US producers are competing for market share of full-size

half ton pickups.

The complete-size half ton pickup phase within the US will get vital

consideration from the media, analysts, and several other producers. But,

it is just the fourth-largest phase within the trade.

The distinctive consideration paid to this car class is due

to a number of information, together with:

- Three of the pickup fashions are quantity leaders for his or her

respective manufacturers in addition to trade broad. - The phase is among the few through which home producers

nonetheless maintain a commanding place. - Homeowners are likely to have excessive model loyalty.

- The autos are extremely worthwhile for his or her respective

OEMs. - The underlying architectures of those fashions are additionally the premise

for full-size SUVs, leading to scale that drives excessive

profits-per-vehicle throughout each segments.

Given this panorama, it’s noteworthy that the relative

positions of a number of entries on this phase have shifted

lately—significantly the Toyota Tundra.

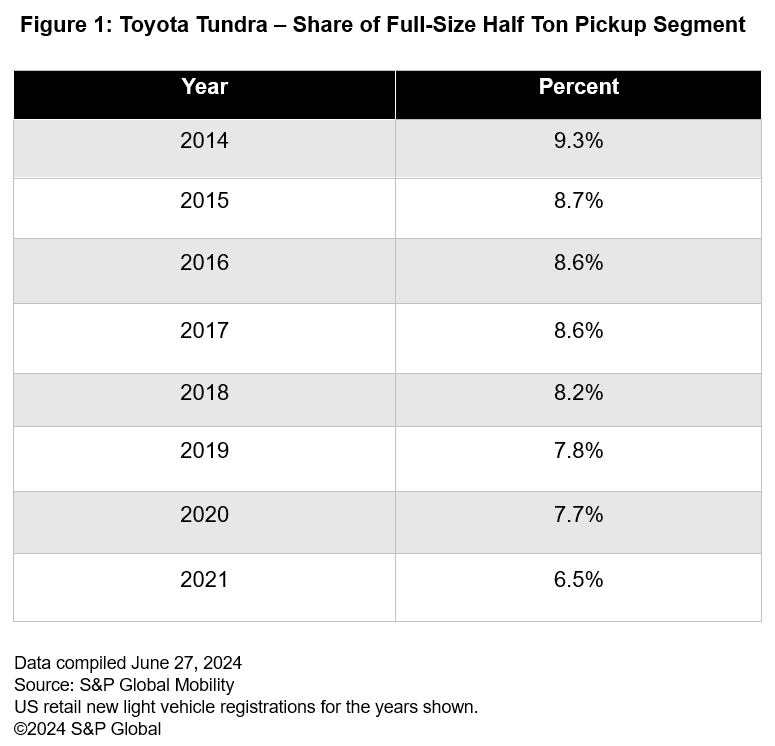

The Tundra has not traditionally been a frontrunner for the corporate,

in comparison with most different Toyota merchandise which rank within the prime three

of their respective segments. The Tundra has lagged behind most

rivals and its place deteriorated from 2014 by means of 2021

(See Determine 1).

Nonetheless, Toyota launched an all-new Tundra within the US in late

2021 as a 2022 mannequin 12 months car (vital new retail

registrations first appeared in December 2021). Designed and

engineered within the US, this car provides content material, expertise, and

a breadth of options which might be far more in keeping with home

rivals than previous Tundra fashions.

New options of the 2022 Tundra embrace:

- Aluminum-block, twin-turbo 3.5-liter V6 engine as commonplace,

mated to a 10-speed automated transmission; this engine delivers

389 horsepower and 479 pound-feet of torque, extra energy and torque

than some aggressive V8 powertrains. - Excessive-strength, totally boxed, steel-ladder body, utilizing aluminum

in key areas for weight discount. - Sheet-molded compound mattress with strengthened aluminum cross

members. - Inside with an instrument panel dominated by a horizontally

mounted 14-inch contact display screen. - Capstone high-end sequence, with upgraded supplies, luxurious

inside, and improved applied sciences as commonplace; this sequence

offers competitors to the F-150 King Ranch and Platinum and

Sierra Denali sequence.

Loyalty Additionally Improves for Tundra in Tandem with Share

Development

S&P World Mobility registration and loyalty information clearly

point out that the Tundra's market efficiency started to enhance at

nearly the identical time as the brand new model arrived at Toyota shops.

