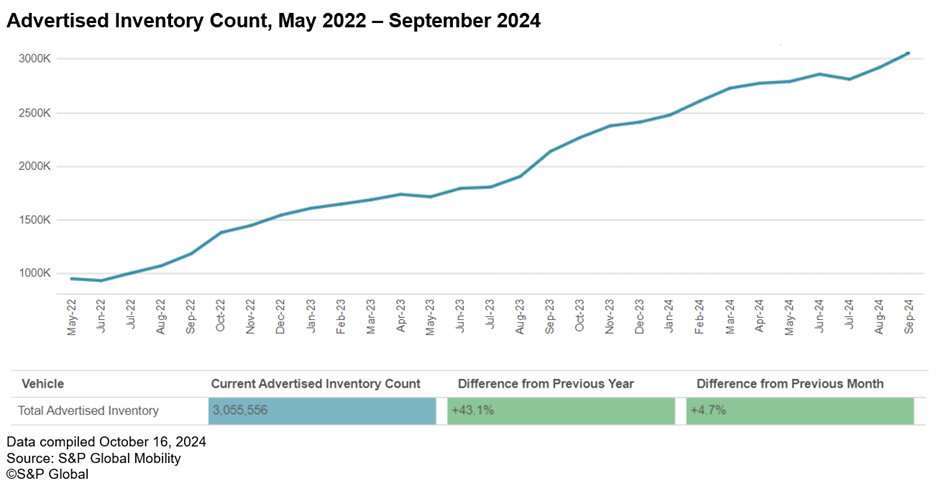

Marketed car stock within the US soared to three.056 million

models in September 2024—marking a major 4.7% enhance

from the earlier month and breaking the three-million mark for the

first time in our dataset. This surge aligns with a broader pattern

we have noticed over the previous two years, the place stock ranges

persistently rise within the fall.

The car stock rise seems throughout most OEMs and

segments, with some exceptions. Stellantis manufacturers are down vs. final

month (Jeep -4.1%, RAM -1.4%, Dodge -9.1%) and a few premium

manufacturers have decreased as properly (Audi -7.8%, Cadillac -1.6%, Lincoln

-0.8%)

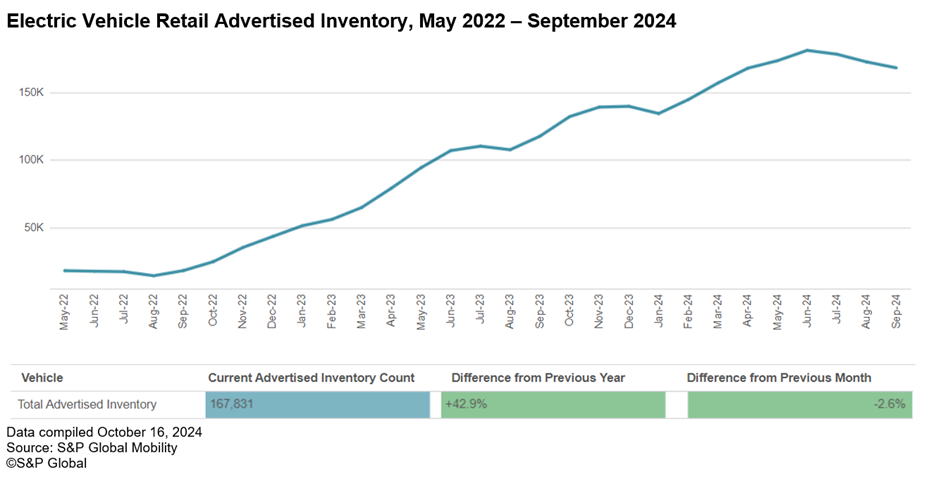

Curiously, whereas general stock has been rising,

electrical car stock has decreased and is down 2.6% vs.

August. This has reversed a pattern that we had seen in earlier

months the place EV stock was rising greater than the {industry} as a

complete.

