[ad_1]

By Greg Genette, Analyst, Technical Analysis and

Andrej Divis, Analysis and Evaluation Govt

Director

Potential adjustments to the US authorities starting in 2025 will

seemingly form the way forward for US local weather insurance policies, as leaders maintain

differing views on local weather motion and main coverage milestones

strategy. The chief and congressional make-up will probably be essential,

with Republicans seemingly pushing for important adjustments within the

coverage surroundings and Democrats favoring continuity.

This evaluation will discover potential impacts on the medium and

heavy business car (MHCV) market, notably automobiles above 6.0

metric tons and roughly equal to US Lessons 4-8.

The place we stand as we speak: Assessing the present

surroundings

The present US trucking market will be categorized into two key

areas: First, the economic system and truck demand, and second, coverage and

electrification. Our baseline forecast anticipates a modest

enhance out there general and within the zero-emission phase.

With labor situations loosening and inflation moderating, the US

Federal Reserve is predicted to proceed chopping rates of interest in

2024, boosting truck demand after a interval of over-capacity and

weak service profitability.

Truck gross sales are predicted to stay flat in 2024, however momentum

is predicted to construct towards a record-setting 2026 because of

improved financial situations and the temptation to purchase forward of

2027 diesel-truck emissions adjustments. On the regulatory and coverage

entrance, California’s Superior Clear Vehicles rule and the federal

Greenhouse Gasoline Part 3 emission laws will form the

trade’s adoption of electrified automobiles via the midterm. We

consider the following 36 months are a crucial make-or-break interval for

trade zero-emission car (ZEV) objectives and aspirations. The

incoming presidential administration can have the chance to

form the vitality transition and the trajectory of general new truck

demand.

Trucking via 2024: Evaluating potential

impacts

The potential impacts of a change in authorities will be

categorized and evaluated underneath the identical two areas described

beforehand: the economic system and truck demand, and coverage and

electrification.

Financial development and demand for brand spanking new vehicles may face two

new realities with a brand new administration taking workplace subsequent

12 months. There are two major pathways that might shift the prevailing

market demand forecast, primarily via new tariffs. The primary

state of affairs predicts increased truck gross sales if the economic system exceeds

expectations, with decrease inflation, rate of interest cuts and strong

shopper spending boosting demand past ranges anticipated in our

baseline for 2025 and 2026.

Conversely, a second state of affairs anticipates decrease truck gross sales due

to detrimental financial components, together with a possible commerce warfare,

rising tariffs and decreased shopper confidence, impacting general

financial efficiency and highway freight tendencies. Beneath the floor,

it is usually essential to notice that new tariffs may instantly hinder

the adoption of electrified business automobiles, relying on the

particulars. A lot of the battery provide chain relies in mainland

China, offering a price benefit. Though efforts to localize

battery manufacturing and different crucial parts are ongoing,

the US remains to be years away from finishing this transition. Greater

tariffs may discourage patrons by elevating costs, additional slowing

the vitality transition in trucking, and it isn’t clear that such

insurance policies could be related to simply one of many presidential

candidates.

In abstract, from an financial and new truck demand perspective,

the important thing issue to observe concerning the affect of the brand new

administration on the broad truck market is the extent to which new

tariffs could also be imposed, affecting macroeconomic indicators, new

truck demand and the prices of electrical car parts and

batteries.

