[ad_1]

Gross sales of hybrid and battery electrical autos (BEVs) have grown

exponentially over the previous couple of years; nonetheless, a bigger query

faces the {industry}: the place do these patrons go subsequent when returning to

market?

By means of S&P World Mobility’s

automotive loyalty knowledge, which analyzes new automobile

registrations and return-to-market exercise, we are able to observe precisely

how these patrons behave when selecting their subsequent automobile.

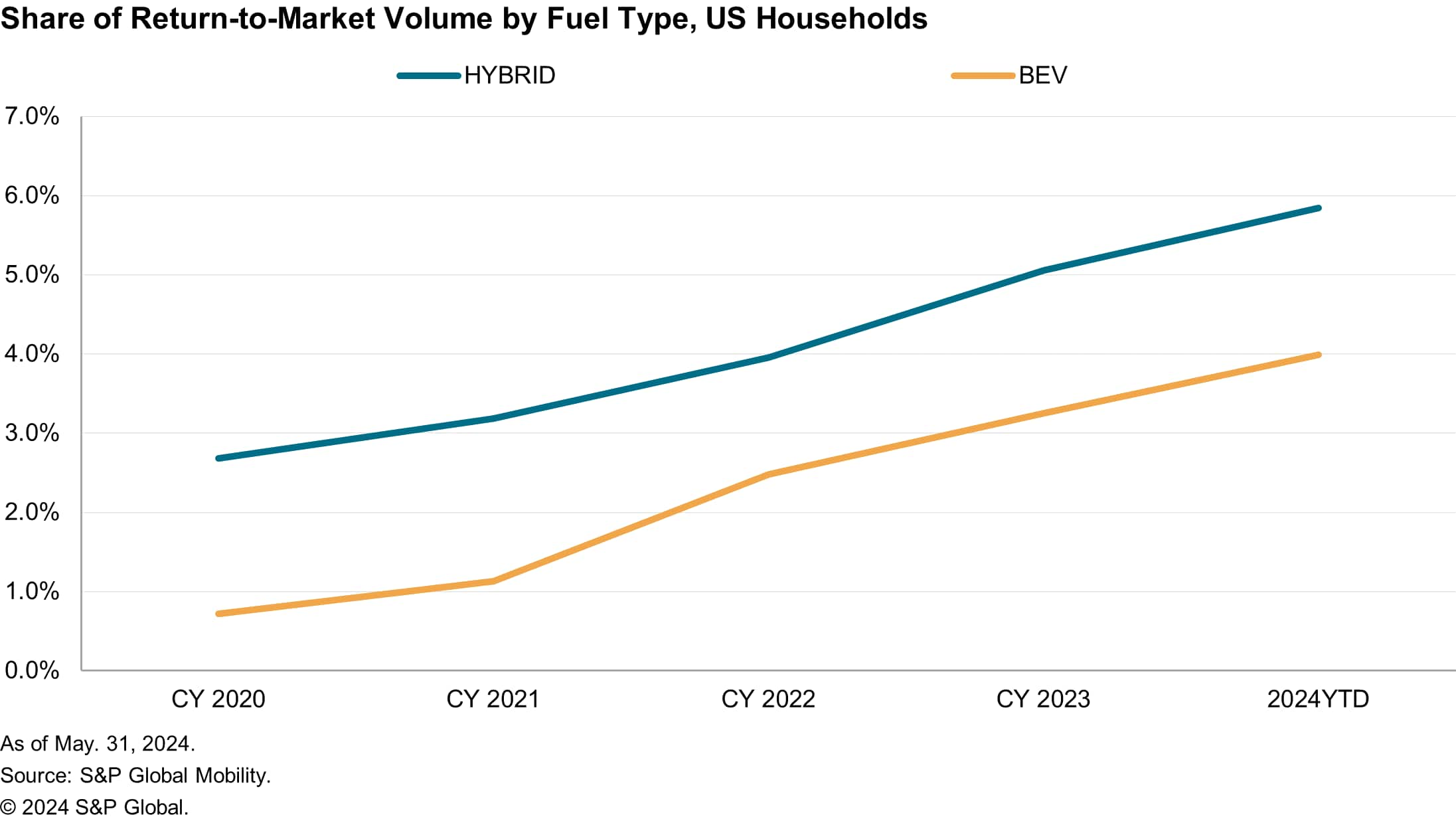

Since 2020, the share of households that beforehand bought

both a hybrid or BEV after which purchased one other new automobile

afterward has steadily elevated by a median of ~1 share

level every year. As of Might 2024, these households characterize shut

to 10% of whole {industry} return-to-market share for the yr to this point

— greater than double the proportion from only a few years

in the past.

The rise in return-to-market share amongst hybrid and BEV

purchasers may be attributed to a rising portfolio of obtainable

choices, with the variety of fashions in these automobile classes

rising by 12% and 157%, respectively, during the last 4 years.

Consequently, the chance for sellers to retain prospects is

stronger than it has ever been.

Latest outcomes, nonetheless, present retention conduct differs

relying on gasoline kind.