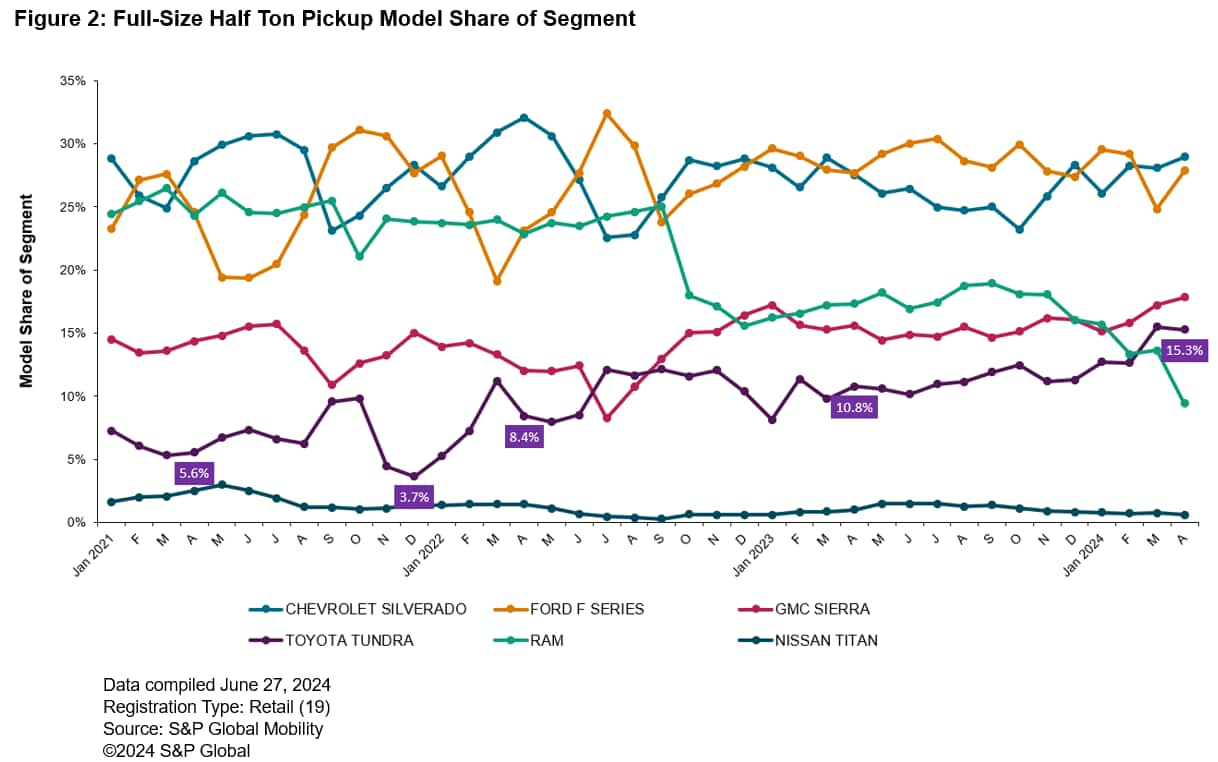

As Determine 2 signifies, Tundra's retail share of the full-size half

ton pickup phase greater than doubled from 3.7% in December 2021 to

8.4% in April 2022.

In April 2024, Tundra's retail share reached a document 15.3%,

greater than 4 occasions its share again in December 2021 when the brand new

model arrived. It is usually noteworthy that Tundra now (as of

April) ranks #4 within the phase, forward of all fashions besides the

Silverado 1500, F-150, and Sierra 1500.

