[ad_1]

All main market segments skilled seasonally adjusted costs that had been down 12 months over 12 months in August, with clearly slowing patterns in market depreciation over the past two months.

Wholesale used-vehicle costs (on a combination, mileage, and seasonally adjusted foundation) had been larger in August in comparison with July, in response to the Manheim Used Car Worth Index (MUVVI), which rose to 203.9, a decline of three.9% from a 12 months in the past.

The seasonal adjustment to the index eased the affect on the month, leading to values that rose 1.2% month over month. The non-adjusted value in August elevated by 2.2% in comparison with July, transferring the unadjusted common value down 4.6% 12 months over 12 months.

“The development of upper wholesale values at Manheim continued into August from July, as we noticed costs respect each week besides the final,” mentioned Jeremy Robb, senior director of financial and trade insights at Cox Automotive, in a Sept. 9 information launch. “Gross sales conversion continued to rise and held at a lot larger ranges than prior years for the month as extra patrons got here to markets to replenish provide for used retail stock. We all know lease maturities are on the decline, and used retail days’ provide has tightened over the past month. That can doubtless preserve strain on patrons at Manheim within the subsequent a number of weeks.”

In August, Manheim Market Report (MMR) values noticed weekly will increase each week of August besides the final week, clearly larger than what’s regular within the month. In the course of the earlier 5 weeks, the Three-Yr-Previous Index elevated an combination of 0.8%, together with a decline of 0.2% within the final week of the month. Those self same 4 weeks delivered a median lower of 1% between 2014 and 2019, illustrating that the appreciation development for the month of August contrasted towards long-term averages for the 12 months.

In August, each day MMR Retention, which is the typical distinction in value relative to the present MMR, averaged 98.9%, that means market costs stayed beneath MMR values once more this month but moved nearer to market valuations for the second month in a row. In comparison with final month, valuation fashions moved up three-tenths of a degree on MMR retention. The common each day gross sales conversion fee rose to 63.3%, an increase of over 4 full factors towards final month and better than regular for this time of 12 months. For comparability, the each day gross sales conversion fee averaged 55.7% in August over the earlier three years.

Main Car Market Value Actions

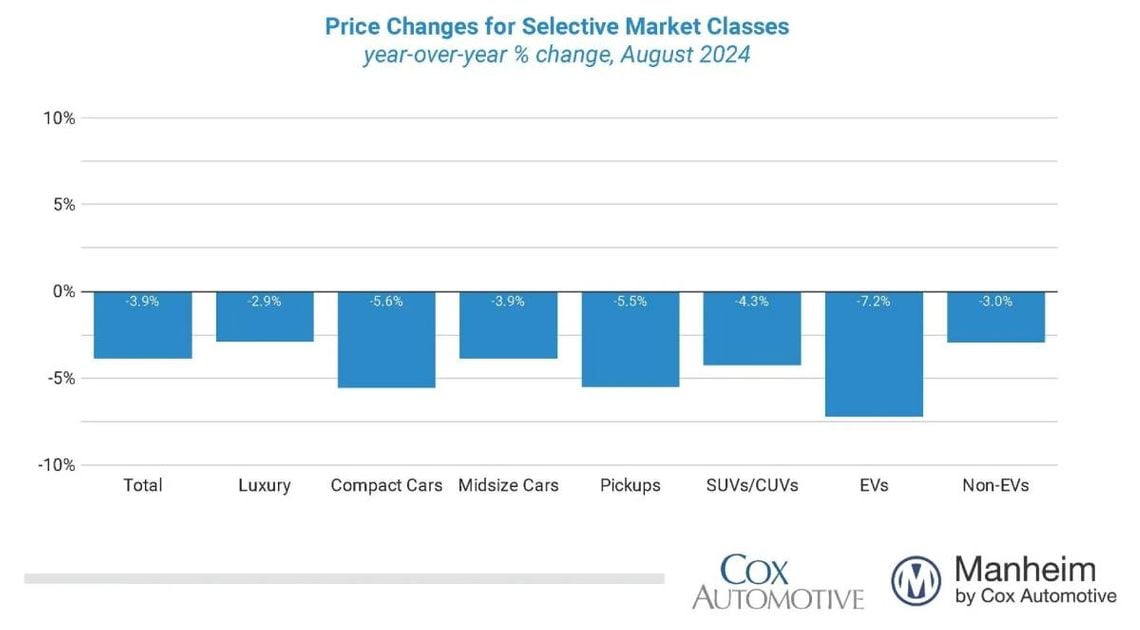

All main market segments skilled seasonally adjusted costs that had been down 12 months over 12 months in August, with clearly slowing patterns in market depreciation over the past two months.