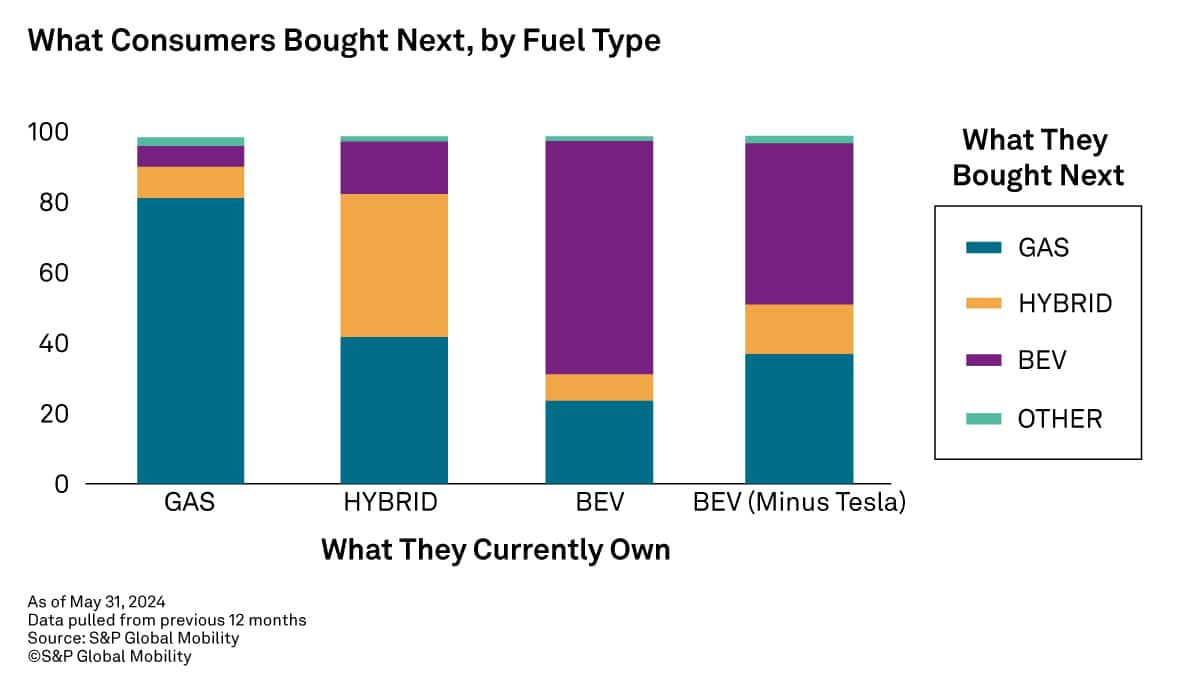

When analyzing family return-to-market exercise, we observe

that every purchaser’s loyalty to their earlier gasoline kind varies when

making their subsequent buy. Within the case of households that

beforehand got here from a gasoline automobile, they are typically extra secure,

with greater than 82% of them buying one other gasoline automobile. For

these gasoline households that select an alternate powertrain as an alternative,

they’re extra prone to want a hybrid over a BEV, as 9% select

the previous vs. 6% who go together with the latter.

For hybrid households, however, decisions are extra

distributed throughout all gasoline sorts. Hybrids may be seen because the

mid-point between a gasoline and electrical powertrain, but solely 15% of

hybrid house owners select a BEV for his or her subsequent buy. As a substitute, they

are break up evenly on remaining with one other hybrid (41%) or transferring

again to a gasoline powertrain (41%). The shortage of motion to BEVs may

persist because of continued struggles in constructing a prevalent charging

infrastructure together with a slowdown in EV demand.

For returning BEV households, there are two totally different patterns,

relying on the way you view the info. On the floor, when taking a look at

all BEV return-to-market exercise, there’s an awesome

dedication to the powertrain with ~68% of those households

remaining loyal to the gasoline kind. Nonetheless, a key driver of this

loyalty is the sturdy retention and recognition of Tesla, which

accounts for many of those households. Tesla’s industry-leading 67%

model loyalty, and 65% share of all BEV return-to-market quantity,

makes them the first driver of any exercise amongst BEV house owners with

the family’s subsequent buy.

Nonetheless, with out Tesla within the combine, return-to-market exercise

among the many remainder of BEV households reveals much less of a dedication to the

electrical powertrain. Solely 47% of non-Tesla BEV households select

one other BEV automobile for his or her subsequent buy, preferring as an alternative to

transfer to both a gasoline automobile (38%) or a hybrid (14%). Though the

highest share of return-to-market exercise stays in a BEV,

the distinction in motion to both a gasoline or hybrid automobile

indicators these households is probably not as dedicated to the electrical

powertrain in comparison with a Tesla family.