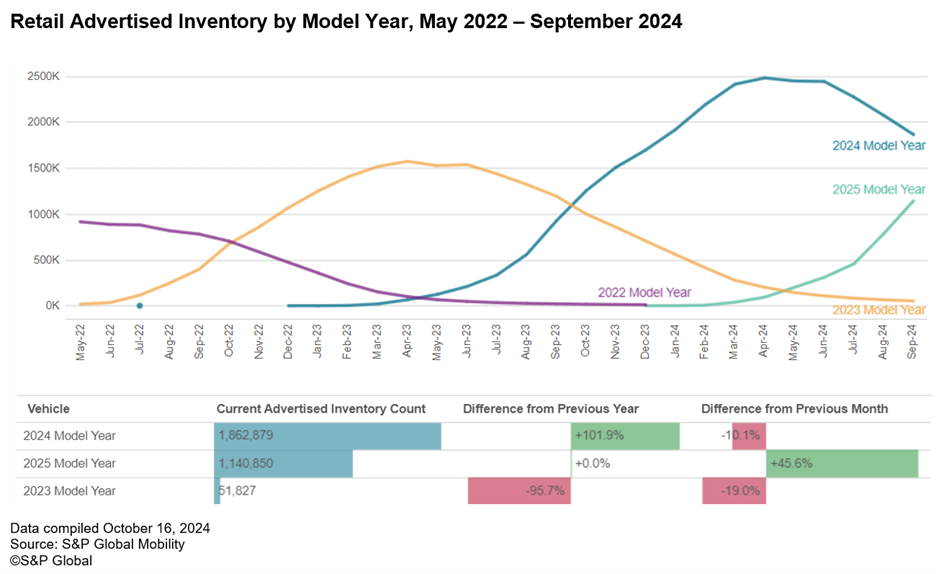

The mannequin yr element helps to elucidate a lot of the general

industry-level outcomes. The roll-out of the 2025 mannequin yr

continues to speed up and is up 45.6% vs. the tip of August.

In the meantime, 2024 and 2023 mannequin yr inventories have decreased by

10.1% and 19.0%, respectively.

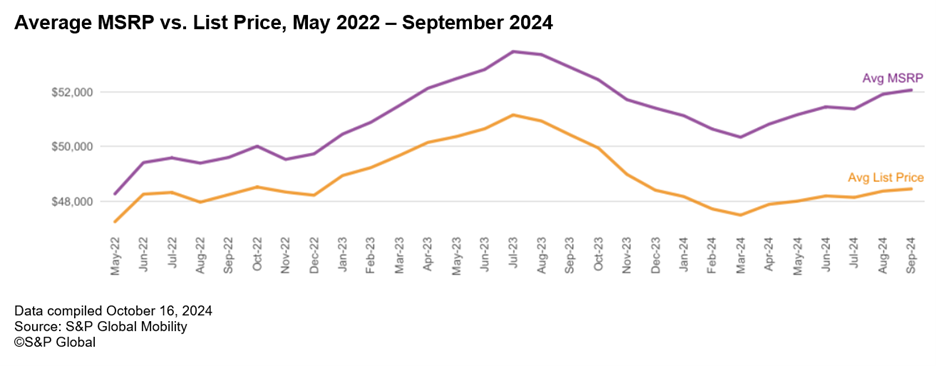

Costs additionally proceed to rise, with the common MSRP standing at

$52,066 on the finish of September, up 3.3% in comparison with March 2024.

The typical supplier listing worth has elevated to $48,460, a rise

of two% vs. March.

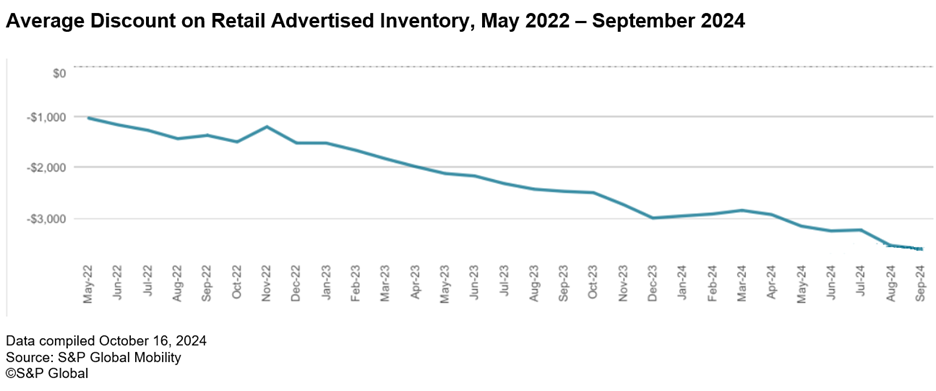

This hole could be seen by

This hole could be seen by

the rise within the common listed low cost, which has reached

$3,606 on the finish of September. This is a rise of 21.2% since

March.

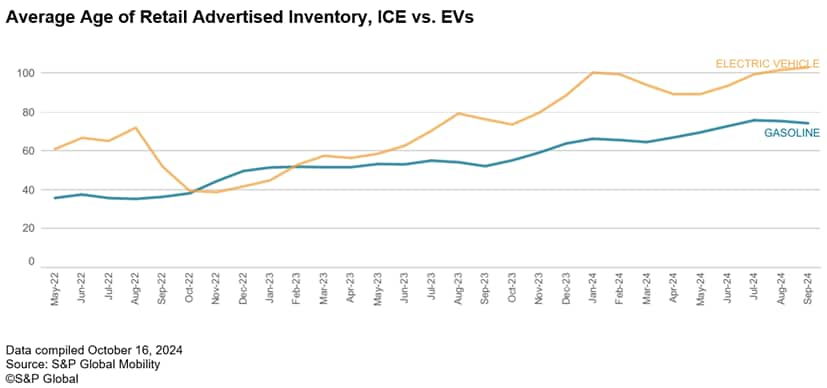

The typical age of marketed stock decreased barely to 79

days in September however is up from 56 days final September. Within the

following chart, we will see that gasoline autos have been

marketed for 74 days on common, whereas electrical autos are

growing older at a higher price and now have been listed for 103 days on

common.

This text was printed by S&P International Mobility and never by S&P International Scores, which is a individually managed division of S&P International.