Below a brand new administration, laws and the

prospects for electrification may face a posh new

future. Below present market situations, zero-emission

vehicles stay comparatively costly for a lot of truck vocations

(functions) relative to a diesel truck, particularly with out

incentives. Subsequently, our forecast assumes that stringent

laws would be the major demand driver for zero-emission

vehicles via the late 2020s and into the 2030s. A shift to

Republican management is extra more likely to considerably change the

regulatory panorama for trucking within the US, introducing

uncertainty and threat to our zero-emission car forecast. The

following paragraphs will discover potential situations and their

impression on our powertrain forecast. We’ll give attention to three key

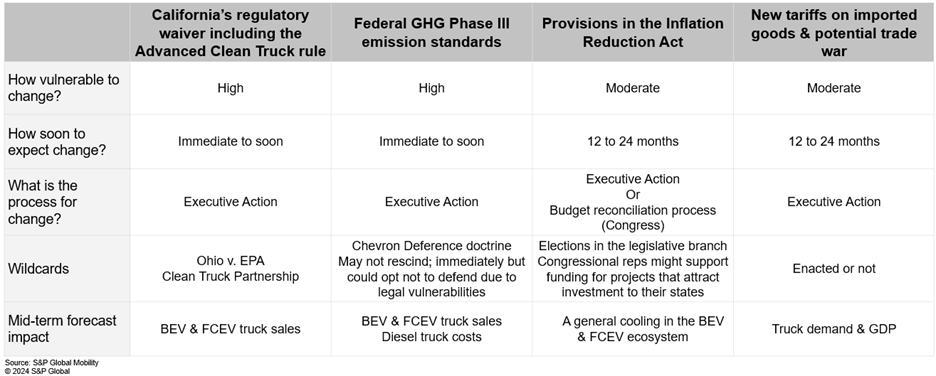

subjects: California’s regulatory waiver, the federal Greenhouse Gasoline

Part 3 requirements and the Inflation Discount Act.

California’s regulation waiver:

California’s authority to set its personal car emissions

requirements, granted underneath the Clear Air Act, was revoked by the

Trump administration in 2019 however reinstated by President Biden,

which enabled California’s current Superior Clear Truck (ACT)

regulation.

One other revocation is one threat underneath a brand new administration, however

not the one threat on this time interval. A pending Supreme Courtroom

case, Ohio v. EPA, may problem California’s waiver, doubtlessly

disrupting these guidelines and including a component of uncertainty to the

way forward for this regulation, no matter administration. Nevertheless,

many truck producers have dedicated to following the Superior

Clear Truck rule no matter authorized outcomes, in what they’re

calling the Clear Truck Partnership, decreasing the chance of main

adjustments to market situations.

In abstract, utterly eliminating this rule would considerably

decrease our zero-emission car forecast. Nevertheless, for this to

turn out to be actuality, a number of uncertainties would must be

resolved.

Greenhouse Gasoline Part 3:

The Greenhouse Gasoline (GHG) Part 3 regulation, set to start in

2027, mandates progressively stricter CO2 requirements for

medium and heavy business automobiles via 2032. Though it does

not require the sale of ZEVs, it does encourage not directly them

via the tightness of the requirements.

We count on a Democratic administration to maintain this regulation in

place and maybe prolong and tighten these emissions guidelines past

2032. A Republican administration could also be extra open to listening to

critics of the measure and maybe rescind and weaken these

requirements, doubtlessly delaying their enforcement.

In the meantime, the Supreme Courtroom’s ruling towards Chevron Deference

may result in elevated authorized challenges towards EPA laws,

including additional uncertainty to the trucking trade and the long run

pathway for GHG laws. Adjustments to delay or reduce GHG

requirements are more likely to diminish our outlook for zero-emission

truck adoption, notably within the late 2020s and early 2030s.

The Inflation Discount Act:

The Inflation Discount Act (IRA), handed in 2022, allotted

$369 billion for local weather and clear vitality, together with a number of key

investments for decarbonizing trucking. The IRA notably provided up

to $40,000 in tax credit for clear business car purchases,

in addition to incentives for infrastructure and clear hydrogen.

Whereas a brand new administration could modify elements of the IRA, a full

repeal is unlikely, because of the legislative course of required to do

so and because of the help for numerous elements of the laws from

throughout the political panorama. Even so, the $40,000 tax credit score is

not anticipated to considerably speed up zero-emission truck

adoption within the close to time period owing to excessive prices and operational

challenges.

Conclusion

Below a Republican administration the next have the

potential to alter:

A brand new authorities in 2025 may considerably impression the US

trucking trade by reshaping tariffs, laws and local weather

insurance policies. Potential adjustments like revising California’s emissions

waiver, rescinding and redrafting federal GHG Part 3 requirements,

and modifying provisions of the Inflation Discount Act may

doubtlessly sluggish electrical truck and bus adoption. The timeline for

these adjustments, particularly throughout the first 100 days, stays

unsure. Key wildcards just like the Ohio v. EPA case, the overturning

of Chevron Deference, and election outcomes in Congress may

additional affect regulatory changes on this extremely regulated

and economically delicate trade.

Obtain our free MHCV forecast by area.

Study extra about our business car options.

This text was printed by S&P International Mobility and never by S&P International Rankings, which is a individually managed division of S&P International.

[ad_2]