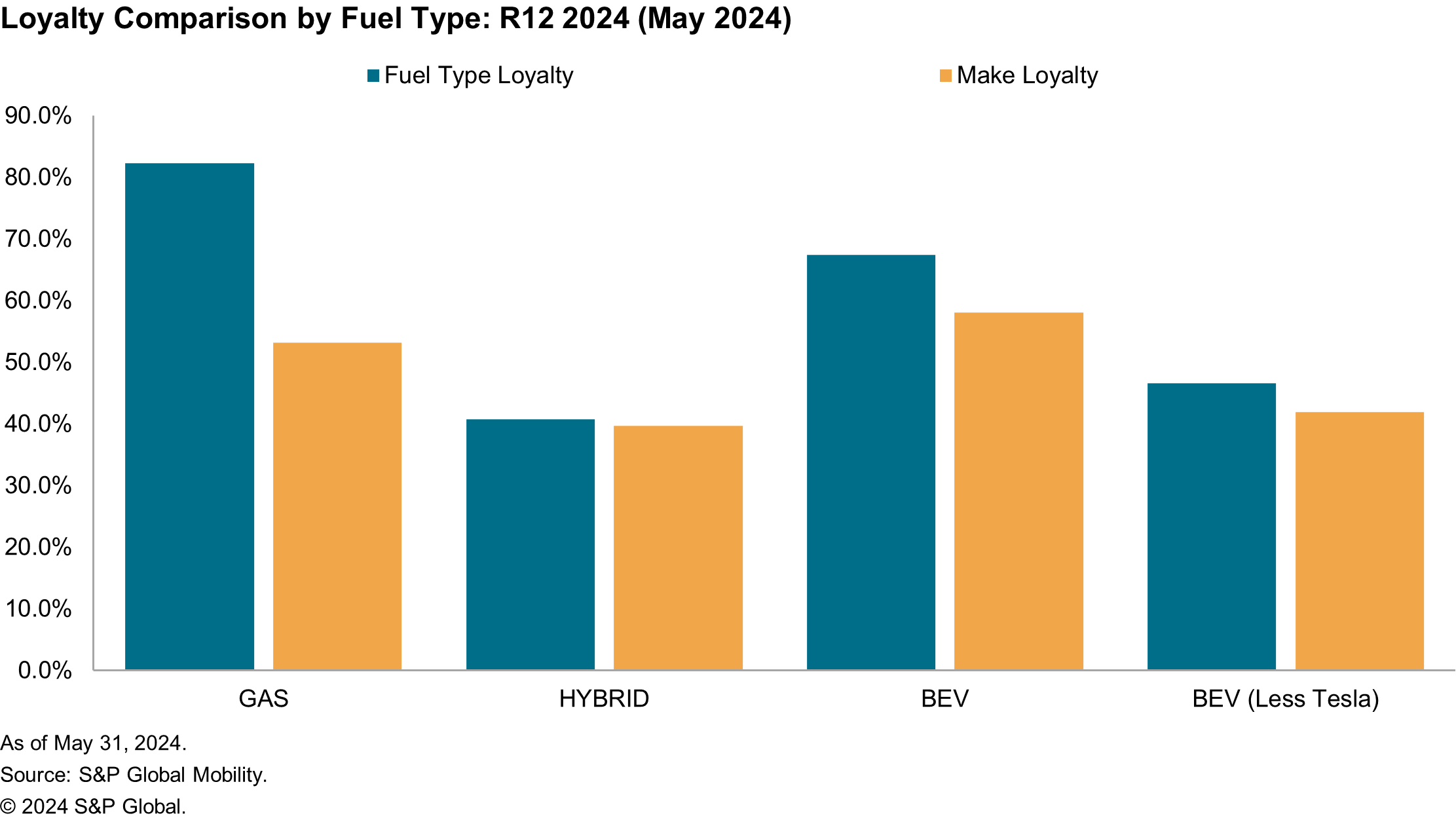

The Tesla impact amongst BEV households can higher be defined

when evaluating loyalty to gasoline kind versus model. Given its early

market entry, Tesla had the benefit of constructing a fame as

the chief on this discipline, yielding sturdy loyalty to the model as

nicely because the gasoline kind.

When taking a look at all BEVs, the outcomes present these households have

excessive loyalty to the gasoline kind (68%) and the model (58%). However in the event you

simply checked out Tesla, the loyalty numbers are even increased (76% gasoline

kind / 67% model). Eradicating Tesla from the combination causes a drastic

shift, with loyalty to the gasoline kind dropping to 47% and model

loyalty falling to 42%. These numbers are extra in step with hybrid

autos (41% gasoline kind / 40% model).

Whereas an assumption could possibly be made that the decrease gasoline kind

loyalty may be attributed to non-Tesla patrons having extra gasoline

choices inside the model they bought an EV from, this isn’t the

case. What the info reveals is non-Tesla households, who come from

both a hybrid or BEV, will not be very loyal and usually tend to

defect away from each the powertrain and model with the subsequent

buy.

Though the present state of retention amongst hybrids and BEVs,

exterior of Tesla, is difficult, continued funding in

infrastructure and new mannequin manufacturing may assist strengthen these

numbers sooner or later. Rising familiarity with the know-how and

a bigger pool of obtainable choices will assist in giving returning

households extra causes to decide to different powertrain

autos with their subsequent buy.

Register for our loyalty developments webinar.

Demo our loyalty analytics instrument.

This text was printed by S&P World Mobility and never by S&P World Scores, which is a individually managed division of S&P World.

[ad_2]