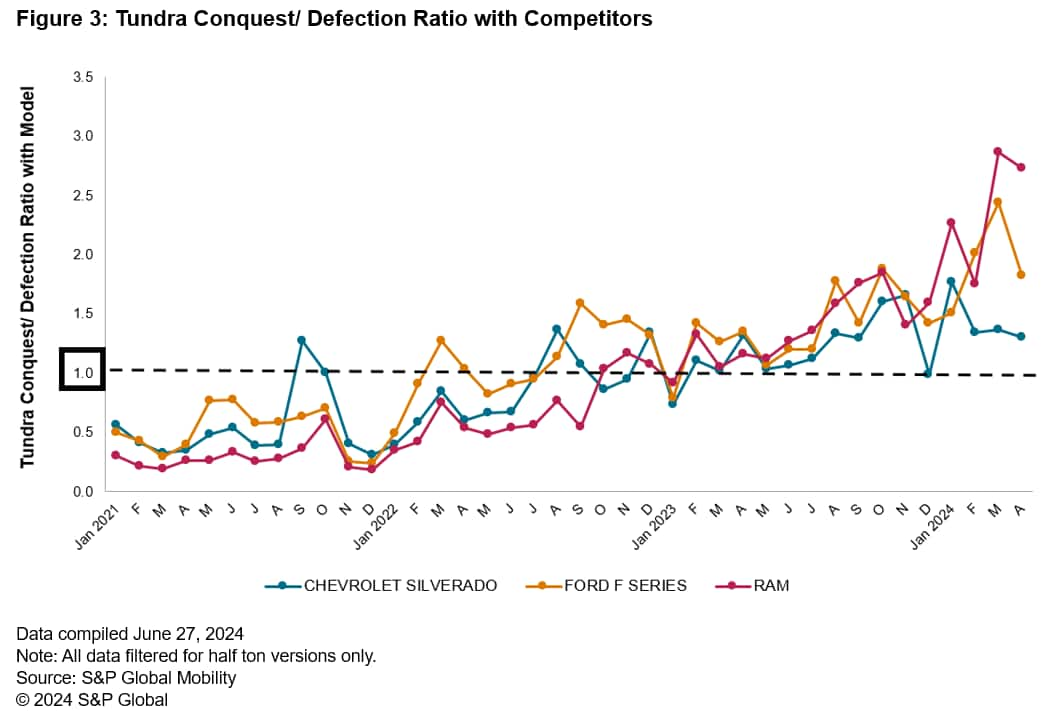

The enhancements in Tundra's conquest/ defection ratios

(conquests or influx divided by defections or outflow) with key

rivals additionally illustrate Tundra's considerably improved

efficiency for the reason that arrival of the re-designed model.

As Determine 3 signifies, in 2021 Tundra had a web outflow with

every of its three most important rivals in each month besides two.

Nonetheless, starting within the early months of 2022, with the brand new Tundra

now accessible, its ratio started to rise and has been better than

1.0 (indicating web influx) with all three fashions each month since

February 2024. Impressively, Tundra's ratio with F-150 and Ram 1500

surpassed 2.0 in a number of of those months.

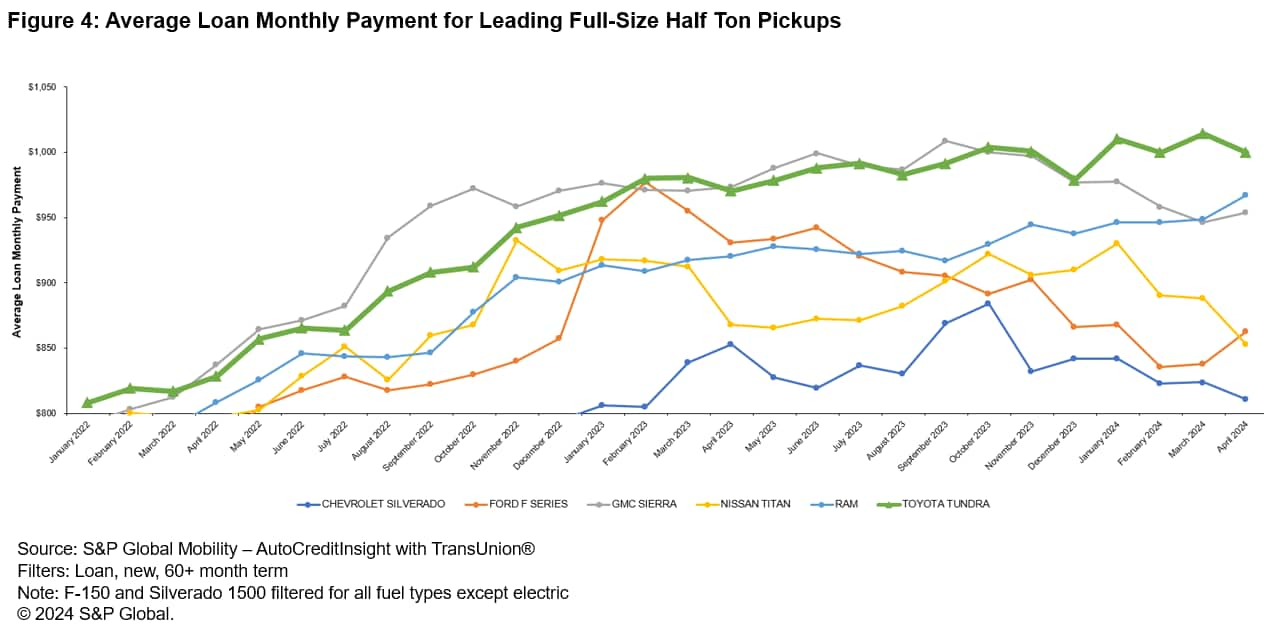

Lastly, Tundra's mortgage month-to-month fee information counsel Toyota was

capable of command a fee equal to the upscale Sierra 1500 for a lot

of the 2023 calendar 12 months and above that of all different rivals,

adopted by a segment-leading fee in every of the 4 months in

2024 for which S&P World Mobility has full information. Furthermore,

Tundra's fee reached a near-term document of $1,014 in March of

2024 exceeding Silverado 1500 and F-150 month-to-month funds by 23% and

21%, respectively.

Sustaining share on this phase is essential for home US

producers to generate the income wanted to develop EVs, which

at present bleed crimson ink for many, if not all, producers.

Toyota, then again, sees this class because the one remaining

house left to overcome within the enormous US retail new car market.

The underside line is that each make might be battling for each

attainable full-size half ton pickup sale within the coming months.