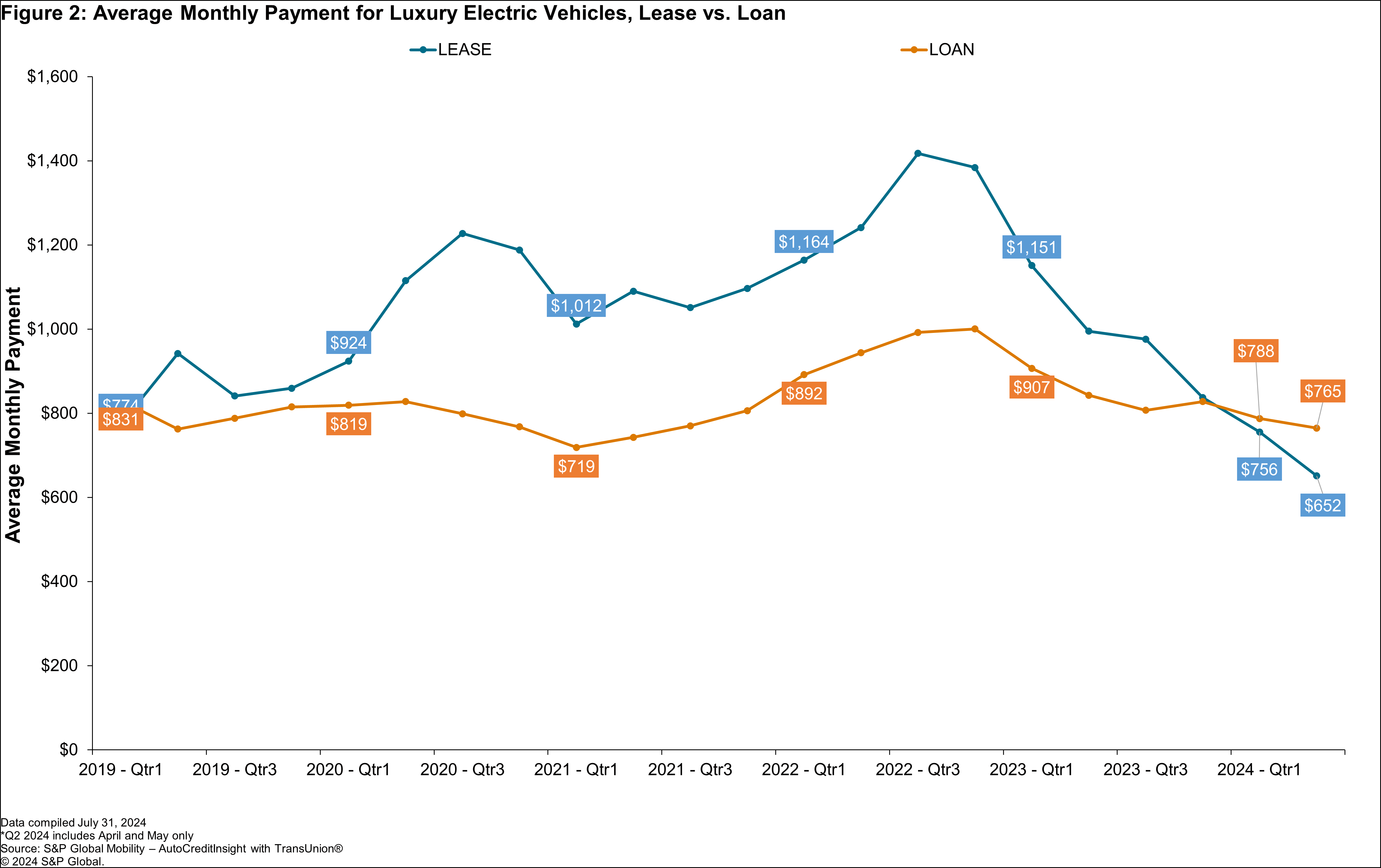

As Determine 2 demonstrates, lease funds for luxurious EVs rose

considerably firstly of 2020 when the pandemic arrived and

stayed elevated by way of a lot of 2022. However, beginning on the finish of

2022 quickly after the IRA went into impact, lease funds started to

decline each in absolute numbers and relative to mortgage funds.

And, within the first 5 months of this yr, luxurious EV lease

funds have fallen beneath mortgage funds (a extra regular relative

place for them based mostly on historical past).