- In comparison with August 2023, luxurious was decrease by solely 2.9%

- Midsize sedans declined by 3.9%, outpacing the trade general.

- SUVs had been down 4.3%

- Pickups fell by 5.5%

- Compact vehicles declined 5.6% towards the prior 12 months

In comparison with the earlier month, all segments had been larger, with luxurious rising essentially the most, up 3.5%, adopted by midsize sedans at 1.6% larger. Growing lower than the general common, SUVs rose by 1.1%, and pickups had been up simply 0.3%, with compacts growing the least, rising by solely 0.2% month over month.

Trying on the market by powertrain, each electrical autos (EVs) and non-EVs had been larger in comparison with July. Seasonally adjusted EV values for August 2024 had been down 7.2% 12 months over 12 months, whereas non-EVs had been down solely 3%, highlighting the upper depreciation EVs have seen over the past 12 months. Trying on the change towards July, seasonally adjusted EV values elevated greater than the general market, rising by 4.4% from July 2024, whereas non-EVs elevated 1.8% over the identical interval.

Retail Used-Car Gross sales Elevated in August

Assessing retail car gross sales based mostly on noticed adjustments in models tracked by vAuto, the preliminary estimate of retail used-vehicle gross sales in August was up 34% in comparison with July and better 12 months over 12 months by 21%. The common retail itemizing value for a used car elevated 1.6% over the past 4 weeks.

Utilizing estimates of retail used days’ provide based mostly on vAuto knowledge, an preliminary evaluation signifies August ended at 38 days’ provide, down 16 days from 54 days on the finish of July and down eight days from August 2023 at 46 days.

New-vehicle gross sales in August had been up 7.6% from final 12 months, and quantity elevated 11.2% from July. The August gross sales tempo, or seasonally adjusted annual fee (SAAR), got here in at 15.1 million, down 0.2 million from final 12 months’s tempo and decrease than July’s 15.8 million stage.

Mixed gross sales into massive rental, industrial, and authorities fleets decreased 21% 12 months over 12 months in August. Together with an estimate for fleet deliveries into seller and producer channels, the remaining new retail gross sales had been estimated to be up 7.6% from final 12 months, resulting in an estimated retail SAAR of 12.7 million, down 0.1 million from final 12 months’s tempo, and down from July’s estimated 13.1 million stage. Fleet share was estimated to be 11.6%, down from final 12 months’s 16.4% share.

Rental Danger Costs and Mileage Have been Blended in August In opposition to Final Yr

The common value for rental threat models bought at public sale in August declined 1.7% 12 months over 12 months. Rental threat costs elevated by 2% in comparison with July. Common mileage for rental threat models in August (at 54,700 miles) was unchanged month over month, but it rose 4.8% for the month towards final 12 months’s stage.

Measures of Client Confidence Elevated in August

- The Convention Board Client Confidence Index elevated by 1.4% in August as views of the current and future improved. Client confidence was down 5% 12 months over 12 months. Plans to buy a car within the subsequent six months declined in comparison with July to the bottom stage since February and had been decrease than August final 12 months.

- In line with the sentiment index from the College of Michigan, client sentiment elevated 2.3% in August in comparison with July however was down 2.2% 12 months over 12 months. The median client expectation for inflation in a 12 months declined to 2.8%, the bottom stage since December 2020. The expectation for inflation in 5 years was regular at 3%. The patron’s view of shopping for circumstances for autos was unchanged from June and on the lowest stage since December 2022 as views of rates of interest and costs remained very adverse.

- The each day index of client sentiment from Morning Seek the advice of noticed additional enchancment in August, extending a streak of three month-to-month positive factors, though it misplaced some momentum at month-end. The index elevated 0.3% for the total month, leaving it up 4.9% 12 months over 12 months.

- Gasoline costs declined 4.3% in August because the nationwide common value for unleaded fuel from AAA was $3.33 per gallon as of Aug. 31, which was down 13% 12 months over 12 months.

[ad_2]