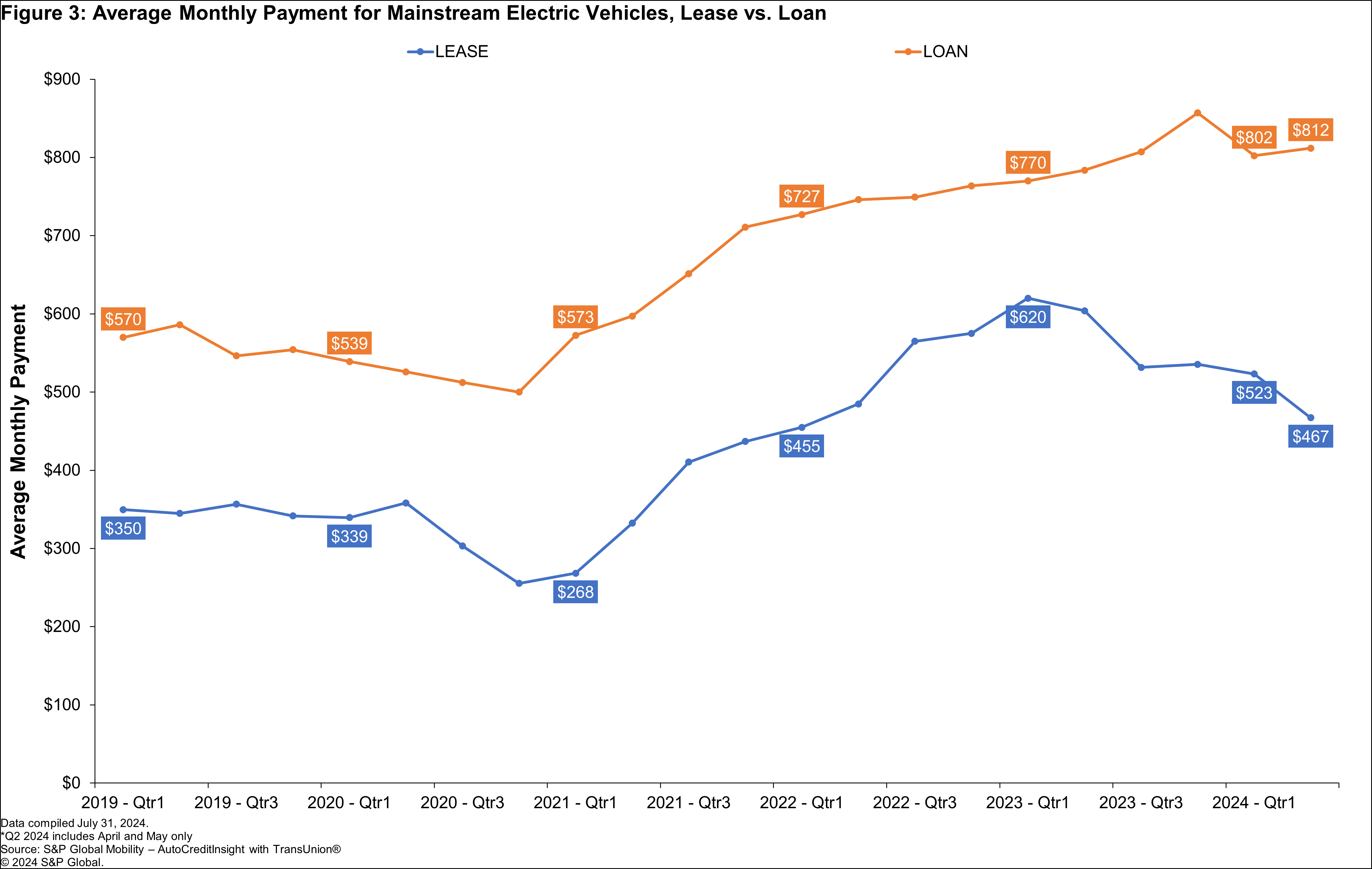

The identical traits have occurred within the mainstream EV market, as

illustrated by Determine 3. Within the mainstream area, EV lease funds

have been beneath mortgage funds all through the displayed time interval,

however the hole started to widen shortly after the IRA adoption date, and

since Q3 2023 the distinction between the 2 metrics has elevated

dramatically.

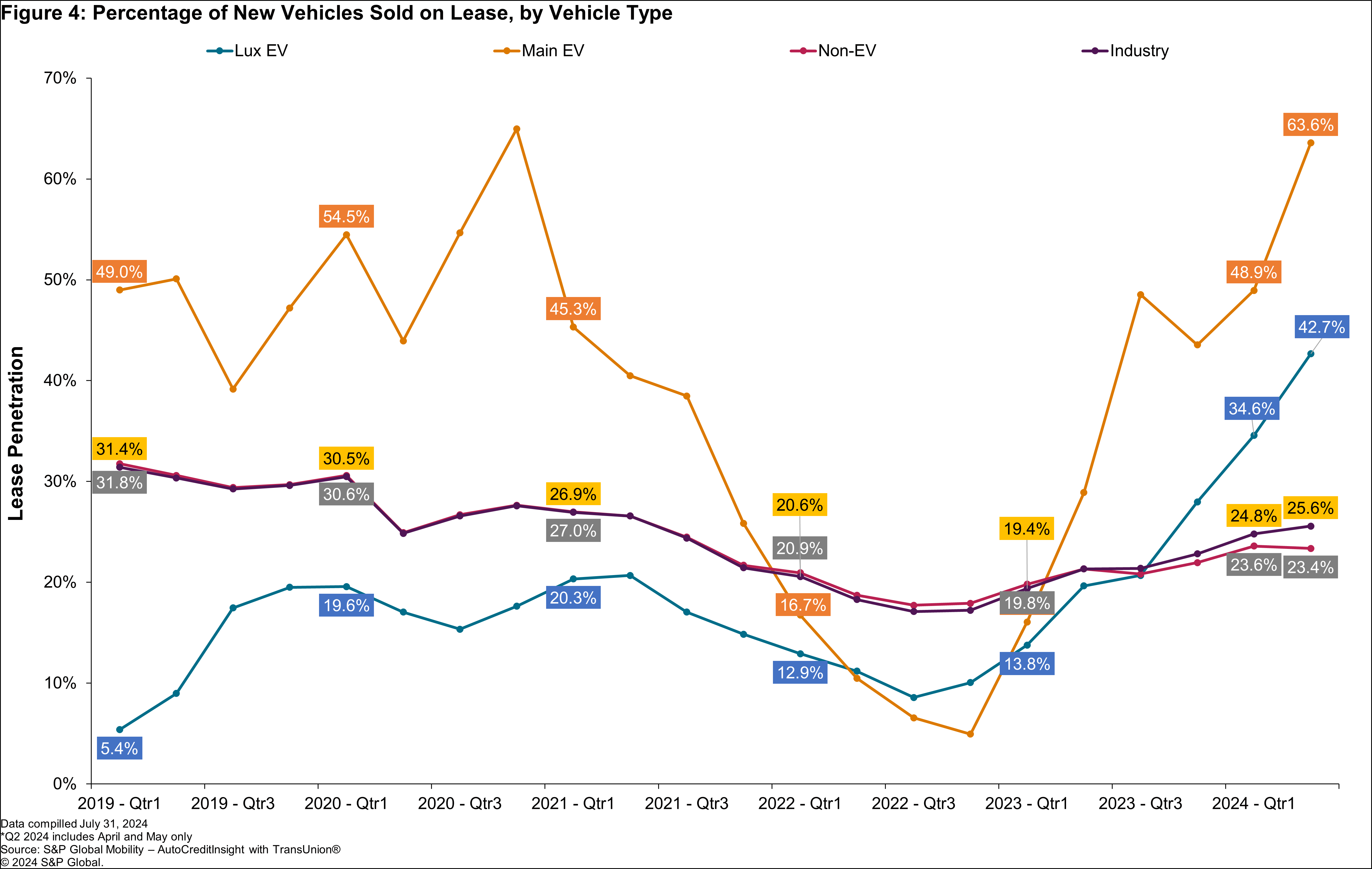

This elevated worth proposition of leasing EVs, relative to

buying them, understandably has pushed lease ranges to

exceptionally excessive ranges. Whereas industry-wide lease combine has solely

risen barely within the final a number of months, the EV lease combine amongst

mainstream merchandise has climbed from 4.9% in This fall 2022 to 63.6% this

previous April and Could; equally, lease penetration within the luxurious EV

sector has jumped from 8.6% in Q3 2022 to 42.7% in April and

Could.

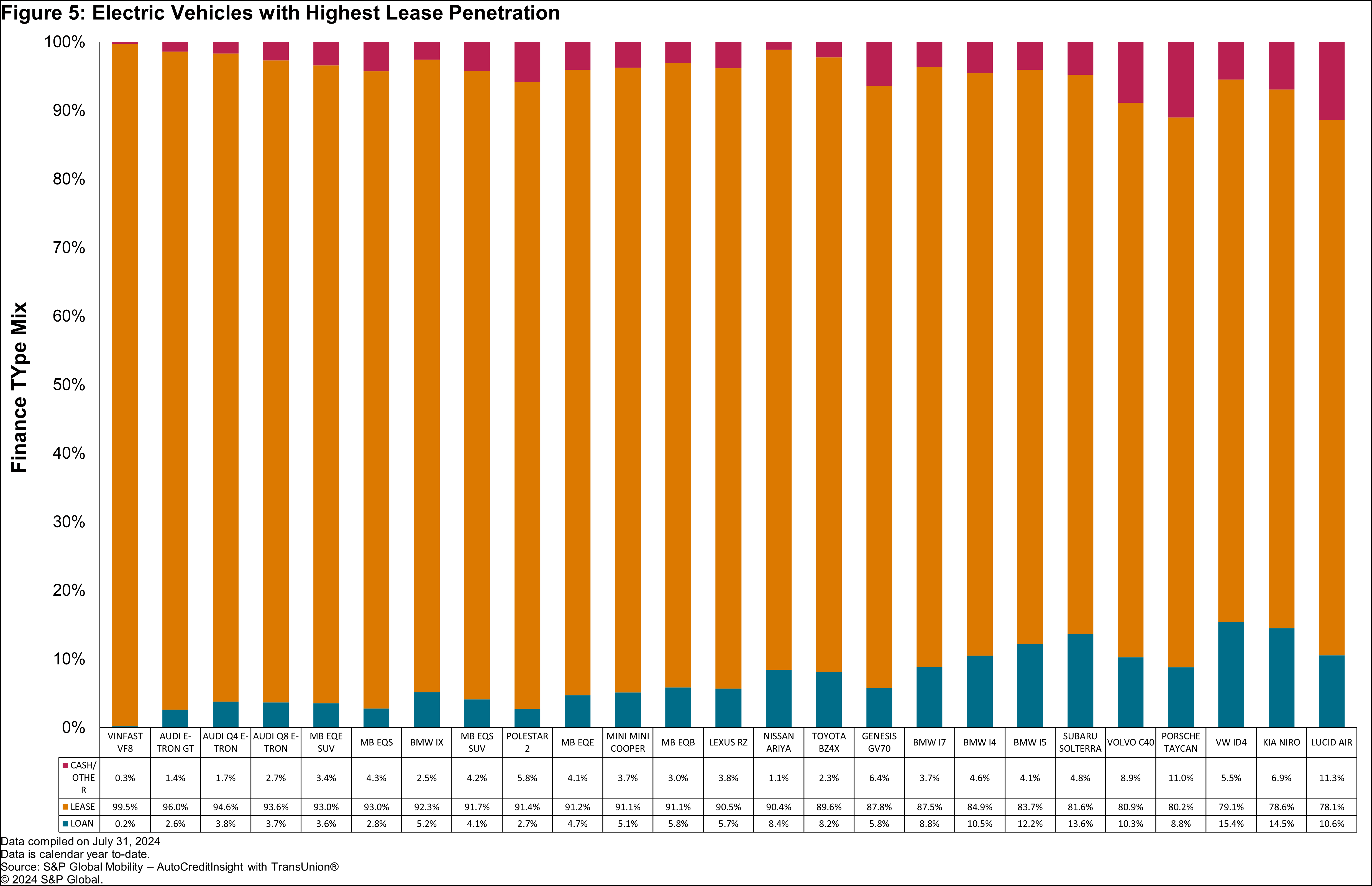

On the mannequin degree, these financing dynamics have introduced some

extraordinary outcomes. Within the first 5 months of this yr, 22

fashions, together with 17 luxurious fashions, had a lease penetration larger

than 80%, and 14 of those fashions loved a lease combine above 90%.

Whereas the posh area historically has a better lease combine than

the mainstream market, such a excessive variety of fashions with

exceptionally excessive leasing enterprise is uncommon.

These knowledge level to no less than three conclusions. An apparent one

is that if a model needs to compete within the EV area, it must be

an aggressive participant within the leasing enterprise. Succeeding on this

endeavor requires an lively, established, and aggressive captive

finance supply.

A second takeaway is that governmental rules, whether or not at

the state or nationwide degree, can nonetheless be used to shift the market

in a path favored by these in energy.

And lastly, these knowledge counsel that the EV market continues to

be in its early phases and subsequently topic to fast fluctuations

relying on rules, incentives, new fashions, discontinued

fashions, different gasoline sort availability, and the ultimate worth

proposition for the patron.

In partnership with TransUnion, S&P World Mobility’s

AutoCreditInsight™ is essentially the most complete, correct and well timed

automobile registration and loyalty knowledge with automotive mortgage

origination exercise.

This text was printed by S&P World Mobility and never by S&P World Scores, which is a individually managed division of S&P World.